Could Silver Be Worth More Than Gold? You may have heard about the increasing uses for silver in industrial applications. The rise in industrial use is often used to argue that the price of silver will rise significantly. Thus equaling or even overtaking gold. But could this really happen? A reader posed just such a question:

“I’ve heard a lot about how useful silver is and the many different purposes it is used for, whereas gold is mainly just precious. Will the usefulness of silver ever cause it to become a more desirable asset (ie: more valuable) than gold?”

This post covers this topic in depth including:

- The gold to silver ratio over 3 centuries

- Some historical evidence of silver being worth more than gold

- Silver industrial demand versus investment demand

- Could Silver Be Worth More Than Gold Due to:

- Peak Silver?

- Increasing Institutional Investment Demand?

- Increasing Photovoltaic Demand?

Table of Contents

- Silver Price Compared to the Gold Price: The Gold to Silver Ratio

- Has There Ever Been a Time When Silver Was Worth More Than Gold?

- Could Silver be Worth More Than Gold? On These Occasions it Might Have Been…

- How Could Silver Be Worth More Than Gold?

- Silver Shortage This Decade, Silver Will Be Worth More Than Gold -FutureMoneyTrends.com

- Could Silver Be Worth More Than Gold Due to Industrial Demand?

- Could Peak Silver Cause Silver to be Worth More Than Gold?

- Could Increasing Institutional Investment Demand Boost Silver Above Gold?

- Could Silver Be Worth More Than Gold Due to Increasing Photovoltaic Demand?

- Could War Increase the Demand for Silver and Cause the Price of Silver to Rise Above the Price of Gold?

- What Do We think? What Could Cause Silver to be Worth More Than Gold?

Estimated reading time: 16 minutes

Silver Price Compared to the Gold Price: The Gold to Silver Ratio

Today silver (in New Zealand dollars) is priced at $39.75 While gold is $3126.70. So it takes a little under 79 ounces of silver to buy an ounce of gold ($3126.70 divided by $39.75). This is known as the gold to silver ratio.

Read more about the gold to silver ratio and how to use it to determine better times to buy gold or silver here: What is the Gold/Silver Ratio? >>

