What is the gold silver ratio? Why is the gold silver ratio still at very high levels? In this post you’ll learn:

Table of contents

- What is the Gold Silver Ratio?

- How is the Gold/Silver Ratio Used?

- So What is the Ratio Telling Us Now?

- How to Use the Gold Silver Ratio to Determine Whether to Buy Gold or Silver

- Why is the Gold/Silver Ratio Still Very High?

- What Do We Think?

- What is the Ratio of Gold to Silver in the Earth?

- How High Could Silver Rise if the Gold/Silver Ratio Falls?

- What to Do?

- Gold Silver Ratio FAQs:

Estimated reading time: 11 minutes

What is the Gold Silver Ratio?

The gold silver ratio is simply the price of an ounce of silver divided into the price of an ounce of gold. The resulting number shows how many ounces of silver it takes to buy an ounce of gold.

The ratio can be helpful in determining whether to buy more gold or more silver at any given time.

To calculate the gold to silver ratio on a given day, take the gold price and divide it by the silver price.

At today’s prices that would be US$1986.39 (gold) divided by US$23.66 (silver) equals a gold to silver ratio of 83.96. Or that it takes around 84 ounces of silver to buy one ounce of gold.

How is the Gold/Silver Ratio Used?

The Gold to Silver ratio (GSR) is used as a method of valuing silver against gold.

It can also be used as a way to determine when it is better to buy silver and when it is better to buy gold. A higher ratio means silver is undervalued compared to gold. Conversely a lower ratio means silver is overvalued compared to gold.

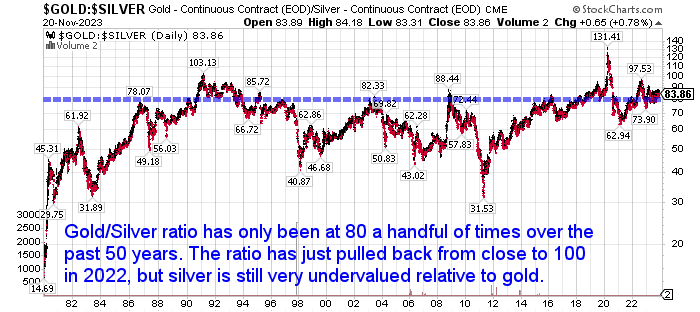

Viewing the gold to silver ratio over time in a chart can be helpful. The chart below shows the ratio has only reached 80 a handful of times over the past 40 years.

So What is the Ratio Telling Us Now?

The gold silver ratio is telling us to buy silver over gold currently. At a little above 80 the ratio remains very high. So silver is very undervalued compared to gold on a historical basis.

Or put another way, silver remains very unloved compared to gold.

We have seen the ratio as high as 131 back in March 2020 when silver briefly spiked down as Covid arrived on the scene.

But as fast as the ratio spiked up in 2020, it fell down almost as quickly. In the 2008 financial crisis the same thing happened. The ratio spiked to almost 90 before then falling sharply for 2 years, down to 31, as silver caught up to gold.

In this current cycle the ratio dropped down as low as 63 in 2021 but then worked its way back up to above 90 in 2022. Today the ratio has dipped down a little above 80.

But currently silver remains very undervalued compared to gold. Both metals are undervalued compared to dollars. Whether they be US Dollars or NZ Dollars.

Investors were rushing toward gold due to the panic around the Corona Virus and crashing sharemarkets in early to 2020. They did not pay so much attention to silver. This theme seems to have changed in 2021 and 2022. Where we witnessed much more interest in buying silver. But so far this has not resulted in a large change in the silver price. In 2023 there has not been much interest in buying gold or silver.

How to Use the Gold Silver Ratio to Determine Whether to Buy Gold or Silver

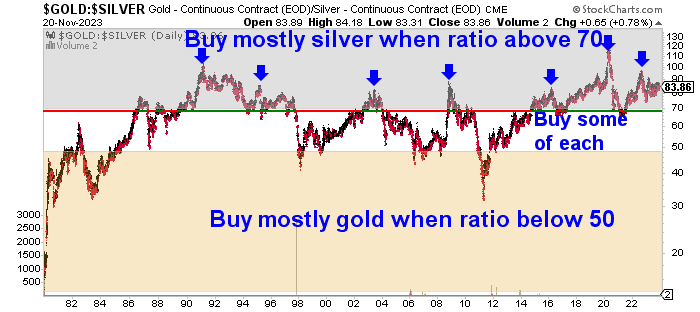

A good rule of thumb in determining which metal to buy is shown in the chart below.

