The team at GATA (Gold Anti-Trust Action Committee) continue to work hard to expose the ongoing intervention in the gold and silver markets by central banks and governments globally. We featured a presentation from their Chairman Bill Murphy earlier this year. The GATA secretary Chris Powell also visited New Zealand a few years ago and we featured his presentation following this visit too. (See: Chris Powell in Auckland: Gold price suppression – why, how, and how long?)

Now Chris Powell is back with an updated presentation from the recent Mines and Money conference in London. But this time with the benefit of actually showing slides of just some of the evidence that GATA has gathering supporting their conclusion that the gold markets are heavily manipulated…

Chris Powell: London Update on Gold Market Manipulation

Remarks by Chris Powell

Secretary/Treasurer, Gold Anti-Trust Action Committee Inc.

Mines and Money London

Business Design Center, London

Wednesday, November 29, 2017

First Published at Gata.org

* * *

SLIDE 1

All you really need to know about gold could have been surmised from a story on the front page of The Wall Street Journal on August 10:

http://www.gata.org/node/17562

SLIDE 2

In that story the newspaper quoted four experts on the gold market, all of them associates of the Gold Anti-Trust Action Committee and all of them introduced to the newspaper’s reporter by me.

SLIDE 3

Those four experts — gold researcher Ronan Manly, Sprott Asset Management’s John Embry, GoldMoney founder James Turk, and futures market analyst James McShirley — accused the Federal Reserve of being involved with the suppression of the gold price through the surreptitious lending and swapping of central bank gold reserves.

The Wall Street Journal story was a triumph for GATA, even though the Journal declined to mention GATA by name. (The reporter told GATA Chairman Bill Murphy that the newspaper just ran out of space.)

But the story would have been a much greater triumph for us – indeed, it would have been a triumph for free markets — if the newspaper had not decided, in reporting these complaints about surreptitious government intervention in the gold market, to violate the first rule of journalism. That’s the rule about getting both sides of a story.

The Journal reported: “Some gold bugs — investors bullish on the yellow metal — think the Fed secretly lends it out to suppress prices, partly to protect the dollar’s value. In theory, the Fed can feed gold into the market through swaps with other countries.”

So where were the Journal’s questions about this for the Fed and the Treasury Department? Are the Fed and the Treasury Department involved in keeping the gold price down through surreptitious interventions, or are they not involved?

But the Journal never asked such questions, even though for a year and a half, as I provided the Journal’s reporter with the documents of these interventions, I repeatedly pressed her to put the questions to the Fed and Treasury Department. I even provided the Journal’s reporter with a video showing New York Federal Reserve Bank President William Dudley refusing to answer a question about gold swaps during his appearance at the Virginia Military Institute on March 31, 2016:

http://www.gata.org/node/16341

https://www.youtube.com/watch?v=p0JYoJ_rKxQ

Ordinarily news organizations are most interested in questions that high government officials refuse to answer. But mainstream financial news reporters are not interested in questions about secret government intervention in the gold market and secret interventions in markets generally. No, such questions are too sensitive, considered matters of national security.

The best that mainstream financial news organizations can do is just to acknowledge the questions sometimes. Mainstream financial news organizations can never pursue the answers, no matter how easy it would be to do so.

Unfortunately most gold market analysts themselves will not pursue these questions either — at least not yet. GATA will continue working on them.

But market manipulation issues have kept coming close to the surface during the last year.