The Long Term Historical Gold to Silver Ratio

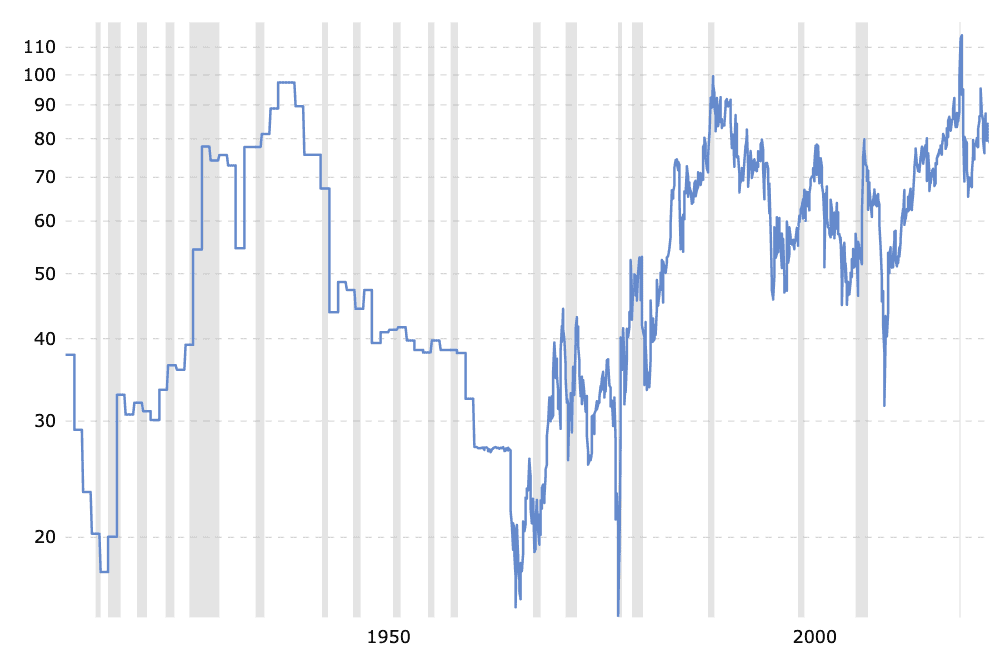

The 100 year chart below shows the gold to silver ratio shows has moved below 20 three times in the past century. The lowest point was reached in January 1980 when the ratio dropped to below 15 (more on that later).

Gold to Silver Ratio – 100 Year Historical Chart

Has There Ever Been a Time When Silver Was Worth More Than Gold?

Has silver ever been worth more or even the same as gold? Put another way, has the gold to silver ratio ever even reached 1:1?

The site measuringworth.com has a dataset all the way back to 1687 for the gold silver ratio.

The silver to gold ratio averaged around 15 all the way up until the late 1800’s when silver was demonetised.

But through much of this time there was a bimetallic standard. Where the government set the silver to gold ratio between the two metals. So this is perhaps why the ratio held around the 15 level for long periods.

The average for the ratio was then much higher during the past century. At a glance you could say it’s been closer to around 40.

This data never shows the gold to silver ratio reaching 1. However it is the average daily ratio over the course of each year. So this dataset would not show any spikes down that may have occurred during the course of a given year.

Prefer a visual summary? Here’s a short video with a visual representation of how the Gold to Silver Ratio has tracked from 1883 to modern day:

Silver to Gold Ratio 1883 to Present

Could Silver be Worth More Than Gold? On These Occasions it Might Have Been…

A bit of hunting around has brought to light some historical instances where silver appears to have been worth the same as gold. The Don’t Tread On Me blog has collated a number of historical quotes that seem to point to occasions when silver has been worth more than gold:

The 1:1 Gold to Silver Ratio has happened before.

“For the first time in history, silver coin, of the leading nations of Europe sold at a higher price than gold coin. This of course does not mean that silver is more valuable than gold, merely a silver dollar or shilling is worth more than a gold dollar or shilling.”

Silver the World Sensation in 1919-1920 – January 24th, 1920

“Are the New York financiers living up to their claims of honesty that they made so vociferously in 1896, or are they paying their debts in a cheap gold dollar?’.’ asked Mr. Bryan the other day when the bullion value of a silver dollar had soared beyond the bullion value of a gold dollar.”

The commoner. (Lincoln, Neb.) December 01, 1919

“With the bullion in a silver dollar worth five cents more than bullion in a gold dollar the cross of gold does not look so yellow and the crown not so thorny as it was” Source

Silver coinage throughout the world is worth more at bullion value than the par value of gold coin. For instance, 5,900 British shilling coins contain just 1,000 Troy ounces pure silver, but are worth 6,929 shillings at the market price of 77 pence for British silver bullion. Over 1,000 shillings is the premium on the market value of 1,000 ounces of pure silver over the coin value in British coinage. The 5,900 shilling coins were worth 346 in the silver bullion market, and only 295 at par or gold value of 295 in gold sovereigns or in gold bullion;…

Mohave County miner and our mineral wealth. (Kingman, Ariz.) January 24, 1920, Source

William Jennings Bryan:

“I’m too much perplexed by the news of the day. The morning papers announce that the bullion In a silver dollar Is now worth five cents more than the bullion in a gold dollar. The shock upsets me. I am not able to speak with composure. My thoughts insist on running back to 1896, when the self appointed champions of an honest dollar vociferously declared that their consciences would not allow them to pay their debts in any but the best money.

I am patiently waiting for the afternoon papers to learn whether these men are paying their debts today In silver dollars at a premium or whether they are using the cheap gold dollar for liquidation purposes. If I find that they are using gold coin, now five cents below the silver equivalent, I shall suggest the appointment of a congressional committee on conscience to ascertain why these men who used to profess so highest standard of patriotism and honor, have fallen from grace….”

