A common question is how do you determine when it’s time to sell gold (and silver)? So this article identifies 7 ways to determine if it is time to sell gold with updated numbers for 2023…

Table of contents

- Is it Time to Sell Gold?

- 7 Indicators For When it is Time to Sell Gold

- Time to Sell Gold Indicator #1: Dow Gold Ratio

- Time to Sell Gold Indicator #2: Housing Gold Ratio

- Time to Sell Gold Indicator #3: Real Interest Rates Rise

- Today vs 1980

- Time to Sell Gold Indicator #4: Governments Become Fiscally Responsible

- Time to Sell Gold Indicator #5: People Discuss How Much Their Gold Mining Shares Have Risen at Dinner Parties and Where to Buy the Cheapest Gold Coins

- Time to Sell Gold Indicator #6: There are Gold Kiosks Selling Gold Bars and Coins Popping up in Shopping Malls Everywhere

- Time to Sell Gold Indicator #7: Our Website Visitors Rise Exponentially!

- Why You Might Not Have to Sell Your Gold at All

- In Conclusion

Estimated reading time: 13 minutes

Is it Time to Sell Gold?

“The ultimate asset bubble is gold” said George Soros in late January 2010.

This was widely reported as Gold is now the ultimate bubble. A subtle but very significant difference, thereby implying that Soros was stating that gold was in a bubble right at that time.

Only Mr Soros knows what the true intent of his remarks were. However, the fact that he had been purchasing shares in both gold mining companies and the Gold exchange traded fund (ETF) at the end of the prior year, made it likely he was doing his best to talk the gold price down. Therefore enabling him to buy some more at cheaper prices. Most likely these were very carefully chosen words that he knew would be misinterpreted by an uninformed mainstream media and help to prod the masses to sell gold.

That in fact proved to be the case, with gold falling in the years following Soro’s remarks. As expected he then also bought back into gold mining companies like Barrick Gold over the next few years. Along with re-entering the GLD ETF. So Soros did re-enter gold and related assets at lower prices than the time of his original statement.

Why Gold is the “Ultimate Bubble”

But history proves that Gold is in fact the ultimate bubble.

5 years after the 1929 stock market crash, gold’s investment purchasing power rose 17 times. From 1970 to 1979 it rose 15 times. But from 2000 to now gold is up just over 6 times.

So with only a 6 fold rise so far in this bull market, the ultimate bubble seems like it is a few years away yet. Or put another way, gold is in fact the anti-bubble, the ultimate extinguisher of debt as per John Exter’s Inverse liquidity pyramid shown above (a whole other topic in and of itself. See: Silver Versus the World (and Exter’s Inverted Liquidity Pyramid)).

But the oft-asked question is “When will I know it’s time to sell my gold?”

Unfortunately there is not likely to be someone holding up a sign proclaiming “The top is in – Sell Gold Now!” However, history shows there may be some not quite so literal signs we can still look out for.

Below is a list of them and our verdict on their “bubblishness”.

