Prices and Charts

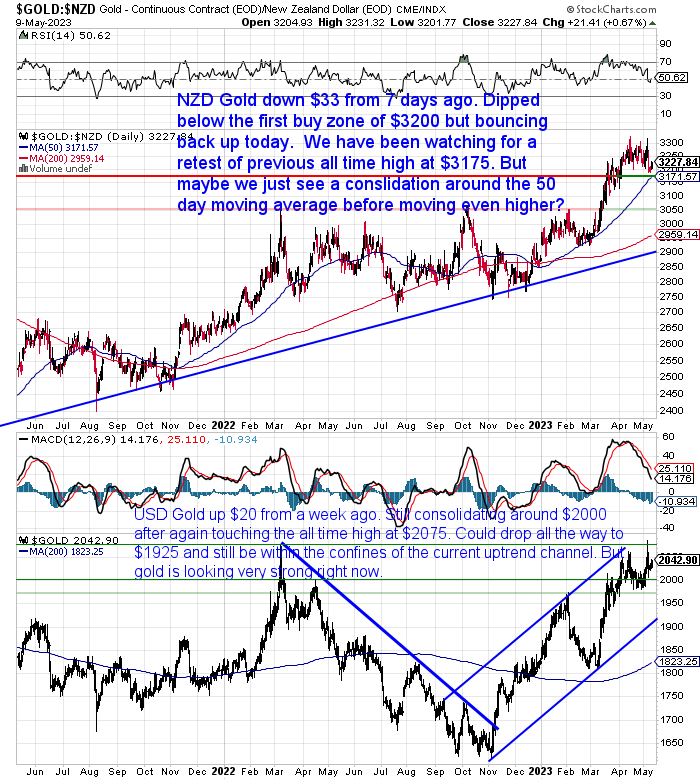

NZD Gold Not Far From Previous All Time High Support Line

Gold in New Zealand dollars is down $33 (1%) from last week. This was solely due to the stronger NZ dollar. As USD gold was actually up 1% from a week prior. The fall took the NZD gold price below our first buy zone at $3200. But today it has bounced back up above that level.

For a while now we have been watching for a retest of the previous all time high at $3175. Now over the past month or so, the 50 day moving average has risen up and is now at the same level as the old high. So that could be a strong magnet for the price in the coming days.

Therefore we may just see a consolidation around these levels before a move even higher.

During the week USD gold once again reached the all time high at $2075 before dipping back down again. So it continues to consolidate around the $2000 mark. Trading in a $100 range between $1975 and $2075ish. It could drop all the way to $1925 and still be within the confines of the uptrend channel (blue lines in the chart). But gold continues to look very strong, so maybe just a further consolidation before a move even higher?

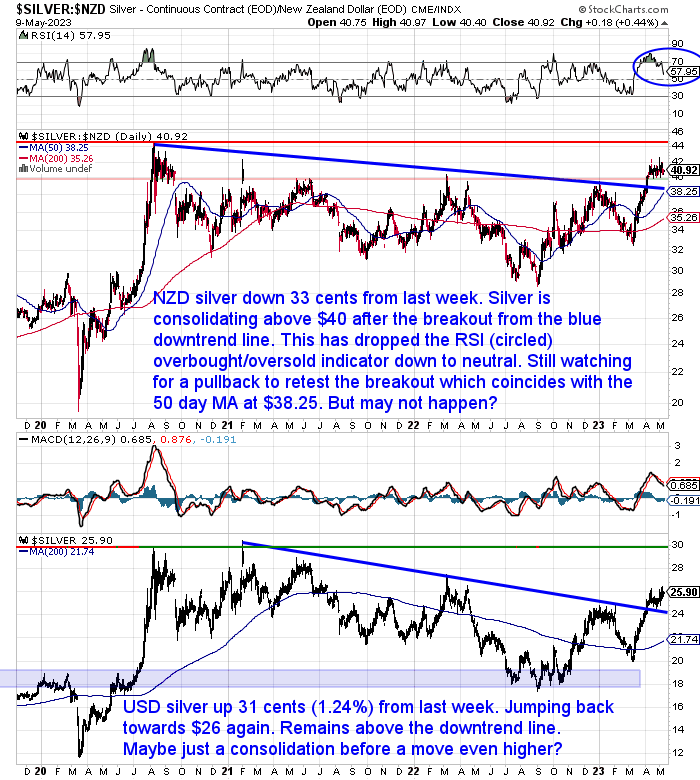

Silver Consolidation Drops RSI Indicator close to Neutral

Silver in NZ dollars was down 33 cents from last week. Silver continues its consolidation above $40 after breaking out above the blue downtrend line. This sideways range trading has resulted in the RSI overbought/oversold indicator (circled in blue), dropping down close to neutral territory (50), without the silver price actually falling. We’re still watching for a pullback to retest the breakout which now also almost coincides with the 50 day MA (currently $38.25 and rising). But a consolidation before a move higher is looking more likely than a large pullback.

