“Haven’t gold prices gone up quite a lot in the last year or so? So why buy gold now? Isn’t it too late to buy?”

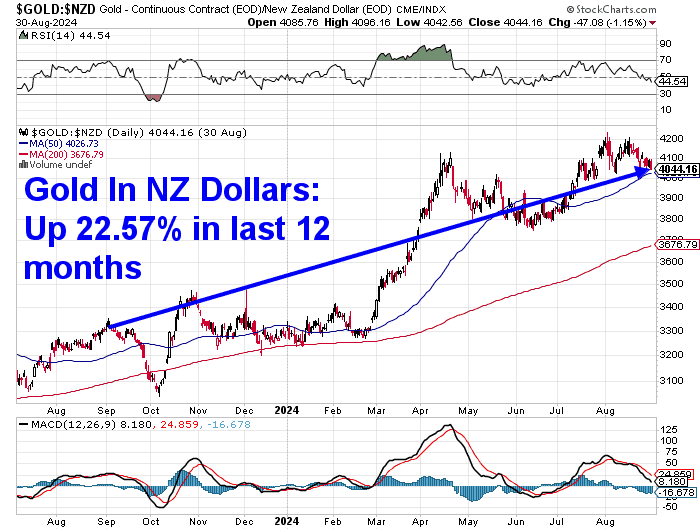

That’s one of the common responses we get when we mention we are involved in selling gold and silver bullion. Unlike a number of years ago the average guy or girl in the street now knows that gold has risen a fair bit since the start of the millennium. And even more so in recent months. As the chart below shows, gold in NZD terms is up 22.5% over the last 12 months:

Therefore people may think that because prices are up compared to where they were, that there’s no need to buy gold now. Is that the case?

Table of Contents

- Why Buy Gold – Reasons to Buy Gold Right Now in 2024

- • Markets in General Are Still Very Risky

- • Geopolitical Risk is Still Very High

- • Inflation Rates Have Fallen From Multi-Decade Highs – But Another Wave to Come?

- • Central Banks Rock and a Hard Place: Inflation vs Easy Money

- • US Dollar Continues to Lose Share of Global Reserves

- • 5 Major Bank Failures Last Year. More to Come?

- • Mine Supply Has Peaked

- • Chinese Are Buying – But Are Likely Much Larger Holders of Gold Than They Declare

- • Central Bank Buying in First Half 2024 Highest on Record

- • Reasons to Buy Gold in New Zealand Now

- Why Buy Gold? Here’s Some Timeless Reasons

- • Why Buy Gold Timeless Reason No 1: To remove some of your wealth from the banking system

- • Why Buy Gold Timeless Reason No 2: Protection from devaluation

- • Why Buy Gold Timeless Reason No 3: To become your own central bank

- • Why Buy Gold Timeless Reason No 4: Protect your purchasing power with history’s best ever store of wealth

- • Why Buy Gold Timeless Reason No 5: Every fiat (government decreed) currency has eventually gone to zero throughout history

- • Why Buy Gold Timeless Reason No 6: Used as money for millennia

- Why Buy Gold? Final Thoughts…

Looking back at past articles, while we’ve mentioned many reasons as to why to buy gold previously, we’ve never actually written them all down in one place.

So today we turn our thoughts to the question “Why buy gold now in 2024?”. While there might appear to be some risks, aren’t the economists and central bankers telling us high inflation is now in the rear view mirror? If everything seems fairly stable, why bother to buy gold?

Why Buy Gold – Reasons to Buy Gold Right Now in 2024

Off the cuff without too much thought we can come up with a multitude of reasons currently as to why to buy gold in 2024 including:

• Markets in General Are Still Very Risky

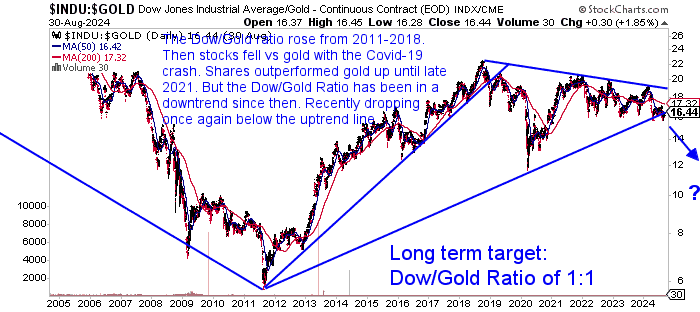

Share markets globally have been rising steadily for many years. There was a blip in early 2022, with stock markets falling for the remainder of the year. But most share markets remain close to record highs. However when compared to gold, the broad stock market has actually been falling since 2018. This chart shows the Dow Jones to Gold Ratio. That is the broad US stock market index vs the gold price. Or how many ounces of gold to buy the Dow.

What if we enter a cycle where sharemarkets actually go nowhere or even fall for a number of years? Likewise with property prices. Real estate in New Zealand has been falling since 2022. There are good arguments to be made that while interest rates remain heightened, demand for property will be dampened.

Our guess is that gold is just at the beginning of a cycle where it will outperform both property and sharemarkets. For more on this see:

NZ Housing to Gold Ratio 1962 – Dec 2023: Measuring House Prices in Gold

Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years? Where to From Here in 2024?

• Geopolitical Risk is Still Very High

In recent years we have had warships amassing in the Strait of Hormuz over murmurings of Israel attacking Iran. There has been a lot of “sabre rattling” going on between China and Japan over the disputed Senkaku Islands. In 2017 we had the agitation between the USA and North Korea. We also had the trade war between the USA and China added into the mix around the same time.

We also have a possible conflict between China and Taiwan, which could draw the USA into the fight.

We have an actual war in Ukraine, with tensions between Russia and the west continuing to rise. Plus the ongoing war between Israel and Hamas, with Iran looking likely to become further embroiled in this (See this article for more on that topic: How Does War Affect the Gold and Silver Price?). Gold usually performs well in times of geopolitical tension and the stress levels are certainly high at the moment!

• Inflation Rates Have Fallen From Multi-Decade Highs – But Another Wave to Come?

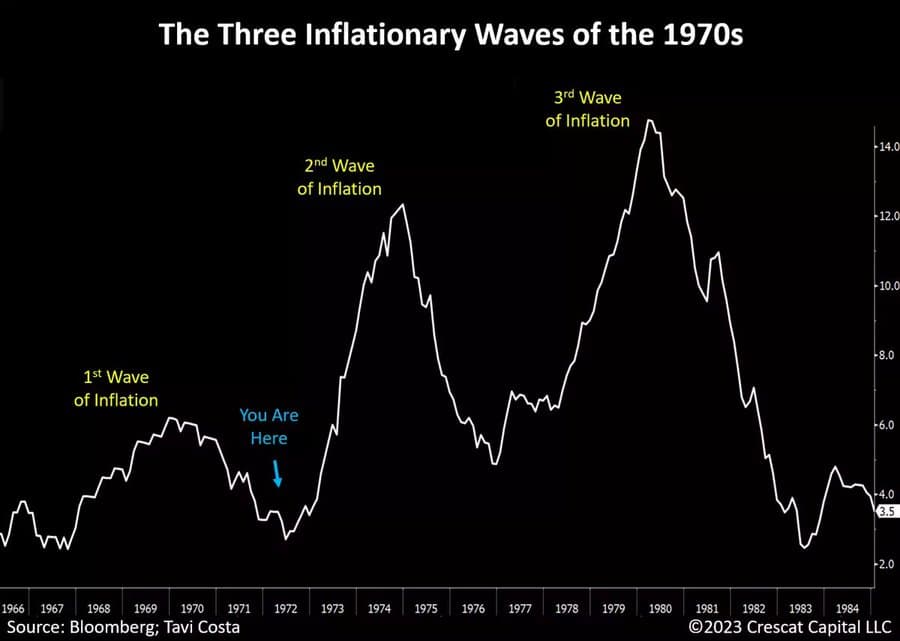

Inflation rates across the world have been dropping from the highest levels since the 1980’s. While central planners and bank economists say these inflation rates and therefore interest rates will soon be back to normal levels, and stay there, we think it may be the start of a much longer term cycle. Past inflationary periods shows that inflation often comes in waves.