7 Indicators For When it is Time to Sell Gold

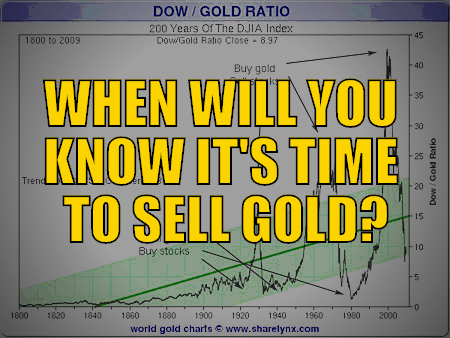

Time to Sell Gold Indicator #1: Dow Gold Ratio

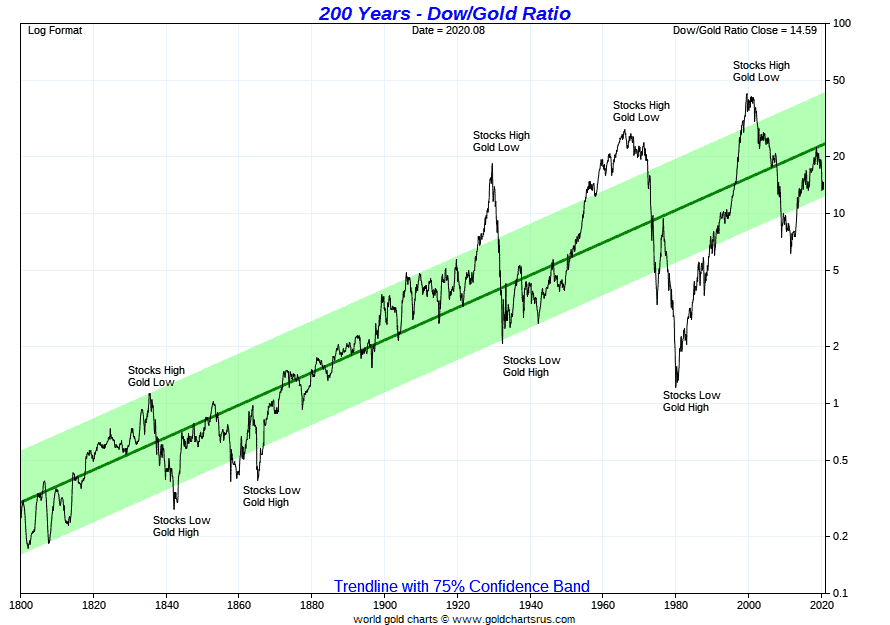

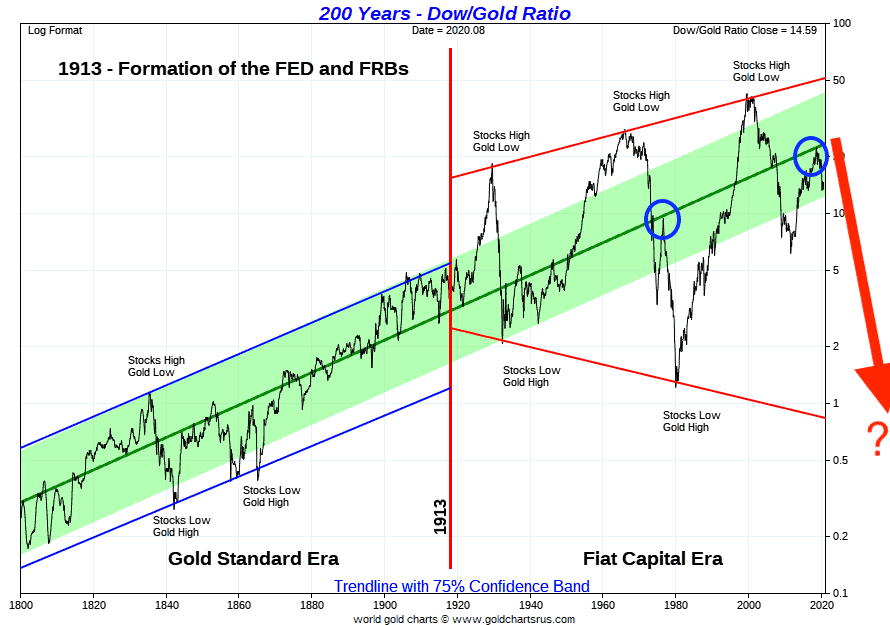

The Dow Gold ratio is simply the Dow Jones Industrial average (a measure of the US stock market) divided by the price of gold. It is useful as a guide as to when stocks are cheap and when they’re overvalued. See the below chart care of sharelynx.com for these extremes.

Towards the end of the 1930’s depression the ratio reached a low of 2 and at the end of the inflationary 1970’s it reached a low of just over 1. It’s currently at just over 18. So history shows the time to sell gold will be when the ratio reaches these much lower levels again.

Interestingly the below Log scale graph (hat tip to Sharelynx.com again – a must visit site for great graphs) shows the ratio has made higher highs each time it has peaked over the last century. It also made a lower low in 1980. So it could potentially fall below 1 at the end of the current monetary crisis.