Conversely USD silver was up 31 cents for the week. It also continues to consolidate above the downtrend line. So buying anywhere above $24 may be a good zone if all we get is an ongoing consolidation before a move even higher.

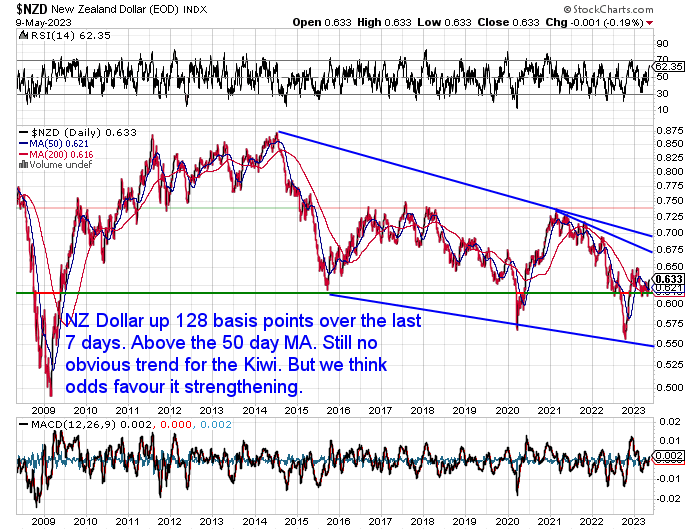

NZ Dollar Up Over 2%

As stated already, the fall in NZD gold and also silver this past 7 days has been solely due to the strengthening Kiwi Dollar. It is up 128 basis points or over 2%. Well above the 50 day MA for the first time since early this year. Although there isn’t a clear trend for the Kiwi right now, we think the odds favour it strengthening over the rest of the year.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Caution: Don’t Be Caught on the Sidelines

Both gold and silver are looking quite strong at the moment. With the consolidations they have been undergoing for the past month or so, holding the price up higher than many people probably have expected.

We imagine there are many people sitting on the sidelines watching for a better entry point than where the prices are right now. This is a perfectly reasonable approach. Always better to not chase the price higher.

However, if a bigger pullback doesn’t eventuate, then what happens? You might end up chasing the price higher anyway.

A better option may be to at least take an initial position around current levels. Then if the price does pull back further you can purchase more bullion. Conversely if we see a break out to higher prices, at least you have some at lower levels.

Either way your overall entry price is certainly better than if the price breaks higher and you end up having to buy at even higher levels than where we are.

We get the feeling that a breakout to higher prices is more likely than a large pullback. We could be wrong of course. But that is where we sit right now.

How to Safely Hold Dollars, Remain Liquid, and Seize Short-term Opportunities

A reader who is about to sell their farm is wondering what to do with the proceeds to keep them liquid but also safe while watching for short term buying opportunities in other investments.

They are concerned about keeping a large sum in their bank.

You may have also sold a property or have more money in the bank than you would like. But you aren’t quite ready to buy anything else. Whether that be precious metals, or another property or even a business. In the current times where “bank failure” is not such an uncommon phrase to hear, what are the options for a New Zealander to keep his or her savings safe but liquid?