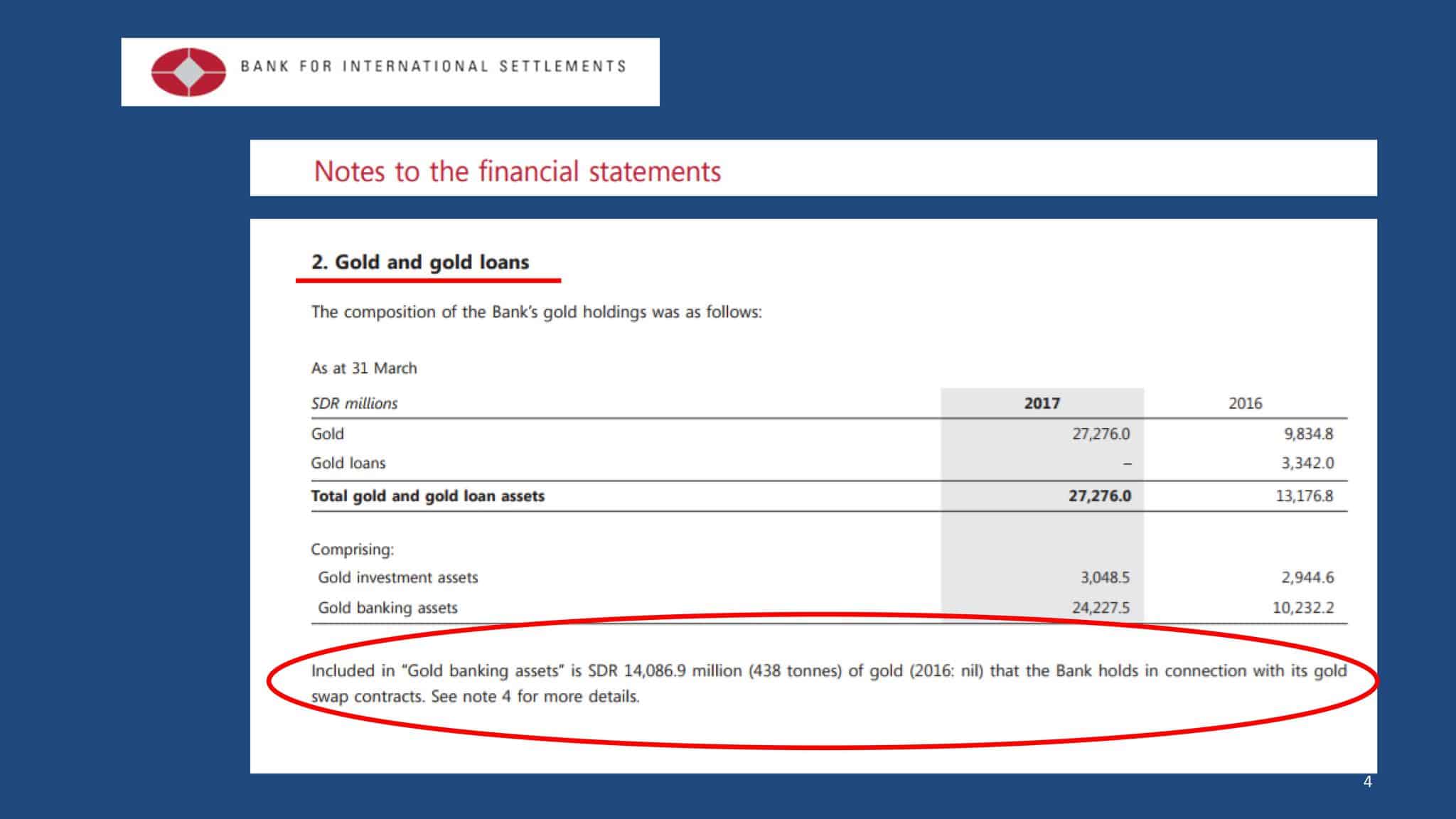

Last month GATA consultant Robert Lambourne, who studies the gold activity of the Bank for International Settlements, reported that gold swaps undertaken by the BIS have exploded from zero a year and a half ago to about 570 tonnes as of last month:

http://www.gata.org/node/17790

The increase in the BIS’ gold swaps is revealed in the footnotes of the bank’s latest annual report and its statement of account for this October.