(Read more on the Dow Gold Ratio).

The Dow Gold ratio was rising from 2011. But has been falling since mid 2018. Now sitting at just over 18. So definitely not in bubble status yet for gold. In fact it seems like the US stock market is more likely closer to bubble status than gold is.

Verdict: No Gold Bubble. So it’s not time to sell gold yet.

Time to Sell Gold Indicator #2: Housing Gold Ratio

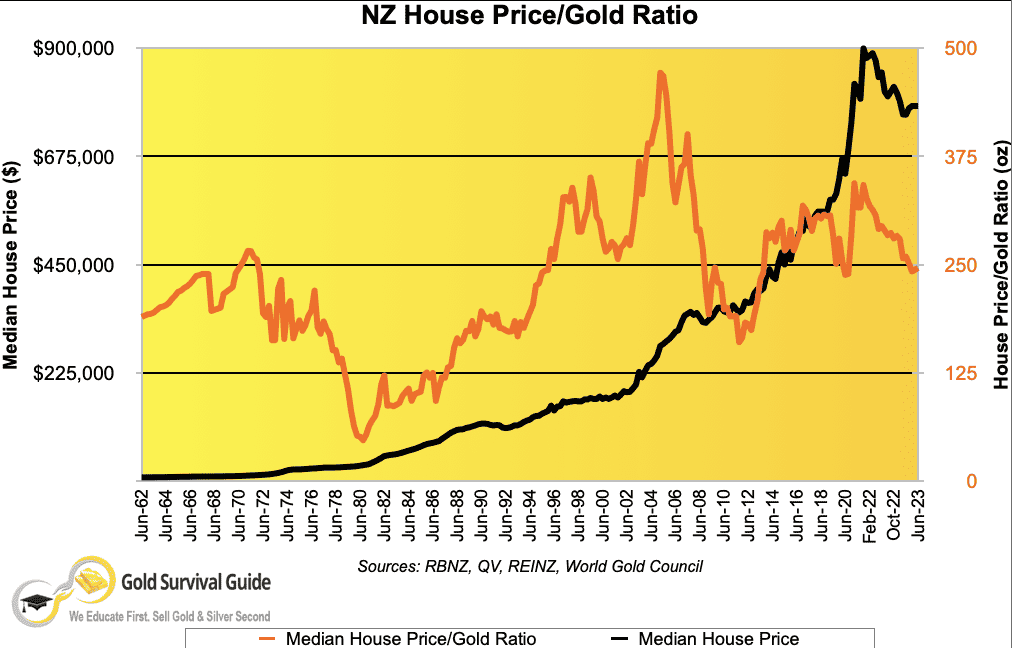

Much like the Dow Gold ratio, the Housing Gold Ratio also indicates when housing is over and undervalued. In New Zealand the ratio last bottomed out in 1980 at just over 50.

(For more on the US, UK and NZ housing gold ratio see: NZ Housing to Gold Ratio 1962 – 2023: Measuring House Prices in Gold)

The NZ Housing to gold ratio is currently at 246 (as of June 20230. The median house price has fallen since the end of 2021. While the NZ gold price has risen. But it still has some way to go before the housing to gold ratio gets down close to 100. That might be the time to swap some gold for property. So a long way from bubble levels for gold.

Verdict: No Gold Bubble. So it’s not time to sell gold yet.

(Note: If you’d like some assistance with timing your eventual exit from gold and silver, then you may want to meet our “secret” investment advisor. You can learn more about who he is… And how you could benefit from his uncanny ability to enter and exit not just the precious metals markets but many other markets too, at just the right time. So go here to learn more now.)