Consider buying gold when the ratio gets below 50 and buy mostly silver when it’s above 70. Buy a bit of both when the ratio is in the middle zone. Currently we remain in the “buy mostly silver” zone.

Why is the Gold/Silver Ratio Still Very High?

The gold silver ratio is down from the spike above 100 which occurred in early 2020. However as stated already, on a historical basis, the ratio still remains very high. Here are some possible reasons for this:

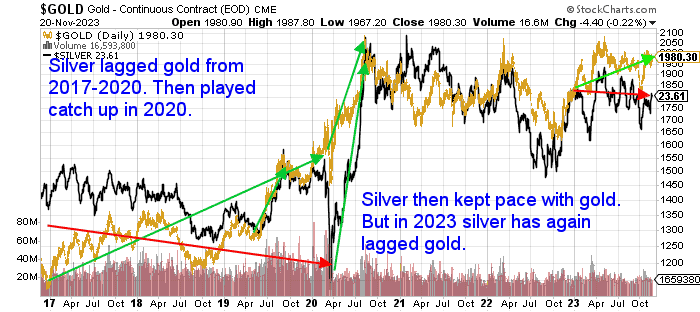

1. It may be that silver is merely lagging gold and will play catch up before too long

Gold is viewed as more of a flight to safety or crisis hedge than silver. So it could be that gold has been stronger than silver due to some worry that sharemarkets are overdue for a correction.

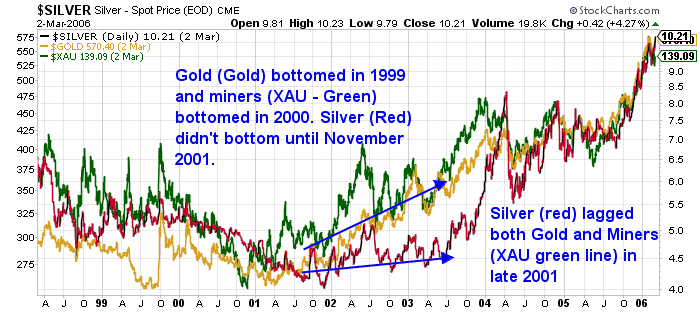

Also back in 2001, at the start of the current bull market in precious metals, gold performed better than silver and precious metals miners did better than both metals. Silver was the last of the 3 sectors to recover. Silver reached its lows in November 2001 (see the chart of that period of time below comparing, gold, silver and the XAU miners index).

So perhaps we have been witnessing something similar play out in recent years?

2. The high gold to silver ratio may be signalling worry of a coming market crash

A post made on Silver Doctors back in 2016 looks to have been on the money. It asked “Is the Gold / Silver Ratio Sending Us A MAJOR WARNING??” It says:

“Over the last 100 years, the major peaks and troughs of the silver/gold ratio [GTSR] have marked HISTORIC turnings in the markets.

As the ratio surges through 80 to 1, is the gold / silver ratio trying to send us a MAJOR WARNING?”

It then goes on to outline how they believe the peaks of the ratio indicate peaks of economic stress. They outline 18 major peaks and troughs in the Gold/Silver ratio over the past century. Noting that the major peaks in the ratio occurred with likes of various crises such as the following occurring:

Oct 1986: 76 Economic and banking headwinds, Russian and currency crises abound

Jan 1991: 100 Start of major banking crisis, housing crash, 1000 banks were closed

Sept 1991: 92 Continuation of bank and housing crash

June 2003: 79 Culmination of tech wreck

…Nov 2008: 81 One month after Lehman crash

…The systemic stresses grow daily as the gold to silver ratio climbs.

The chances are much better that gold will go up significantly in price before silver. Silver is a lagging indicator.

I surmise gold goes up first because it is a metal that means something to the central banks, central governments and wealthy individuals.

Silver is poor man’s gold and when the vast majority of people realize they are behind the curve and must acquire precious metals, they go to silver.”

Source.

So in essence, they argue gold has been rising as an indicator of economic troubles brewing. It shows a loss of faith in governments and central banks. Wealthy individuals are buying gold.

Silver will catch up when more people start to notice and they buy silver. It’s likely they’ll think gold is too expensive and opt for silver instead.

3. People may believe that inflation is going to be “transitory”. Silver may rise once they realise inflation is here to stay

Most central banks (New Zealand’s included) have been saying the high rates of consumer price inflation are just temporary and will subside as the world returns to normal after 2 years of lock downs and supply chain disruptions.