Source The commoner. (Lincoln, Neb.)December 01, 1919,

“For a silver mine today is more valuable than a gold mine”

(Source.) The State of the Union by Archer Wall Douglas The Independent April/May/June 1920

(Special thanks to row5_seat47 on Kitco for the info.)

Source.

How Could Silver Be Worth More Than Gold?

Silver would have to rise in value 79 times from today’s price in order to be worth more than gold. So what could cause silver to be worth more than gold?

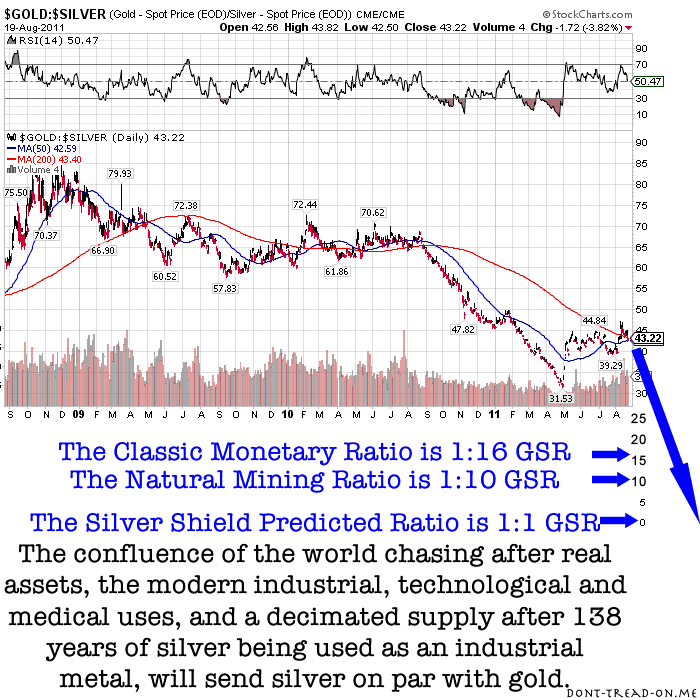

The post from Don’t Tread on Me that we referenced above is titled “The Case for the 1:1 Gold to Silver Ratio”.

Here are their 11 reasons why the gold silver ratio will fall to 1:1 in the coming years:

1. The historical monetary ratio of gold to silver is 1:16 to 1:12, which means that silver should rise 200%+ faster than gold.

2. The natural mining ratio coming out of the Earth of gold to silver is 1:10, which means that silver should rise 350% faster than gold.

3. The ratio of gold to silver at the CRIMEX is 1:9.

4. If we understand that all of the gold ever mined has been treasured by humanity as a truly precious metal, while silver has been used and abused as an industrial metal, this Gold to Silver ratio must be lower than either of the above ratios.

5. All of the major stockpiles of silver that all of humanity ever mined are gone.

6. Silver is second only to oil for the amount of uses of any commodity.

7. Silver has started to catch investment demand, but so far most of the money has gone into paper derivatives of silver like SLV, futures or mining stocks.

8. Silver has naturally been used as money more times and more often than gold.

9. There is already a 1:1 ratio of dollars invested in gold and silver in Sprott Asset Management, GoldMoney and the US Mint.

10. The 1:1 Gold to Silver Ratio has happened before.

11. Finally, the USGS said that silver has the very real possibility of becoming the first element on the periodic table to become extinct by 2020.

Source.

If you prefer to watch rather than read then here’s a video from FutureMoneyTrends.com that also argues Why Silver Will be Worth More Than Gold…

Silver Shortage This Decade, Silver Will Be Worth More Than Gold -FutureMoneyTrends.com

Could Silver Be Worth More Than Gold Due to Industrial Demand?

As our reader alluded to in her question, silver has industrial uses as well as monetary value. Gold also has some industrial applications, but comparatively to silver these are very minimal. Gold is chiefly bought as a store of value. Or what is known as “investment demand”.

