Here’s an excellent question from a reader which we received a few years ago. It’s about whether to buy gold today or wait. Even though he asks whether the “powers that be” will let the stock market crash while Obama is in power, it’s still relevant today.

Why?

Because it shows the things we think might happen don’t necessarily occur. Or they can take much longer to play out than we think.

So the answers to his questions are still relevant today. Therefore they might also be helpful to you if you’re mulling over whether to buy gold today or wait a bit longer…

Do you think the US will keep the Bond market going a little bit longer? We can all see the world-government banking cartel are getting ready for something big but I wonder because Obama’s reign is not over yet, they will prop this up at least until next year when his reign ends.

I am lost as to whether to invest now with various sources-talking heads and historical chart events approaching, super high stock markets, inflation talk and also now deflation ? bond markets getting nervous, there seems to be a chop of opinions and charts depending what angle to look at.

At the end of all these measures , opinions and insiders do you just go for a gut feeling and run with whos the boss and “is it time yet”, will they have Obama leave office with a crashing stock-market and bond market? I wonder if they will let that legacy happen.

I know the worlds trillions in debt but I am confused in which to understand if we are hitting the high inflation or are we going into deflation (cutting rates) I wondered if you had more of a take on this ?

Thanks and sorry if you have covered this in length before already.

“Should I Buy Gold Today or Wait?” – Here’s Our Response

Here’s our answer, bearing in mind we don’t offer advice, just our own thoughts and opinions. So take from them what you may, but be sure to make up your own mind!…

Should I buy gold today or wait and see? That is the $64,000 question alright! If we knew we’d be on the beach somewhere sipping our profits! Great question though.

Precious Metals Can Rise Without a Crisis

The first point that you might not have considered is that the factors you mentioned are not necessary for precious metals to rise. That is, we don’t necessarily have to see the bond market and/or stock markets tank for gold and silver to rise.

Recall that gold rose for close to a decade without a major crisis hitting prior to 2008. While the factors you mention might also be gold positive, we don’t believe they are a must for gold and silver to enter a renewed bull market.

So while waiting for these factors to occur, gold could still rise in the meantime. (In fact that as you’ll see below, that is exactly what has happened since our reader first asked this question back in 2015).

On a related note, here’s an article that highlights what we might see happening as a new bull market in gold appears: History Shows A Gold Bull Market Is Fast Approaching

The Trend Change Did Indeed Happened Without a Crisis Taking Place

Back in 2015 we wrote:

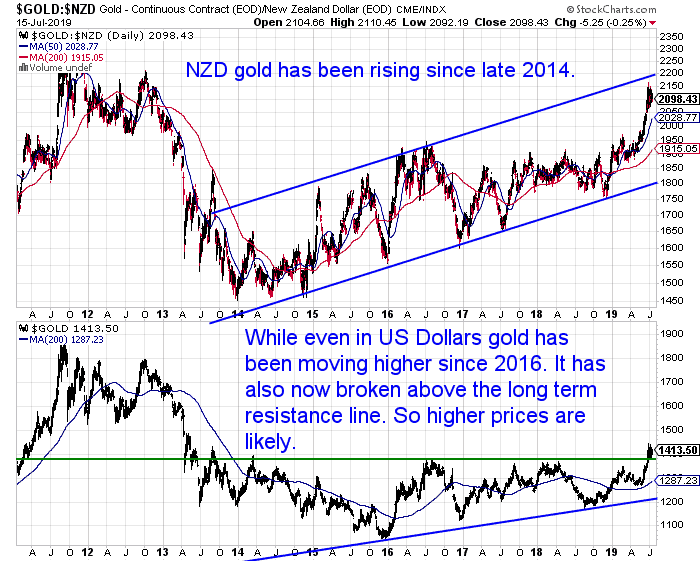

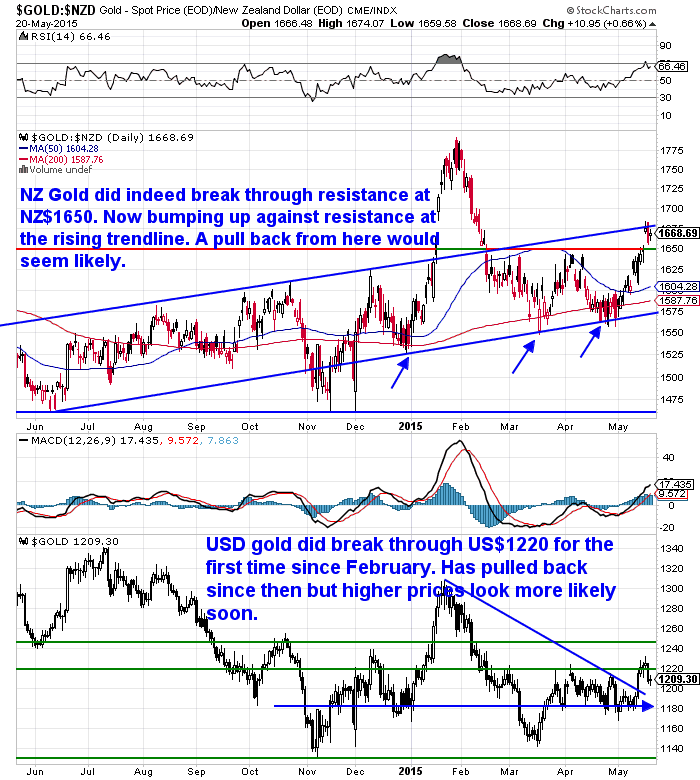

We’re starting to think the trend change may have already happened in New Zealand dollar terms. Gold has been quietly trending up for the past year without too many noticing. So with an uptrend in place, that would make today a good time to buy gold.