In February 2022 the RBNZ stated:

“Inflation has continued to rise, but is expected to ease in coming years… Inflation is expected to decline as monetary policy acts to reduce demand, softening the pressure on available resources. Less pressure on housing-related resources and an easing in supply-chain bottlenecks are also expected to support a slowdown in inflation.

Expectations for inflation over the next few years have increased. Although longer-term inflation expectations have risen, they remain close to 2 percent.”

However we have serious doubts that this will prove to be the case. As more people begin to realise inflation is like to be here for many years to come, more people will look to gold to protect them. At the same time this will likely attract more people to silver too. The silver market is much smaller, so even if the same number of people bought both, silver should rise more than gold.

What Do We Think?

It’s likely that all 3 of the above factors have played a role in keeping silver down compared to gold. Another possible reason is that of price manipulation. As noted the silver market is much smaller than gold and therefore even easier to manipulate. See: The Latest on Gold and Silver Manipulation Exposed. However, history shows that any manipulation cannot last forever.

We believe that a new bull market in precious metals has begun. But that silver is lagging gold much as it did back in 2001.

Previously we had thought this trend might be coming to an end. With silver starting to play catch up in 2019. But then silver sharply underperformed gold through to early 2020. It then played a quick game of catch up through 2020 and since then had been mostly keeping pace with gold. Until the start of 2023, where silver again started underperforming gold.

However as noted already, it’s worth looking back to 2008 in our earlier gold to silver ratio chart. You’ll see that silver fell during the early stages of the 2008 crisis (depicted by the ratio rising sharply).

But silver then shot up quickly higher. In fact, within 3 years silver rose to touch its all time high of close to $50 an ounce from 1980.

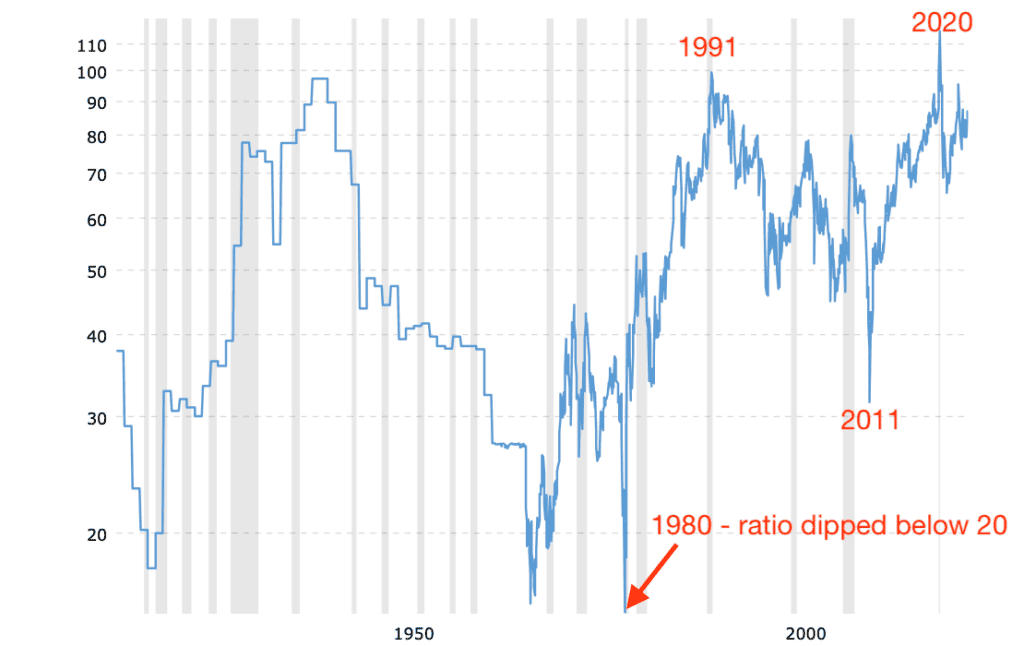

Our guess is we are at the start of the next phase of this precious metals bull market. We are likely to start to see silver gain some ground on gold. Maybe this year or next and then continue into the coming years. Long term we could see the ratio return down to 30 as it did in 2011. Or even below 20 as it did at the conclusion of the 1980’s precious metals bull market. See the 100 year gold silver ratio chart below.