Time to Sell Gold Indicator #3: Real Interest Rates Rise

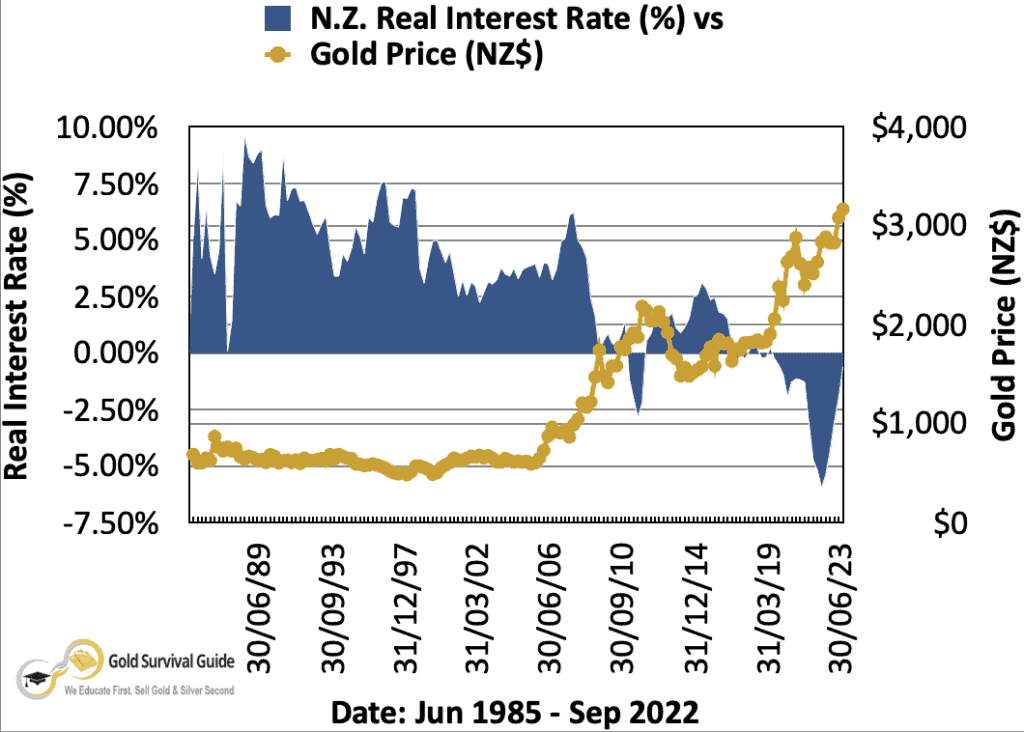

A common misconception is that gold performs poorly when interest rates rise as gold pays no dividend or interest.

(For a fuller explanation on this see: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?)

However the key is what real interest rates are doing. That is the nominal interest rate less the rate of inflation. Currently it might appear that there is some reward (in the form of interest) for keeping your money in the bank. However real interest rates are actually still negative in many countries around the world. Including here in New Zealand where the real interest rate as of June 2023 was still -0.6%.

The historical graph below from McClellan Financial Publications, www.mcoscillator.com clearly shows how gold performs well when real interest rates are negative.

You’ll notice how gold continued to rise throughout the 1970’s until real interest rates finally turned strongly positive again.

Today vs 1980

However, today central banks find themselves in a worse position than 1980. It will likely be very difficult to raise interest rates to make them strongly positive after inflation, without destroying their economies in the process.

In mid 2019 the Federal Reserve halted their interest rate rises much earlier than originally planned. Having only managed to raise rates back to 2.5%. They have so far managed to get them higher than that in the USA. But can they realistically go much higher?

For more on this topic see: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand?

However even if interest rates did rise further from here, the question then becomes will inflation rates continue to fall? If they don’t, then real rates could stay below zero for much longer than many people think possible. Therefore gold could continue its rise as there would still be insufficient reward for dollars in the bank.

Verdict: No Gold Bubble. So it’s not time to sell gold yet.

Time to Sell Gold Indicator #4: Governments Become Fiscally Responsible

At the end of the inflationary 1970’s we had the likes of Margaret Thatcher in the UK cutting government spending and Paul Volker for the US Federal Reserve raising interest rates significantly to fight inflation.