• Central Banks Rock and a Hard Place: Inflation vs Easy Money

Central bank balance sheets have been ever expanding since the 2008 crisis. The European Central Bank, the US Federal Reserve and also the Bank of Japan all engaged in massive money printing programs post 2008. Then in 2018 and through to 2019, the US central bank attempted “quantitative tightening”. But in September 2019, the Federal Reserve had to reverse course when troubles arose in the overnight interbank “repo” market . (Read more on that here: Federal Reserve Balance Sheet Reduction: What Impact Will it Have?)

The Covid19 response saw a massive increase in the Fed’s balance sheet. But in 2022, central banks started to reduce this stimulus and also raise interest rates as inflation started to get out of control.

So they face an impossible exit.

Raise interest rates too much and cause markets to crash. Gold could dip initially in this situation but is likely to come back fast like it did in the 2008 crash.

Or don’t raise them enough and let inflation run wild. High inflation is indirectly positive for gold. See below for more on this. It looks like this is the more likely scenario. Many central banks have just started to cut interest rates. Our thinking is this will lead to the next wave of inflation.

But in the long run, which ever way the central banks go, we think it will be positive for gold.

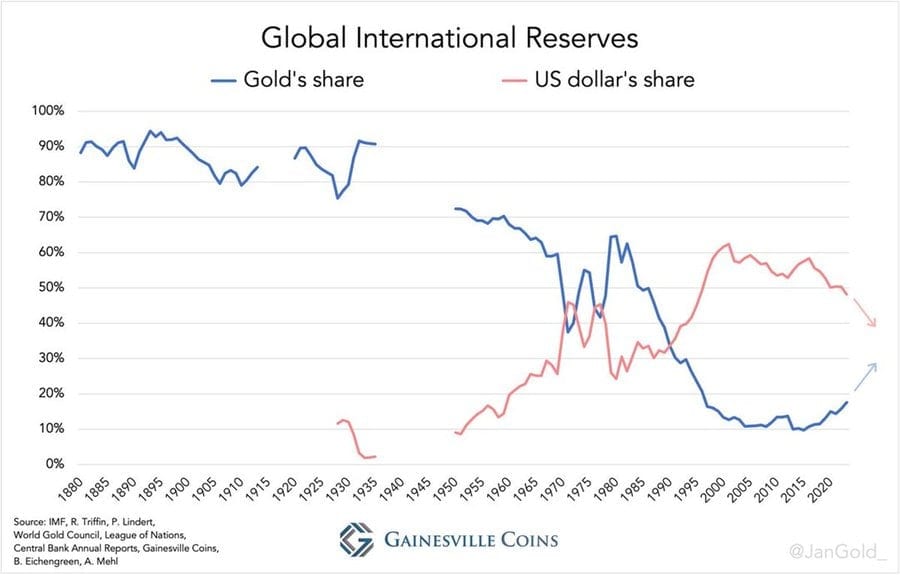

• US Dollar Continues to Lose Share of Global Reserves

Since 2014 the US Dollars share of global reserves has dropped from 59% to 49%. While Gold has increased from 10% to 19%. But there is likely still a lot more to come for this trend.

• 5 Major Bank Failures Last Year. More to Come?

In May 2023 First Republic Bank, became the 4th US bank to be shut down by authorities. It was “sold” to JP Morgan Chase. Counting the Credit Suisse sale that made 5 major failures in 2023. JPM CEO Jamie Dimon said, “the system is very very sound”. But as they noted on ZeroHedge “Doesn’t seem like it Jamie, old chap?” We wager there are more bank failures to come down the track. The 2008 financial crisis showed that these failures came in waves that got closer and closer together over a period of years. See further down the page about how gold has no counter-party risk, so unlike a bank account you are not reliant upon your bank to remain solvent.