You’ve likely read plenty about how the industrial demand for silver is increasing. Is this the case?

Well it’s pretty hard to know. We can only look at the numbers from the Silver Institute. Many in the precious metals community would take these numbers with a grain of salt or even pour scorn upon them. But we don’t have much else to go on.

So what do they say?

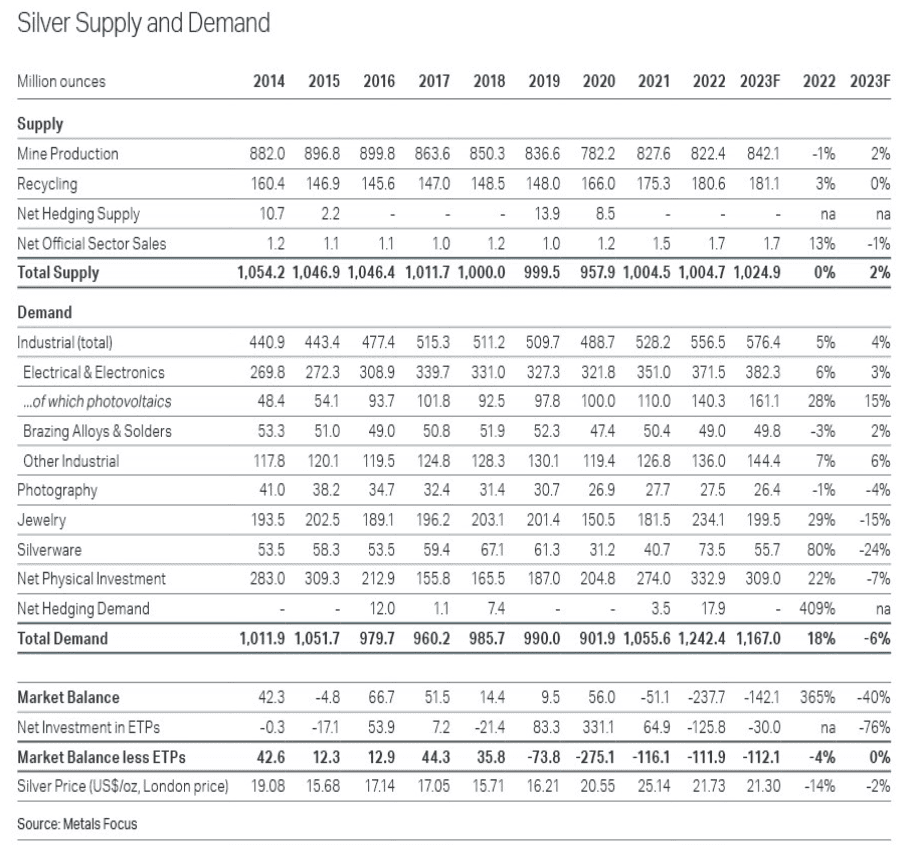

Total industrial demand for silver has been in a general trend upwards since 2012. So far in 2023 demand looks to be up again as well. The much hyped photovoltaic usage (solar panels) had been fairly flat from 2016 to 2020. But demand jumped higher in 2021 and 2022 and is also rising in 2023.

Coin and Bar demand hit a record high in 2022 of 333 million ounces. In the first half of 2023 it looks to be done 7% with.

Physical demand has been rising steadily since then with a big 72 million ounce jump in 2021. So it will be interesting to see what the second half of 2023 brings.

On top of this Net Investment in ETPs (Exchange Traded Products) was also down quite sharply in 2017 and then went negative in 2018. Indicating the Exchange Traded Products were being sold down. But since then ETP demand has bounced back with a huge surge in 2020. ETPs were sold down in 2022 and this has continued into 2023. These products are usually purchased by institutional investors. So demand for silver continues to be low from them.