Here in New Zealand the 80’s saw “Rogernomics” and some harsh medicine for the country to swallow.

Worldwide generally this period saw taxes cut along with government spending.

Cast our eyes across the planet at the politics of today and generally we see more government spending and increasing public debt. In recent years there have been massive increases in both government spending and debt as a result of the COVID-19 lock downs. Can we realistically expect governments to cut spending while many consumers are struggling to make ends meet?

Verdict: No Gold Bubble. So it’s not time to sell gold yet.

Time to Sell Gold Indicator #5: People Discuss How Much Their Gold Mining Shares Have Risen at Dinner Parties and Where to Buy the Cheapest Gold Coins

Most likely you currently know very few people in your wider circle of friends and acquaintances that have any gold or gold related investments.

When the tables turn and gold is dominating discussions at social gatherings and regularly on the mainstream news we are likely getting near a top (think bitcoin back in 2021). But we’re a long way from there yet we’d say. In fact from our experience, the current level of interest in buying gold is actually down significantly on what it was in the past few years.

Verdict: No Gold Bubble. So it’s not time to sell gold yet.

Time to Sell Gold Indicator #6: There are Gold Kiosks Selling Gold Bars and Coins Popping up in Shopping Malls Everywhere

As we have mentioned previously here, we are seeing the opposite of this currently with kiosks existing to buy gold from the public.

Also a couple of local bullion retailers have actually disappeared from the market since 2010. So there is no proliferation of people selling gold or silver.

Verdict: No Gold Bubble. So it’s not time to sell gold yet. (However, there is a counter to point 5 and point 6 above that is worth considering. At the peak in gold Joe Public may be so tapped out and broke that he won’t be able to afford to buy any gold. In this case it will be institutions that are buying gold bullion and gold mining shares.)

Time to Sell Gold Indicator #7: Our Website Visitors Rise Exponentially!

Highly likely if more and more people start paying an interest in gold. Our visitor numbers increased to a peak in March/April 2020. This was caused by fears created by the COVID-19 lockdown and quantitative easing by the NZ reserve bank. But since then they have returned down to similar levels to previous years.

But don’t worry. We’ll let you know if our visitor numbers start exploding without us doing anything to warrant it.

However, you can use Google Trends to see the level of interest in the term “buy gold”. There was a spike in 2020, but the interest was still far below the peaks of 2008 and 2011. Right now in 2023 we are at levels much lower than 2020.

When this level of interest in buying gold is surging much much higher, then will be the time to consider selling.

Verdict: No Gold Bubble. So it’s not time to sell gold yet.

If you’d like to know the exact process for selling gold and silver see: Sell Gold & Silver Bullion, Bars or Coins

Why You Might Not Have to Sell Your Gold at All

The other possibility to consider is that you may not have to sell your gold at all. “Huh?” You may be thinking, “I’ve read stories of people who didn’t sell gold when it was in the $800’s at the end of the 1970’s and then watched it drop all the way down to $300 or less.”

Well, you see, the possibility exists that gold could become widely accepted again as money. This could come about in a number of ways…

1. The elites may be forced to reintroduce a gold standard and hopefully a true gold standard as existed prior to WW1. Whereby an ounce of gold is worth a specific dollar amount. So gold = money.

2. The above doesn’t happen and so the global financial system totally breaks down, maybe hyperinflation ensues, paper money is worthless and people resort to trading and bartering. Gold will still buy the same amount of goods and services as it always has. Again gold = money.

For more on this see: Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine? and What is the Best Type of Gold to Buy For Trading in a Currency Collapse?

3. Another possibility bandied about by the likes of Jim Sinclair of jsmineset.com, is that the elites merely introduce a loose gold link. This would possibly be by way of a new global currency with gold trading in a narrow range but at a much higher price. This would allow the master planners to still control the currency issuance – albeit with a partial handbrake on their money creating powers.

Read more: The Gold Standard & A Free Market For Money: What Do We Think About It?

And: Is The Return To A Gold Standard Inevitable? What Might it Look Like?

