Prices and Charts

Everything is Falling – Including Gold

Look around and just about every sector of the financial world is falling. Stocks, currencies (except the USD), crypt0s all down significantly. House prices too. Bonds are up lately but down for the year. Even gold has joined in lately. However gold in USD terms is only down slightly for the year. While in most other currencies including the NZ Dollar, gold is actually up year to date.

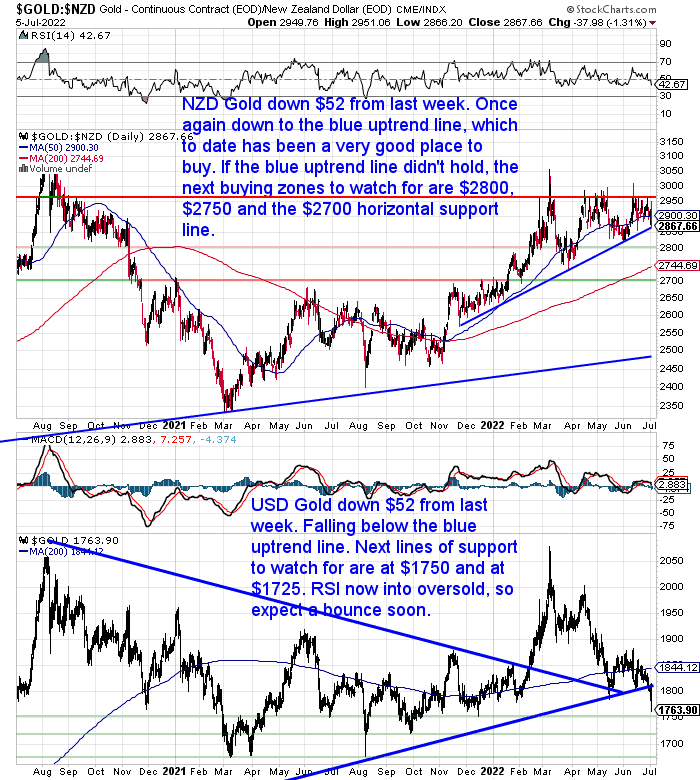

But over the past 7 days gold in New Zealand Dollars is down just under 2%. It is back once again to the blue uptrend line. Which to date has proven to be a very good place to buy. Will it repeat this time? Only time will tell. If not then the next buying zones to watch for are $2800, $2750 and then the horizontals support lines at $2700.

In USD terms gold was down close to 3% and as noted already is down a touch year to date.

Silver Following Industrial Metals Lower

In times like these history shows us that silver often reverts to being seen as more of an industrial metal than a monetary metal. Look back to 2008 or even 2020 when Covid first appeared for example of silver dropping sharply.

So it probably shouldn’t come as a big surprise to see silver struggling currently.

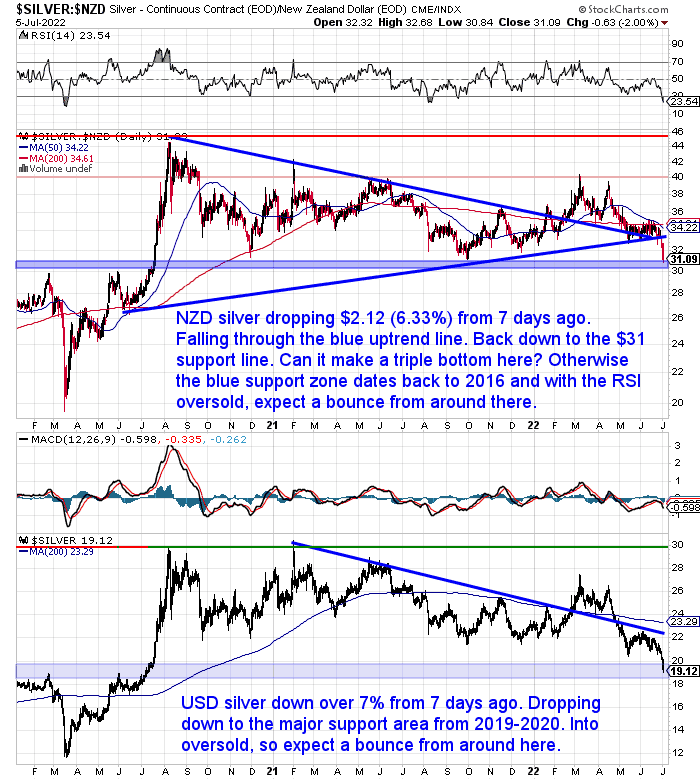

From 7 days ago NZD silver is down over $2 per ounce or over 6%. Silver clearly fell through the blue uptrend line. Currently it is back to the $31 horizontal support line. Just below this is a support zone dating back to 2016. With the RSI now oversold for the first time in almost a year, we should expect a bounce soon.

Silver in USD sits in a similar support zone. We watch for an expected bounce.

Times like these are why we have always said it pays to have some gold as well as silver.

