Prices and Charts

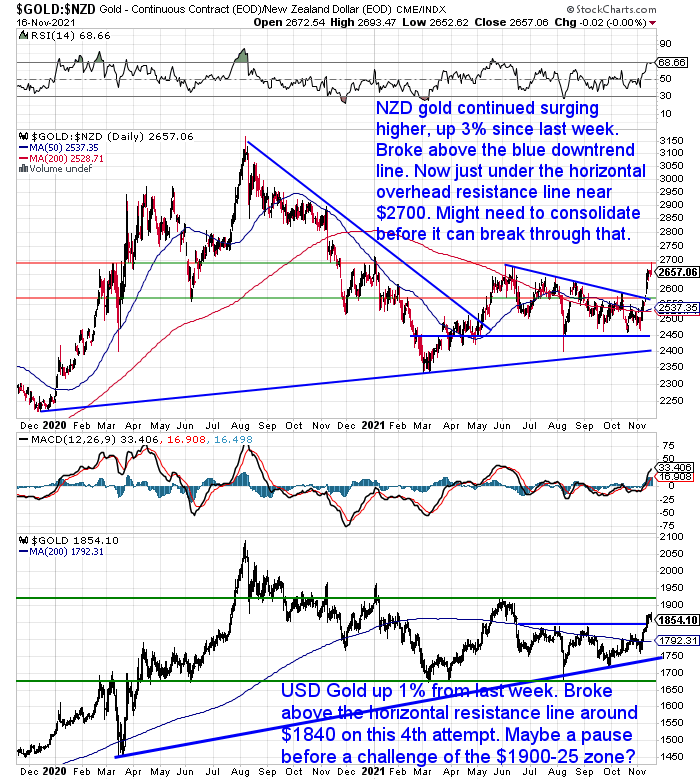

NZD Gold Breaks Out of Downtrend

Gold in New Zealand dollars continued to surge higher over the past 7 days. Breaking out of the downtrend it has been in since June, it powered up 3%. It is now sitting just under the overhead resistance line near $2700. This line is likely to provide some decent resistance, so it won’t be a surprise to see gold turn back down from here. Particularly as it is getting close to overbought levels on the RSI. This corrective phase looks to be over and after a consolidation it wouldn’t be a surprise to see gold begin the next wave in a move up towards last year’s all time high.

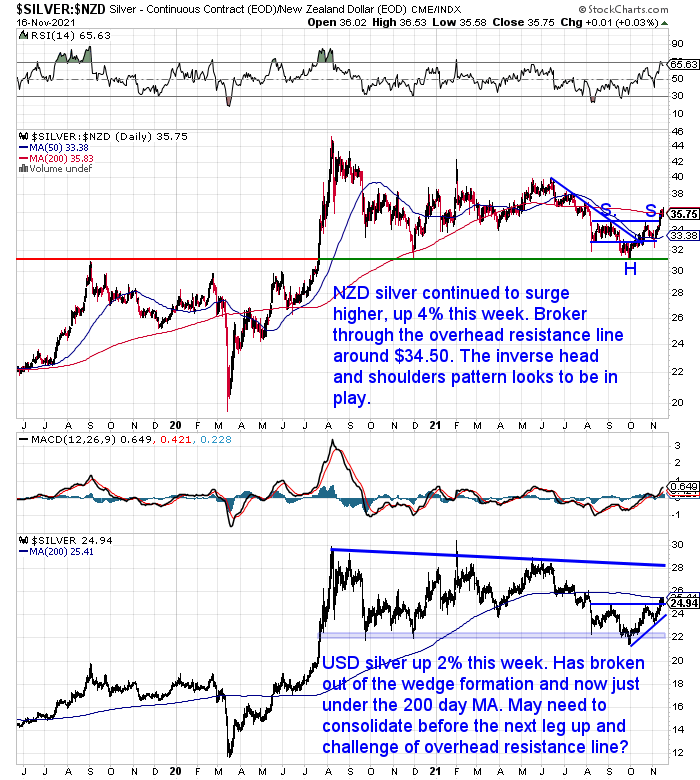

NZD Silver Also Marches Higher – Up 4%

Silver in New Zealand dollars also continued its move upwards. Rising 4% and breaking through the overhead resistance line around $35, NZD silver is now hovering around the 200 day moving average. It looks like the inverse head and shoulders pattern is in play. As we said last week this would mean a move back up to the $40 level that silver dropped from in June.

From there it is not a very big jump up to last year’s high around $45. We need to see that mark bested in order for NZD silver to have a crack at the all time high at $64 from 2011.

