How many people own gold? How does that number today compare to what it was historically?

A reader asks:

“I strongly suspect that far fewer people historically by percentage are holders of investment physical precious metals and if so then it may hardly rate in the mass media. I would be interested in your opinion?” – M. B.

Or put another way what is the level of private gold ownership today? And how does this compare to what it once was?

Table of Contents

- Gold Ownership Numbers Not at All Clear

- Global Per Capita Gold Ownership in Ounces

- Some Countries Have Much Higher Private Gold Ownership

- How Many People Have Gold in the USA?

- What Percentage of New Zealanders Own Gold?

- How Does Private Gold Ownership Compare to What it Was Historically?

- Underinvestment in Gold Continues

Estimated reading time: 7 minutes

Gold Ownership Numbers Not at All Clear

The gold market is a very opaque. There is very little in the way of solid numbers about private gold ownership recorded. So all we can do is look at various sources and guesstimates.

We know what the official gold holdings per country are (well, at least what each country reports them as being!). That is what the central banks own.

Read more: How Much Gold Does the Reserve Bank of New Zealand Have?

And: Australia Has 80 Tonnes of Gold, How Much Gold Does New Zealand Have?

But private gold ownership is much harder to determine.

“The primary body that tracks the supply and holdings of gold on a global basis is the World Gold Council. However, that organization claims it cannot accurately state the private holdings of gold in the United States, or most other countries.”

Source.

Global Per Capita Gold Ownership in Ounces

We can determine what the average per capita gold ownership is in ounces globally:

“Total gold above ground is estimated at 160,000 tons or 5.144 billion ounces. Divide this figure by a world population of 6.88 billion and you arrive at 0.75 ounces per capita.”

However the above was from 2011 on the PrudentInvestor website which no longer exists.

The World Gold Council reports that as of 2023:

“The best estimates currently available suggest that around 208,874 tonnes of gold has been mined throughout history, of which around two-thirds has been mined since 1950. And since gold is virtually indestructible, this means that almost all of this metal is still around in one form or another. If every single ounce of this gold were placed next to each other, the resulting cube of pure gold would only measure around 22 metres on each side.”

Source.

So 6.715 billion ounces divided by the current world population of 8.182 billion gives us 0.82 ounces per person.

That is up a little from the 0.75 ounces per person estimate from 2011. But whichever of these figures we use means little. Because obviously many people own no gold at all. While others own a lot and some countries own very large amounts.

The 100oz Club

This excellent video (hat tip to D.P.) comes up with a very similar number. It shows that there is only enough gold in the world for each adult in the world to hold 1oz of gold on average.

The video also explains how today while not exactly simple, it is far easier to obtain 100oz of gold than to attain $5-10 million. Interestingly he also has a theory that if all the world’s gold was distributed in the same proportion as other wealth, then all it would take [as of 2018] is to own just 18 ounces of gold to push you into the top 0.8%!

“A fortune in gold is built one ounce at a time.”

