Prices and Charts

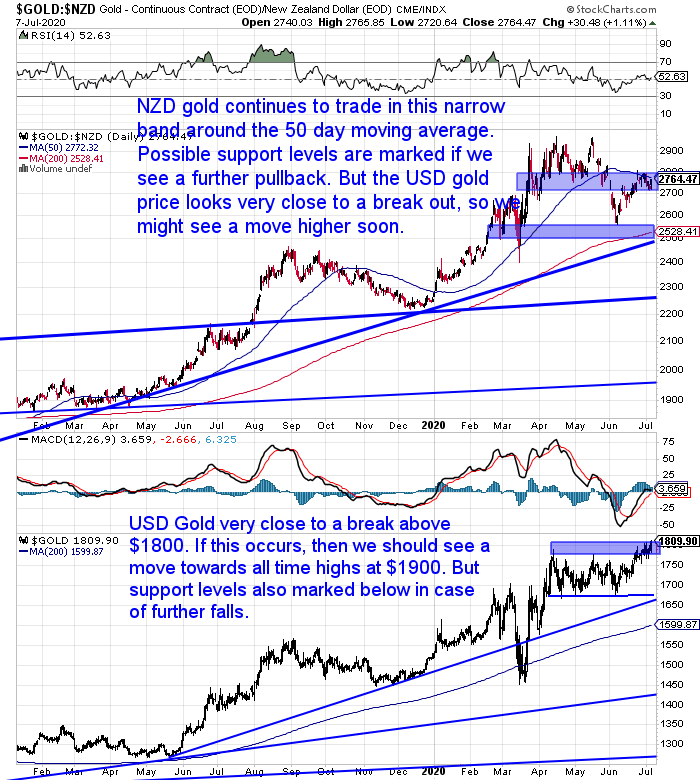

NZD Gold Sideways Trading Continues

While down a little this week, the current trend for gold priced in New Zealand dollars is clearly sideways. It has been locked in a trading range between $2700 and $2800 for the past few weeks.

It’s likely to take the USD gold price breaking out above $1800 to also move the NZD gold price higher. This looks very close to happening. With USD gold hovering just under that mark today.

That is still the key level to watch for.

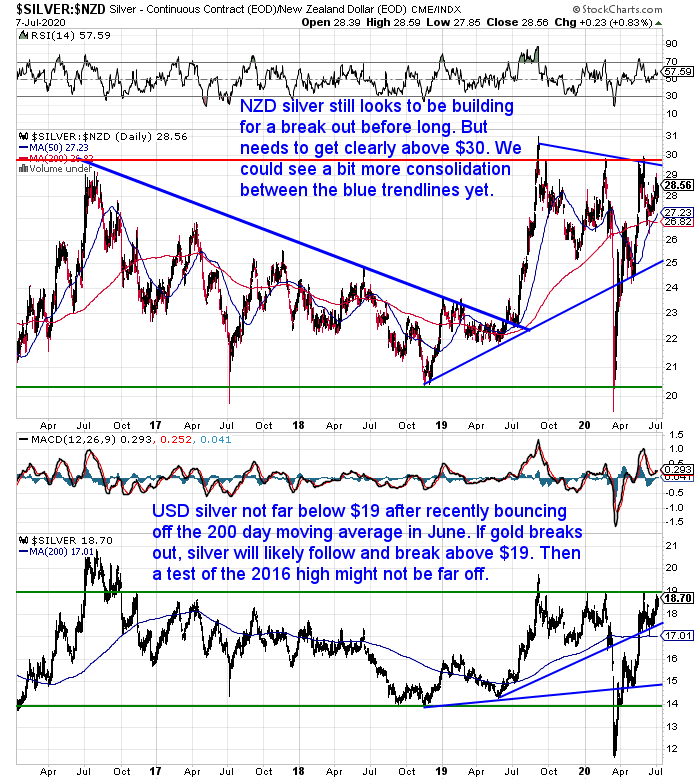

Silver Also Treading Water

Silver in New Zealand dollars was also down this week. Although it too looks to be building for an attack on overhead resistance levels. We need to first see $29 bettered and then $30.

It’s likely it will take the above mentioned US$1800 breakout in gold before we see a move higher for silver too.

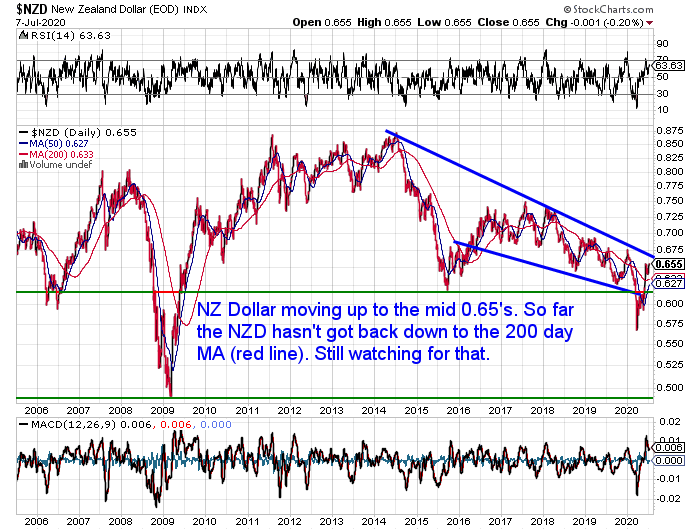

Kiwi Dollar Handbrakes Gains in Local Precious Metal Prices

Meanwhile the Kiwi dollar is down for the week. But still hovering around the 0.64 mark. The Kiwi dollar is higher this week. That has been the cause of the week’s losses in local gold and silver prices.

To date we have not seen the NZ dollar return to test the 200 day moving average line. Unless we see some new negative news for New Zealand, perhaps we won’t see that after all?