Since we wrote the above back in 2015, the trend change has certainly occurred.

Gold has been quietly trending up for many years with hardly anyone noticing. This has occurred without a crisis or stock market crash taking place.

It seems to us that most people have probably been scared off by the lack of action in the US dollar price of gold from 2014 to now. We certainly haven’t seen a lot of buying in recent years. And those we know around the world dealing in precious metals report the same.

However, more recently we have also seen gold in both NZ and US Dollars breakout to new multiyear highs. So gold is likely heading higher in the medium term now. See: USD Gold Breakout – 6 Year High Above $1400 – What Happens Now?

So with an uptrend firmly in place and a breakout occurring, that would make today a good time to buy gold.

Should I Buy Gold Today or Wait and See If It’s Inflation or Deflation?

As for the inflation versus deflation argument. If you believe Harry Dent, deflation will cause gold to fall to $700. We’re not sure we buy his argument though. Jeff Clark gives a good run down here of the holes in Dents theory along with the inflation versus deflation argument.

We’d say many of Harry Dents points are moot because in the 1930’s depression gold was still money anyway. But he seems to ignore that point in much of his “gold will fall during deflation” argument.

Trying to second guess where the price will go and time the exact bottom is going to be near impossible. Also consider that we could see some price rises quite rapidly, just as we had a rapid fall back in 2013.

Consider the Psychology of Buying Gold

Something to perhaps consider when deciding whether to buy now or to wait for troubles to start, is how would you feel if you sat on the sidelines while a sharp rise occurred? Would you then be tempted to buy in at even higher prices?

What is Your “Sleep Soundly at Night” Comfort Level?

Another good consideration to mull over is what would be your “sleep soundly at night” comfort level.

That is, buy enough gold so that if the price fell you wouldn’t be too worried. But also buy enough so that if the price rose you won’t be kicking yourself.

Only you know what this level is. It just takes some imagination in terms of different amounts/situations to determine it.

Maybe Keep Some “Powder Dry”?

Similarly you might also want to buy some gold today and “keep some powder dry”.

That way if the gold price fell further you can buy some more at lower prices. But you also won’t be kicking yourself if it rises sharply.

Also on this topic you might want to check out this 2 minute Chris Duane video on “not being greedy”. And buying for reasons other than just price.

But that said, if you can get more ounces for your money why not?!

What Might Happen in the US?

As far as what might happen in the US? it’s still a case of who knows? We have a Trump presidency instead of an Obama Whitehouse when our reader first posed his question.

The bond bull market (i.e. falling interest rates) has been going on for well over 30 years. So it is certainly due for a trend change and for interest rates to rise.

US 10 Year Treasury Bond Yields Since 1954

Source: CNBC

You might have noticed global bond interest rates did bounce up sharply following the lows in 2015. They fell to new lows in 2016 before rising through to late 2018 where yields got over 3.00%. But since then interest rates have fallen again. End result – they’ve really gone sideways for the past 5 years.

US 10 Year Treasury Bond Yields 5 Year Chart

So we’d say it’s too early to call that a trend change and to expect interest rates to necessarily just continue on rising steadily from here.

We read recently how when the bond market and interest rates made their last major change in trend in September 1981, rates had zigzagged up and down for about 2 years before the change was confirmed.

So we could well see the same happen now. With it not being clear for some time yet where interest rates are going in the longer term.

Don’t Bet on the Bond Market Falling Over

So we wouldn’t necessarily bet on the bond market falling over anytime soon.

As for the stockmarket, the US and many others are certainly overvalued and ripe for a correction at the very least.

But as for whether a crash is just around the corner, who knows? The Yield Curve is pointing to a US recession being not too far away.

If a crash did happen, it could actually send more money into US bond markets and therefore actually lower bond interest rates further.

Back in 2015 we said:

The death of the US dollar is not such a sure thing as many believe. We could well see the US dollar get even stronger yet – against other fiat currencies anyway.

That is exactly what happened with the US Dollar being very strong versus other national currencies including the NZ Dollar. This in turn increased the price of gold in NZ dollars.

In Summary… Should I Buy Gold Today or Wait?

So in summary it really is anybody’s guess as to how things will pan out. Our readers fears from 2015 were not unfounded. However most of them have not yet happened.

But this has not stopped gold prices (especially in NZ dollars) rising steadily since 2015.

We have posted a few charts lately that look promising. Gold appears to have broken out and a new gold bull market seems to be underway. But at the end of the day, a chart really just shows you where the price has been – not where it’s going!

The answer to the question “Should I buy gold today or wait?” may be to do both!

You may sleep better knowing that you’ve got some precious metals and some cash as well. That way regardless of how things pan out you’ve got a foot in both camps.

If deflation were to mean gold falls further yet you’ve got some cash to buy more at a later date. But conversely if gold and silver move higher from here (we think the more likely option), you’ve also got a position there too.

For help with timing when to buy gold or silver and check out this article: Gold and Silver Technical Analysis: The Ultimate Beginners Guide

To learn more about when to buy gold and silver see: When to Buy Gold or Silver: The Ultimate Guide

Editors Note: This post was first published 26 May 2015. Updated 17 July 2019 with new gold charts. US bond charts added. And commentary updated.

Pingback: NZ Dollar Gold Breakout About to Happen? - Gold Survival Guide

Pingback: Has the Silver Breakout Started? Why a Short Squeeze Could be Developing - Gold Survival Guide

Pingback: Silver is the Star this Week - Gold Survival Guide