• Mine Supply Has Peaked

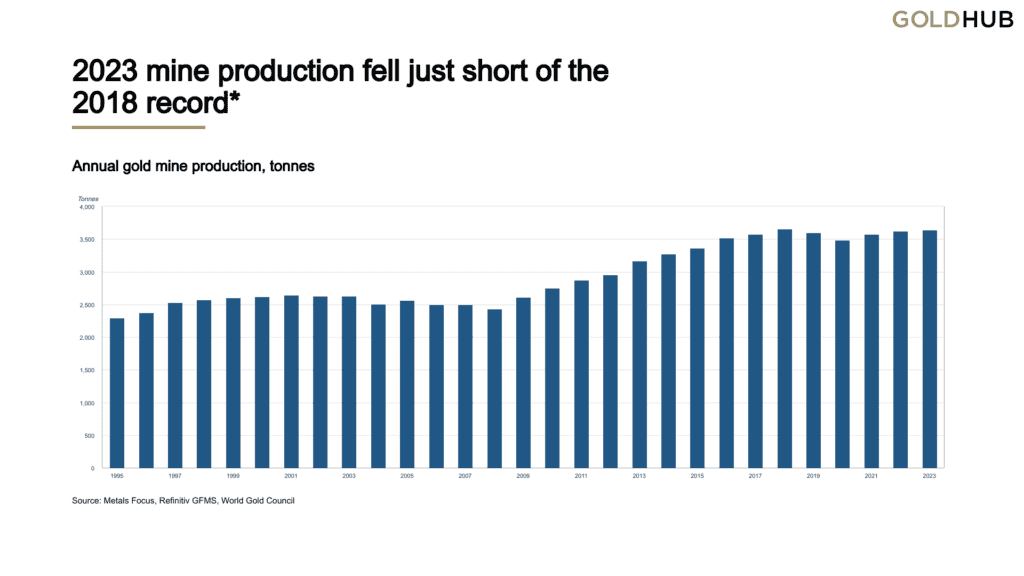

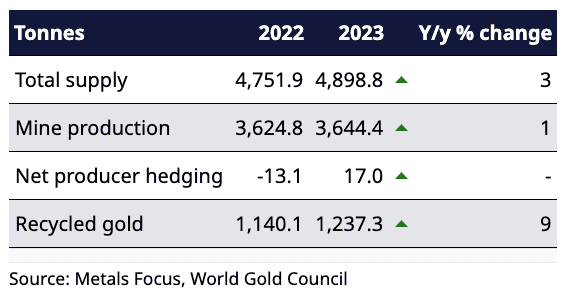

While up 1% in 2023, mine supply peaked in 2018.

In 2023 total gold supply was up 3% from 2022.

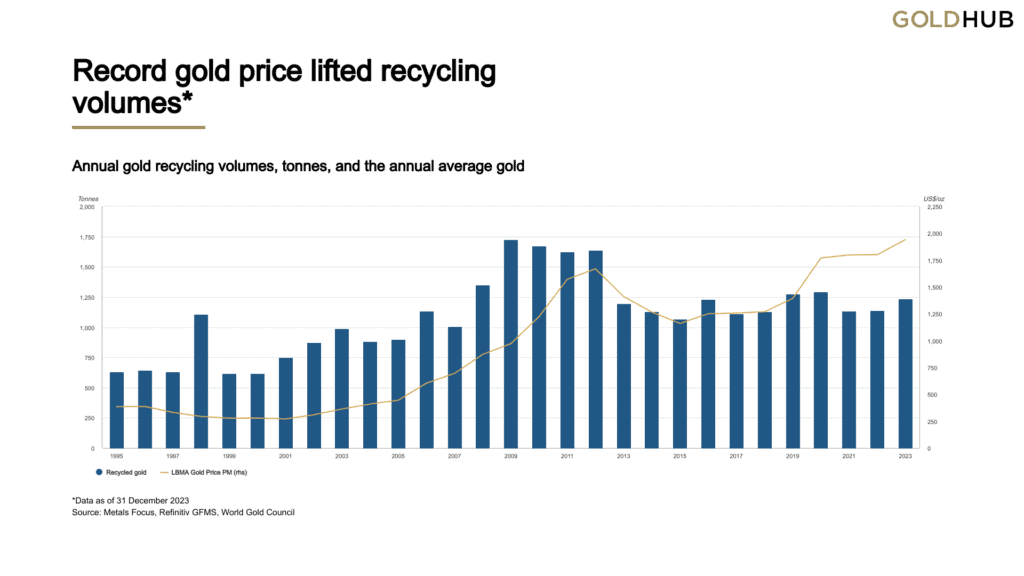

Recycling was up 9% but is 30% below the all-time high seen in 2009, despite the record annual average gold price in 2023.

