After last week’s flash crash in gold and silver, we pointed out that this wasn’t the first time we have seen what is likely to be manipulation of gold and silver. See: Deja Vu – Precious Metals Smashed Lower… Again

Table of Contents

- Latest Precious Metals Manipulation Charges

- “Spoofing” Proven to Be Widespread

- A Deluge of Information on Gold and Silver Manipulation

- A Visual Representation of Manipulation in Precious Metals Markets

- Are the Regulators Serious about Ending Gold and Silver Manipulation?

- Not All Silver Price Rigging is Illegal

Estimated reading time: 8 minutes

Latest Precious Metals Manipulation Charges

Manipulation has been proven in a court of law on more than one occasion. With the latest trial taking place just last month. Two former precious-metals traders for Bank of America Corp.’s Merrill Lynch unit are on trial for “spoofing” precious metals lower.

Chat logs produced as evidence show one of the accused, Edward Bases, bragging about how easy it was to manipulate gold prices:

On Jan. 28, 2009, when Bases was working at Deutsche Bank AG, he put out bids to buy 2,740 gold futures contracts valued around $244 million over the course of four and a half minutes, according to Maria Garibotti, a vice president at Analysis Group who studied exchange and trading data for prosecutors. More than 98% were canceled without being filled, she said.

As prices rose, a fellow Deutsche Bank trader Bases coordinated with sold his 170 contracts valued at $15,172,500, Garibotti told jurors on Wednesday. Her testimony continued Thursday.

“that does show u how easy it is to manipulate it sometimes,” Bases wrote minutes after the trading in a chat message sent to the other Deutsche Bank trader, Cedric Chanu, according to Garibotti. Chanu and another Deutsche Bank trader, James Vorley, were sentenced last month to a year in prison each for their convictions in 2020 on spoofing charges at a separate trial.

Source.

“Spoofing” Proven to Be Widespread

These charges are merely the latest in a long line of gold and silver manipulations recently made public.

Back in September 2020, JPMorgan Chase & Co agreed to pay more than $920 million and admitted to wrongdoing to settle federal U.S. market manipulation probes into its trading of metals futures and Treasury securities.

JPMorgan will pay $436.4 million in fines, $311.7 million in restitution and more than $172 million in disgorgement, the Commodity Futures Trading Commission (CFTC) said on Tuesday, the biggest-ever settlement imposed by the derivatives regulator.

Between 2008 and 2016, JPMorgan engaged in a pattern of manipulation in the precious metals futures and U.S. Treasury futures market, the CFTC said. Traders would place orders on one side of the market which they never intended to execute, to create a false impression of buy or sell interest that would raise or depress prices, according to the settlement.

This manipulative practice, which is designed to create the illusion of demand, or lack thereof, is known as “spoofing.”

Some of the trades were made on JPMorgan’s own account, while on occasions traders manipulated the market to facilitate trades by hedge fund clients, the CFTC said. The bank failed to identify, investigate, and stop the behavior, even after a new surveillance system flagged issues in 2014, the agency said.

Source.

This was just days after J.P. Morgan settled for an undisclosed amount, a private lawsuit by hedge fund manager Daniel Shak and two commodity traders. They accused J.P. Morgan of manipulating the silver futures market, costing plaintiffs $30 million in losses.

While in 2019 three JP Morgan metals traders were charged with precious metals market manipulation, also as a result of spoofing.

Then back in November 2018, a former JP Morgan trader plead guilty to a charge of manipulation of precious metals markets over a period of 7 years.

“John Edmonds, 36, pleaded guilty to one count of commodities fraud and one count of conspiracy to commit wire fraud, price manipulation and spoofing. Edmonds, a 13-year J.P. Morgan veteran, said that he learned how to manipulate prices from more senior traders and that his supervisors at the firm knew of his actions.”

Source.

Much like the latest case, Edmonds also used the method of “spoofing” where trades are placed via high speed computer and then quickly cancelled. This is done solely with a view of affecting the price of a metal. So as to make a gain on the traders own position.

A Deluge of Information on Gold and Silver Manipulation

These latest reports come after a deluge of information on manipulation in the silver and gold markets has been released in recent years.

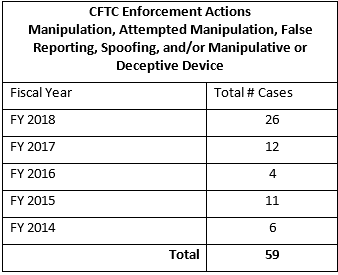

In January 2018, the US CFTC ordered UBS, Deutsche Bank and HSBC to pay millions in a spoofing settlement. The number of enforcement actions by the CFTC increased sharply in 2018:

Source: CFTC

So just as we’ve been saying for the past couple of years, this isn’t likely to be the last we’ll hear of manipulation in the precious metals markets. And JP Morgan may not be the only one to have a civil case taken against them.

