Prices and Charts

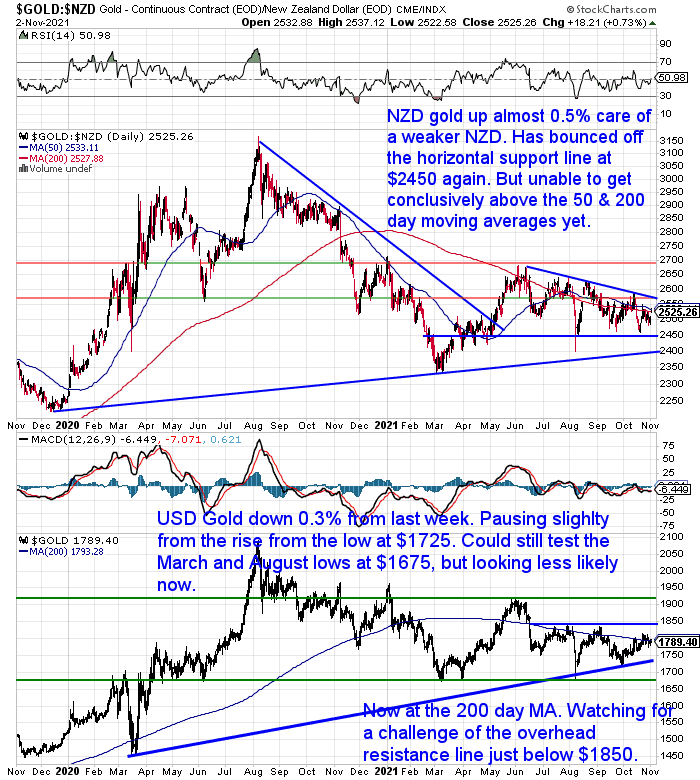

NZD Gold Up Almost 0.5% – But Only Due to a Weaker Kiwi Dollar

Gold in New Zealand dollars was up $11 or almost half a percent from 7 days ago. But this was solely due to a sharply weaker Kiwi Dollar. NZD gold is once again sitting around the 50 and 200 day moving averages (MA). We need to see it head back above $2575 to break out of the downtrend it’s been in since June. However it is looking more likely that we have seen the bottom at $2450.

While in USD gold is pausing after a strong bounce back during October.

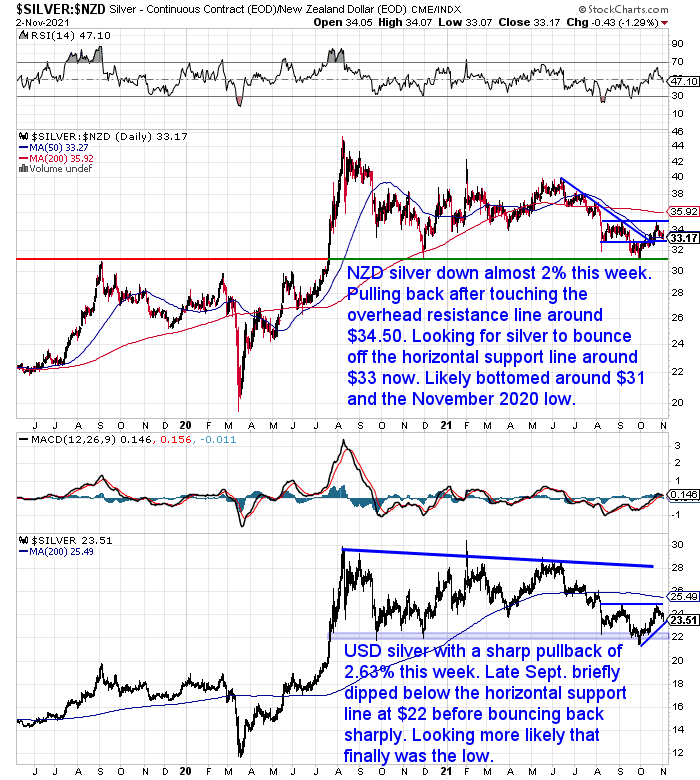

NZD Silver Down Almost 2%

The weaker Kiwi dollar was still not enough to hold the NZD silver price up for the week. It is down almost 2%. Pulling back after touching the overhead resistance line around $35. We’re now watching for silver to bounce off the horizontal support line near $33.

But like gold, we think the odds are good that silver bottomed out at the end of September around $31, which was also the low from back in November 2020.