Nonetheless, the Kiwi dollar remains stuck in the multi-year downtrend from 2014. We’d need to see a clear break above 0.67 for this to change.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

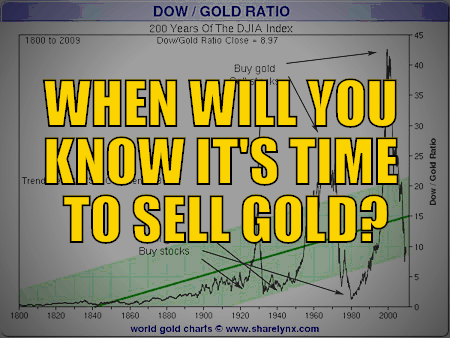

The Theme This Week: Selling Gold

The theme of this week is selling gold. We’ve had a few questions lately on this topic. Not because people are looking to sell now. Rather they are looking to buy, but sensibly thinking ahead to their exit from precious metals.

A common concern seems to be if the price rises substantially, will anyone want to back gold back?

So we tackle this question and a few related queries in this week’s feature article…

When Will You Know It’s Time to Sell Gold?

Then something you should also think about when buying…

When will you know that it’s time to sell or rather as we like to say “spend” your gold?

This article has 7 factors that will help identify when gold has peaked and it could be time to move on…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

The Bank For Central Banks Issues Warning

The Bank for International Settlements (BIS) this week issued a stark warning for markets in its Annual Economic Report released this week.

Interestingly the BIS (referred to as the Bank for Central Banks) is often much more frank on market risks than central banks themselves are.

The report points out that the response to COVID-19 has been unprecedented. With central banks responding to collapsing economies and high unemployment by flooding the system with money to keep liquidity.

But Selva Freigedo in the Rum Rebellion, highlights that:

“…the move MORE THAN appeased the markets, as the report noted (emphasis added):

‘Just like the virus, the crisis has been evolving. In some respects, the success of central banks in calming markets and shoring up confidence has even helped spark some market exuberance: at the time of writing, equity prices and corporate spreads in particular seem to have decoupled from the weaker real economy.Even so, underlying financial fragilities remain: this feels more like a truce than a peace settlement.’

It’s something Agustin Carstens, the BIS’s general manager also echoed in his speech:

‘Financial markets may have become too complacent — given that we are still at an early stage of the crisis and its fallout. The outlook for the world economy is still highly uncertain. At best, we have only just overcome the liquidity phase of the crisis in the countries that are now relaxing restrictions. In many others, the health crisis is still acute. And the epidemic could flare up again anywhere.’

This may have started as a health crisis, but the truth is that things weren’t that great before.

We were at the tail end of a long bull market. There were still problems with liquidity as the Fed tried to taper off all the stimulus from the last financial crisis…remember the repo crisis?

There was also high corporate debt and interest rates were stuck at record lows. At the same time, asset prices were at record highs, which had driven up household debt levels.

And then COVID-19 hit…

Investors left markets in record droves, as you can see below (right figure), jumping back when central banks injected liquidity.

But things are from over.

The crisis has fuelled an increase in downgrades, as you can see in the graph on the left above.

As the BIS continued in the report:

‘[M]ore fundamentally, what first appeared to be a liquidity problem, more amenable to central bank remedies, is morphing into a threat to solvency. A wave of downgrades has started, alongside concerns that losses might cause widespread defaults.’

So far markets seem to have recovered. The NASDAQ is trading above 10,200 at time of writing; higher than before the pandemic. The S&P 500 Index is trading above 3,100.

But there are a couple of problems ahead.

The Wall Street Journal reports that more than 40% of the companies in the S&P 500 have withdrawn their guidance because of too much uncertainty.

And all this central bank stimulus isn’t translating into jobs yet.

Markets may be cheering unemployment falling to 11.1% this week, but this is still a far cry from the unemployment level back in February of 3.5%, a 7.6% drop.

Higher unemployment means less consumer spending.

Markets may be plodding higher but investors are ignoring the most important driver of stock prices in the long run — that is, earnings.”

The question now is how high can central bank currency printing drive markets? That is the unknown. We’d rather not risk our capital in the general share markets. Much simpler and safer to merely hoard gold and silver for now. The returns are likely to be better too in our opinion.

No Escape: The Fed Bail Out of the Entire Global Dollar System, Will Destroy the Dollar as the Global Reserve Currency

The response from central banks in March meant that the US Federal Reserve had to hurriedly implement swap lines with 9 other central banks around the world (the Reserve Bank of New Zealand was one of them). Just as they did back in 2008. This was to ensure there was enough liquidity in the global financial system.

In promoting its annual report, the BIS this week tweeted about these swap lines. Pointing out that:

“For central banks with an international currency, the role of crisis manager does not stop at national borders #USdollar #FederalReserve #SwapLines https://bit.ly/2CPcTdf”

An insightful retweet of this by Will Schryver @imetatronink pointed out that:

“The BIS is unequivocally alerting the world to the simple fact that the Federal Reserve is now locked into a course of action: it must bail out the entire global dollar system, and in so doing, destroy the dollar as the global reserve currency. There is no escape.”

To which Alistair Macleod of Goldmoney commented:

“This is undoubtedly correct. The scale of the problem is why I am convinced this credit cycle will finish off fiat currencies by the year end and have been saying so for the last three months.”

The end of the year seems like a very very bold prediction. We’d have our doubts about that. But as the COVID-19 scare has shown us, things can move very quickly in today’s markets.

Owning a meaningful amount of gold and silver will help you ride out this crisis. It will also act as a bridge for your wealth when the US dollars role as reserve currency ends. Something we definitely see as a when not an if.

Please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Silver Break Out Beginning - Gold Survival Guide