Prices and Charts

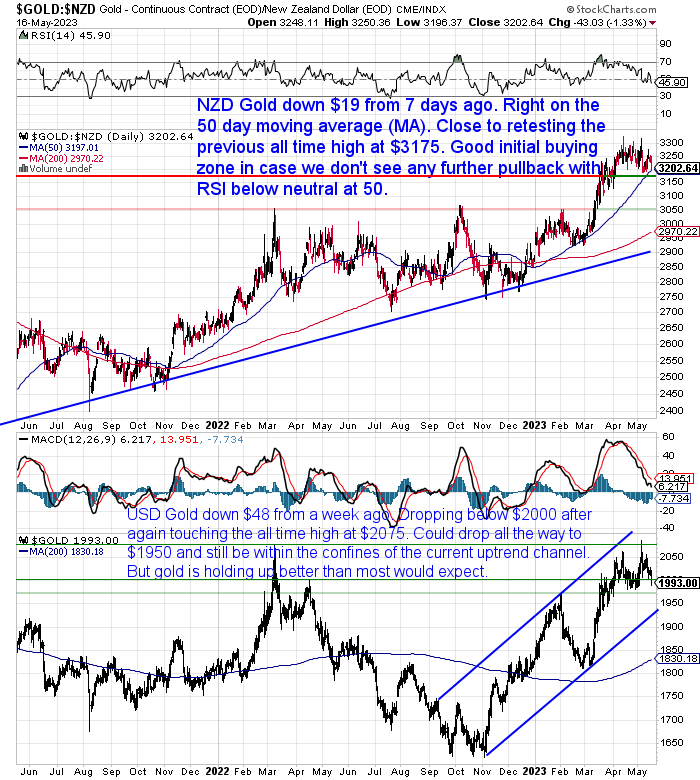

NZ Dollar Gold Touches the 50 Day Moving Average

Gold in New Zealand dollars fell $19 from last week. Down to the 50 day moving average and also close to retesting the previous all time high at $3175. NZD gold still remains a long way above the 200 day moving average. So it could pull back further to close that gap up. Maybe to $3050 which marks the highs from 2022. But current levels are likely a good initial buying zone in case a further pullback doesn’t eventuate.

The weaker NZ dollar held local gold prices up better than offshore, where USD gold was down a hefty $48 (2.34%) from 7 days ago. The consolidation above $1975 continues. Although USD gold could fall all the way back to $1925-50 and still be within the confines of the uptrend channel.

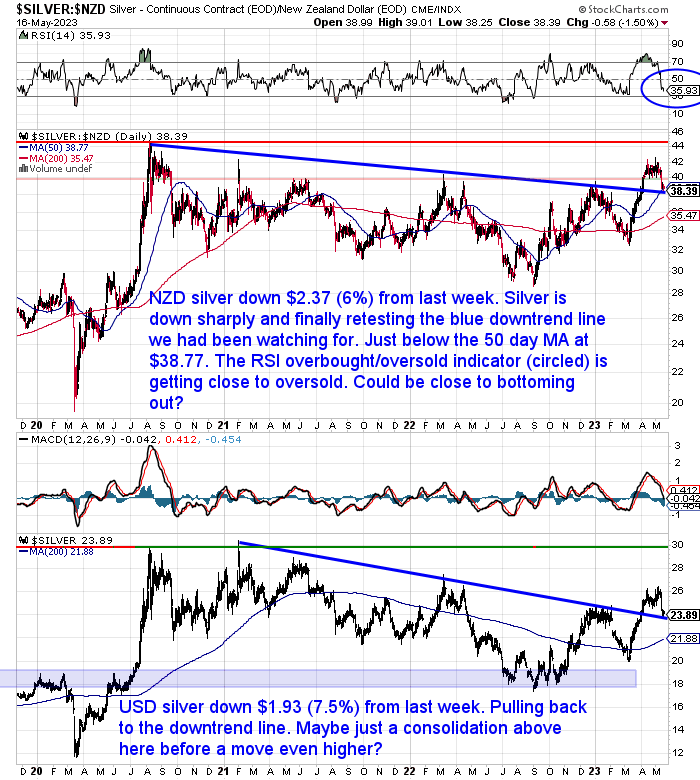

NZD Silver Down almost 6%

Silver has undergone a sharp correction this past week. NZD silver fell $2.37 (5.84%). Taking the price back down to just below the 50 day MA and also retesting the breakout from the blue downtrend line. This is the pullback we had been watching for. With the RSI getting close to oversold we could be close to bottoming out perhaps? Likely a good long term buying zone around these levels.

USD silver fell even more, down 7.5% for the week. It is also now right on the downtrend line. So perhaps we’ll see a consolidation along that line before a move even higher begins?