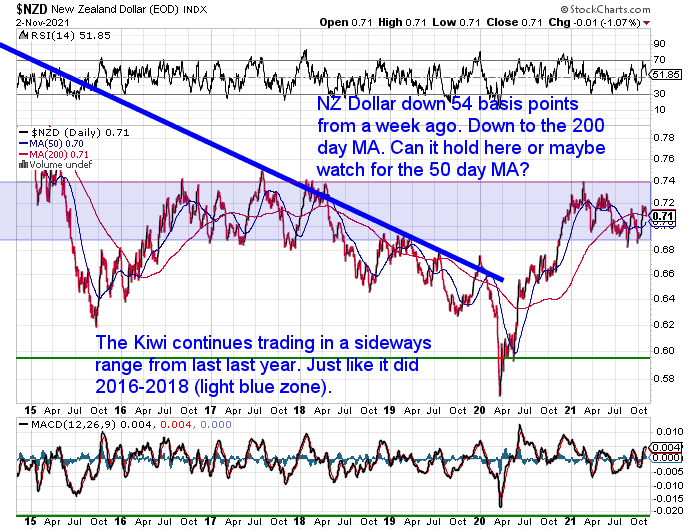

NZD Down 0.75%

The New Zealand dollar was down 54 basis points or 0.75% from 7 days ago. As noted already this held local prices up compared to the USD precious metals prices. The Kiwi is now hovering around the 200 day moving average. Can it hold above there this time? Whether or not it does, it seems likely this wide sideways trading range will continue for a while yet.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

