Prices and Charts

Weaker NZ Dollar Boosts NZD Gold Price

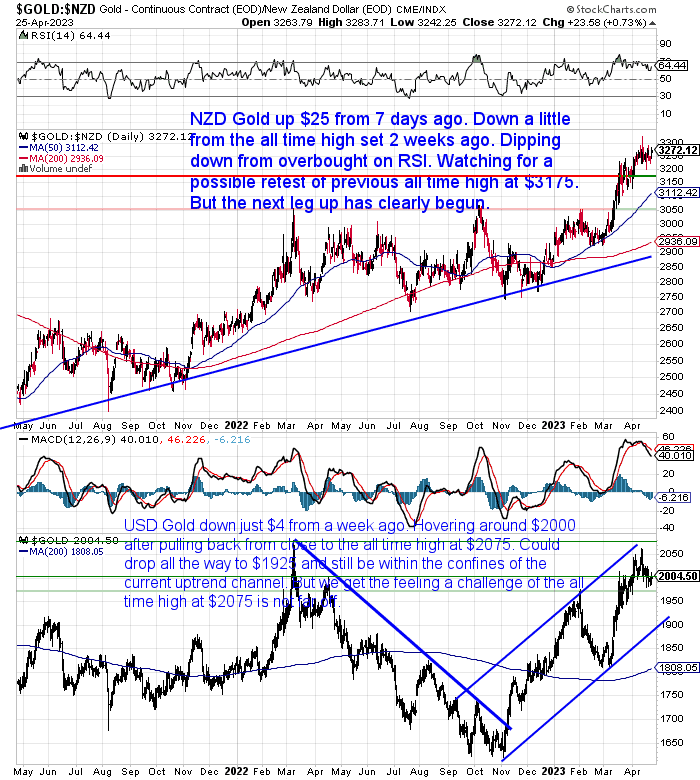

The price of gold in New Zealand dollars was up $25 from a week ago. But this was solely due to the weaker NZ dollar, which dropped 1%. NZD gold continues to hover around $3250. It has dipped down from overbought on the RSI indicator. So we are still watching for a retest of the previous all time high at $3175.

However so far $3200 is acting as fairly solid support. We could therefore see more sideways trading which would get the RSI down into neutral territory. This would also fool everyone that is sitting and waiting for a decent pullback to buy. Because as the old saying goes a bull market likes to run with the least people on board.

USD gold is down just $4 from 7 days prior. It is hovering around the $2000 level after pulling back from close to the all time high at $2075. USD gold could drop all the way back to $1925 and still be within the confines of the uptrend channel it is in. But it may just consolidate around current levels before making a challenge on $2075.

NZD Silver Holding Above $40 Support Level

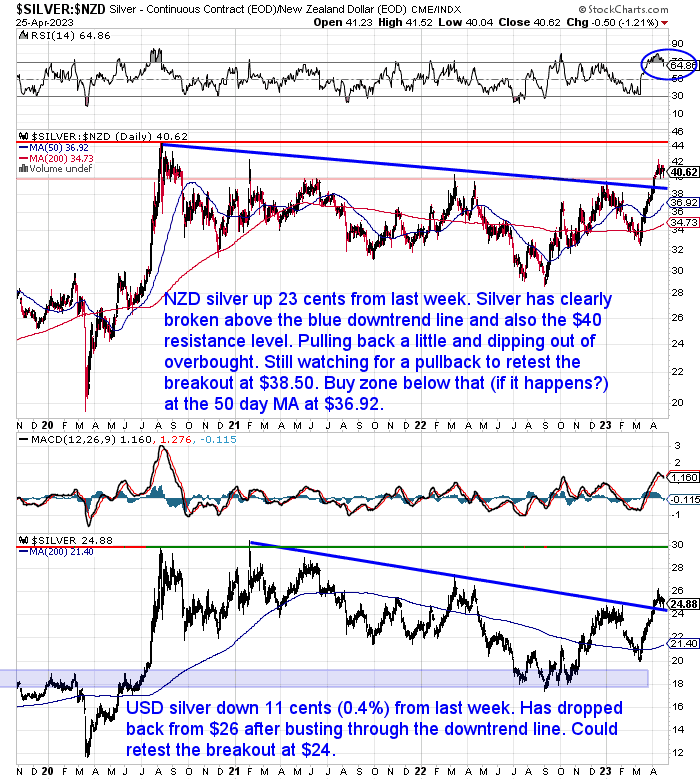

Silver in New Zealand dollars is up 23 cents from 7 days ago. After clearly breaking through the downtrend line from 2020, and also the $40 level, silver has pulled back a little. This has also seen the RSI (blue circle) now dipped out of the overbought condition (above 70) that it has been in all month.