NZD Down Against the USD Like Just About Everything Else

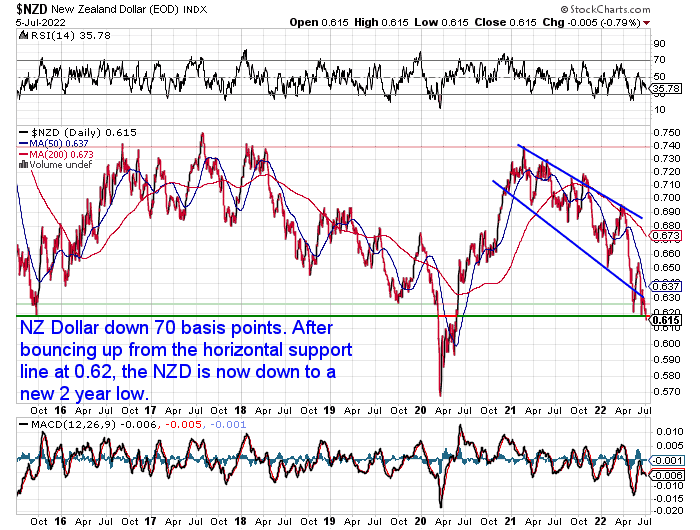

The New Zealand dollar was down over 1% this past week. The much maligned US dollar is once again proving to be a safe haven in times when most other sectors are falling.

This might be counter intuitive for many. Here’s an explanation that might help from a previous post of ours:

“Many talk about the US dollar being the first to collapse. However as the dollar is at the centre it could in fact be the last. We first heard Sandeep Jaitly say this many years ago and it took a bit to get our head around. Ronald Stoeferle also was of this theory when he was in New Zealand some years ago.

We have seen this scenario in action in recent years. With many emerging market currencies falling massively against the US dollar. A collapse is more likely to begin in the periphery and move towards the centre. So somewhat paradoxically, in a “dollar collapse”, it may well be that the US dollar is the last domino to fall.”

Source.

This latest fall has taken the NZ dollar to a new 2 year low. Now that the Kiwi has broken below 0.62, we could see it dip even further yet.

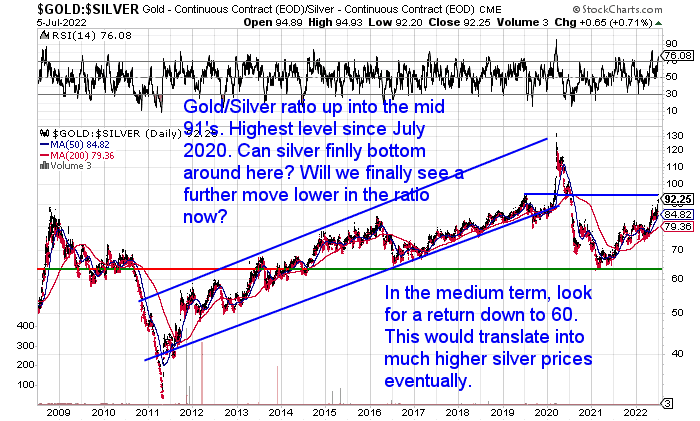

Gold to Silver Ratio Highest Since Mid 2020

This latest fall in silver has pushed the gold silver ratio up above 90. The highest level it has been since mid 2020. In the medium to long term we are still expecting the ratio to head back down to 60. But as always with silver, getting the timing of this is very difficult.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

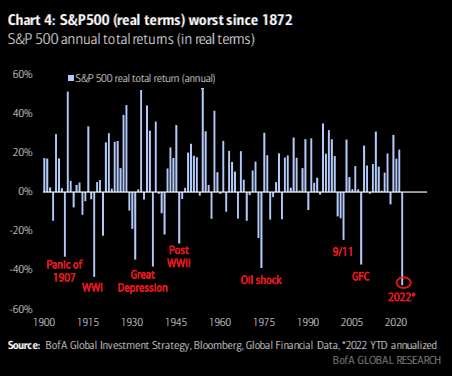

2022: The Worst Since…

As noted already, 2022 has not been a good year for investments. With stock markets in particular hit hard.

But this list we happened across this week even surprised us with how bad 2022 has been so far…

Scott Rubner’s [Bank of America] “worst list”;

1. The US 60/40 “World’s Retirement Portfolio” – second worst start to the year since 1900, that is 122 years. (-17%)

2. The worst start to the year in the past 122 years happened during The Great Depression in 1932 (Market bottom July 8th, 1932)

3. US bonds – worst start to the year on record dating back to 1900

4. The S&P 500 – worst start since 1970

5. The last 4th of July, investors were opening their half-year statements with a +14.41% gain for the S&P, and the 60/40 hasn’t seen a down first half in the past 11 years

6. He sees the biggest risk for 2H is that investors have not seen their 1H half statements and decide to reduce risk

7. No unwinds from the largest and most important owner of the market (households)

(Chart shows Hartnett’s latest “worst” SPX annualized chart)

Source.

Source.

Reader Question: Why is the RBNZ Not Buying Gold?

