Prices and Charts

Unusual Happenings in the Gold Futures Markets

There have been some unusual happenings in the gold futures markets the past few days.

There has been a much wider than normal gap between the spot price of gold and the nearest futures month for gold.

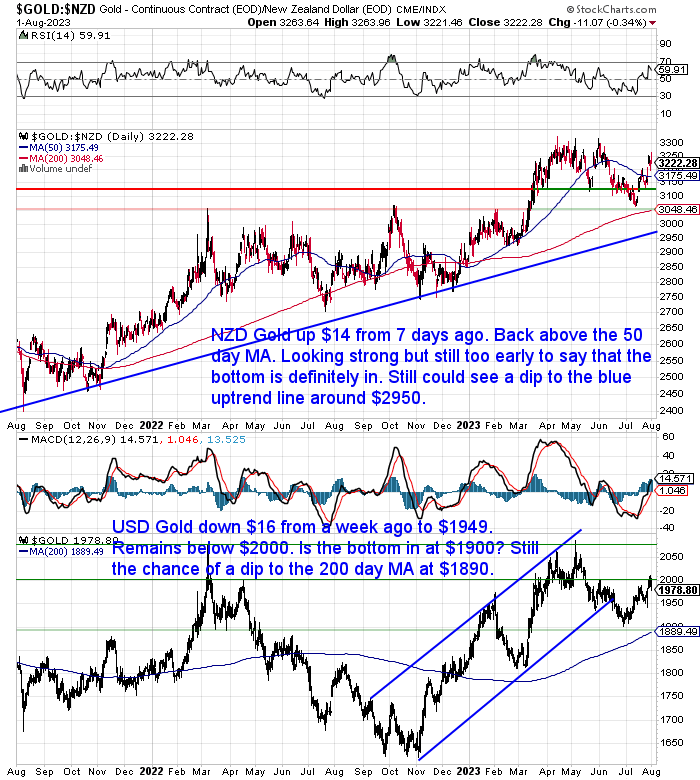

This is evident in the charts below from stockcharts, where it seems their pricing is taken from the nearest futures month not from the spot market. For example the spot price yesterday was US$1965, but the nearest futures price was above $2000, eventually closing at $2009 according to Stockcharts. Usually this difference is just a few dollars. Today that gap has diminished somewhat, but is still over $20: futures $1978 vs spot $1949. We’re likely to see this spread diminish further over the coming days. But will it be via a falling futures price or a rising spot price?

“Jim Wyckoff, senior technical analyst at Kitco.com, noted that the spread between prices is “unusually wide.”

“The December contract trading above $2,000 suggests traders think gold is going higher,” said Wyckoff. “There is a normal ‘carry’ in forward futures contract months—but not nearly as much as the spread is now. My bias is that Dec and spot will converge in the coming weeks.”

Source.

Maybe the worry of yet another US bank failure over the weekend is driving these expectations?

You can see these higher prices on the gold chart below. The latest NZD gold closing price is $3222 whereas the spot price as we write is currently $3181. This is up about 0.5% from last week, solely due to a weaker NZ dollar. The 200 day moving average (the red line) is now up to $3048, so pretty much up to where the low in July was, at $3050. So perhaps any pullback will only be to the 200 day MA?

While gold in US dollars is down $16 from a week ago. Like the NZD chart, it is lower than what is shown at $1978 vs $1949 in the spot market currently. So USD gold remains below $2000. Still watching to see if the bottom is in at $1900.

In short, gold continues to look strong but still too early to say that the bottom is in for sure.

