Prices and Charts

Everything in the Red This Week

Our price change table above shows nothing but red this week.

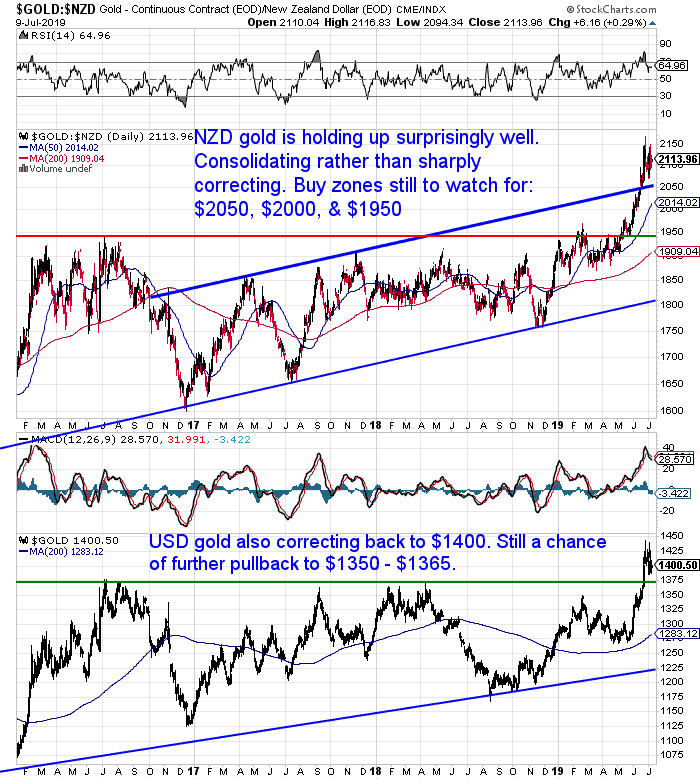

After such a strong run higher it is not surprising NZD gold is down for the week. However what is surprising is how little gold has fallen to date.

NZD gold is still above $2100. So far it hasn’t gotten back to any of the buy zones shown in the chart below.

There does seem to be a fair bit of expectation that it will pull back further yet. We’ve had a few people write in asking if we thought gold will get back below $2050.

So perhaps it will surprise us all and just consolidate at these higher levels for a little while instead? That would also get the RSI overbought/oversold indicator back down to more neutral levels around 50.

It’s impossible to say what the price will do in the shorter term. However in the longer term we do look set up for much higher prices ahead. For more on this see: USD Gold Breakout – 6 Year High Above $1400 – What Happens Now?

Silver Holding Firm

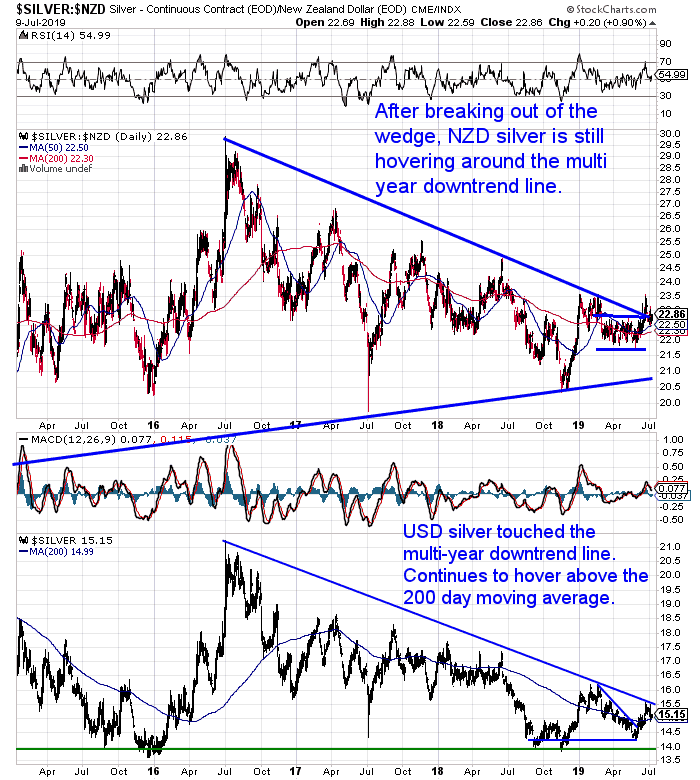

NZD silver was barely down this week. Silver continues to sit right on the multi year downtrend line after breaking out of this wedge formation. We need to see silver head back above $23.50 to confirm the breakout.

More on silver below.

