Is the return to a gold standard inevitable? Grant Williams, Senior Advisor at Vulpes Investment Mgmt, Writer of Things That Make You Go Hmmm, and cofounder of Real Vision Television, presented at The Silver & Gold Summit in San Francisco in October. Luckily for us Cambridge House has released the whole presentation. (Hat tip to Mike L. for sharing this with us.) We summarise it below or scroll down for the full video. Williams breaks down the history of the gold standard and the impact it will have on the future of world currency. He uses the wolf and its reintroduction to Yellowstone National Park as an allegory to the gold standard.

Here’s a Summary of Grant Williams Presentation “Cry Wolf”

Williams makes the point that 594 currencies have all disappeared. The average length of a fiat currency is only 30 years. The fiat US dollar is now getting close to 50 years old and this is the only pure fiat era in human history. This fiat based system works really well for politicians and bankers – until it doesn’t.

The Classical Gold Standard limited leverage and social spending.

Aesops Fable: Cry Wolf – the bad ending is the lesson

The possibility of a return to a gold standard is completely ignored – just as the boys cries of wolf were ignored in the fable. Many people including Williams have been warning of the end of the US dollar for some time. It hasn’t happened yet. But that doesn’t mean it’s not likely.

Current US Dollar Standard

The dollar has to weaken over the long term. But Trumps policies have caused the dollar to strengthen recently.

Gold is the “Apex Predator”

Removal of gold from Exeters Pyramid is akin to the removal of the apex predator that is the wolf from a forest. This leads to a proliferation of deer who slowly destroy the forest. Just like the removal of gold leads to a proliferation of the financial sector.

US Monetary Base Gold Backing

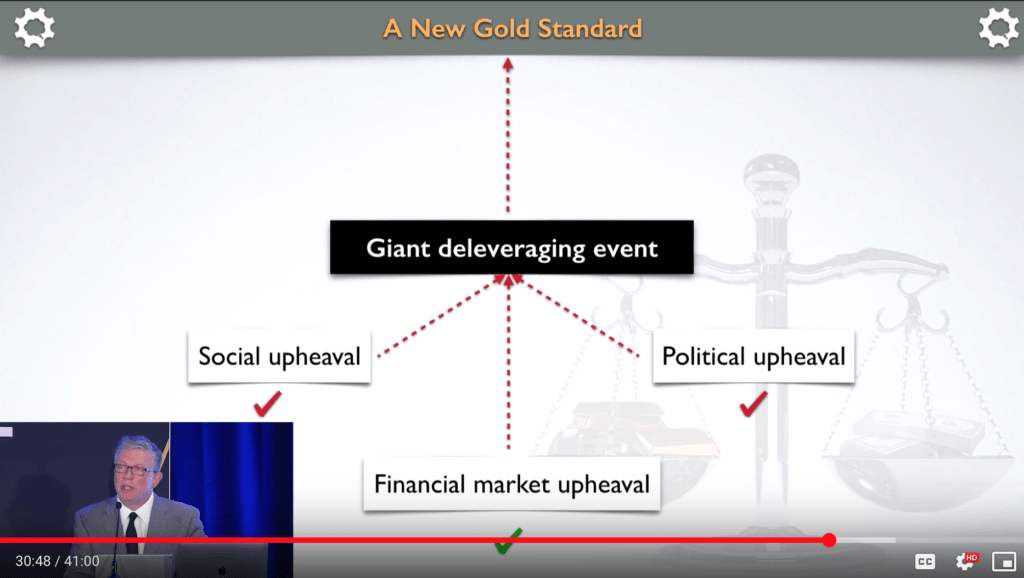

Is the Return of a Gold Standard Imminent?

No Inevitable? Most likely yes. But it will take a further crisis to force this to happen. It won’t be by choice. Currently we have the social and political upheaval. We are just waiting on the financial market upheaval.