NZD Silver Up Just 7 Cents

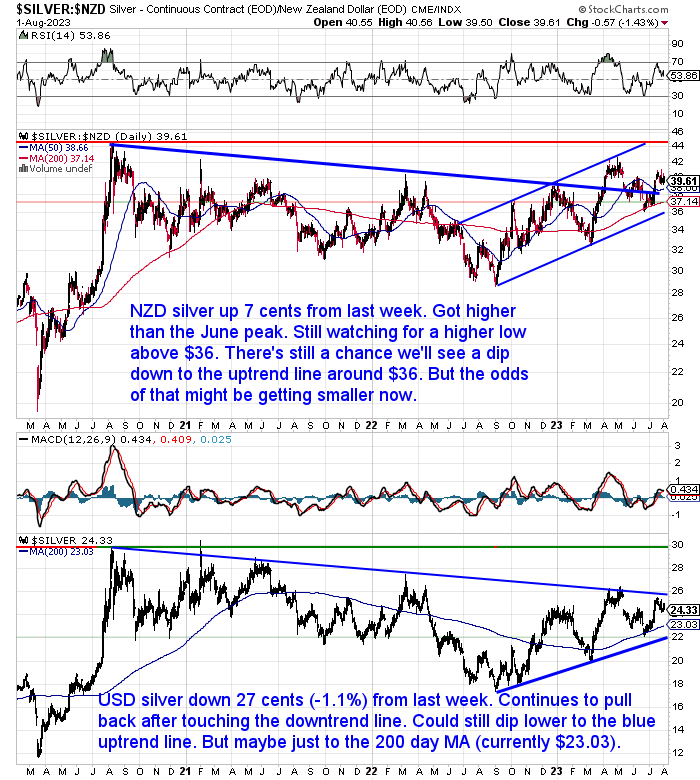

Silver in New Zealand dollars was up just 7 cents from last week. Having made it above the June peak we are still watching for a clear higher low above the June low at $36. There remains a chance we’ll see a dip down to the uptrend line which currently sits at $36. But maybe like gold, silver will just dip down to the 200 day MA ($37ish)?

While USD silver dropped 1.1% from a week prior. It continues to pullback after rising to touch the overhead downtrend line. It could yet dip down to the blue uptrend line, currently around $22. But maybe just a pullback to the 200 day MA (currently $23.03).

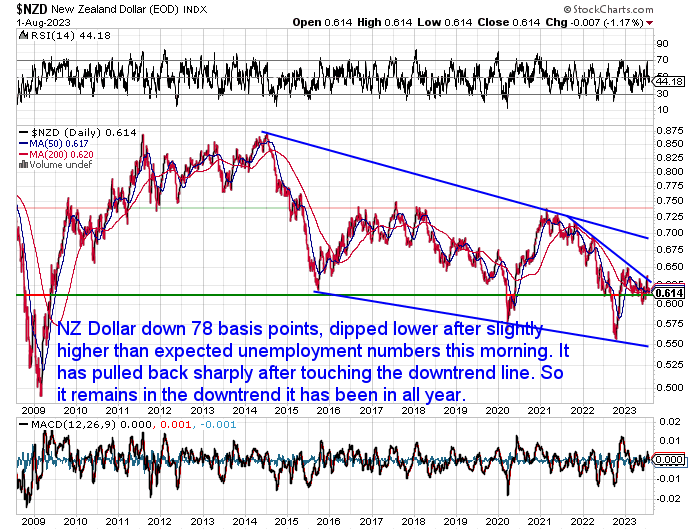

Kiwi Dollar Drops 1.25%

As noted already the NZ dollar dropped sharply this week. Down 78 basis points or 1.26%. It dipped lower this morning following slightly higher than expected NZ unemployment numbers.

The unemployment rate was 3.6% for the June quarter, compared to 3.4 for the March 2023 quarter. This was slightly higher than the expected rate of 3.5%.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

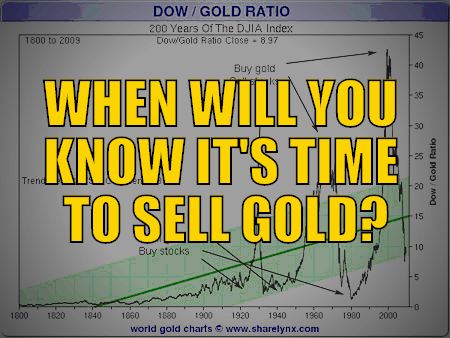

Should You be Selling or Buying Gold Right Now?

We have seen a noticeable increase in people selling gold and silver in recent weeks. In fact probably over the last few months. Of course we don’t know the reason for people selling. It could be to fund the purchase of an alternative asset. It could be that they need the cash due to the slowing economy. Or it could be because the price is hovering just under all time highs in NZ dollar terms and perhaps people don’t believe the price will move any higher from here?

