Prices and Charts

Weaker Kiwi Dollar Boosts Local Gold Price

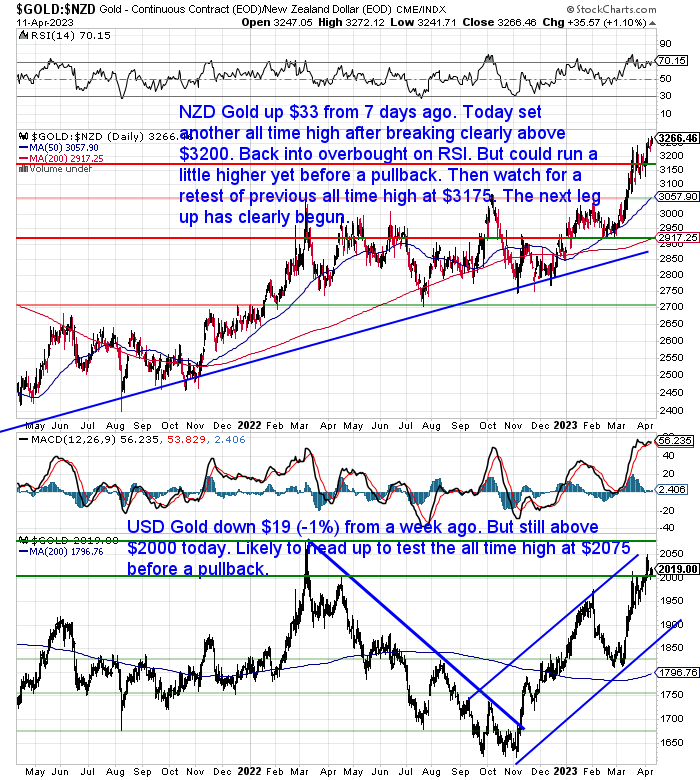

The NZ dollar dropped almost 2% this week and that resulted in a $33 rise (1%) for gold in NZ dollars. That set another new all time high for gold here in New Zealand today. It also edged the RSI back into overbought (above 70). But gold could well run even higher yet. Why do we say that? Because unlike other times when gold has been hitting highs there is nowhere near the demand or interest. Meaning that perhaps people are sitting on the sidelines, expecting a big pullback. We’ve found this to be a good contrarian indicator. And gold often does just the opposite.

As we’ve said many times in the past, the best answer to this is probably to split your purchases up. Put “a stake in the ground” around current levels and then look to average down if we see a fall. That way you’re not left on the sidelines as the price runs higher.

In US dollars gold was down about 1% ($19) from 7 days ago. But it remains above the key $2000 level. We could still see a run at the all time high of $2075 before any pullback takes place.

Silver Breakout Continues

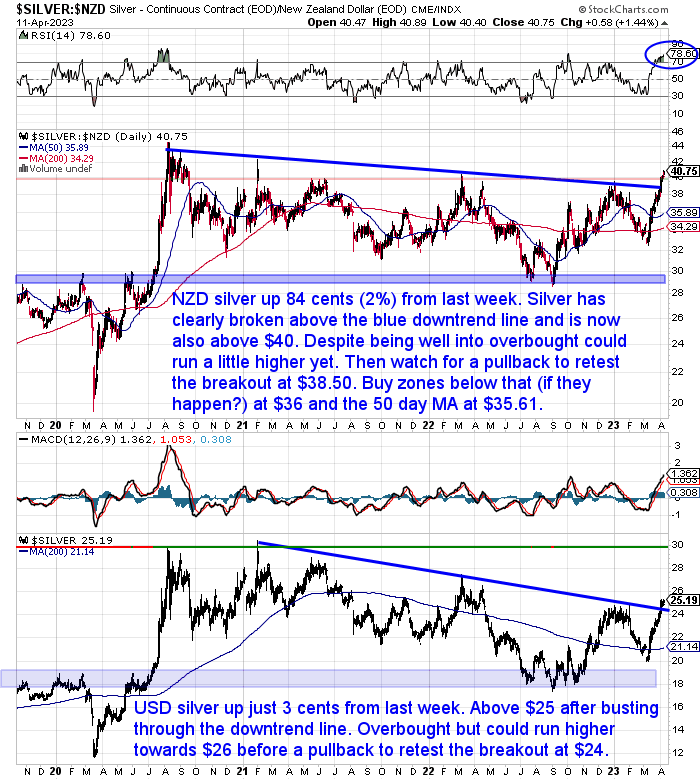

Silver in New Zealand dollars continued higher after the breakout above the downtrend line last week. It was up 84 cents (2%) from last week. This rise has now also taken it above the resistance line at $40. But much like gold, despite being overbought, it wouldn’t be a surprise to see silver head even higher yet. But we’d expect it to return and retest the breakout at some point soon.

USD silver was pretty much unchanged from a week ago. It remains above $25 after clearly busting through the downtrend line. While overbought we could see it run higher towards $26 or $27. Before likely returning to retest the breakout.

More on the breakout (or fake-out?) in this week’s feature article below.