We continue to watch for a pullback to retest the breakout at about $38.50. But before that there is still the $40 horizontal support level which is holding for now.

While in USD, silver is getting close to retesting the breakout at $24.

Once the pullback is over our guess is that whether in NZD or USD the 2020 highs in silver might not be too far from being challenged.

NZ Dollar Back to the 200 Day Moving Average (MA)

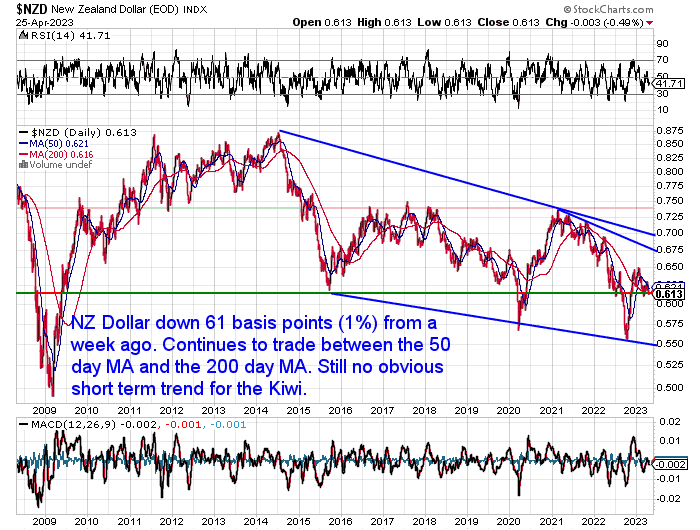

As mentioned above, the New Zealand dollar is down 61 basis points from a week ago. This is what kept NZD gold and silver prices in the green this week. The Kiwi is sitting on the 200 day MA, having continued to bounce between that and the 50 day MA. There is strong support around current levels, so we may see the NZ dollar bounce from here. That would help huge local gold and silver prices back towards the support levels we discussed above.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Paper Gold vs Physical Gold – What Should You Buy in 2023?

Last week’s article comparing physical gold to gold mining shares generated a bit of interest.

So this week we thought we’d take a look at the subject of physical gold vs paper gold. Because mining shares are just one part of the many options when it comes to getting exposure to gold. But as you’ll read, you need to decide if exposure to the price of gold is all you want, as there are other factors to consider…

Here’s what’s covered:

- What is Paper Gold?

- What is the One Disadvantage All Paper Gold Has Compared to Physical Gold?

- 6 Different Types of Paper Gold:

- And What Their Disadvantages Are

- Advantages of Physical Gold in your Possession

- What Type of Physical Gold to Buy?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

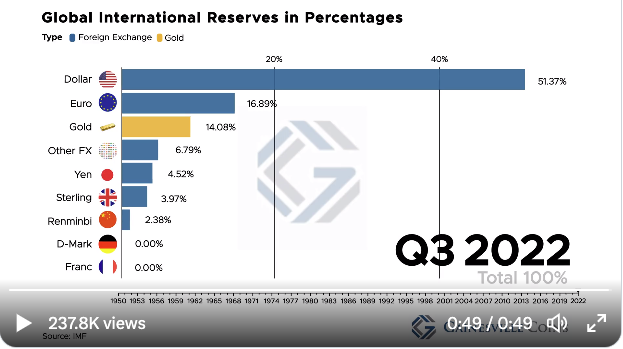

Animation: Gold as a Percentage of International Reserves Through the Years

The interesting animation in the link below shows why we think gold remains very undervalued. It compares gold to global international reserves. This percentage got as high as 72% in 1950. Dropping to 40% in 1971, before rising back above 60% in the 1980s. In the early 2000’s gold made its way back toward 10%. The last date in the chart is in 2022 where the percentage is only at 14%. So there is a long way back to above 60%.

“All throughout history precious metals have made up the majority of global international reserves. In the 1990s, a fiat currency, the US dollar, firmly took over from gold for the first time.”

Click here to see the animated chart.

Click here to see the animated chart.

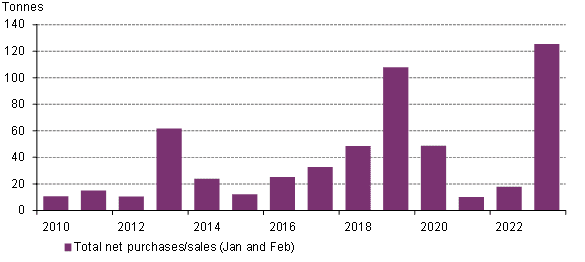

Central Bank Record Gold Buying Continues

Adding some weight to the theory that gold’s share as a percentage of international reserves will increase, is the action of central banks in 2023.