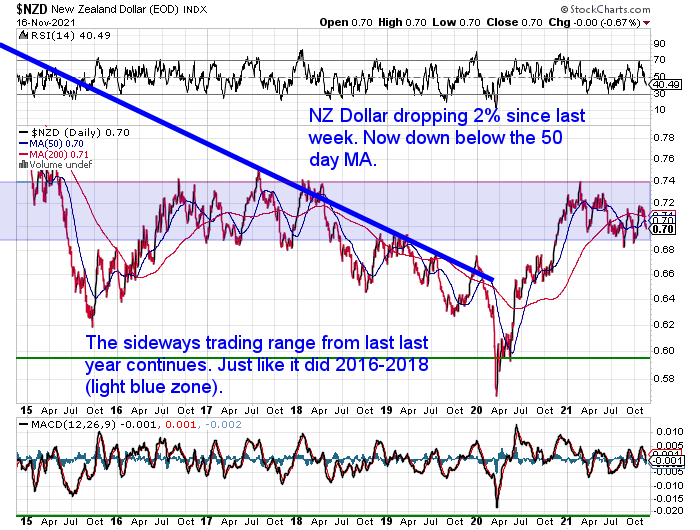

NZD Drops 2%

It is the weaker New Zealand dollar that has supercharged NZ precious metals prices this week. With the Kiwi falling 2% at the same time as gold and silver prices have risen. This is an important reminder that it doesn’t always take a weaker US dollar for gold and silver to rise.

The NZ dollar is down below the 50 day moving average again. But could be trying to put in a higher low. The weaker Kiwi may be an indicator that interest rate rises are not coming here quite as quickly as commentators have been warning.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

How Many People Own Gold? New Zealand vs Other Countries

We have seen a definite increase in first time buyers for gold and silver in recent weeks. So just how many people might own gold in New Zealand compared to other countries?

This week’s feature article attempts to answer this. It covers:

- Gold Ownership Numbers Not at All Clear

- Global Per Capita Gold Ownership in Ounces

- How Owning Just 18 Ounces of Gold Might Push You into the Top 0.8%

- Some Countries Have Much Higher Private Gold Ownership

- How Many People Have Gold in the USA?

- But What is the Possible Percentage of People Who Own Gold?

- What Percentage of New Zealanders Own Gold?

- How Does Private Gold Ownership Compare to What it Was Historically?

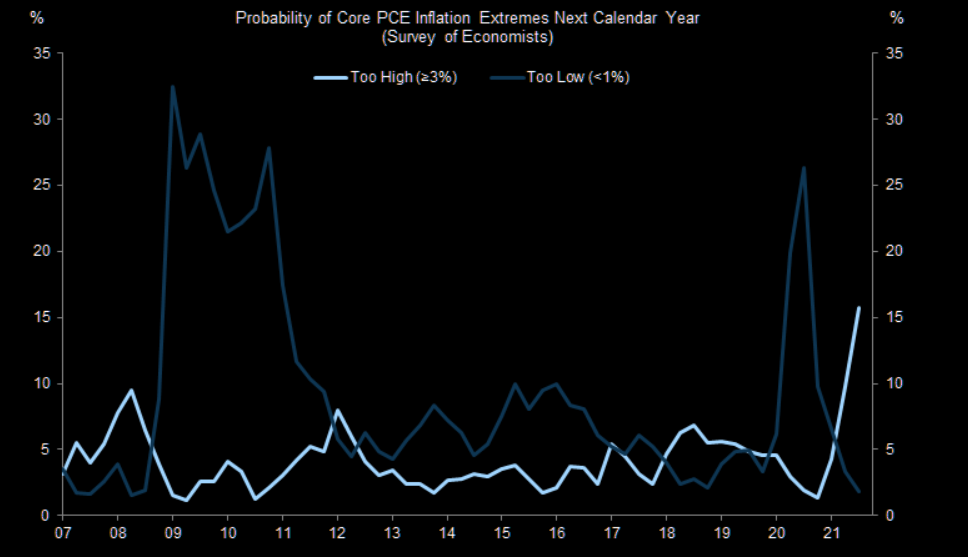

The Inflation Conundrum

The breakout in gold last Thursday came on the news of the unexpectedly high US consumer price index (CPI). The CPI vaulted 6.2% from a year ago, decidedly higher than the estimated 5.9%. This is the largest annual increase since 1990.The renewed inflation fears simultaneously drove down stock prices with the Dow dropping 240 points.

Many are still saying this jump in prices is transitory and supply chain driven. We’re not so sure. The Market Ear shared this chart from a survey of economists which also warns of risk to the high side.