With many gold mines due to reach the end of their life in the coming decade, gold production is not likely to increase significantly in the coming years. If it just stays relatively flat and if demand then continues to rise, prices will likely continue to rise too.

• Chinese Are Buying – But Are Likely Much Larger Holders of Gold Than They Declare

China has increased their central bank gold reserves this year by 29 tonnes. This despite not officially reporting any purchases for May, June or July. However a report says:

“China still has plenty of appetite for official gold purchases despite pausing in May and June, as its bullion holdings remain low as a share of reserves and geopolitical tensions persist, according to a policy insider, industry experts and data.” Source.

But prior to this recent stretch of buying, China hadn’t reported any addition to their official gold reserves since 2019. Despite China being the largest miner of gold in the world, it is illegal to export gold from China. So what gold is mined in China, stays in China. This interesting report outlines why China likely has much much more gold than their official 2068 Tonnes. As the report mentions, eventually the Chinese may announce their true gold reserves, and that may have a significant impact on the price when they do.

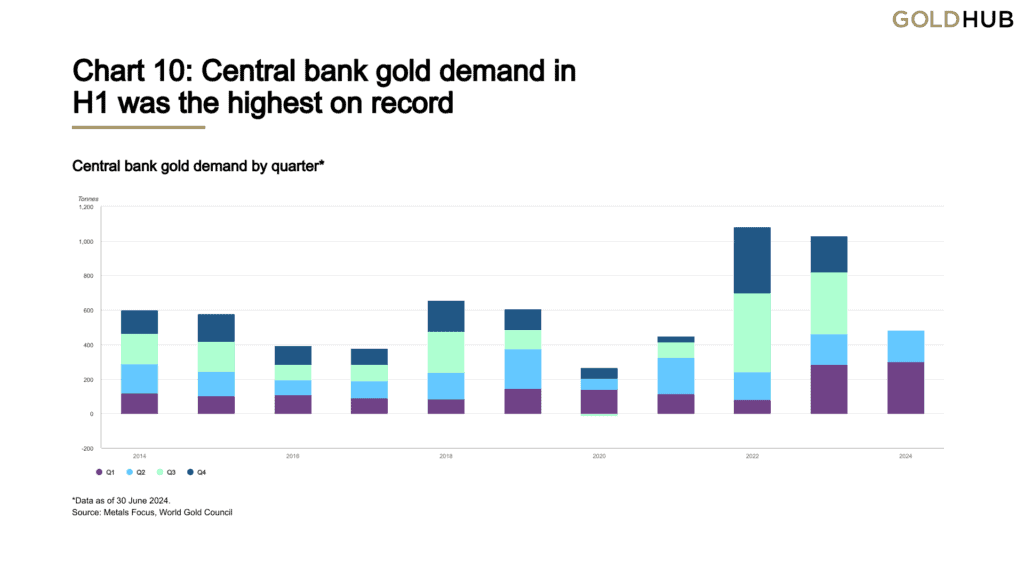

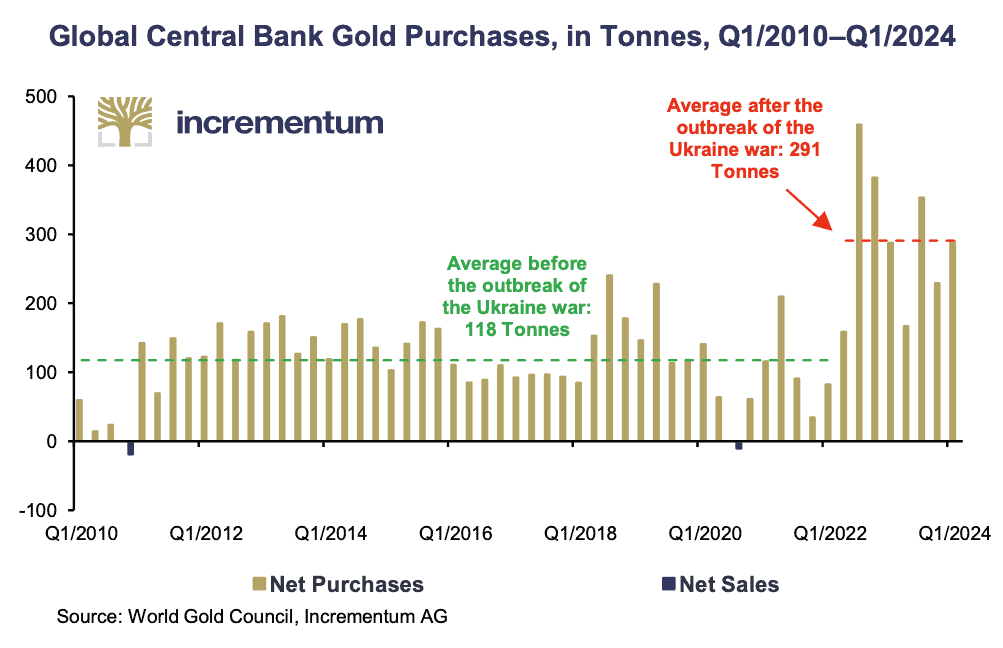

• Central Bank Buying in First Half 2024 Highest on Record

Central banks turned from net sellers to net buyers of gold in 2011. In recent years these have included Russia, South Korea, Mexico, Kazakhstan, Ukraine, Sri Lanka, Philippines, Turkey and China. “Central banks currently hold 20% of all the gold ever mined—33,000 metric tons.” Source.

Word Gold Council data showed that central banks were net buyers of gold for the 13th consecutive year in 2023.

Here in 2024 that demand continues, with the first half of the year showing the highest H1 demand on record.