“On a y-t-d basis, central banks have reported net #gold purchases of 125t. This is the strongest start to a year back to at least 2010 – when central banks became net buyers on an annual basis. Read more here.”

Source.

Source.

Not all central banks report their gold purchases. Or if they do it is very spasmodic.

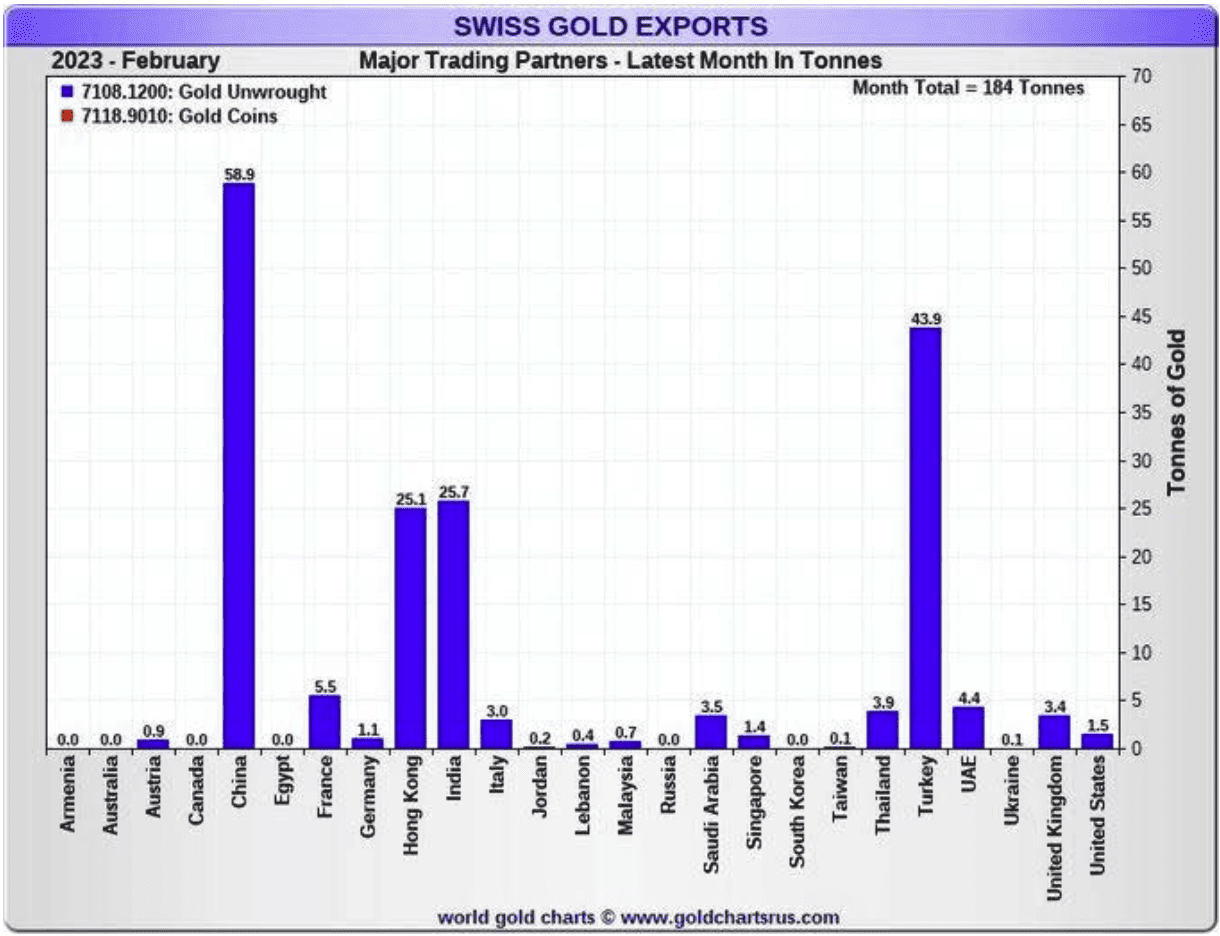

However this chart from goldchartsrus.com allows us to follow where the gold exported from Switzerland goes each month.

In February, Swiss gold exports hit 184 tonnes which was the highest since July 2022.

The chart clearly shows that China was the biggest buyer of Swiss gold exports In February with 84 (combining them with Hong Kong). Then Turkey with 44 tonnes, and India with almost 26.