Source: The Silver Institute

However, the main takeaway from this table is that since 2019 there has again been a net deficit of supply compared to demand in silver. Mine closures due to lockdowns in 2020 and 2021 likely caused the sharp fall in silver supply in those years. However in 2022 mine supply has jumped back to pre-covid levels already. However the deficit is still almost 100 million ounces, which excluding 2020 and 2021 is higher than every year since 2012. In 2023 the deficit looks likely to be in excess of 100 million ounces yet again.

Could Peak Silver Cause Silver to be Worth More Than Gold?

It would appear the demand for silver will continue to be strong. With both investment demand and industrial demand increasing, it appears supply deficits could be here to stay.

Scrap supply peaked in 2012 at 208 million ounces. Falling steadily to be hovering around 150 million ounces from 2015 to 2019. It remained 28 million ounces below the peak still in 2022. This years scrap supply looks likely to be similar to 2022.

It won’t be easy to increase the mine supply of silver though to make up for this. Silver is chiefly mined as a byproduct of other metals like gold and copper. The lower prices of these metals have meant investment in exploration and development of new mines has dropped in recent years. So while mine supply of silver has increased over the last couple of years, it is still down over 50 million ounces from the 2016 peak. So a significant increase does not look that likely.

You can read more on the subject of “peak silver supply” here: Has Peak Silver Arrived? >>

Could Increasing Institutional Investment Demand Boost Silver Above Gold?

2016 saw a large increase from the previous 3 years in Exchange Traded Fund demand for silver (see Net Investment in ETPs in the Table Above). Although as noted already, this demand fell in 2017 and 2018. The outbreak of covid in 2020 saw a huge increase in Exchange Traded Fund demand. But then a huge pullback in 2021 and 2022. Net ETP demand is down again so far in 2023.

And from what we’ve seen, this Exchange Traded Product demand seems to affect the silver price more than coin and bar demand or industrial demand.

Large increases in 2008, 2009 and 2010 coincided with sharp gains in the silver price. Conversely 2011, 2013, 2014 and 2015 and 2017 were years with lower ETP demand also were years when the price fell or was flat. Same thing again in 2021 and 2022. The silver price looks to be close to breaking out this year. So perhaps there will also be a pick up in demand for ETPs?

Could Silver Be Worth More Than Gold Due to Increasing Photovoltaic Demand?

Photovoltaic demand has hit a record every year since 2018. That is on track to continue in 2023. So perhaps this could be the start of a longer term rise in demand? With the likes of Elon Musk now producing solar panels that actually replace roofing tiles, and potentially for the same or maybe even less cost than a normal tile, the demand for these panels is likely to grow significantly in the future.

Perhaps this could be enough to really increase the price of silver dramatically?

Could War Increase the Demand for Silver and Cause the Price of Silver to Rise Above the Price of Gold?

With war continuing in Ukraine, could this increase the use of and therefore the demand for silver.

An article called Silver Cycles and War Cycles showed how major wars of the past 100 years did appear to boost silver prices significantly.

Read more on: Silver Cycles and War Cycles >>

However silver was not worth more than gold any time in the past century. So we have our doubts as to whether even a major war will cause the silver price to rise above the gold price in the future either.

What Do We think? What Could Cause Silver to be Worth More Than Gold?

All the reasons mentioned above are good reasons as to why silver will likely increase in value much more relative to gold in the coming years.

But we think monetary demand for silver will likely be the biggest factor in increasing the silver price in the long run.

If we look back to the last precious metals bull market in the 1970’s, it was monetary or investment demand that drove gold and silver higher.

The argument is made that the Hunt brothers were manipulating the price by “cornering the market” in silver and that pushed silver to its record price of $49 per ounce in 1970.

However, it seems to us the Hunt Brothers were really just worried about the state of the USA and the arrival of inflation. They were simply buying more and more silver as a hedge against this.

Read more: The Real Hunt Brothers Silver Story >>

As a result in 1980 the gold to silver ratio dropped to its lowest point in the past century. Getting just below 15 (albeit only briefly for one day).