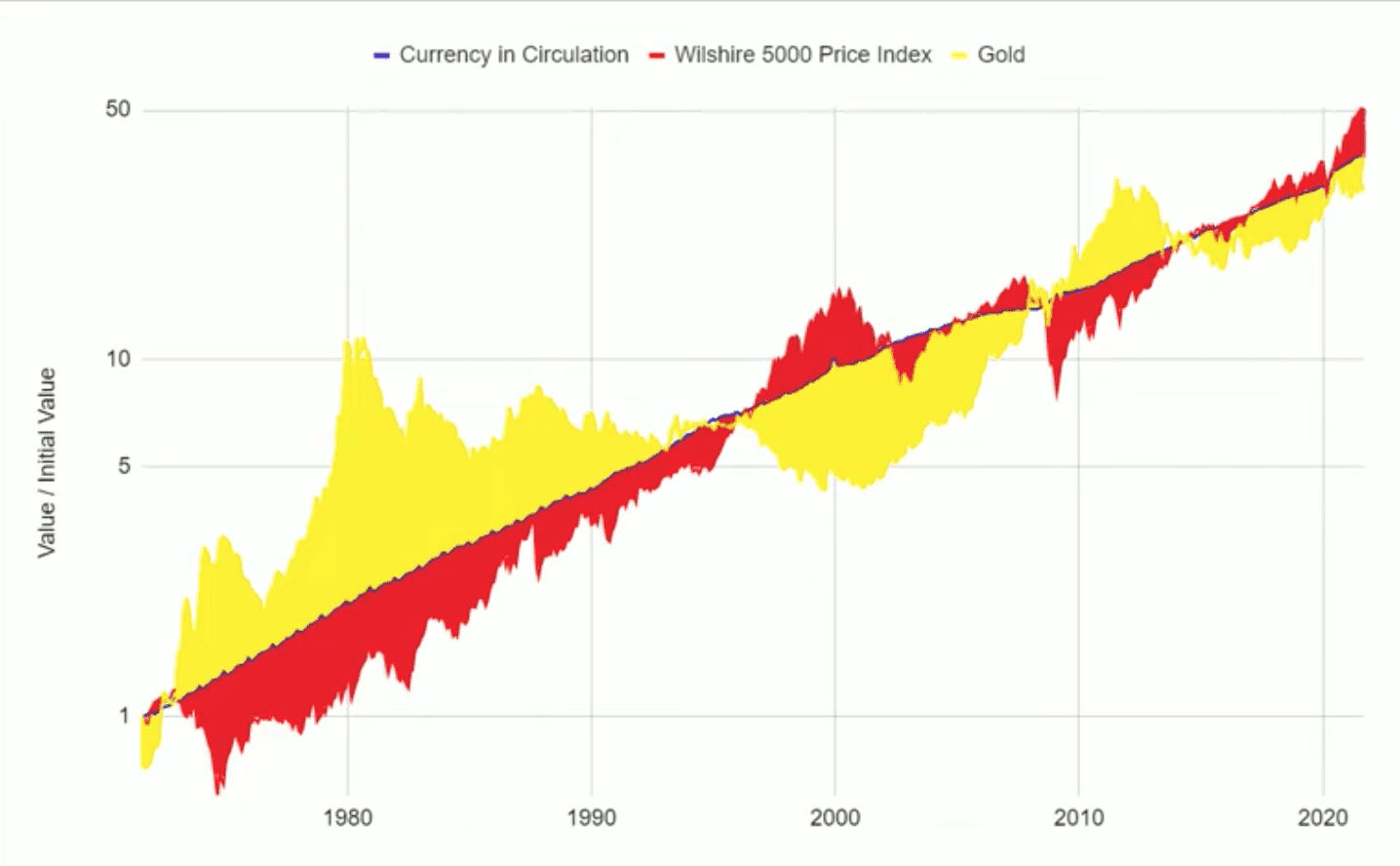

Currency in Circulation, vs Stocks and Gold

Here’s an interesting video from a week ago from the YouTube channel “Evidence Based Wealth (a.k.a. belangp)”. We’ve shared some of Paul’s videos previously. This one was entitled:

Ignore the Noise. See the Big Picture.

It is all about the below chart.

Source: Evidence Based Wealth (a.k.a. belangp)

The chart depicts the currency in circulation – the thin blue line through the middle. Along with stocks (by way of the broad US Willshire 5000 index) in red. Along with gold in yellow.

It shows a very high correlation of both stocks and gold with the currency in circulation. The chart also shows how over time stocks and gold move from undervalued to overvalued, compared to currency in circulation. That is, when either is above the blue line, they are overvalued, while below it they are undervalued.

Currently, stocks are overvalued while gold is undervalued. In the past both have been more and less over or under-valued than current measures. So it doesn’t necessarily mean stocks are about to fall or that gold is about to rise. But it does show that currently gold is the better buy in comparison to stocks.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Question of the Month Winner for October

Ian M was the winner of the 1 oz silver coin for October with his question:

“My question is, to what extent do you subscribe to the “Dollar milk shake theory”, (USD being the last man standing) and how would you see this panning out, affecting NZD? Would it happen slowly, or as a crash?”

Congratulations Ian. Here is our answer in case you missed it previously.

Thoughts on the Dollar Milkshake Theory

Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years? Where to From Here in 2021?

Another way of comparing stocks to gold is with the Dow Gold Ratio. This week’s feature article covers:

- So How Does Gold Compare to the Dow For the Past 100 Years?

- Why Shares Should Outperform Gold Over the Long Term

- Compare Gold with Stocks Using the Dow/Gold Ratio

- What is the Dow Gold Ratio?

- How Might Gold Do Versus Stocks Over the Next Decade or So?

- Why The Dow Gold Ratio May Make a New Low

US Inflation Rate Nearly 3x the 30-Year Treasury Rate

Have you been worried that gold and silver haven’t been performing very well lately? Especially given the talk of higher inflation?

If so, our secret’s investment advisor’s right hand man, Bit Hill, made a good point this week:

“Investors sometimes forget that gold isn’t moving on its own. Gold—like all markets—moves as people buy and sell it. Gold isn’t what is reacting to inflation, it’s people that react to inflation and purchase gold, driving up prices. It takes time for people to react to change because at a core level, we all hate major changes. Most people would rather live in denial of the changing external forces than admit that we have to reshape our worldview and the way we see things, but things are changing whether we’d like to admit it or not. Once people feel the effects of the change—the effects of inflation—and start to react to prices increasing across the board, hold onto your horses, because things are going to move fast.

I’d like to point out that the inflation rate is nearly 3x the 30-year treasury rate in the US. That is a new and uncomfortable change that bondholders have yet to react to, but when they decide to react, the effects on the bond market—and subsequently all markets—could be violent. The Fed uses terms like “transitory” to make people feel as though it will be temporary, just like many people used similar terms at the beginning of the Covid Pandemic.

The sudden realization that Covid was worse than we originally thought and here to stay changed the dynamic of the world in a matter of days, could the same realization over inflation change the course of our markets as we know them? I think so, the question is when, but I think sooner than most realize.”

An inflation rate 3 x the long term US bond interest rate means real (as in after inflation) interest rates are very negative. So perhaps interest rates will rise somewhat to make up for this. But Brit’s theory is hard to argue with. It’s likely gold will play catch up with these negative rates before too long too.

Local refinery operations continue under Level 3. But dispatches to Auckland addresses and collections have been suspended as goods cannot be inspected, counted or signed for by the customer.

Dispatches will stored and insured free of charge until it is safe again to dispatch them and signatures can be obtained. When we drop down a level, you will be advised when your order is ready to collect and to book in a collection time to ensure an adequate distance between customers.

Although, currently imported orders are continuing to be delivered via Fedex. So that is an option if you are looking to spend more than around NZ$10-15,000.

Please get in contact if you’d like a quote or have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|