It’s significant that since the outbreak of the Ukraine war, the average global central bank gold purchases have increased from 118 tonnes per quarter to 291 tonnes. Likely in recognition of the risk of holding US dollars as reserves which can be confiscated, just like they were from Russia.

Source: In Gold We Trust Report

Read more about central bank buying, particularly in the eastern hemisphere: Why Does Gold Demand Remain Strong in the East? and Why is Russia Selling US Treasuries and Buying Gold?

• Reasons to Buy Gold in New Zealand Now

Here’s 7 factors that will help you determine if now is a good time to buy gold in New Zealand: Is Now a Good Time to Buy Gold in New Zealand?

Why Buy Gold? Here’s Some Timeless Reasons

On top of the current reasons above, there are also a number of what you could call “timeless” reasons as to why to buy gold:

• Why Buy Gold Timeless Reason No 1: To remove some of your wealth from the banking system

Gold is the only financial asset that has no counter-party risk. Physical gold in your possession has no debt obligation, so there is not someone else on the other side of the trade whom you rely upon to remain solvent. Learn more: Why Gold Bullion is Your Financial Insurance

• Why Buy Gold Timeless Reason No 2: Protection from devaluation

Paper currencies have steadily been losing value over the past century. Precious metals “store of wealth” characteristics offer protection against government devaluation of currencies. Be they of the slow and steady kind by inflation of the money supply, or overnight devaluations by government decree.

• Why Buy Gold Timeless Reason No 3: To become your own central bank

In case you didn’t know the Reserve Bank of New Zealand has no gold reserves, so don’t expect any help from them in terms of maintaining the purchasing power of the NZ dollar. Buy gold and become your own central bank instead. For more on this see: Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves.

