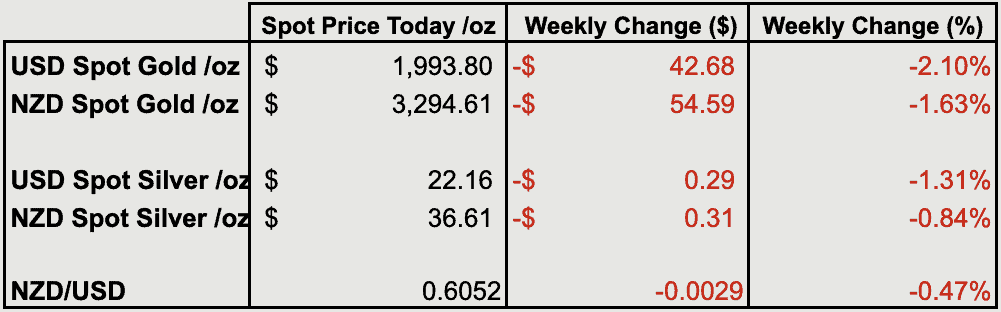

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3151 |

| Buying Back 1kg NZ Silver 999 Purity | $1117 |

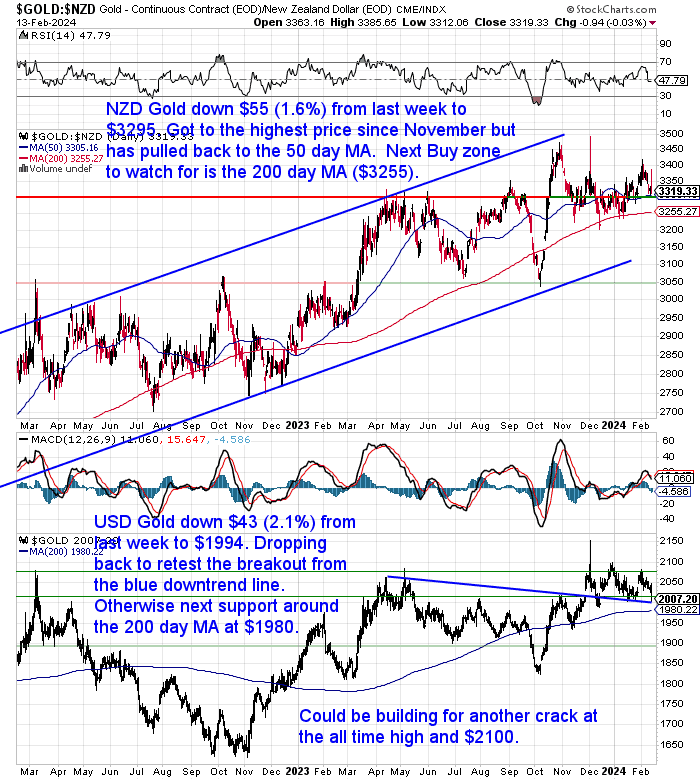

NZD Gold Back to the 50 Day MA

Gold in New Zealand dollars was down $55 or 1.6% from 7 days ago. Today it sits just under the 50 day moving average (MA) at $3295, having pulled back from the highest price since November. The next buy zone as we said last week is now the 200 day MA at $3255. That has been strong support over the past couple of years, with the price only dipping below this on a handful of occasions.

While in US dollars gold was down $43 dropping back under the $2000 mark. It is retesting the breakout from the blue downtrend line. If that doesn’t hold then the 200 day MA is just below that at $1980. Then horizontal support at $1950.

Silver Once Again at Uptrend Line Buying Zone

NZD silver fared a bit better than gold for the week. Dipping 31 cents or 0.85% to yet again be back down to the blue uptrend line of the wedge formation. So it is once again also in what has proven to be an excellent buying zone over the last few years.

Pretty much the same situation on USD silver too. Down 29 cents or 1.3% this past week and also yet again close to the uptrend line too. Great place to grab a position too.

NZ Dollar Back Around Recent Lows

The Kiwi dollar was down 29 basis points from last week to 0.6052. Sitting just under the 200 day MA. Still watching to see if it can again challenge the downtrend line like it did over the holidays. But so far in 2024 the trend has remained down

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

NZ Housing to Silver Ratio 1968 – Dec 2023 – Measuring NZ House Prices in Silver

How to Buy a Median Priced House in NZ Freehold, for Only $44,815…

For decades, Kiwis have dreamt of owning their own slice of paradise. But with house prices still sky high despite the recent correction, that dream seems increasingly out of reach. But what if there was another way? This week, we explore the fascinating world of the “Housing to Silver Ratio” and delve into the possibility of using silver as a barometer for property investment.