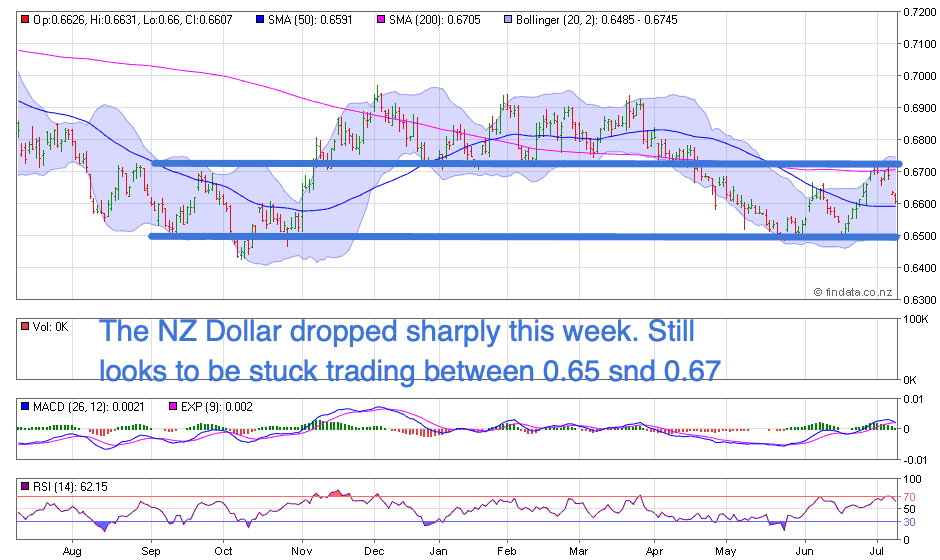

The New Zealand dollar is down almost 1% on last week. Just like last week the 0.67 level again proved tough resistance to crack. The Kiwi sits on the 50 day moving average now. But we could see a further move back down to test 0.65 again.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

What is Best – Gold or Silver?

Here’s perhaps one of our most common questions. A reader asks:

“I suppose my biggest question (like most others I guess) is what is best – gold or silver? It seems to me that silver is so undervalued at the moment that it is the best investment – but then nothing is generally as it seems. I would appreciate your thoughts on this.”

Our thoughts:

Right now silver certainly has more upside than gold. The gold to silver ratio is the highest since 1991 at around 93.

This will almost certainly come down to at least the long run average in the 50’s. Just as it has done previously when at such elevated levels. But it’s a case of when this will happen?

With silver you certainly need to have patience. Just buy it and forget about it for a while. Don’t watch the price every day.

Also have you read these couple of articles?

Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver

Could Silver Be Worth More Than Gold?

As we say in two these posts, our general thought is that it’s a good idea to get a bit of both. Then you don’t have to guess which performs better. As at certain times (like the last few years) gold will outperform silver.

However in the coming years, our best guess is silver will, before too long, outperform gold. So right now is a good time to be overweight in silver.

How to Swap Gold for Silver – Taking Advantage of the Record High Gold Silver Ratio

But what about if you already own a reasonable amount of gold? Would you like to sell your gold and buy silver. There is a better more cost effective way.

See why choosing to swap your gold for silver just might be a good idea right now…

NZ’s Proposed Deposit Insurance Falls Well Short of Protecting People’s Savings

Last weeks article on the proposed bank deposit protection scheme certainly drew plenty of interest and a few thoughtful comments.

New Zealand Bank Deposit Protection Scheme – Does N. Z. Have Bank Deposit Insurance?

Helen Mary Dervan, a senior lecturer at AUT, this week chimes in on where the weaknesses of the scheme are.

As we showed last week, the proposed limits are well below other developed nations.

She notes:

“If the [deposit protection] limit is too low, the risk is that the deposit insurance scheme will not stop bank runs and not protect financial stability and the economy.

It could even cause pre-emptive bank runs. If that happened, the Government would need to urgently increase the deposit insurance limit and take other extraordinary measures, but this can lead to other difficulties, including increased overall costs, which ultimately fall back on the taxpayer.”

Source: NZ’s plan for deposit insurance falls well short of protecting people’s savings

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Bank Economists Change Their Tune – Again

Way back in July of last year we were highlighting numbers that pointed to the New Zealand economy slowing.

We also highlighted that interest rate cuts were far more likely than anyone expected.

The bank economists were at that stage predicting interest rate increases and then a long period of time on hold.

How things have changed in a year.

Kiwibank economists are now highlighting the likelihood of the Official Cash Rate (OCR) getting below 1%.

“Wholesale interest rates drifted lower last week, as the domestic data weakened and central banks offshore cut. We continue to expect the RBNZ to cut the OCR in August. The question is whether the RBNZ will need to do more. The need to cut the OCR to 1% and below, is becoming increasingly likely,” the economists said.”

Source.

ASB have also have changed their tune. They now believe we’ll see two more rate cuts in 2019. And that the OCR will hit 1% by the end of the year:

“NZIER Q2 Quarterly Survey of Business Opinion was weaker than we expected – again.

Reported activity was very weak over Q2 and consistent with quarterly GDP growth of just 0.3-0.4%.

We now expect the RBNZ to cut the OCR by 25 basis points both August and November.”

Meanwhile…

“Westpac economists have taken the pruning shears to their economic growth forecasts and now see GDP growth of just 0.4% (down from previous pick of 0.6%) for the 2019 June quarter.

This would give annual GDP growth of just 2.4%, which the economists, in their Weekly Commentary, note would be “not much faster than the rate of population growth over the past year”.

Source.

So the banks are starting to agree that we’re likely to see interest rates at or below 1% by the end of the year. While ASB expects “annual headline CPI inflation to remain below 2% over 2019”.

Negative Real Interest Rates

This means we’re likely to see negative real interest rates here in New Zealand for some time.

Remember the real interest rate takes into account the rate of inflation. If inflation is higher than interest rates, then the real inflation rate will be negative.

This is the environment in which people flock to gold.

If you’re worried about the lack of return on your savings in the bank consider moving some into gold (and silver).

The current deal on Perth Mint gold bars for less than local gold is hard to beat.

Or give us a call if you have any questions about buying either.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Has the Silver Breakout Started? Why a Short Squeeze Could be Developing - Gold Survival Guide

Pingback: Yes the “Small” NZ Banks Are Still Subject to Bail-In - Gold Survival Guide

Pingback: RBNZ Slashes OCR - The Race to the Bottom is Speeding Up and NZ Won’t Be Left Behind! - Gold Survival Guide