Prices and Charts

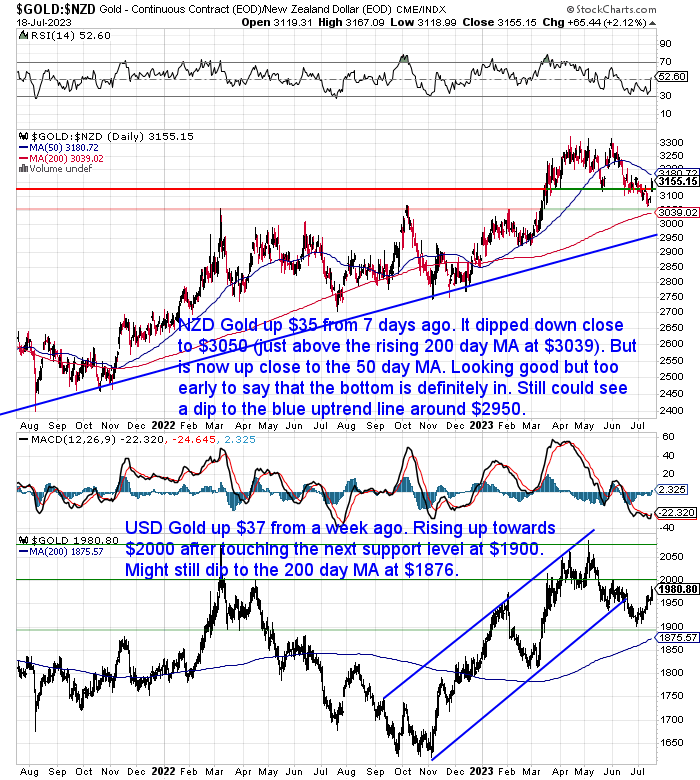

NZD Gold Up Over 1%

Gold in New Zealand dollars has jumped $35 from 7 days ago. It dipped down close to $3050 (just above the rising 200 day MA at $3039). But from there it bounced back to and is now just under the 50 day MA. Looking good but too early to say that the bottom is definitely in. We won’t really know that for certain until it breaks above $3300. For now we still could see a dip to the blue uptrend line around $2950.

While gold in USD was up nearly 2%. Rising back up towards $2000 after dropping down to touch $1900. Until we see new highs above US$2064, there is still a chance of a dip to the 200 day MA ($1875).

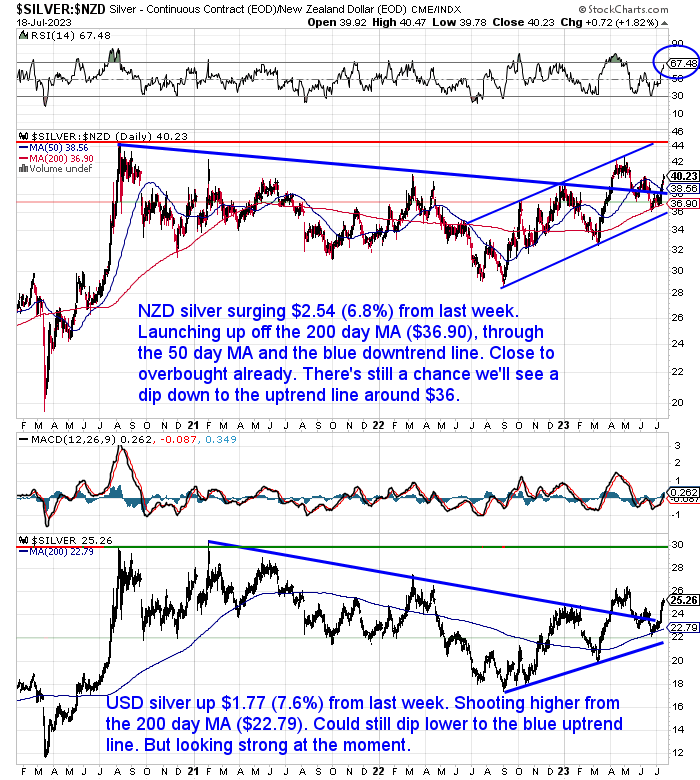

But Silver Surges Nearly 7%

NZD silver has shot up by $2.54 from last week. This 6.8% jump saw silver launch up off the 200 day MA ($36.90), through the 50 day MA and the blue downtrend line. But silver is now already very close to being overbought. So there’s still a chance we’ll see a dip down to the uptrend line around $36.