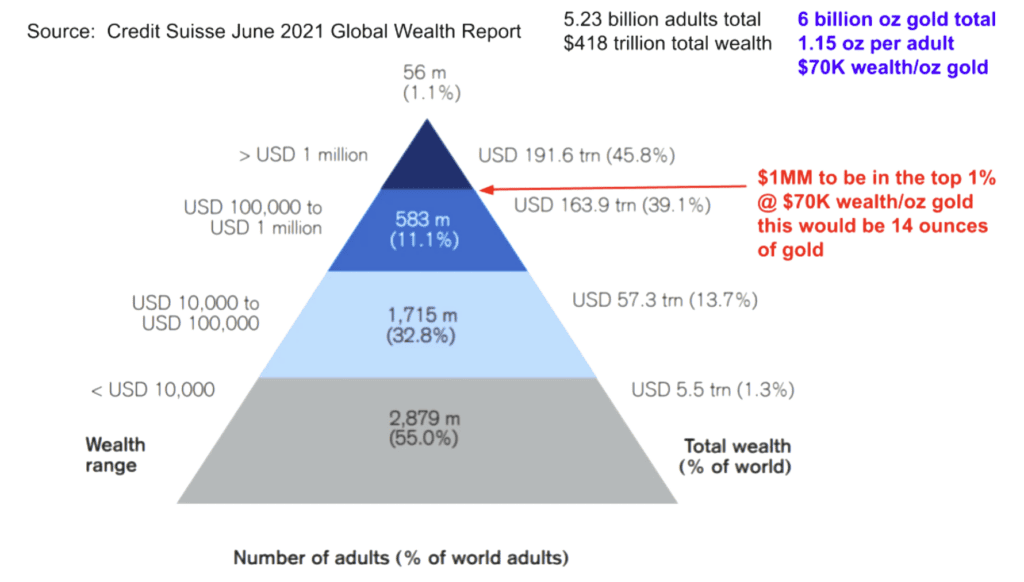

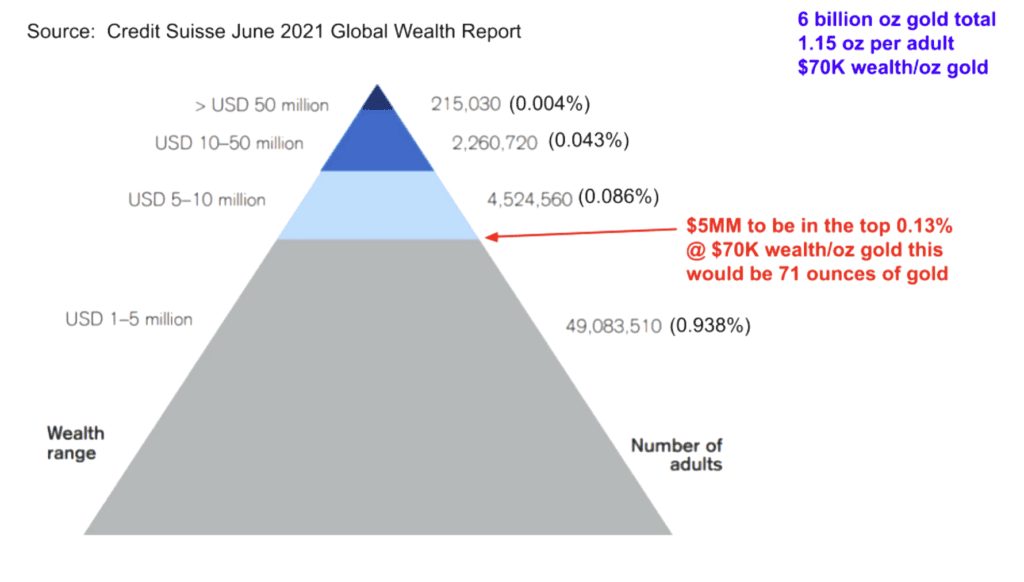

He has updated the numbers in 2022 to see how things have changed. The Credit Suisse Global Wealth Report from 2021 shows that 14 ounces of gold would get you into the top 1%.

While holding just 71 ounces of gold would push you into the top 0.13% of global wealth holders…

Some Countries Have Much Higher Private Gold Ownership

So how about per country? How does gold ownership vary amongst private citizens across the globe?

Indian Private Gold Ownership

India is a well known example of a country with very high private gold ownership. But the level may still surprise you.