Our guess is that this increase in selling is likely due to the latter reason and actually (another) contrarian buy signal.

We believe now is likely a good time in fact to be buying, not selling. So then the question you may have is, when will it be time to sell gold and/or silver?

So this week’s featured article highlights 7 indicators that will give a pretty good idea of when it is time to sell gold. It also has some reasons why you might not have to sell your gold at all.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

BRICS + Friends Gold Hoard Equals USA – Is it to Back a New Currency?

Reports on the possible new BRICS+ currency continue to bubble.

The latest we have come across from the Iran Steel Service Center from earlier in July was headlined:

BRICS Nations Buy Massive Amounts of Gold to Back the New Currency

The BRICS alliance plans to launch a new currency backed by gold, reported RT News a month ahead of the summit. Russia has reportedly briefed the bloc on the importance of pegging the soon-to-be-released currency to gold. The move could make it easier to take on the U.S. dollar and challenge its global reserve status. The next BRICS summit will be held in South Africa in August and the formation of a new currency will be laid out.

The yet-to-be-launched BRICS currency could be backed by gold and the bloc of five nations are stockpiling the precious metal. In the last 18 months, the BRICS nations have increased their gold buying expenditure to end reliance on the U.S. dollar.

The World Gold Council published a report saying that China purchased 102 tonnes of gold. Russia has purchased 31.1 tonnes of precious metal in the last six months. In addition, India added 2.8 tonnes to its gold reserves in 2023, for the first time in more than a year. India accumulated gold for several months and could add more by the end of the year.

Source: Iran Steel Service Center

So is this just the expected Anti-west/USA propaganda, or are the Iranians “in the loop”?

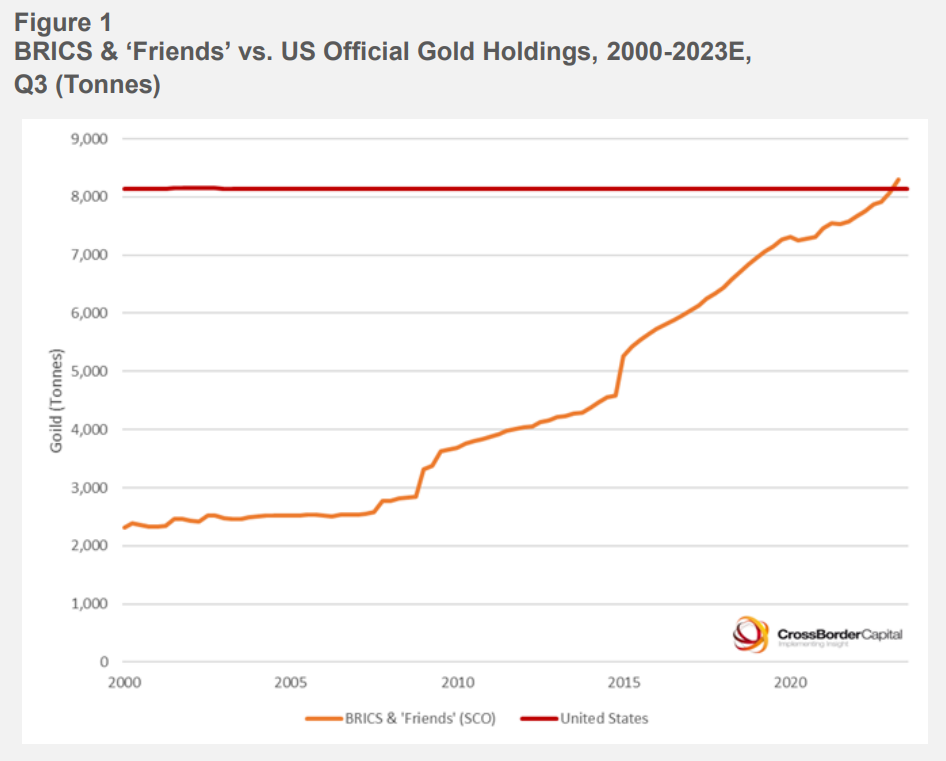

Interestingly this ties in with a new report from Cross Border Capital where they point out that a potential gold-linked BRICS currency would be supported by gold reserves from BRICS nations, including Brazil, Russia, India, China, and South Africa, along with the reserves of over 40 other interested countries. This collective hoard of gold could surpass the (official) gold reserves of the United States by the end of the year, if it hasn’t already.