The rise in USD silver has been stronger. Now not far from the high for the year just above $26. But until we see new highs above the $29-30 area before we can confidently call the bottom being in.

Although any pullbacks should be seen as buying opportunities.

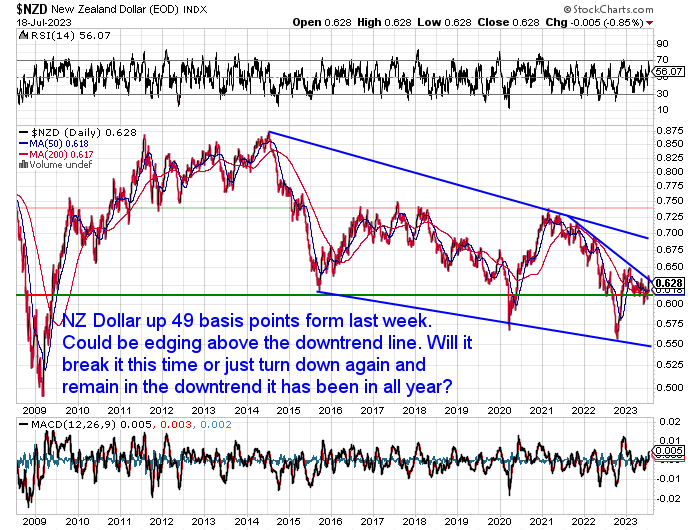

Downtrend in NZD Close to Over?

The Kiwi dollar is up 49 basis points (0.78%) from a week ago. It could be edging up above the downtrend line. Will it break through this time or just turn down again to continue in the same downtrend it has been in all year?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Could Silver Be Worth More Than Gold?

You may have heard about the increasing uses for silver in industrial applications. The rise in industrial use is often used to argue that the price of silver will rise significantly. Thus equaling or even overtaking gold. But could this really happen?

This week’s feature article covers this topic in depth including:

- The gold to silver ratio over 3 centuries

- Some historical evidence of silver being worth more than gold

- Silver industrial demand versus investment demand

- Could Silver Be Worth More Than Gold Due to:

- Peak Silver?

- Increasing Institutional Investment Demand?

- Increasing Photovoltaic Demand?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

COMEX Silver Futures Positions Say: Prepare for Fireworks in Silver

Speaking of silver, no one has spilled more ink on the topic of silver futures positions than Ted Butler. This week Butler reported on the strange goings on in COMEX silver futures.

He believes there are the makings of a market emergency in COMEX silver futures, with prices expected to sharply rise or fall. Butler says there is a physical silver shortage, with a significant increase in short positions on SLV and redemptions from SLV indicating tightness in the market. Total open interest in COMEX silver futures has dramatically increased, suggesting massive new bets on price direction. The motivation of the sellers appears to be controlling prices rather than making a profit. The emergency conditions in COMEX silver could lead to extreme price volatility, and higher prices are expected in the end.

He finishes by saying:

“…I am convinced a real and present danger and emergency exists in COMEX silver, mainly as a result of the new 100 million oz long and short position created over the past three days which can’t help but result in extreme price volatility dead ahead. But in the end the result will be sharply higher prices – regardless whether we see lower prices first (or not).”

Source.

In the retail market there is certainly silver available currently. Premiums on silver coins continue to drop indicating a lack of demand. But maybe this is different in the futures market where the large institutional investors like to play?

Who knows? So keep a close eye on silver in the coming weeks. Could be a buying opportunity. Or could be a case of getting it before it spikes higher.