In this article, you’ll discover:

How much silver it really takes to buy a house in New Zealand today (and how it compares to the past)

Why silver could be poised for a major comeback

Whether the 1970s housing market stagnation holds any clues for the future

So buckle up and get ready to rethink everything you thought you knew about property investment. Silver might just surprise you!

P.S. Want to know more about the magic number of 1000 ounces? Read the full article to find out!

NZ Housing to Silver Ratio 1968 – Dec 2023 – Measuring NZ House Prices in Silver

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Record Central Bank Gold Demand Continues

This week’s feature article shows silver is very undervalued compared to property. While last week’s article on the housing to gold ratio, showed that there was a fair bit of upside in gold compared to property.

So silver remains super undervalued compared to property and therefore compared to gold too.

This is partly evidenced by the differing demand for the two metals globally right now. Gold demand remains robust, mostly due to central banks and Chinese consumer demand:

China’s Gold Sales Surge As Economic Confidence Crashes

As China’s economy slows, it is increasingly taking refuge in gold and helping to drive global demand to new heights.Since the end of its draconian pandemic-era restrictions last January, the world’s second-largest economy has been menaced by challenges from a stagnant manufacturing sector to a high debt-to-GDP ratio to an ongoing property sector crunch.

Yet the People’s Bank of China, the country’s government-dominated central bank, was the single-largest purchaser of gold last year, according to a report released Wednesday by industry group the World Gold Council.

Global demand for the metal last year was down 5 percent from 2022 when excluding over-the-counter (OTC) market trading, the report said. However, taking OTC into account, this figure rises to 4,899 metric tonnes (5,400 tons), an annual record. The report noted that the average price of the commodity, US$1,940 per ounce, was also a record, exceeding that of 2022.

Source.

The report goes on to explain that it is central banks who are doing most of the purchasing when it comes to gold:

“Central banks continued buying up gold at “a blistering rate,” per the report, securing 1,037t in 2023—the second highest on record after 2022. The People’s Bank of China boosted its reserves by 225t year-on-year, for a total of 2,235t of the commodity.”

This made up for the drop in coin and bullion demand in Europe, along with a fall in jewellery demand in India. Whereas Chinese consumer demand for both bullion and jewellery was up in 2023.

While Silver Demand Falls

Whereas according to the Silver institute overall demand for silver is expected to drop 10% in 2023. While industrial demand is up 9%, physical investment in silver coins and bars is forecast to drop 21% in 2023 to 263 Moz.

“Losses have been concentrated in India and Germany. In India, record-high local prices led to profit taking, resulting in a 46% decline. In Germany, investor sentiment was diminished by the Value Added Tax hike on some silver coins at the start of 2023. On the plus side, the resilience of the United States market kept the global total historically high.

While outflows are predicted for Exchange Traded Funds (ETFs) for the second straight year too.

Record Low Premiums

This lower demand for investment silver is reflected in the premiums above spot price for some products being very low. This includes bulk silver maple coins with the lowest premiums above spot price that we can remember for some time. Along with silver coins from other mints such as Austria, Australia and South Africa also at multi-year lows.

Meanwhile the gold price continues to build and quietly move higher. This is what often happens in the early stages of a cyclical bull market. Gold won’t be making any headlines, except for the wrong reasons like this one: Gold Prices Tumble to Two-Month Lows as U.S. Inflation Data Provokes Sell-Off. But the price will tick higher without many people noticing. Then slowly more new buyers will be attracted in.

Could This Be the Start of Gold Getting a Bit More Attention?

A clip from Joe Rogan’s podcast doing the rounds this week perhaps could be the start of gold getting a bit more attention on it?

“Joe Rogan: Have you ever seen the amount of Gold that exists on Earth?

The finite amount of gold that exists on Earth is shockingly small …

Today we have the silver price once again back down to what has been an excellent buying zone on the multiyear blue uptrend line. Combine this with the lowest premiums above spot price for many many years and right now is an excellent time to be buying a mint box of 500 silver coins. Check out the silver coin options here with 500 x 1oz Austrian Philharmonic Silver Coins being the best value right now.

Get in touch for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|

— Prepared for the unexpected? — Never worry about safe drinking water for you or your family again…New Australian Product: The Superoo 16 Litre Gravity Water Filter by Filteroo. Leak free design with double the capacity of similar filters.This filter will provide you and your family with safe drinking water for years to come. It’s simple, lightweight, easy to use, and very cost effective. Comes complete with Stainless Steel Tap, Stand and Water Jug.—–

|

Pingback: Gold Open Interest Lowest in 5 Years - So What? - Gold Survival Guide