Cross Border Capital views this development as the most significant in international finance since the US abandoned the gold standard in 1971.

Although a gold-backed or partially backed BRICS currency might not dethrone the US dollar as the dominant global currency, it could potentially shake up the international financial landscape. China, in particular, is seen as driving this initiative to challenge US dominance in international finance subtly. Hiding the Chinese Yuan within a new BRICS unit could be a strategic move to expedite this goal.

While the impact of a gold-backed BRICS currency may be more political than economic, it could still have consequences for financial markets. Any announcement is expected to raise prices for US Treasuries and potentially support the price of gold as the BRICS bloc expands. However, the dollar’s centrality and the dominance of US financial markets are not likely to be significantly challenged.

Ultimately, the stability of the US dollar depends on the strength of the US Treasury market and backing from the US military. Therefore, any potential threat to the US dollar as the world’s primary reserve currency would require more than just the adoption of a BRICS alternative. It would necessitate the demise of US finance and the transformation of the global funding system.

There is also speculation about BRICS potentially cornering the gold market and causing a scarcity in global markets. However, this strategy could also negatively affect some emerging economies. For example, an overvalued Yuan could negatively impact the Chinese economy.

So as the 15th BRICS summit approaches, we’ll be keeping a close eye on any potential announcements regarding the currency. While the impact of a gold-backed, partially backed or even just a gold linked BRICS currency on the US dollar may be limited in the short term, the ongoing developments in international finance could have significant implications for global trade and the monetary system.

“These Capital Wars will prove bruising,” [Cross Border Capital] said. “Russia has recently adopted discriminatory tactics, similar to those used by the US, for her energy payments, while China herself has history of sanctioning countries that speak-out against her, such as Australia. Exactly which camp, friend or foe, each national economy now chooses matters a lot.”

“Clipping the wings of the US dollar funding system is very different from successfully building a rival,” they concluded. “Expect a whimper in August, not a bang.”

Source.

What Might a BRICS Currency System Mean for NZ?

We have been covering the BRICS currency closely for the past couple of months. But we were surprised to see it featured in somewhat mainstream financial press here in New Zealand this week too.

Worth a listen is this “Of Interest” podcast interview with Nathan Lewis, who we have featured in these pages in the past. See: The Gold Standard & A Free Market For Money: How Could This Work? and “Rules-Based” Monetary Proposals Won’t Create Stable Money.

Lewis points out that the BRICS nations require a reliable currency for trade and debt financing, that is an alternative to the US dollar:

“Most of these countries’ currencies have a history of mediocracy or outright failure, which means they tend to fall in value a lot. So no one wants to borrow or lend for any length of time in Russian rubles,” Lewis says.

“They need a currency that’s reliable enough so they can access the world debt markets, that international lenders will buy these bonds and their own people will buy these bonds. Historically that has meant ‘pay me in dollars’.”

So why gold?

“They want to land on some kind of internationally acceptable medium…There’s one thing that everyone’s always been able to agree on and that is gold,” says Lewis.

“The reason why it [gold] has been the basis of money for literally 5000 years is because it works. And the reason it works is because it does not vary in value very much. The basic premise is that gold is stable enough [so] it doesn’t really cause a problem.”

For small trading nations like New Zealand, which has close ties with the US but relies heavily on trade with China, it could mean the need to adapt to the new system pragmatically. Lewis comments that individuals or businesses could potentially open accounts in Chinese banks like the Industrial and Commercial Bank of China, allowing them to trade with digital gold checking accounts. In case of urgent situations, physical gold delivery could be an option, but the goal is to minimise the need for extensive international cooperation.

Definitely worth a listen to the full interview…

How and why the so-called BRICS countries may develop a currency system independent of the US & what it might mean for NZ. At the heart of suggestions the so-called BRICS countries may develop a new international currency system based on gold that’s separate from the US dollar are some simple necessities, according to Nathan Lewis.

Read summary or listen to the interview here.

Odds are the NZ government won’t be ready for such a development. So best to make sure you are…

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|