In this week’s feature post article we look at 6 options and what their various pros and cons are including:

- NZ Banks

- Australian Banks

- KiwiBonds

- Treasury Bills

- Cash

- Cook Islands Banks

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

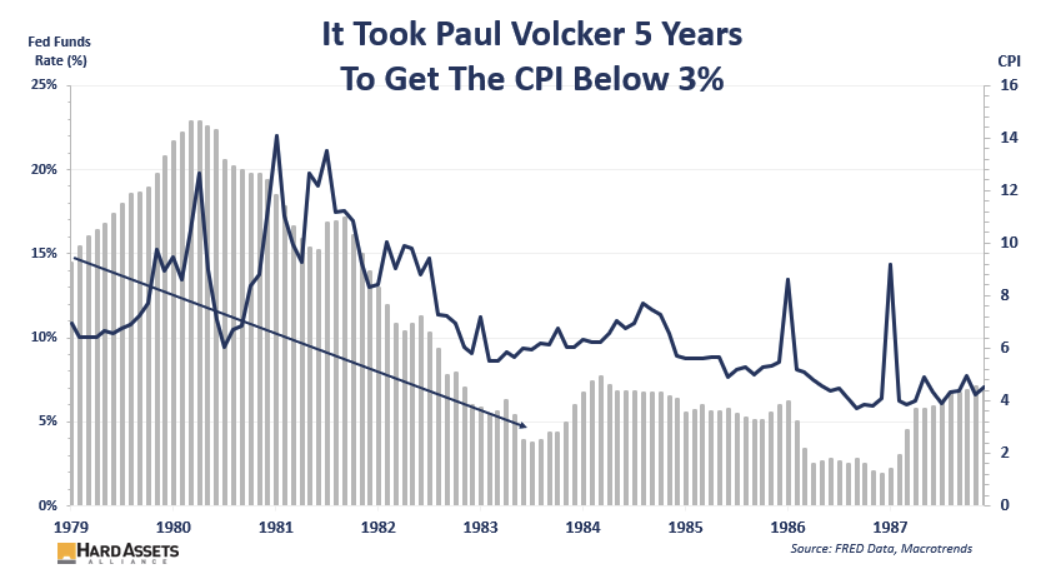

The Historical Precedent For High Inflation to Stay Higher For Longer

Here’s a selection of recent headlines we spotted detailing the impacts of the rise in interest rates:

Homeowners with a mortgage can expect to be paying 22% of their disposable income in interest payments on their home loan on average by the end of the year, the Reserve Bank says. That would be up from a low of 9% in 2021, and the increase will be much higher for many recent home-buyers with hefty mortgages.

Read more

Households behind on mortgage repayments up 26%

Read more

Mortgage rates have exceeded what many borrowers were stress-tested at

Read more

The Reserve Bank says the country’s financial system remains in good shape, but there are emerging signs of stress as households spend more on mortgage repayments. In its half-yearly financial stability report, the central bank said as households face higher debt servicing costs due to rising interest rates, mortgage arrears have increased from a “very low starting point”, and there have been limited signs of increased mortgagee sales.

Read more

A quarter of all mortgage debt is owed by borrowers who people who took the loans out at the pandemic peak of the market. That equates to more than $85 billion in home loans that have refixed, or will refix, on higher interest rates than the rates banks stress-tested borrowers against when the loan was made.

The finding appeared to cause alarm at last week’s Finance and Expenditure Committee, but the Reserve Bank said those borrowers were likely able to cope by cutting back on other spending, and that stress tests themselves had buffers built into them.

Read more

But what if these rates stay higher for longer than anyone expects? What if inflation stays high too? Then there may be a limit as to how much people can cope by “cuttin back on other spending”.

As we keep saying this could likely go on much longer than most people expect. There is historical precedent for our view that inflation and interest rates may stay higher for longer. We have mentioned before that the 1970s saw waves of inflation rising and falling.

This chart clearly shows how long it took for the US central bank head Paul Volker to get the consumer price index (CPI) back below 3% after the high inflation of the late 1970s…

Source.

“The CPI continued to rise for over a year after he was hired. And look at the arrow… it took a whopping 5 years to get it below 3%!

You might claim inflation was much higher then—that’s true, but it’s all relative. Reducing inflation from 22% to 5% is the rough equivalent of reducing it today from 7.7% to 2%… both require the CPI to fall by over 70%.

There’s another concern looking at that chart…

After Volcker got inflation below 3%, you’ll see it spiked back up again… and took another 2½ years to fall to 2%.

So, we have historical precedence that during high inflationary cycles…

It can occur in waves. Meaning, after it falls it’s possible there could be another spike.

It could easily remain elevated not for months but for years, based on the last time we had high inflation.

The bottom line is that…

It historically takes YEARS to push high inflation to low levels.”

So best to plan accordingly. Your mortgage rate could stay higher longer and so might inflation. Balance these out by holding gold and silver.

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Are You Happy to Work an Extra 22 Days a Year For Free? - Gold Survival Guide