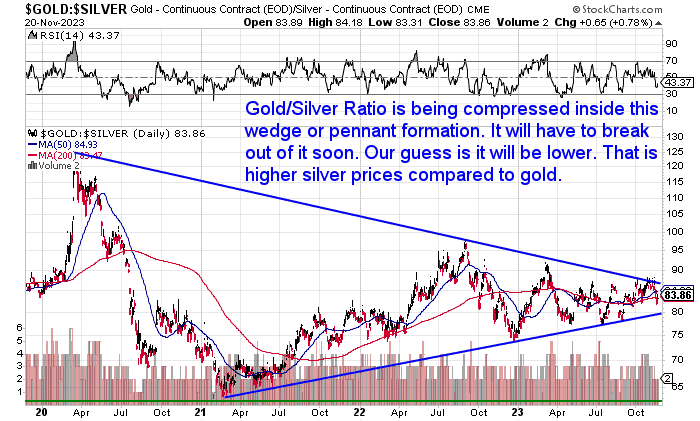

Also over the past few years the gold silver ratio has been trading inside a large wedge or pennant formation. See the chart below. Getting more and more compressed inside a smaller and smaller trading range. As the flag or pennant comes to a point the ratio will have to break out of this formation one way or the other. Our guess is that this will be down, which would mean higher silver prices compared to gold.

What is the Ratio of Gold to Silver in the Earth?

One argument for what the gold to silver ratio should be is that the gold price to silver price ratio should match the ratio of below ground gold to silver. We have seen geologist estimate that this ratio of below ground gold to silver is 19 to 1. While there are other numbers that report the ratio of historically mined gold and silver to be 12 to 1 or even as low as 9 to 1.

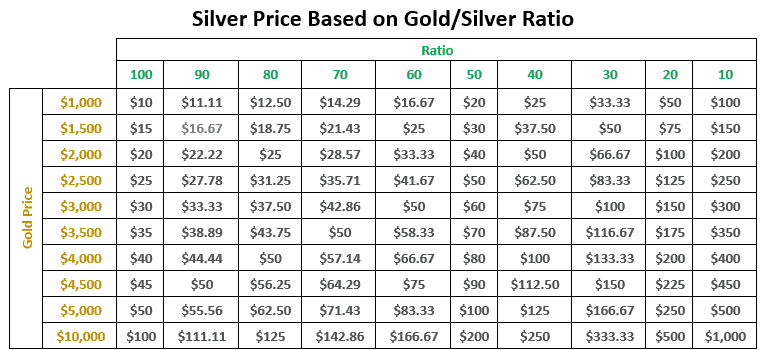

How High Could Silver Rise if the Gold/Silver Ratio Falls?

Below is an excellent table from Jeff Clark at goldsilver.com. It clearly depicts the possible upside in silver if the gold silver ratio heads lower from here.

What to Do?

As we’ve said many times, when people ask gold or silver, we prefer to say gold and silver.

Own some of both as each metal performs differently under different circumstances.

But right now the ratio continues to say that silver may be a better buy than gold. So there is a good argument for heavily skewing any purchases in favour of silver.

What Percentage of Silver Versus Gold Should I Own?

Maybe a minimum of 25% in silver or even up to 50% compared to gold, given the current high gold to silver ratio. You can buy silver here.

But when silver moves, it moves fast. So it’s better to be months early than days too late. So even if the ratio were to go higher, we think a major move higher for silver is only a matter of time.

What do you think? Show us you’re alive and leave a comment below!

To learn more about when to buy gold or silver check out this article: When to Buy Gold or Silver: The Ultimate Guide

Editors Note: This article was originally published 18 September 2018. Last updated 21 November 2023 with new charts and commentary.

Gold Silver Ratio FAQs:

A: The gold silver ratio is the number of ounces of silver it takes to buy one ounce of gold. It is calculated by dividing the gold price by the silver price. For example, if the gold price is US$1986.39 and the silver price is US$23.66, the gold silver ratio is 84.

A: The gold silver ratio can help us determine whether gold or silver is undervalued or overvalued compared to each other. A higher ratio means that silver is cheaper than gold, and a lower ratio means that silver is more expensive than gold. Historically, the ratio has ranged from 15 to 100, with an average of around 50.

A: The gold silver ratio can be used as a trading strategy to take advantage of the price fluctuations of gold and silver. The basic idea is to buy silver when the ratio is high, and sell silver and buy gold when the ratio is low. For example, if the ratio is 90, you could buy 90 ounces of silver with one ounce of gold. If the ratio drops to 45, you could sell your 90 ounces of silver and buy two ounces of gold. This way, you would increase your gold holdings by one ounce without spending any money.