New BRICS Currency Talk Won’t Die

Yet again there has been more talk this week of the potential new BRICS currency. This time we have news out of Iran:

“A tremendous change is taking place in the international economy,” Rasoul Mousavi, the head of the South Asia Department at Iran’s Foreign Ministry, said on Sunday.

“The BRICS’s introduction of a gold-backed currency, which is supported by 41 countries with large and influential economies, will weaken the dollar and the euro and will benefit countries such as Iran, while Iranians in possession of gold will experience a wealth increase,” Mousavi added.

The Russian government confirmed a day earlier that Brazil, Russia, India, China and South Africa would introduce a new trading currency backed by gold.

The state-run RT also reported that the initiative was adding new momentum to the ongoing de-dollarization trend unfolding in the global economy.”

Source.

As we’ve already said, this is something worth monitoring and could be significant. But we’ll wait to see something concrete announced before we get too worked up about it.

That said, there have been some knowledgeable people discussing this in the past week.

American author and economist Nomi Prins believes that it’s going to lift the price of gold. She expects it to convince institutional investors to move into gold and then eventually retail investors and savers around the world will too.

Then Alisdair Macloed had some really interesting thoughts on the topic at zerohedge.

It’s a very lengthy article that we think is worth reading in full. But here’s our summary of it in case you don’t have the time…

Alisdair Macleod discusses the importance of Russia’s announcement regarding a new gold-backed trade currency to be discussed at the upcoming BRICS meeting. Russia and China are working to remove the US dollar from their sphere of influence and establish a better alternative. They aim to consolidate trade partners and create a powerful bloc by merging BRICS, the Shanghai Cooperation Organisation, and the Eurasian Economic Union. The groundwork for the new currency has been laid, and it is expected to evolve rapidly. The move away from fiat currencies and towards gold-backed systems has been happening for some time, with gold flowing from west to east and Asian central banks accumulating reserves. Macleod suggests that the new currency proposal is a pre-emptive attack on the dollar, aimed at countering the potential threat of rising US interest rates and the impact on emerging economies. China and Russia are ready to challenge the dollar’s hegemony and return to a gold standard for trade and their own currencies. The geopolitical tensions between Russia and the US, particularly over Ukraine, further contribute to the urgency for Russia to undermine the dollar. A financial war can be waged without official declaration or reconciliation.

Macleod then discusses the design of a gold-backed trade currency and the potential consequences of its implementation. A trade currency has advantages as it will not be used to fund government deficits and will focus solely on cross-border trade settlement and dealing in physical commodities. It does not need to appeal to public confidence and much of the credit will self-extinguish. The key elements of the currency include the establishment of an issuing entity and the allocation of physical gold from the reserves of participating central banks. Macleod then goes on to outline the steps and features of the new currency, highlighting its potential stability, low interest rates, and its ability to insulate physical markets and derivatives from fiat currency collapses.

The introduction of a gold-backed currency by the BRICS nations and potentially other countries will have wider consequences. It is expected to undermine the purchasing power of Western fiat currencies and lead to a decline in their value. International capital will shift towards real values in commodities, with nations stockpiling energy, metals, and raw materials instead of fiat paper. The price of gold is likely to reflect the demise of fiat currencies. The consequences for the Western alliance, including the US, EU, and the UK, will differ in their impact, with potential challenges in funding government debt, rising bond yields, and economic and political divisions. Macleod believes that Western governments may need to abandon Keynesian macroeconomics and revert to classical economic theories to address the crises that may arise from the implementation of a gold-backed currency.

Read the full report here.

Some points to consider are how would this work if only China and Russia have significant gold reserves? What will the other potentially 40 nations do? Will they need to buy significantly more gold in order to settle cross border flows? Will all these central banks have sufficient discipline not to inflate their own currency supplies?

Here’s Why Even If Inflation Drops to 3%, It’s Still Likely Going Higher Again

New Zealand June CPI numbers came in close to those expected. CPI was up 1.15 for the June quarter and up 6% compared to a year ago.

