It is interesting to see a mainstream news organisation in Australia reporting on the state of the Reserve Bank of Australia’s gold reserves. The Wentworth Report’s David Evan summarised and commented on an article published by “The Australian”.

First check out David’s thoughts. After that we also share some disturbing information on the one and only audit of Australia’s gold reserves. Then we’ll have some comments of our own at the end about New Zealand’s gold reserves…

Gold’s Demise Bar None. … Well, Four

In a vault deep in the basement of the Reserve Bank’s Martin Place headquarters in Sydney sits a hoard of gold bars worth about $US500,000 each — all four of them.

The RBA now holds almost the entirety of the nation’s gold in vaults administered by the Bank of England.

To add insult to injury to the nation’s gold devotees, the vaults are stuffed full of the redesigned $10 polymer banknotes awaiting official release in September. …

Australia sold its gold in 1997, in a sale timed to suppress the price of gold, to bury it forever, and replace it with government paper:

Then-treasurer Peter Costello agreed to sell most of its holdings in 1997.

The decision prompted cries of betrayal from the gold industry and, with the benefit of hindsight, was incredibly poorly timed. Since the sale of 167 tonnes of gold for $2.4 billion, or just over $400 an ounce, gold in Australian terms has rallied to record highs. The price peaked last July at $1819.44 an ounce, at which point the gold Australia sold for $2.4bn would have been worth $10.7bn. …

Australia is in the paper camp, with the monetary progressives:

The RBA’s current gold holdings, in the Bank of England’s vaults, now total just under 80 tonnes.

That’s less gold than is held by the central banks of Iraq, Poland and Romania, according to figures compiled by the World Gold Council, and is just a sliver of the amount held by similarly sized economies such as Spain (281.6 tonnes) and Russia (1706.8 tonnes).

Gold has been accepted as money most everywhere civilized for the last 5,000 years. Paper currencies come and go, usually ending in a storm of inflation and over-production to meet some crisis or other.

That storm will be on the West soon. We have record low interest rates, near zero, so next time there is a recession the only available tool for the central banks is “printing.” In addition, the debt load across society is greater by far than at anytime in history (courtesy of the great bubble, 1982 – 2008), and the temptation to inflate society out of its debt will become irresistible at some point.

Government got us into this mess, and government will keep digging until it collapses.

Here’s a link to the full article on the Australian Website. Although it is behind a paywall so may not open for you. Otherwise just search for: “Gold’s Demise Bar None. … Well, Four” and it will likely open from the search result.

(Also in case you’re interested, we’re pretty sure it’s the same David Evans of GoldNerds, that we’ve featured previously from his talks at the Gold Symposium in Sydney).

A New Gold Scandal – England Denies Australia Access To Its Gold

Another potential issue for Australia’s remaining gold reserves, is that 99.9% of the gold reserves are held at the Bank of England. The Reserve Bank of Australia (RBA) has previously said:

“The Reserve Bank has processes in place to ensure that the gold reserves are maintained appropriately. It is not considered necessary from management, security or operational perspectives to relocate the gold bars to a facility in Australia.”

However check out the below interview with John Adams (Hat to to G.C.). Adams clearly points out that Australia’s gold reserves likely haven’t been “maintained appropriately” at the Bank of England.

John Adams outlines how a freedom of Information release in 2014 highlights 3 scandals in relation to Australia’s gold reserves:

- Prior to 2013 Australia had never conducted an audit of its gold at the Bank of England!

- The RBA never had a formal arrangement with the Bank of England (B of E) as to: What were their obligations to look after the gold reserves? How often could the RBA check on the gold? What were the circumstances around the verification of the gold? The RBA finally asked for this in 2012 when they also wanted to audit the gold.

- Given there was perhaps a suspicion that the gold may not be there, it is very surprising that the B of E set the rules of the game for the audit. The audit took place in September 2013. But communication began in June 2013. Adams details how the Bank of England specified:

- what areas the RBA could take their “random sample” from.

- How they had a very long lead time to prepare for the audit.

- How there was a non random component of the sample with enough time to have the required bars refined.

- It was unknown how many bars were in the random sample. But the B of E specified this random sample would also come from a similar area as the non random sample!

The Audit results were never released which is very surprising. If the gold was there, then there should be no need to keep the results secret?

There was talk of a further audit by the RBA in 2019. John Adams believed it should be much more thorough than the previous audit and the Bank of England should not be given any warning of it.

However it doesn’t appear a further comprehensive audit has been done. The RBA’s 2019 annual report simply states:

“During the year in review, the Bank audited its gold holdings, including that portion stored at the Bank of England.”

Then, earlier this year, the Australian Auditor-General responded to a request from Senator Gerard Rennick dated 22 March 2021, that the Auditor-General put in place the practice of annually auditing Australia’s gold reserves.

The Auditor-General’s reply simply said:

“The audit procedures undertaken include: obtaining assurance from the BoE annually on the RBA’s gold holdings with the BoE; auditing the transactions undertaken in any year that impact the gold balance; and reviewing the cyclical stocktake work undertaken by RBA’s internal audit function over the gold holdings. Your letter refers to Australian Auditing standard ASA 501 Audit Evidence—Specific Considerations for Inventory and Segment Information. This standard is not applicable to the ANAO’s audit of the RBA’s gold holdings as these holdings are not considered to be inventory.”

So basically the reply from the audit office was, we just look at the relevant documents as the gold reserves are classed as inventory, so don’t have to be physically inspected.

It appears unlikely that there will be a further audit of the actual gold reserves held by the Bank of England.