• Why Buy Gold Timeless Reason No 4: Protect your purchasing power with history’s best ever store of wealth

An often quoted point is that a fine toga and sandals in roman times cost an ounce of gold. Today an ounce of gold still buys a fine mens suit and pair of shoes. But, the same can not be said with any fiat or paper currency of only 100 years ago. $20 may have bought a suit in the early 20th century. It doesn’t buy much more than a couple pairs of socks a century later.

•Why Buy Gold Timeless Reason No 5: Every fiat (government decreed) currency has eventually gone to zero throughout history

Today we are in the unique situation where every currency on the planet is a totally unbacked fiat currency. And history has shown that no fiat currency lasts forever. So, if a few thousand years of history is any indication, then buy gold as it can’t go to zero and will always be worth something. Learn more: No Fiat Currency Lasts Forever – What About the NZ Dollar?.

•Why Buy Gold Timeless Reason No 6: Used as money for millennia

Because gold is a store of value, unit of account and medium of exchange. Learn more about why gold is money: What Good is a Bar of Gold When the Shelves are Empty?

Why Buy Gold? Final Thoughts…

It’s interesting that people have no trouble believing property prices can go up year after year, but struggle to comprehend why it is that gold is rising in price. Even though both are often driven by the same factors such as easy money, low interest rates and expanding debt. But unlike property gold can also thrive in times of higher interest rates like we are seeing currently.

We believe it is paper currency (or digital currency these days) that is in a bubble not gold. That is, because gold reflects the amount of paper currency in existence we can therefore state that there is no limit to how high gold can go. Any future crisis is likely to be met with the same response as we have seen in the past. Where Central Banks the world will create even more currency out of thin air, so the paper bubble can be inflated much higher yet.

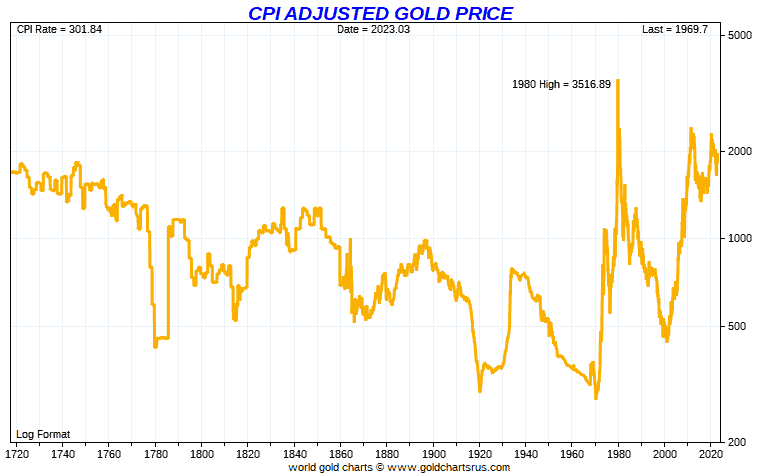

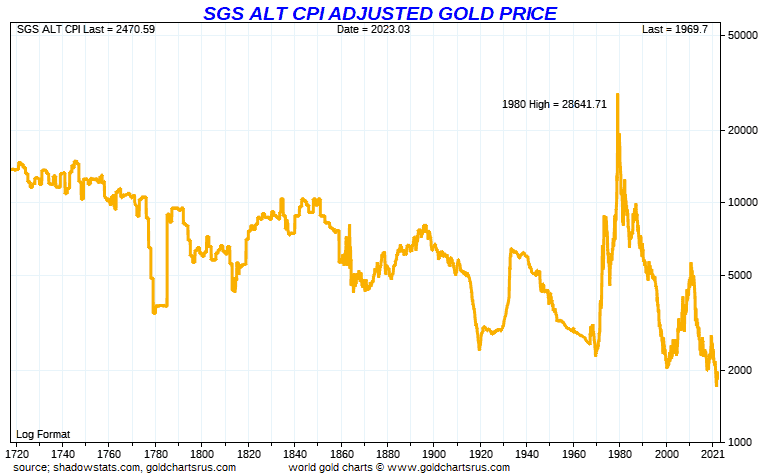

What is the Inflation Adjusted Gold Price?