At the start of the pandemic, the dominant concern among monetary policymakers was another long stretch of very low inflation. In an effort to curtail deflation risks—and perhaps taking on board lessons learned through the last business cycle—they responded forcefully with rate cuts, quantitative easing, and various forms of forward guidance. But as the Covid recovery has progressed, tail risks to the inflation outlook have shifted from the downside to the upside.

Survey of Professional Forecasters

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Here are some thoughts from a couple of other people on the subject too…

Our “Secret Investment Advisor”: The ‘good’ inflation that only lifts asset prices is probably coming to an end, and the ‘bad inflation’ that lifts consumer prices is beginning

First is Chris Weber – our “secret investment advisor”: https://goldsurvivalguide.co.nz/meet-our-secret-investment-advisor/

Chris lived and invested successfully through the inflationary 1970’s so his thoughts are worth paying attention to:

“I view this past decade or so in much the same way as what happened from 1949 to 1966. All the while monetary inflation was going on, the price level (with the temporary exception of the Korean War period) did not rise so much. Only asset prices in the stock market rose, making everyone happy.

However, by the late 1960s prices began to rise for consumers, slowly at first, and then much faster. It is no accident that when this happened for the first time in 1966, the Dow put in its highs at levels which would not be seen again, in real terms, for another two decades. It is entirely possible that we could see a repeat of history in the coming quarters.

I wonder whether this thinking is shared by Warren Buffett: he has been steadily exiting the stock market: being a net seller for the past four quarters, and building cash to record levels of around $150 billion.

[See more here.]

As a huge and very public player, he can’t risk being seen as a dramatic seller. But it seems to me that he is doing what he can to quietly prepare for a halt in the endless record highs of the averages.

I think he sees recent equity action as inflated and unsustainable.

The ‘good’ inflation that only lifts asset prices is probably coming to an end, and the ‘bad inflation’ that lifts consumer prices is beginning… much like the period which started in 1966.”

John Mauldin: Very low-growth 2022 accompanied by uncomfortably high inflation

John Mauldin also had some thoughts on inflation this week:

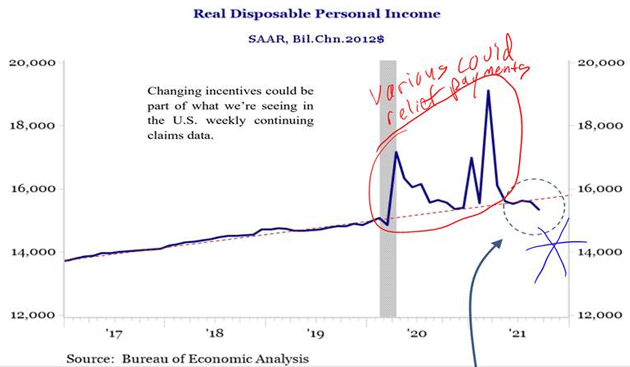

“The economic growth we’ve seen [over the past year] came not from the Fed and quantitative easing but from the massive fiscal stimulus provided by Congress, leading to the current inflation. Now that it is mostly spent, future growth will be inhibited. My friend David Bahnsen sent this chart:

Source: David Bahnsen

This is not the stuff that 3% GDP dreams are made of. It should give us pause in our exuberance of hopefully being past the COVID crisis, that the real economy is still governed by supply and demand, and demand depends on income.

I think it is quite possible we will have a very low-growth 2022 accompanied by uncomfortably high inflation. Fed officials are way behind the curve. They have now painted themselves into a corner. How do you tighten to the extent needed when GDP growth is only 1–2%?

An entire generation of portfolio managers and investors have never dealt with inflation, except in the theoretical context of an economics book. Inflationary periods have often not been kind to stock market investors. I literally have no idea what Jerome Powell (assuming he is reappointed) will do. He will only have bad choices. Doing nothing is a bad choice. Reducing QE, let alone raising interest rates, will likely prove uncomfortable for markets, to say the least. I would have your hedges and portfolio positioned for a lot of volatility over the next 14 months.”

Source.

So there is some commonality between the 2 of them. Both are concerned that stock markets may struggle in the coming years. Both also thinking we may be entering a period similar to the 1970’s.

John Mauldin’s comment about a low growth 2022 accompanied by high inflation is much like was seen in the 1970’s. In fact that is the very definition of stagflation.

So his advice to have your hedges in place seems prescient. Make sure you have enough gold and silver to cover you in what may be a bumpy road ahead.

Please get in contact if you’d like a quote or have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|