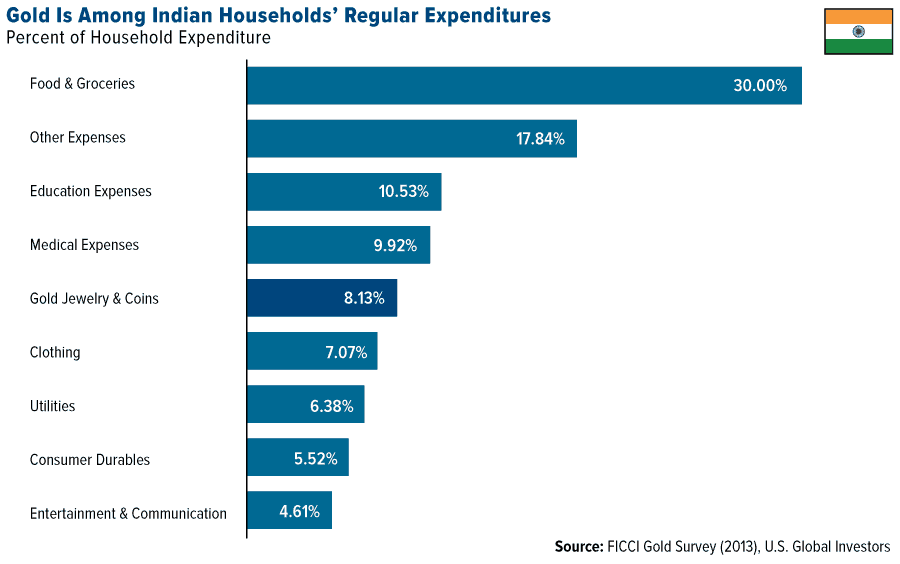

“A 2013 survey conducted by the Federation of Indian Chambers of Commerce & Industry (FICCI) found that more than three quarters of Indians view the precious metal as a “safe investment.

The same FICCI study also found that gold is a regular line item in most Indian households’ budgets, comparable to what they spend every year on medical expenses and clothing.”

Source.

Odds are gold would not even feature on a similar survey of household expenditure in any western nation!

Germany is Likely a Western Outlier in Terms of Gold Ownership

Germany is routinely in the top 5 countries for gold consumption.

In 2022, China was on top at 824.9 metric tons. Then India second on 672.4 metric tons. The USA was a distant 3rd at 235 tons. Germany was in 5th place. Source.

But a recent survey from the World Gold Council revealed that:

“More than one-third of Germans have, at some point invested in gold, and 28% of them still do, making it the third most commonly owned investment after savings accounts (61%) and equities (46%).” Source.

How Many People Have Gold in the USA?

As noted already there is very little information on current gold ownership in the USA. So let’s look at a number of estimates made from various sources to see if there is any consensus.

“How much gold does the average U.S. household own? In my opinion, a good guess is between 1/3 and 1 troy ounces (10 to 31 grams) of pure gold, plus or minus. Almost all of this gold will be in the form of solid karat gold jewelry and gold coins, with a smattering from gold-filled jewelry and electronics scrap. With gold currently trading at $1,800 per troy ounce, this translates into anywhere from $600 to $1,800 worth of gold, give or take, per household.

…it is safe to assume that these private gold holdings do not represent a significant addition to most peoples’ net worth.”

Source.

As this writer notes, it is likely gold jewellery that makes up a large portion of westerners gold holdings.

But What is the Possible Percentage of People Who Own Gold?

Looking at an overall percentage of people who own gold is probably more useful than looking at an average number of ounces owned per person.

“A detailed 2010 poll designed to elicit the views of Americans sympathetic to the tea party movement found that 5% of those who viewed the movement favorably said that they had purchased gold coins or bars in the preceding 12 months. (The poll did not report a result for the same question from the general population.) Many of the newsletters and consultants that advise people to buy precious metals estimate that between 1% and 3% of the American population owns precious metals.”

Source.

A survey in 2020 of 1500 Americans showed that 10.8% of the American population owns gold in the form of bars or coins. This number seems quite high but then 2020 did see a big increase in demand due to the covid panic.

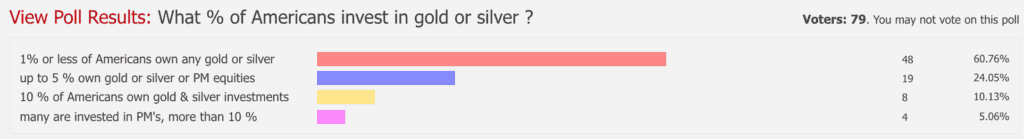

While a Kitco forum poll showed the vast majority of people guessed Amercian gold ownership was less than 1%.

So the estimates for how many people own gold in the USA vary widely. From around 1% or less, all the way up to 10%. We have even seen a survey that stated 38% of US retail investors directly own physical gold.

What Percentage of New Zealanders Own Gold?

In New Zealand there are even less figures available for gold ownership. There is no official data collected. There are also no surveys or database which tracks these purchases (for those who value their privacy we might say thankfully!)