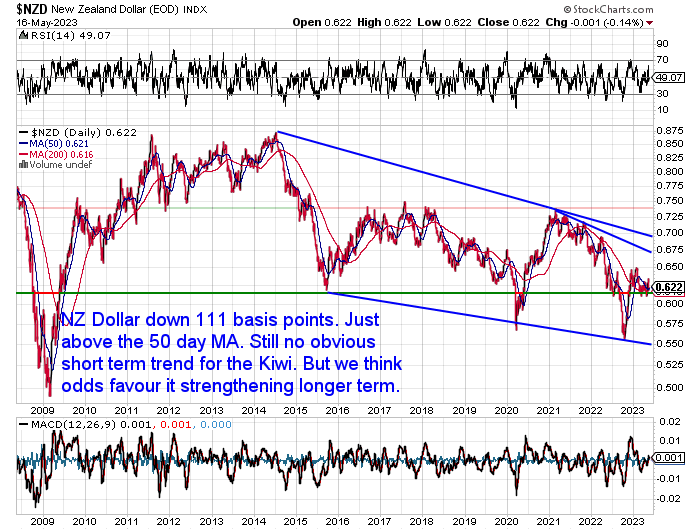

NZ Dollar down 1.75%

The NZ dollar gave up most of the previous week’s rise. Dropping 111 basis points or 1.75% from last week. Pulling back to just above the 50 day moving average. This sideways consolidation continues with no obvious trend in place. In the longer run we do think the USD will weaken so the Kiwi is likely to gently trend up.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

New Zealand Bank Deposit Protection Scheme – Does N. Z. Have Bank Deposit Insurance in 2023?

Our featured article from last week, How to Safely Hold Dollars, Remain Liquid, and Seize Short-term Opportunities, generated a bit of interest.

However it also highlighted that, despite all we’ve written over recent years, many people are still unaware of whether their bank deposits in New Zealand have any guarantee or insurance.

So this week we’ll give you the full run down on this topic including:

- History of Bank Guarantees in New Zealand

- Latest Update 2023: What We Now Know About the Proposed Bank Deposit Protection Scheme

- What About Accounts at Multiple Banks?

- Will Bank Deposits Held by a Kiwisaver Scheme be Covered by a Deposit Guarantee?

- Does a Government Bank Deposit Guarantee Make Our Banks Safer?

- How Does the Proposed N.Z. Bank Deposit Guarantee Compare to Other Countries?