4. Or we could see a combination of a basket of currencies linked to gold, or even a blockchain based gold linked currency.

In Conclusion

Whatever the final outcome, it appears that paper currency is slowly (or maybe not so slowly) dying. Who knows what will deliver the death blow, and it could be a way off yet, but none of the above signs of a “gold bubble” are here yet so don’t sell gold….. Buy gold (and silver). Hold gold (and silver). Learn, observe and wait.

Read more on this topic:

How to Sell Gold and Silver Bullion>>

Exit Strategies For When the Time Comes to Sell Gold and Silver >>

Note: This article was originally written 14 April 2010. Last updated 1 August 2023 to include the latest charts and numbers for every indicator.

(Note: If you’d like some assistance with timing your eventual exit from gold and silver, then you may want to meet our “secret” investment advisor. You can learn more about who he is… And how you could benefit from his uncanny ability to enter and exit not just the precious metals markets but many other markets too, at just the right time. So go here to learn more now.)

Great report, thank you for all your hard work. Cheers

Pingback: Gold in Perspective - the 1970's compared to today | Gold Investing Guide

Soros is an old crook , while he is saying gold is a bubble he and others of his ilk are buying big time, particularly physical and shares ( not the scams of ETF etc)

Pingback: Casey Research: When to sell gold | Gold Investing Guide

Pingback: NZ Housing to Gold Ratio - Update | Gold Investing Guide

Pingback: Why Gareth Morgan Investments and the mainstream are wrong about gold | Gold Investing Guide

Pingback: NZ Dollar Gold and Silver: A Beginners Guide to Technical Analysis | Gold Investing Guide

Pingback: Gold’s Critical Metric: The One Indicator to Watch | Gold Prices | Gold Investing Guide

Pingback: The Gold Bull Market - Is it Over Yet? | Gold Prices | Gold Investing Guide

Pingback: How Do You Value Gold - What Price Could it Reach? | Gold Prices | Gold Investing Guide

Pingback: Gold and silver steadily trending up | Gold Prices | Gold Investing Guide

Pingback: Ever lower interest rates? | Gold Prices | Gold Investing Guide

Pingback: When to buy a ticket for the gold train? | Gold Prices | Gold Investing Guide

Pingback: Just checking: Is gold in a bubble? | Gold Prices | Gold Investing Guide

Pingback: Gold Symposium 2012: What is the End Game for the Global Monetary Crisis? | Gold Prices | Gold Investing Guide

Pingback: Is it Time to Sell Gold or Silver? | Gold Prices | Gold Investing Guide

Pingback: Why It's Not Time to Sell Gold & Silver Yet | Gold Prices | Gold Investing Guide

Pingback: Exit Strategies For When the Time Comes to Sell Gold and Silver | Gold Prices | Gold Investing Guide

Pingback: Is Gold ready for a fall? -

Pingback: Lessons for the Average Gold Investor From a Very Different Gold "Miner" - Gold Survival Guide

Pingback: How to Sell Gold and Silver Bullion - Gold Survival Guide - Gold Survival Guide

Pingback: Gold’s Critical Metric: The One Indicator to Watch

Pingback: NZ Housing to Gold Ratio 1962 - 2019: Measuring House Prices in Gold

Pingback: Selling Gold: If the Gold Price Rises Substantially, Will Dealers Buy it Back From Me? - Gold Survival Guide

yea, thanks guys. interestingly, Australia and NZ are in the top 5 “but gold” searched countries.

https://trends.google.com/trends/explore?q=buy%20gold

Pingback: No Escape: The Fed Bail Out of the Entire Global Dollar System Will Destroy the Dollar as the Global Reserve Currency - Gold Survival Guide

Pingback: Why Will Gold Still be Valuable in the Future? - Gold Survival Guide

Pingback: What Might a BRICS Currency System Mean for NZ? - Gold Survival Guide

Pingback: How Much Gold Has China Got? - Gold Survival Guide

Pingback: Inflation - Not Beaten Yet? - Gold Survival Guide