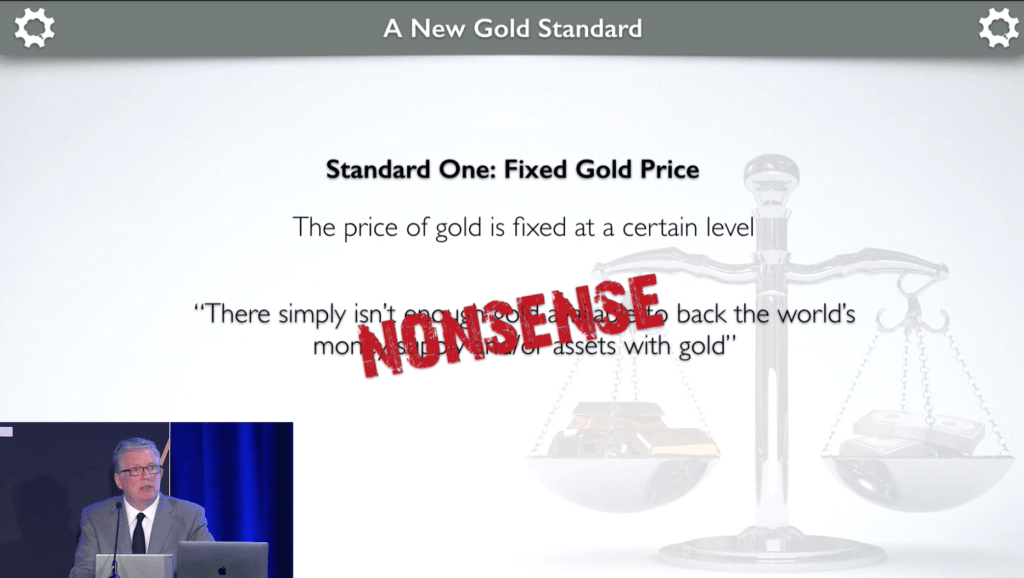

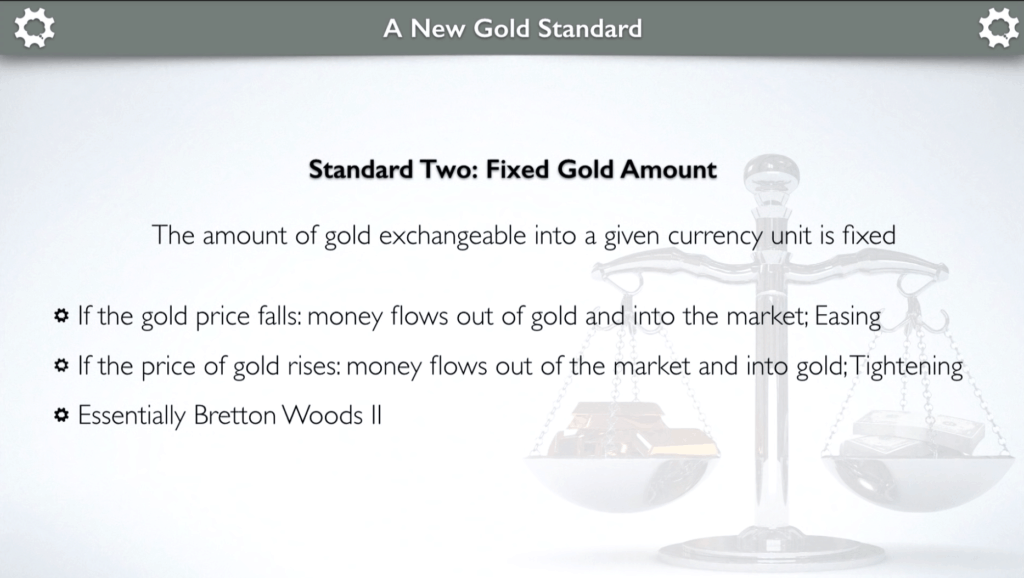

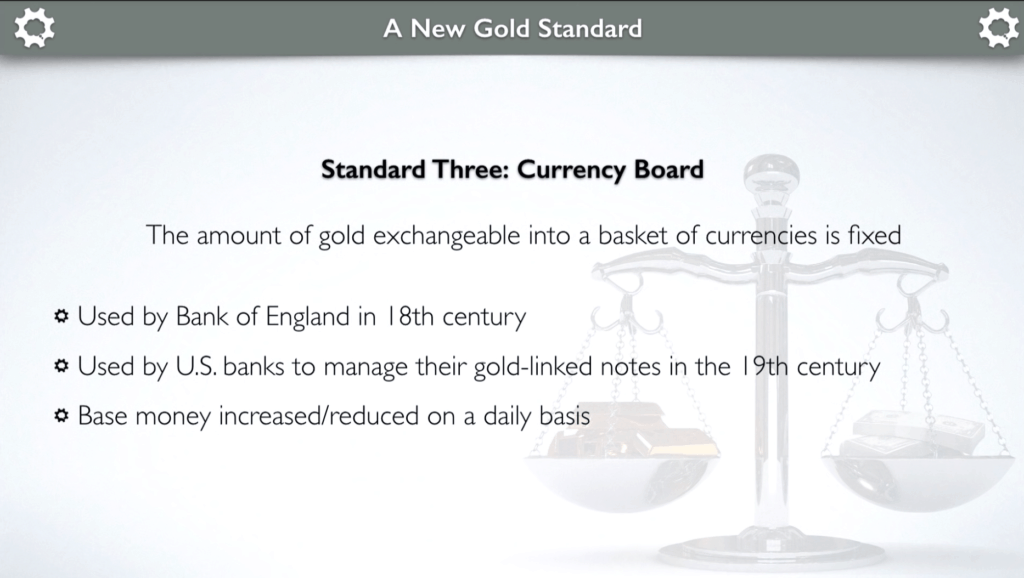

What Will A New Gold Standard Look Like?

He sees three possibilities:

Read more on the Gold Standard: The Gold Standard & A Free Market For Money: What Do We Think About It?

Read more on the Gold Standard: The Gold Standard & A Free Market For Money: What Do We Think About It?

Full Presentation of Cry Wolf – The Fall Of The US Dollar: Is The Return To A Gold Standard Inevitable?

Related: If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

Pingback: What Use Will Silver Coins be in New Zealand in a Currency Collapse? - Gold Survival Guide

Pingback: When Will You Know It's Time to Sell Gold?