We think that it will be investment or monetary demand that sends silver much higher this time around too.

But Will Silver Be Worth More Than Gold?

We have our doubts. Perhaps we could see the gold to silver ratio drop below 15 which is about in line with the ratio of gold to silver in the ground.

So at the current gold price of NZ$3127 that would put silver at NZ$208 per ounce. Not an insignificant move from the current price of $39.75!

Or maybe the ratio could even get down close to 1?

But all these arguments on why silver will be worth more than gold overlook one key factor.

The Stocks to Flow Ratio and Why Silver Will Not Be Worth More Than Gold

Unlike all other commodities, gold isn’t consumed and is very stable in terms of above ground stocks. In fact gold’s “stocks to flow ratio” is the highest of any commodity – at about 80 to 1. Meaning its “stock” i.e. the amount readily available above ground is 80 times more than its annual mined production. Silver is next at only about 5 to 1 (from memory give or take).

Philip Barton, of the Gold Standard Institute, does a great job explaining this fact which is not commonly discussed… http://www.goldstandardinstitute.net/2011/07/stock-to-flow-ratio-a-primer/

So even if the mined production of gold doubled (which would be an extraordinary feat) the flow of new gold to market would only be 3%. This stability of supply – that is not present in any other element – and is definitely not present in any Central Bank controlled fiat currency, is an absolute key factor as to why gold is money.

Silver is second, but a distant second, in terms of its stocks to flow ratio.

History shows countless examples where the rulers have tried to cheat the people by clipping coins or calling them back in and reducing the gold/silver content. And currently we are in a unique period where there is nothing but fiat currency the world over. So the “stock” of paper money has been and is continuing to be increased year after year.

We continue to believe that the world is heading for a change or at the very least a rebalancing of the monetary system. If this happens silver’s monetary value will likely take precedence over its industrial attributes.

And it is silver’s monetary attributes that have little value placed upon them currently.

So in a rebalancing of the monetary system gold will likely rise and silver will rise even more. But the higher stocks to flow ratio of gold will likely keep its value above that of silver.

While we don’t think silver will be worth more than gold, we think silver will increase in value more than gold. How high could silver go? See: What Price Could Silver Reach?

The price of silver appears to have bottomed out in 2018. Currently silver is still down from highs it reached in 2020. But it seems to be building for a break out. That makes it a great time to be buying some silver. Go here to buy silver today.

To learn more about when to buy gold or silver check out this article: When to Buy Gold or Silver: The Ultimate Guide

Editors Note: This post was originally published 5 September 2017. Last updated 19 July 2023 with latest charts, numbers and supply and demand data.

Pingback: Gold to Silver Ratio Update for 2017: Time to Buy Silver Again - Gold Survival Guide

Pingback: Why is Silver Lagging Gold? - Gold Survival Guide

Pingback: Why Buy Silver? Here's 21 Reasons to Buy Silver Now

Pingback: Bullish Indicator: Large Silver Speculators First Net Short Position in Memory - Gold Survival Guide

Pingback: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver - Gold Survival Guide

Pingback: Buy Silver in New Zealand

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated) - Gold Survival Guide

Pingback: The “Time Price” - Why Gold is Money and Will Continue to Be - Gold Survival Guide

Pingback: What is the Best Type of Gold to Buy For Trading in a Currency Collapse? - Gold Survival Guide

Pingback: Why Fractional Reserve Banking is Not the Problem

Pingback: Gold at New All Time High in NZD - 7 Year High in USD - Gold Survival Guide

Pingback: CoronaVirus Spreads Into Italy - Sharemarkets Plunge - Gold Survival Guide

Pingback: Everything is Falling - Including Gold - Gold Survival Guide

Pingback: Is the New Zealand Economy Worse Off than Others in the OECD? - Gold Survival Guide

Pingback: What Might a BRICS Currency System Mean for NZ? - Gold Survival Guide