Prices and Charts

The Gold Correction is Underway

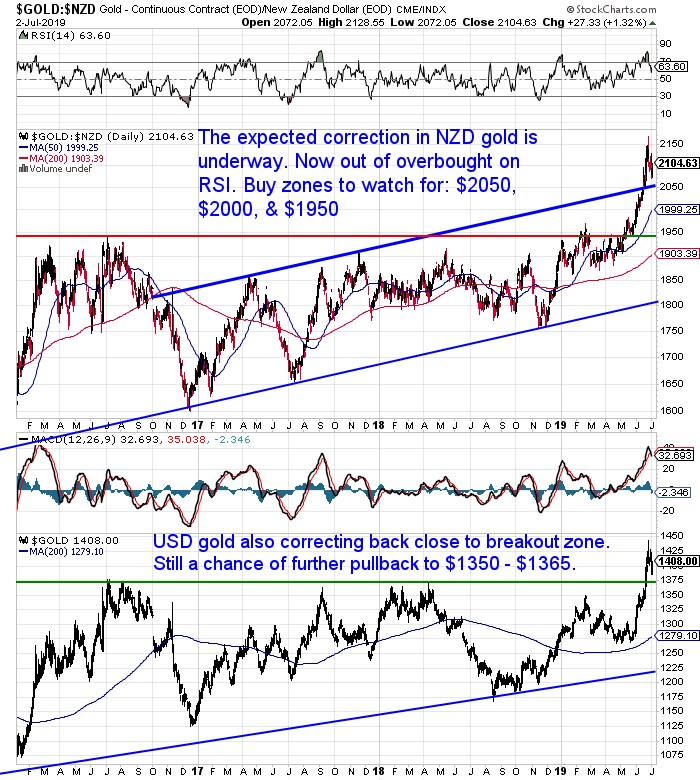

The gold correction we expected (see: USD Gold Breakout – 6 Year High Above $1400 – What Happens Now?) is underway.

NZD gold is down just under 2% from last week. It was even lower than that level yesterday. But this morning bounced back.

The unknowable question now is how far will gold correct?

We outlined some levels to watch for last week in the post mentioned above. So check that out for more detail.

However we’d guess $2050 remains a good mark to watch for.

But there is also the chance we see gold consolidate in a more sideways range for a bit. This too would work it back down to more neutral levels on the RSI overbought/oversold indicator.

You may choose to split any buying you wish to do so you don’t get stuck waiting on the sidelines.

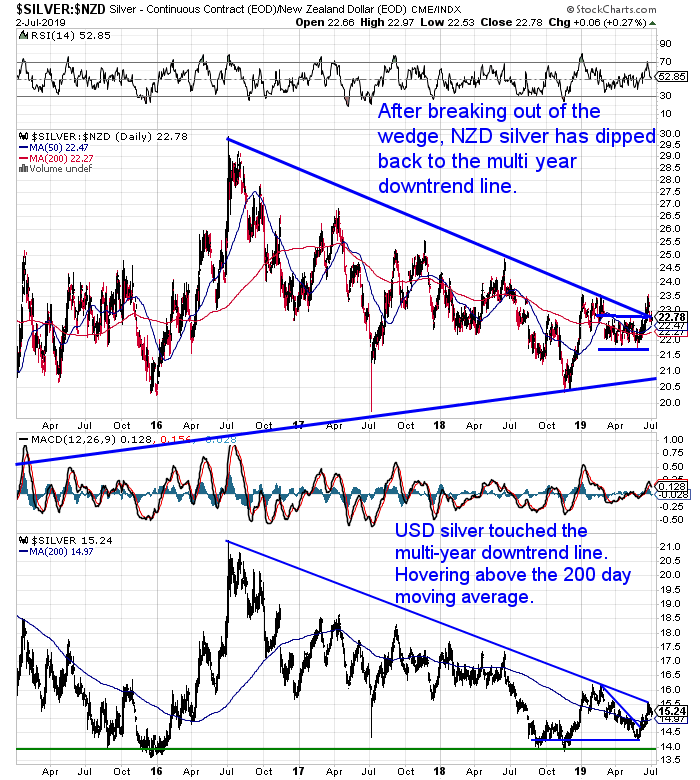

Meanwhile silver is down too. Just not quite so much as gold.

Having broken above it, NZD silver now sits right on the multi year downtrend line.

So we’re still waiting for silver to play catch up with gold.

The New Zealand dollar moved higher during the week. But has pulled back today. So the Kiwi remains stuck in the 0.65 to 0.67 range it’s been in since April.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

New Zealand Bank Deposit Protection Scheme – Does N.Z. Have Bank Deposit Insurance?

The government announced a proposed bank deposit protection scheme last week.

So we delve into what is effectively a limited government guarantee of bank deposits will look like.

You’ll see:

- The history of bank guarantees in New Zealand

- What we don’t yet know about the proposed bank deposit protection scheme

- Will bank deposits held by a Kiwisaver scheme be covered?

- Does a government guarantee make our banks safer?

- How does it compare to other countries?

- An alternative to relying on the bank deposit protection scheme

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Derivatives – a Beginner’s Guide to “Financial Weapons of Mass Destruction”

Have you noticed lately there is still plenty of discussion over Deutsche Banks derivative portfolio and the risks this places on the global financial system?

Greg Hunter at USA Watchdog recently interviewed Charles Nenner on the subject of Deustche Bank.

While others think: “The black hole surrounding derivatives is just as dark today as it was in 2008 – and just as dangerous.”

So just what are these mysterious derivatives?

Read on to learn about:

- The history and origin of derivatives

- How derivatives morphed from farmers friend to financial weapons of mass destruction

- Why do interest rate derivatives now make up so much of the total derivative pool?

- What do these derivatives mean for New Zealand?

- How NZ bank derivatives have grown too

- How to protect yourself from derivative Risk

Get Your Wealth Protection

A key theme of both this weeks articles is protection.

Gold and silver are wealth protection.

They’ll give you peace of mind – once you own the physical metals.

Give us a call if you have any questions about buying either.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Bank Economists Change Their Tune - Again - Gold Survival Guide