The closest we have seen are numbers for Australia as reported by Shae Russell in 2018. Her numbers show more Aussies own bitcoin than gold. And less than 0.5% of Australians own gold:

“…few people understand gold and even less own it.

Last year, I discovered that more people own bitcoin than physical gold.

Turns out, roughly 1% of Australians own some bitcoin.

Less than half that own physical gold bullion.

Through all my years of writing about gold, I’ve often found most people don’t own gold because they don’t know why they should and where to start.”

Source.

(We can help with why people should own gold. See: Reasons to Buy Gold.)

So it would seem reasonable to assume New Zealand private gold ownership is no higher than Australia. In fact we’d guess that 0.5% owning gold would seem to be on the high side even. Now we have certainly noticed an increase in first time buyers over the last few years. However, from our experience we’d still be lucky if one in a hundred people we talk to know much about gold, let alone own any of it (other than a gold wedding band or the odd bit of 12 or 14 karat jewellery).

With all time highs recently we have actually seen a noticeable increase in people selling. This of course could be a reflection of the state of the New Zealand economy currently.

Read more: What Percentage of Gold and Silver Should Be in My Portfolio?

How Does Private Gold Ownership Compare to What it Was Historically?

“When gold was declared illegal in the United States in 1932, it was estimated that “gold hoarders” were holding onto at least $1.4 billion of the precious metal. That was, at the time, double the stated reserves of the wealthy Bank of England. Even after a concerted effort to confiscate privately held gold, it was estimated at least 20 percent of that amount remained hidden by individuals.”

Source.

Gold was actually money prior to 1932. You could elect to exchange your bank notes for an equal value of gold. And many people did. So the level of gold ownership was certainly much much higher percentage wise than today.

It was then illegal to own gold in the USA from 1933-1974. Ownership likely increased with the gold bull market in the latter 1970’s. But today in the western world it is likely still in single digits. Maybe even still not much more than 1%.

Underinvestment in Gold Continues

So there is still significant underinvestment in gold. We’d be inclined to agree with reader M.B. where he also wondered:

“Given that fewer people in history own precious metals could there be a collective yawn from the masses and worlds media. While the small investor misses out and the only winners may be the Nations of the world sensible enough to have bought and stored metals?”

The crisis kicked off by COVID-19 certainly increased the demand for physical gold in 2020. Globally refiners had trouble keeping up with demand and there were long waits for delivery of gold throughout much of 2020. This continued throughout 2021 and much of 2022.

But while there has been an increase in private gold ownership, it is from a very low base of interest.

In 2024 Central bank gold demand looks likely to continue at similar high levels to recent years. With a World Gold Council survey reporting that:

“In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022.

Following these record numbers, gold continues to be viewed favourably by central banks as a reserve asset. According to the 2024 Central Bank Gold Reserves (CBGR) survey, …29% of central banks respondents intend to increase their gold reserves in the next twelve months, the highest level we have observed since we began this survey in 2018.”

However, we doubt a survey of the general population would report that 29% of people intend to buy gold in the next 12 months! We doubt it would even be 2% of the general public.

Odds are, when it really matters, there still won’t be many more people who own gold. It’s more likely people will want to buy gold as or after the crisis reaches a peak.

Make sure you are not one of them and have your financial insurance before you need it. See what gold is available to buy today.

Editors note: First published 28 November 2018. Last updated 15 October 2024.

Pingback: Silver Break Out Beginning - Gold Survival Guide

Pingback: John Mauldin: Very low-growth 2022 accompanied by uncomfortably high inflation - Gold Survival Guide

I still suspect very few and with an example like our NZ Reserve Bank holding none ,is it any surprise.

I’ll keep accumulating and wait in the mean time

M B

Pingback: How Much Gold Has China Got? - Gold Survival Guide

My interest in gold was spurred many years ago, by a German uni professor who pointed out it’s virtues. He commented that he bought some with every pay cheque. I told him he was crazy. After all it was $US 35 an ounce!

Yes the Germans certainly seem to have more of an affinity to gold – probably due to their history with hyperinflation.