ASB had expected a 0.9% quarterly increase, with annual inflation to fall below 6% for the first time since December 2021.

So it came in higher than that, but inflation is falling here, just as it is in most places around the world.

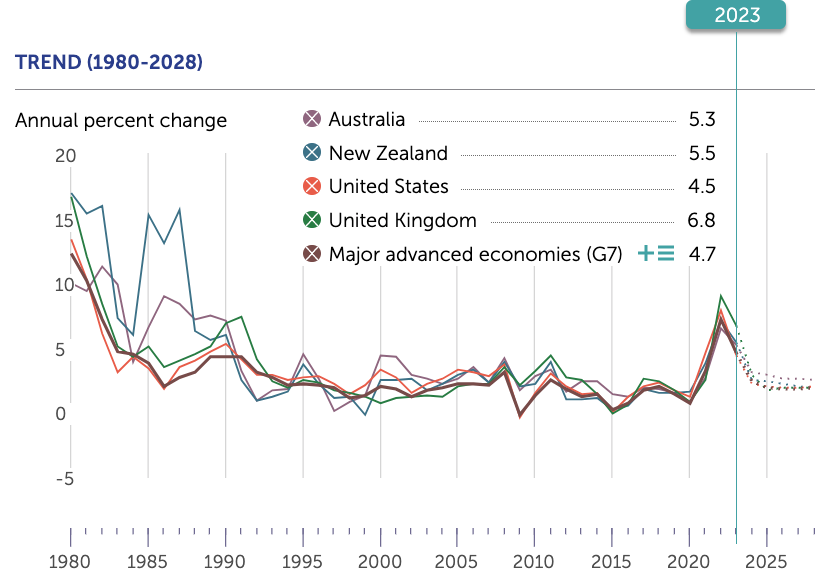

Now the question is, will this fall continue as the IMF predicts in this inflation chart below?

This is broadly in line with what central banks, including ours here in NZ, are saying. That is, inflation will continue to fall and get back to normal in the second half of 2024.

Here’s some recent headlines and quotes that it might be worthwhile to look back on in a year.

ASB:

We expect inflation will fall back into the 1-3% target band in the second half of 2024, fairly similar to the RBNZ’s view. Retail spending and construction remain under pressure, with further mortgage rate pressure still to come over the rest of this year as some borrowers refix mortgages at higher rates. Rising unemployment will moderate wage growth and bring down inflation over time. In the short term the cost pressures that businesses are facing remain high, though. The main thing the RBNZ has to be wary of is the housing market, which looks like it is bottoming out.

We are comfortable with our view that the RBNZ has done enough to get inflation under control. The Bank will remain wary for the time being though so won’t relax. And it continued to emphasise that restrictive monetary policy is needed for some time: we don’t expect OCR cuts until May next year, give or take.

Rampant price inflation ‘a memory’ by mid next year, Infometrics says

Read more

So the RBNZ, ASB and infometrics all expect inflation to get back to around normal at 3% in about a year.

We have our doubts they will prove correct. Remember these were the same people saying inflation was just “transitory” back in 2021.

Actually perhaps we should explain our thinking a bit more. Rather it is if they do get inflation back to 3%, we doubt it will stay there. Why do we say this?

Because if inflation gets back close to 3%, it’s likely central banks will have also cut interest rates again.