A Visual Representation of Manipulation in Precious Metals Markets

If you’ve been involved in the world of precious metals for any length of time it’s highly likely you’ve come across some charts from Nick Laird’s excellent website www.goldchartsrus.com.

In December 2016 screeds of documents were released (350,000 pages!), as part of a settlement by Deutsche Bank in a lawsuit for manipulation in the silver market (i.e. paying a smaller amount to avoid going to trial and paying a much bigger one). Nick Laird did a fantastic job of creating a timeline chart. This timeline shows the price action in silver, highlighting specific acts of collusion by a cabal of banks including Deutsche Bank as outlined in the released documents.

This timeline takes a bit of reading as there are plenty of links to click on. However Mike Maloney did a good job of summarising some parts of it in the video below.

He walks you through the historical silver charts and pinpoints the exact moments bank traders colluded together to rig the markets. The evidence leaves little to doubt. But as you’ll learn, there’s an upside to this manipulation for silver investors who accumulate physical metals.

There can be little doubt now that the likes of the Gold Anti Trust Action Committee (GATA) have been right all along. This latest prosecution is a further vindication for GATA’s tireless (and much maligned) work in proving there is manipulation in gold and silver.

For more of the evidence GATA have gathered over the years, see the speech that Chris Powell gave a few years ago here in Auckland. He clearly outlines many of the documents that show banks and central banks plainly intervene in the precious metals markets.

See: Chris Powell in Auckland: Gold price suppression – why, how, and how long?

Or for GATA’s latest summary of manipulation see: Update on Gold Market Manipulation

Are the Regulators Serious about Ending Gold and Silver Manipulation?

Do all these charges show that the authorities may finally be waking up to how deep seated this manipulation has been?

Are the regulators serious about cleaning up the markets? Or is this just a case of appearing to do the right thing?

It’s hard to say. But so far we haven’t seen anyone further up the food chain at JPMorgan get indicted. The likes of CEO Jamie Dimon or former head of Global Commodities, Blythe Masters have not been charged. The banks all say these are the actions of “individuals” and how they have invested “considerable resources” in boosting their internal compliance policies, surveillance systems and training programs.

Not All Silver Price Rigging is Illegal

But it’s also important to note, as Bix Weir does, that not all price rigging in silver is illegal:

“Although the price rigging of silver is MOSTLY illegal, it is not ALL illegal. It is illegal for the bullion banks to rig the silver market without approval from the US Treasury but it is NOT illegal to rig the silver market when you are instructed to by the US Government.

The US Treasury has the right and the DUTY to rig the silver market under the power of the Gold Reserve Act of 1934 which legalized the Exchange Stabilization Fund which is used to “influence markets.” This fund is controlled by the President’s Working Group on Financial Markets which answers directly to the President. The Working Group consists of the Head of the Treasury, the Head of the Fed, the Head of the SEC and the Head of the CFTC…oops.

So don’t ask WHY the CFTC is not opening up a new silver market rigging investigation after seeing all this proof of the rigging. They have already closed 3 separate silver inquiries and found NOTHING.

Of course they found nothing…they are part of the rigging mechanism!

Yes, it’s all a CON but it is also ENDING as the Bad Guys are being removed from power.

If the current price of silver has got you frustrated and you KNOW that they have been suppressing the price for decades if not centuries… ask yourself what the price of silver will have to do to become “freely traded” once again?

If you are thinking $1,000’s of dollar per ounce you are most likely correct…at least while as the price unwinds decades of manipulation.

So take heart all you frustrated Silver Bugs…our day in the sun will come very soon.”

Yes indeed silver holders have been frustrated in recent years. But as was shown by the London Gold Pool in the 1960’s manipulation cannot last forever. When it finally ends silver and gold are likely to be priced much higher than they are currently.

But even if silver doesn’t reach the lofty heights Bix Weir mentions above, there is certainly plenty of upside ahead. See what silver products are available: Buy Silver.

Read more: If Precious Metals Prices Are Manipulated, Why Does the Price Rise at All?

Editors Note: This post was originally published 15 December 2016. Last update 17 August 2021 with latest charges to Bank of America Corp.’s Merrill Lynch traders.

Pingback: Can Silver Rise When JP Morgan Controls So Much Physical and Paper Silver? - Gold Survival Guide

Pingback: Buying Precious Metals: Common Questions from First Time Buyers

Pingback: If Gold and Silver Are Manipulated, Why Bother Investing? - Gold Survival Guide

Pingback: Gold Prices Moving in Tandem with Negative Yielding Debt - Gold Survival Guide

Pingback: Paper Gold vs Physical Gold - What Should You Buy? - Gold Survival Guide

Pingback: What is the Gold Silver Ratio? What is the Ratio Telling Us Now?

Pingback: What Do These Recent Large Purchases of Gold Around the Globe Signify? - Gold Survival Guide

Pingback: Gold and Silver Technical Analysis in 2024: The Ultimate Beginners Guide - Gold Survival Guide