A very good question recently asked by one thoughtful reader:

“Why when the rest of the world’s reserve banks are accumulating gold is the NZ govt not doing the same? And could we expect a confiscation policy in a global currency crisis even with no historical precedence?”

Our reader was no doubt aware that the NZ central bank has no gold reserves whatsoever.

We outline in today’s article why that is.

As we outline in that article, reports in recent years from the RBNZ indicate that the lack of gold reserves is not likely to change anytime soon either.

Looking at the list of central banks who are buying, central banks in the west have been noticeably absent recently. See this World Gold Council report.

So it’s not just NZ. It seems eastern and developing world central banks are the ones doing most of the buying. This has been the case for many years.

So is that down to the heads of those central banks knowing more than those in the western world?

Or maybe rather that western central banks don’t want to put any unnecessary attention on gold, given it is the canary in the coalmine for the fiat currency system?

As for confiscation, never say never, but that is likely down the list of other things governments could resort to first. Especially given how low the gold holdings in NZ (and other countries) likely are. But we have a full discussion of that here:

As we outline in that article, reports in recent years from the RBNZ indicate that the lack of gold reserves is not likely to change anytime soon either.

Looking at the list of central banks who are buying, central banks in the west have been noticeably absent recently. See this World Gold Council report.

So it’s not just NZ. It seems eastern and developing world central banks are the ones doing most of the buying. This has been the case for many years.

So is that down to the heads of those central banks knowing more than those in the western world?

Or maybe rather that western central banks don’t want to put any unnecessary attention on gold, given it is the canary in the coalmine for the fiat currency system?

As for confiscation, never say never, but that is likely down the list of other things governments could resort to first. Especially given how low the gold holdings in NZ (and other countries) likely are. But we have a full discussion of that here:

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

How Long Lasting Will the Surge in NZ Inflation Be?

The Quarter 2 NZIER Quarterly Survey of Business Opinion is out.

ASB reports:

- The Q2 QSBO depicted stagflation-like conditions for the business sector, with shrinking economic activity, still-intense capacity pressures and soaring prices and costs.

- Risks of a hard-landing continue to increase, albeit it’s not our core view at present.

- Despite a soft activity backdrop, the OCR needs to move higher to try and cool increasingly entrenched high inflation. We expect a 50bp hike next week and a 3.50% OCR peak.

In another report last week ASB also asked the question:

How long lasting will the surge in NZ inflation be?

- Developments in the labour market play a pivotal role in impacting inflation, although many of the factors influencing labour market conditions are outside of the RBNZ’s control.

- Short of a material loosening in tight labour market conditions, there is the risk of annual CPI inflation remaining above 3% for considerably longer than the RBNZ May 2022 MPS forecasts imply.

- Prospects of a soft economic landing look less assured and the RBNZ may face uncomfortable trade-offs ahead.

Our guess is the hard landing will shift to being their “core view” before too long.

Make sure you have enough gold to protect you from that.

Please get in touch if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

|

This Weeks Articles:

|

Wed, 6 Jul 2022 12:45 PM NZST

Covid responses have seen the government encroaching more and more into everyday life, both here and across the planet. As a result we have more people getting concerned about the potential for gold confiscation. In various gold and silver newsletters we read, we’ve seen a few queries on the topic of confiscation of gold in […]

The post Gold Confiscation | Could it Happen in New Zealand Today? appeared first on Gold Survival Guide.

|

|

Tue, 5 Jul 2022 9:37 PM NZST

We’ve had the odd query from other New Zealanders asking, “how much gold does the Reserve Bank of New Zealand (RBNZ) actually have?”. Our guess is people are probably asking because since the financial crisis net gold purchases by global central banks have switched from negative (i.e. they were selling), to positive (i.e. they are […]

The post How Much Gold Does the Reserve Bank of New Zealand Have in 2022? appeared first on Gold Survival Guide.

|

|

|

|

Tue, 28 Jun 2022 4:25 PM NZST

Could Silver Be Worth More Than Gold? You may have heard about the increasing uses for silver in industrial applications. The rise in industrial use is often used to argue that the price of silver will rise significantly. Thus equaling or even overtaking gold. But could this really happen? A reader posed just such a […]

The post Could Silver Be Worth More Than Gold? 2022 Update appeared first on Gold Survival Guide.

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

|

|

|

|

|

|

1kg “Scottsdale Gold” Bar 99.99% with unique serial number

$94,992.11

$94,992.11 |

1oz ABC Bullion Gold Cast Bar

$3,018.50 (Not on website – email to order)

$3,018.50 (Not on website – email to order)

|

|

|

1 oz RCM Silver Maple Coin

(Minimum order size tube of 25 coins)

Tube of 25: $1011.75 (pick up) (Not due for around 4 weeks)

Box of 500:

Tube of 25: $1011.75 (pick up) (Not due for around 4 weeks)

Box of 500:

$20,141.56 (Pre-order)

Including shipping/insurance 6/7 weeks delivery

|

|

|

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Plus we accept BTC, BCH, Visa and Mastercard

|

| Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

| The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2020 Gold Survival Guide.

All Rights Reserved. |

|