I agree that the ratio is too high but don’t know how to take advantage of this except by buying more silver than gold. Is selling gold futures and buying silver futures a safe way of achieving the same thing…how about margin calls, commission rates etc…I don’t know much about futures trading

Regards

Paul

I too believe that silver is lagging gold but sometime in the next couple of years there will be a catch up period. The maths is simple…if gold rises from is current $1250 USD to say $2000 USD with a current GSR of 83 (60% increase) then a drop in the GSR to say 60 would see the silver spot go from its current $15.15 USD to $33.33 USD (120% increase).

In my view, a 33% gold vs 66% silver investment ratio is a safe approach rather than putting all the eggs in the silver basket.

Can’t argue with that theory Stuart. Silver does seem to have plenty of upside from here. And yes indeed best not to have all eggs in one basket.

Thanks for commenting Paul. We prefer the method of buying more silver than gold too at times like this. From a trading perspective then yes buying futures or even Exchange Traded Funds (ETF’s) could be profitable on a more short term horizon. But yes you’d need to take commissions into account and only “play” with what you can afford to lose as silver can be volatile for sure!.

Pingback: Gold to Silver Ratio Update for 2017: Time to Buy Silver Again - Gold Survival Guide

Pingback: Silver’s Relationship to Interest Rates + How High Might it Go?

Pingback: What to Make of Legal Tender (Face Value) Gold and Silver Coins? - Gold Survival Guide

Pingback: Gold & Silver in NZ Dollars: 2016 in Review & Our Guess For 2017 - Gold Survival Guide

Pingback: Could Silver Be Worth More Than Gold? - Gold Survival Guide

Pingback: The Gold-Silver Ratio – Another Look

Pingback: Is Silver a Better Value than Gold Right Now? - Gold Survival Guide

Pingback: Interesting Historical Comparisons in the Valuation of Silver

Pingback: Have We Seen the Bottom for Silver in NZD?

Pingback: NZD Silver Bottom is Here - Technical and Sentiment Analysis - Gold Survival Guide

Pingback: Gold and Silver ChartFest - Update for 2016 - Gold Survival Guide

Pingback: NZD Gold and Silver Update: Is the Bottom in this Time?

Pingback: Ronald Stoeferle: 2016 Will Be a Good Year For Gold Investors

Pingback: Gold to Silver Ratio: What Can We Expect Now After QE3?

Pingback: Gold Silver Ratio: Silver Ready to Rise Versus Gold?

Pingback: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver - Gold Survival Guide

Pingback: Why Buy Silver? Here's 21 Reasons to Buy Silver Now

Pingback: Buy Silver in New Zealand

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated) - Gold Survival Guide

Pingback: Gold Ratios Update: Dow/Gold, NZ Housing to Gold, & Gold/Silver Ratio - Jan 2019 - Gold Survival Guide

Pingback: Why Buffett is (Still) Wrong About Gold - But How He Loves Silver - Gold Survival Guide

Pingback: Gold in NZ Dollars Hits New 6 Year Record High - Gold Survival Guide

Pingback: NZD Gold Above $2000 - Should You Buy the Breakout? - Gold Survival Guide

Pingback: Reader Comment on Property versus Gold - Has Gold Really Performed That Well? - Gold Survival Guide

Pingback: How to Swap Gold for Silver - Taking Advantage of the Record High Gold Silver Ratio - Gold Survival Guide

Pingback: Bank Economists Change Their Tune - Again - Gold Survival Guide

Pingback: Learn how to Put money into a Recession the Proper Approach – FinanceDay

Pingback: RBNZ Joins the Fed in the Race to The Bottom! - Gold Survival Guide

Pingback: Update on Bullion in New Zealand Post Lock Down - Gold Survival Guide

Pingback: Is it Too Late to Buy Gold? [Video] - Gold Survival Guide

Pingback: Silver Plunges 8% Overnight But Still Up 5% on a Week Ago - Gold Survival Guide

Pingback: International Reaction to Russian Invasion to Speed Up the End of the US Dollar Reserve Currency System? - Gold Survival Guide

Pingback: The Queens Death and N.Z. Currency - Gold Survival Guide

Pingback: What Price Could Silver Reach? - Gold Survival Guide

Pingback: Higher Interest Bill = Bank Reserves Becoming More Imperiled - Gold Survival Guide