- Alternative to Relying on the Bank Deposit Protection Scheme

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

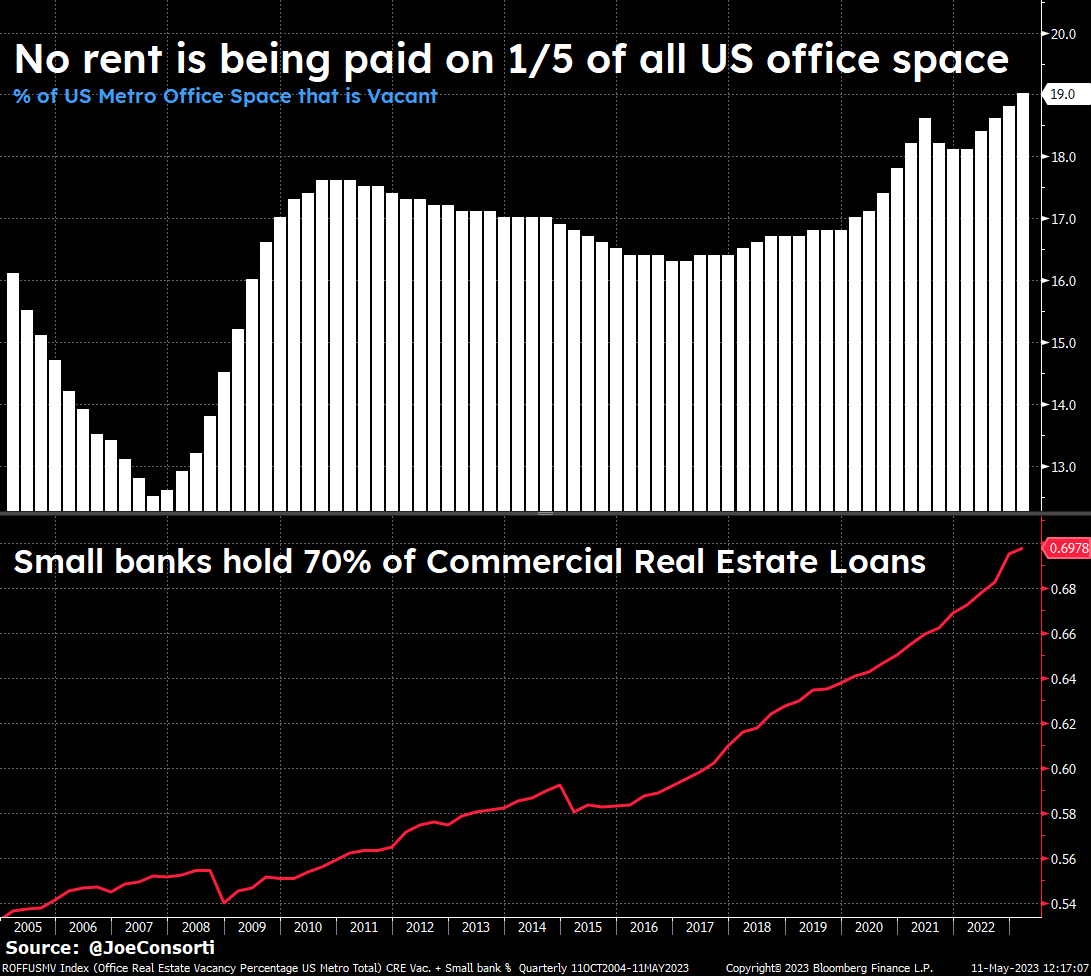

JPM Head: Commercial Real Estate Losses May Take a Few Banks Down

Empty commercial real estate is a big problem right now in the USA. Even Jamie Dimon the head of JP Morgan says commercial real estate losses may take a few banks down and that this is “normal”.

But this tweet and chart shows it could be very very significant:

“No rent is being paid on 1/5 of all US office space, and small banks hold 70% of commercial real estate loans.

As cash flows from empty properties dry up, loans will be defaulted on — wiping out many of the small banks who wrote them:

Source.

If the small banks hold 70% of commercial real estate loans, maybe it could be more than just a “few” that get into trouble?

Largest Food Price Rise since 1987!

This will come as no surprise to anyone doing their household grocery shopping:

“Food prices soar 12.5% annually – largest increase since 1987”

Read more

1987 was a long time ago. We believe it was the time of fluro t-shirts and Stubbies shorts were still cool. It was also when GST was introduced (1986). So part of the 1987 rise was actually due to that. That makes the current rise sound even worse.

Of course this has got the powers that be looking at what they can do to stop the grocery stores from raising prices even more. Because surely they are the cause of this aren’t they?

However…

“A new report says the current grocery sector reforms are unlikely to deliver significant benefits for consumers, with stronger measures needed. The report has been released the day after it was announced Stats NZ’s food price index rose 12.5 percent in the year ended April, the highest annual rate since late 1987.

Read more

This shouldn’t come as a big surprise to anyone who looks at the root cause of high food prices. It’s not simply due to a “supermarket duopoly”, as food prices are high in most countries.

The Statistics NZ report said “fruit and vegetables prices increased by 22.5%”. Hmmm. We’re pretty sure fruit and veg prices have gone up at our local farmers markets as well. Last time we looked the prices there were set by Farmer Joe and Joanne not a big bad duopoly.

Sure the weather will have played its part in these rises. But we’d still say the main contributor is inflation of the currency supply. Which initially jacked up house prices, and which is now filtering through to everyday goods. Who caused that? The RBNZ and every other central bank on the planet.

No Kidding: Inflation Remains “Uncomfortably High”

So we’re seeing more and more stories like this one:

Inflation remains ‘uncomfortably high’ as New Zealand’s economic growth predicted to slow in year ahead – Westpac

The New Zealand economy has lost steam and economic growth is predicted to slow over the year ahead, a report has found. Westpac’s latest Economic Review found that while inflation pressures are starting to soften, it is still “uncomfortably high”.

Read more

No kidding. As we’ve been saying this will likely prove much harder than most think to get back to the 1-3% target band. It’s more likely we’ll see it zig-zag up and down but with a trend that remains high.

Maybe the same thing is happening here, as in the USA. The Wall Street Journal reports:

“We May Be Getting Used to High Inflation, and That’s Bad News

Companies’ ease with raising prices may mean more rapid increases are becoming entrenched.

The more people behave as if high inflation is here to stay, the likelier it is to stay. That would force the Federal Reserve to choose between inducing a potentially deep recession to force inflation lower, or giving up on its 2% inflation target.”

Source.

We’d say the latter is more likely. As Nomi Prins Points out:

“Central bankers seem wedded to gradualism—accepting a very slow fall in inflation to avoid too much damage to the labor market… The problem with gradualism is that the longer the path for lowering inflation, the less likely it is to happen.”

Source.

Years and years of “easy money” (currency) won’t be reversed by just a year or so of high interest rates.

Prepare accordingly for higher inflation for longer…

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|