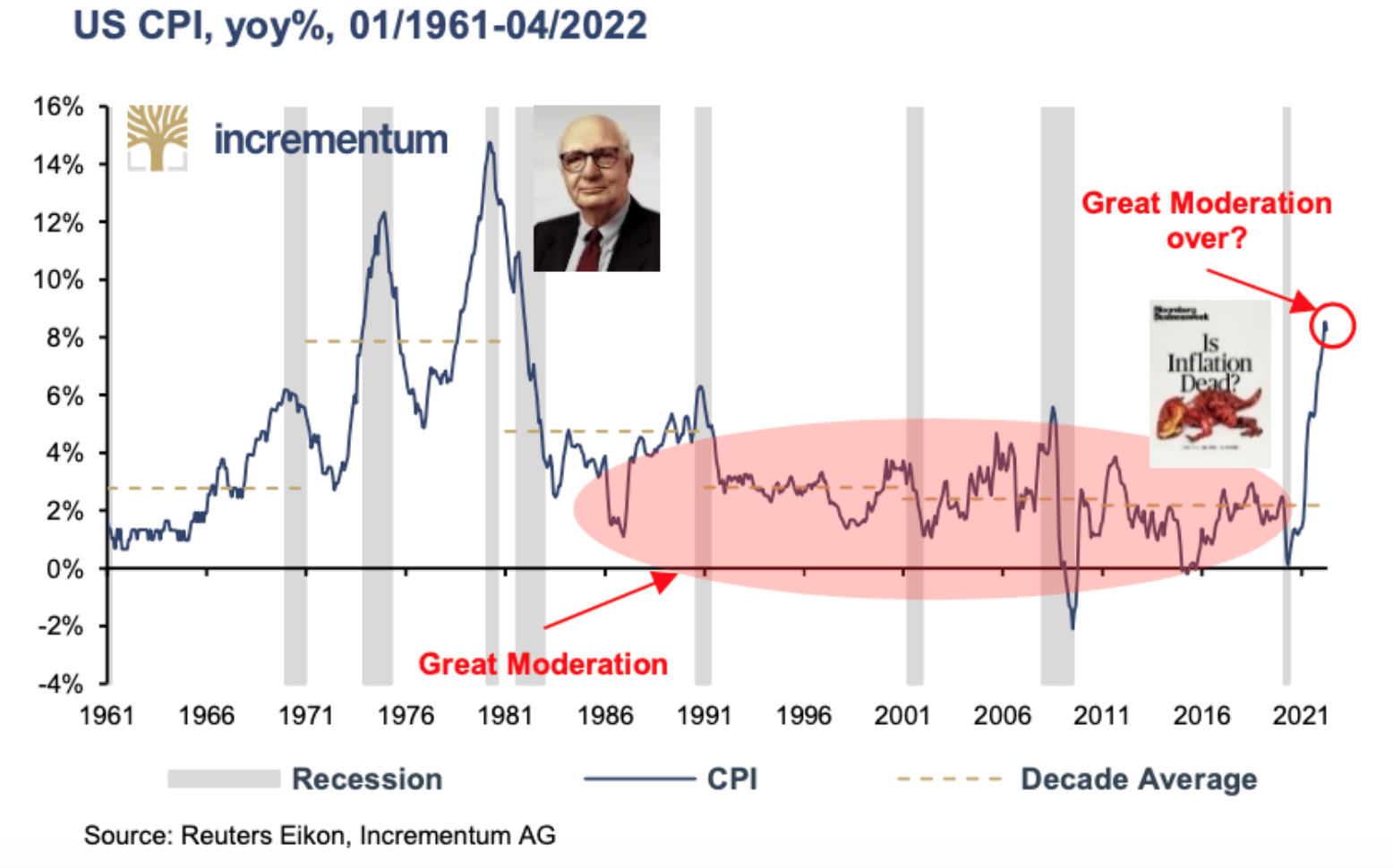

So let’s look back to the 1970s, the last time there was stagflation to see what happened then.

This chart from last year’s In Gold We Trust report clearly shows the US CPI dropping from 6% back to 3% around 1973. However there were 2 further cycles up in inflation. Hitting 12% in the mid 70s and then 15% in 1980. With both peaks coinciding with recessions in the US.

Our bet is we are heading for something similar this time around. As there has been so much currency created and very little of it extinguished so far. Therefore anytime central banks loosen things up a bit, we’re likely to see inflation surge again in the following years.

That’s our theory anyway. Time will tell if we are right or if the bank economists are.

if you think “normal” is likely to be more than a year away then you might want to add to your financial insurance reserves.

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|