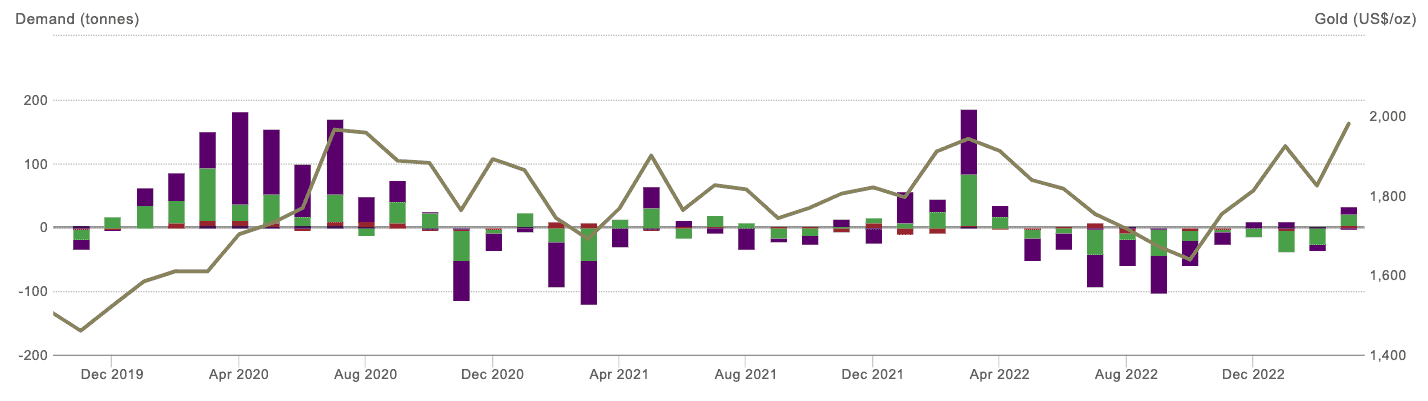

Our guess is that it is these central bank purchases which are pushing the price of gold up. Why? Because, apart from a short term surge after the US bank failures, we are not seeing high levels of demand from the retail public. Also in the futures markets we are also not seeing record high purchases by speculators. Likewise ETF holdings have not increased that significantly compared to past times when the gold price was hitting highs. See below chart, where ETF holdings have only just gone positive despite the gold price having risen since September.

Our guess is that it is these central bank purchases which are pushing the price of gold up. Why? Because, apart from a short term surge after the US bank failures, we are not seeing high levels of demand from the retail public. Also in the futures markets we are also not seeing record high purchases by speculators. Likewise ETF holdings have not increased that significantly compared to past times when the gold price was hitting highs. See below chart, where ETF holdings have only just gone positive despite the gold price having risen since September.

Monthly ETF Flows in Tonnes (Bars) vs Gold Price (Gold Line)

Source.

So maybe these central banks see the writing on the wall for the US dollar as a global reserve currency? If you do too, then you might want to add to or start your own gold reserves.

As our guess is that when more of the public, futures traders and gold ETF investors start to buy, the gold price will likely be even higher than it is right now.

Get a quote on gold or silver products:

Source.

So maybe these central banks see the writing on the wall for the US dollar as a global reserve currency? If you do too, then you might want to add to or start your own gold reserves.

As our guess is that when more of the public, futures traders and gold ETF investors start to buy, the gold price will likely be even higher than it is right now.

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

|

|

This Weeks Articles:

|

Wed, 26 Apr 2023 10:49 AM NZST

Buying the right type of gold is key. You have the choice between physical gold vs paper gold in its many varied forms. But how do you decide which type of gold is right for you? Is it paper gold or physical gold? When deciding between paper and physical gold, the answer comes down to […]

The post Paper Gold vs Physical Gold – What Should You Buy in 2023? appeared first on Gold Survival Guide.

|

|

Tue, 18 Apr 2023 5:14 PM NZST

Here’s quite a specific question from a reader looking at gold mining shares vs physical gold bullion. “I’m interested to know if owning gold and silver mining shares or owning actual gold and silver products makes any difference if your goal is wealth creation? In the short term and in the long term which would […]

The post Gold Mining Shares vs Physical Gold Bullion – Which to Buy in 2023? appeared first on Gold Survival Guide.

|

|

Wed, 12 Apr 2023 6:43 AM NZST

Prices and Charts Looking to sell your gold and silver? Visit this page for more information Buying Back 1oz NZ Gold 9999 Purity $3112 Buying Back 1kg NZ Silver 999 Purity $1255 Weaker Kiwi Dollar Boosts Local Gold Price The NZ dollar dropped almost 2% this week and that resulted in a $33 […]

The post Kiwis Looking to Get Into Shares at the Wrong Time? appeared first on Gold Survival Guide.

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

|

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Plus we accept BTC, BCH, Visa and Mastercard

|

| Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

| The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2022 Gold Survival Guide.

All Rights Reserved. |

|

Pingback: Why Buy Gold? Here's 15 Reasons to Buy Gold Now

Pingback: Caution: Don't Be Caught on the Sidelines - Gold Survival Guide