There is a petition for Australians to sign to “Bring Home Our Gold”. However given the response from the audit office it seems unlikely this will have much impact.

How Does New Zealand Compare to Australia in Terms of Gold Reserves?

We’ve previously discussed how if the US dollar were again linked to gold, New Zealand couldn’t directly peg it’s dollar to gold.

Why is that?

Because, unlike the US there is nothing to back this change with!

Why New Zealand Doesn’t Need to Audit its Gold Reserves…

New Zealand Beats Australia – But Best We’re Not Too Proud of This One

Australia may have sold a very big chunk of its gold reserves in 1997 – 167 tonnes to be exact, with 80 tonnes now remaining. However, the Reserve Bank of New Zealand 9RBNZ) managed to do even better.

New Zealand now has a grand total of 0 (as in zero) tonnes of gold. So there is no need for any audit of New Zealand’s gold reserves!

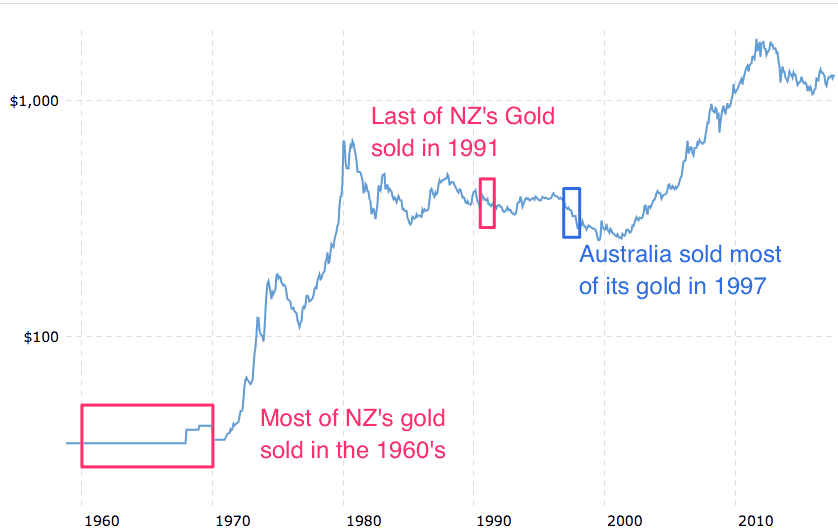

This total of zero tonnes hasn’t changed since we wrote about it back in 2009. However we couldn’t recall exactly when New Zealand’s gold reserves were sold. Helpfully the Reserve Bank Museum tell us that:

“Most of the gold reserves were divested in the 1960s. The last remaining gold was sold in 1991.”

So not only did we sell more gold than our trans-Tasman cousins, we also managed to do it earlier! Although at least we may have gotten a slightly better price than they did in 1997 on the 1991 sale. (But only slightly).

However we can’t say the same about the 1960’s sales. They took place when the US Dollar was still linked to gold at $35 per ounce. So the bulk that was sold in the 1960’s would have net just US$35 per ounce at whatever the USD/NZD exchange rate was at the time.

The Epitome of Badly Timed Gold Sales

Check out the chart above though. Considering how much the gold price rose from 1970 to 1980 – peaking at over US$800 per ounce, the sale of the bulk of New Zealand’s gold in the 1960’s would have to rival “Brown’s Bottom” for the worst timed gold sale ever!

(Brown’s Bottom refers to the sale of the U.K.’s gold by Chancellor of the Exchequer (similar to our Minister of Finance role) Gordon Brown in 1999-2002. Pretty much at the lowest point for gold in 20 years and just as gold was about to start rising.)

But all is not lost – as there is an answer to the issue of New Zealand not having any gold reserves. And it is not to start a petition for the RBNZ to begin buying gold…

The Answer: Create Your Own Gold Standard

We don’t know what the future will hold. We don’t know what the monetary system will look like, but odds are that in the next decade it will have undergone some serious change.

There are a lot of technological changes going on currently. But there is only one currency that has stood the test of time for Millenia. There is only one currency that will likely still be around and of value (and likely more valuable than today) in 10 years time.

So it seems like a good idea to create your own gold (and silver) standard. Become your own central bank and start your own gold (and silver) reserves. See: Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

Head over to our product page to see what options are available or get in touch if you have any questions.

Editors Note: This article was originally published 8 August 2017. Last updated 8 June 2021 with latest information in the Audit of Australia’s gold reserves.

Pingback: How to Create Your Personal Gold Standard - Gold Survival Guide

There’s more gold in my mobile-phone than in RBNZ’s vaults.

There’s more gold in my mobile-phone than in RBNZ’s vaults.

Who what why: How much gold can we get from mobile phones?

http://www.bbc.com/news/blogs-magazine-monitor-28802646

Pingback: The Russian Central Bank and the New Golden Rule - Gold Survival Guide

Pingback: Gold Backing to Debt Ratio: A Reset Like in 1934 and 1980 Would Mean $21,000 Gold - Gold Survival Guide

Pingback: When Will You Know It's Time to Sell Gold?

Pingback: Why New Zealand Won’t Have Any Say in a Global Currency Reset - Gold Survival Guide

Pingback: Rickards: The Lucky Country is Out of Luck - How About New Zealand? - Gold Survival Guide

Pingback: Jeff Berwick: The End Of The Monetary System As We Know It

Pingback: How Many People Own Gold? New Zealand vs Other Countries - Gold Survival Guide

Pingback: Why You Should Become Your Own Central Bank - Even if Your Nation’s Central Bank Has Gold Reserves - Gold Survival Guide

Pingback: Russia Eliminates US dollar From Its National Wealth Fund - Gold Survival Guide