The current inflation adjusted price for gold to reach its 1980 high clearly shows how much upside gold likely still has left. Today gold would need to reach US$3,516.89 just to match the 1980 high of US$850.

How about if we use the CPI figures from Shadow Government Statistics? – a more reliable measure than the current US government inflation numbers. The 1980 high now becomes $28,641. There is potentially a lot of upside to come in gold.

In fact by this measure gold is almost as cheap today as it was when the current bull market started in 2000. Even more significantly gold is close to the cheapest it has been for 300 years.

For more on what price gold could reach check out: How Do You Value Gold | What Price Could Gold Reach?

So you can see there are still plenty of valid reasons as to why to buy gold.

If you agree and would like to buy some gold bullion in 2024, then head on over to our online gold shop to check todays indicative prices to buy gold now.

Or more information on the process of how to buy gold see: How to Buy and Invest in Gold >>

Can you think of any other reasons to buy gold? Share them with us and other readers – Leave a comment below!

Read more: When to Buy Gold or Silver: The Ultimate Guide

Editors Note: Initially published on 26 September 2012. Last updated 3 September 2024 with updated reasons to buy gold now and many more charts and tables.

Pingback: Gold to Silver Ratio: What Can We Expect Now After QE3? | Gold Prices | Gold Investing Guide

Hi there, Good reasons, may they be oft repeated. Another one is that, at this point at least, there is no tax to pay when selling, or GST… it is possible to “hide” ones wealth in precious metals. Its not officially money right? There is no need to declare it in any way. I’m just another conspiracy nutter with dreams of Gold but no “real” digits in any bank computer; no need to bother with me…thats how I like it!

Keep up the good work!

Gerry.

Hi Gerry,

Thanks for taking the time to add another very relevant reason – especially for those who prefer to stay “off grid”.

Cheers

Glenn

Pingback: Why Buy Silver? | Gold Prices | Gold Investing Guide

Pingback: Winston Peters - Let’s Join the Currency Wars | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Silver or Gold? Which Should You Buy? - Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide NZ Dollar Gold and Silver: Update After the Fall

Pingback: How Much Further Could Gold in NZD Fall? -

Pingback: Buying Precious Metals: Common Questions from First Time Buyers -

Pingback: Gold & Silver in NZ Dollars: 2015 in Review & Our Guess For 2016

Pingback: GoldSurvivalGuide's Mission Explained - Gold Survival Guide

Pingback: Gold and Silver Technical Analysis: The Ultimate Beginners Guide - Gold Survival Guide

Pingback: 12 Reasons Why Gold and Silver Will Rise in 2018 - Gold Survival Guide

Pingback: Reader Question: Why is Gold More Valuable Than Worthless Paper?

Pingback: Just How Well Capitalised are New Zealand Banks?

Pingback: Derivatives - a Beginner's Guide to “Financial Weapons of Mass Destruction”

Pingback: 7 Reasons to (Still) Buy Gold

Pingback: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver - Gold Survival Guide

Pingback: What Type of Gold Bar Should I Buy? - Gold Survival Guide

Pingback: 28 Reasons to Buy Physical Gold - Gold Survival Guide

Pingback: The 5 Biggest Market Risks That Billionaires are Hedging Against - Gold Survival Guide

Pingback: How Many People Own Gold? New Zealand vs Other Countries - Gold Survival Guide

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated) - Gold Survival Guide

Pingback: What Percentage of Gold and Silver Should Be in My Portfolio? - Gold Survival Guide

Pingback: Why Buy Gold? No Fiat Currency Lasts Forever - What About the NZ Dollar? - Gold Survival Guide

Pingback: Russian Gold Ban - Will the “Law of Unintended Consequences” Strike Again? - Gold Survival Guide

Pingback: Caution: Don't Be Caught on the Sidelines - Gold Survival Guide

Pingback: Bank Failures: Most Likely Just the Start - Gold Survival Guide

Pingback: Largest Food Price Rise since 1987! - Gold Survival Guide

Pingback: Exit Strategies For When the Time Comes to Sell Gold and Silver