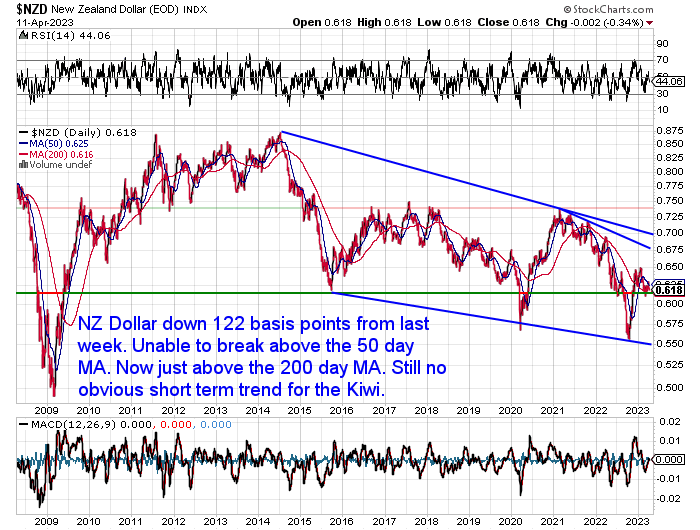

NZ Dollar Drops 2% – Still No Clear Trend

The New Zealand dollar has seen a somewhat counter-intuitive fall of 122 basis points (2%) from last week. This was after an initial jump higher when the RBNZ raised rates by 0.50% which was higher than most expected. (We actually even incorrectly wrote 0.25% in a late update before we sent out last week’s newsletter!)

So after touching the 50 day moving average (MA), the Kiwi is now back down to the 200 day MA. Still no real obvious short term trend for the Kiwi. Perhaps this sideways action in currencies is what the rest of the year holds in store for us?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Silver Breakout or Silver Fakeout? – Where to Next for Silver in 2023?

As alluded to earlier, our feature article this week looks at the recent breakout in silver. Is it the real deal? Or just another fake-out like we’ve seen many times with silver in recent years?

It’s probably not a massive giveaway to say we’re leaning towards the former. The lack of buying demand at this breakout that we mentioned earlier is another indicator silver could be the real thing.

Here’s what’s covered anyway:

- Is the Silver Breakout For Real This Time?

- What’s Different About This Current Rise in Silver?

- After the Breakout – Where to From Here For Silver?

- 100% Upside in Silver From Here to the All Time USD High

- Could Silver Have Even More Upside than US$50?

- Silver to Monetary Base Update for 2023

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Gold Survival Guide Co-Founder Interviewed on Reality Check Radio

Last week we mentioned our interview on Reality Check Radio.

We now have a link to the recording. If you’re pressed for time you can also speed it up and play back at up to 2 times faster.

The interview covers:

- The recent bank failures in the USA

- The lack of deposit insurance or bank deposit guarantees currently in New Zealand

- The banking system – what’s different today versus how banking started out

- History of gold in the monetary system

- Gold vs silver – why people choose one or the other

- Central Bank Digital Currencies

Kiwis Looking to Get Into Shares at the Wrong Time?

ILast week we discussed shares vs gold.

So this headline caught our eye: “Plans to buy shares swing upwards”.

With house prices down a recent survey shows people are planning to spend more on stocks over the next 3-6 months.

“Consumers are planning to reduce spending in the next three months, but stocks is one area where buying intentions are on the rise.”

Source.

But this has us wondering, are Kiwis likely going to get it wrong when it comes to a renewed interest in the sharemarket?

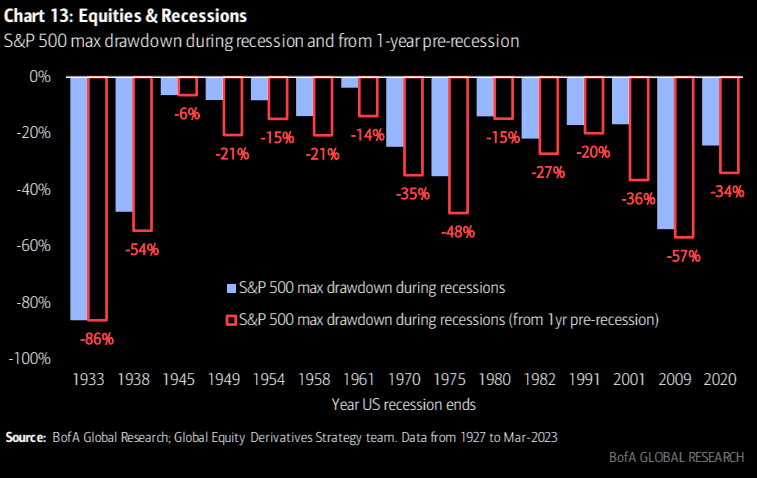

Analysts at Bank of America think there is still plenty more downside to come for sharemarkets.

Plenty more downside…

BofA’s great derivatives team points out: “8 of the last 10 recessions saw S&P 500 drawdowns of over 20%”.

Source: BofA

A 20% fall when costs are increasing, house prices are falling and interest rates are rising would not be a good thing.

So make sure you have plenty of wealth insurance in place to cover you against all these scenarios.

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Central Bank Record Gold Buying Continues - Gold Survival Guide

Pingback: Gold to S&P500 Ratio - Breaking out? - Gold Survival Guide