This page is taken from the BIS annual report issued in June, covering the year ending March 31. It acknowledges 438 tonnes of gold swaps:

SLIDE 4

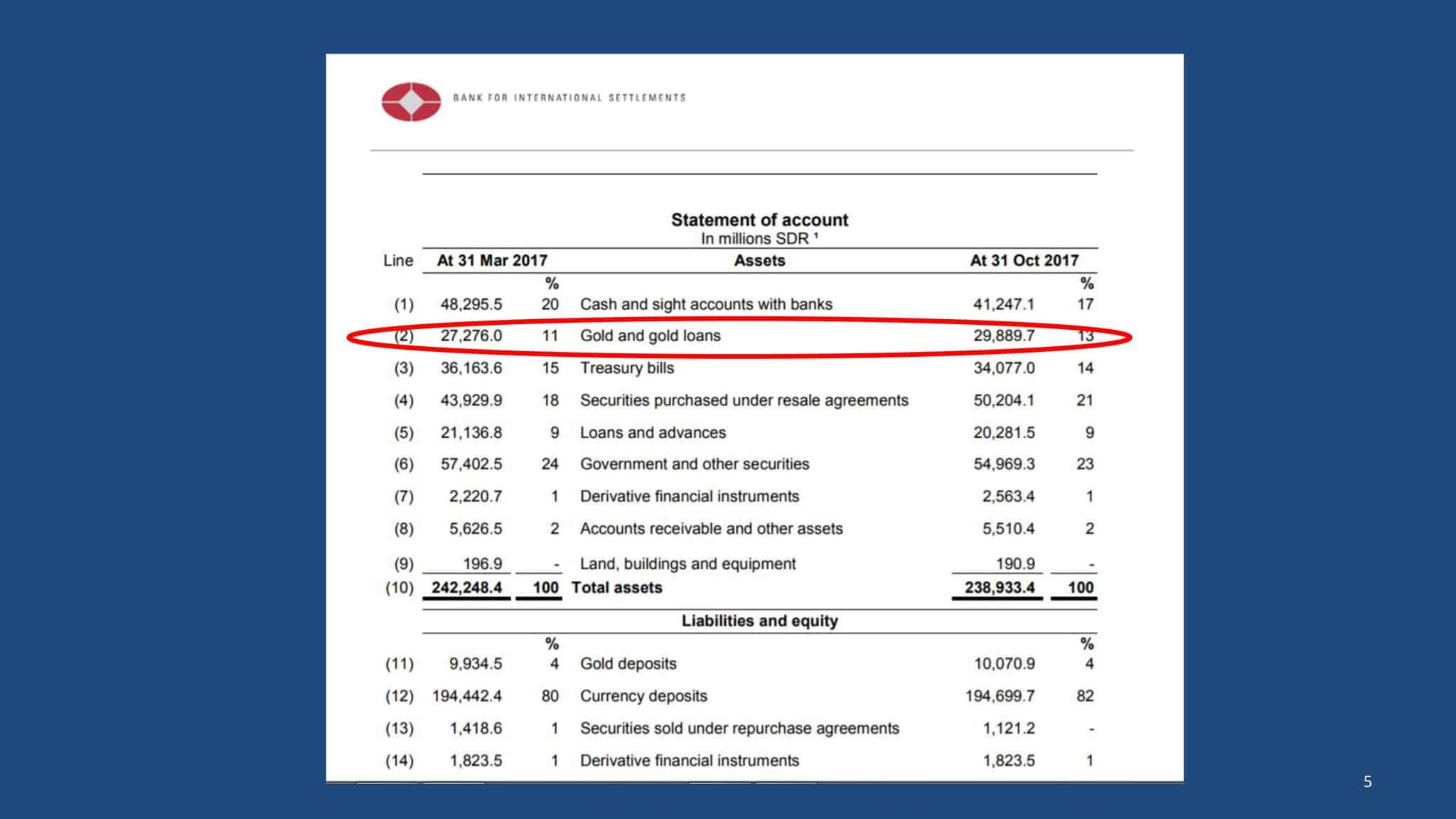

This page, from the BIS’ October statement of account, shows that gold loans have risen substantially since March.

SLIDE 5

Lambourne says there is reason to believe that the swaps undertaken by the BIS in the last year and a half were undertaken just as the gold price showed signs of breaking upward.

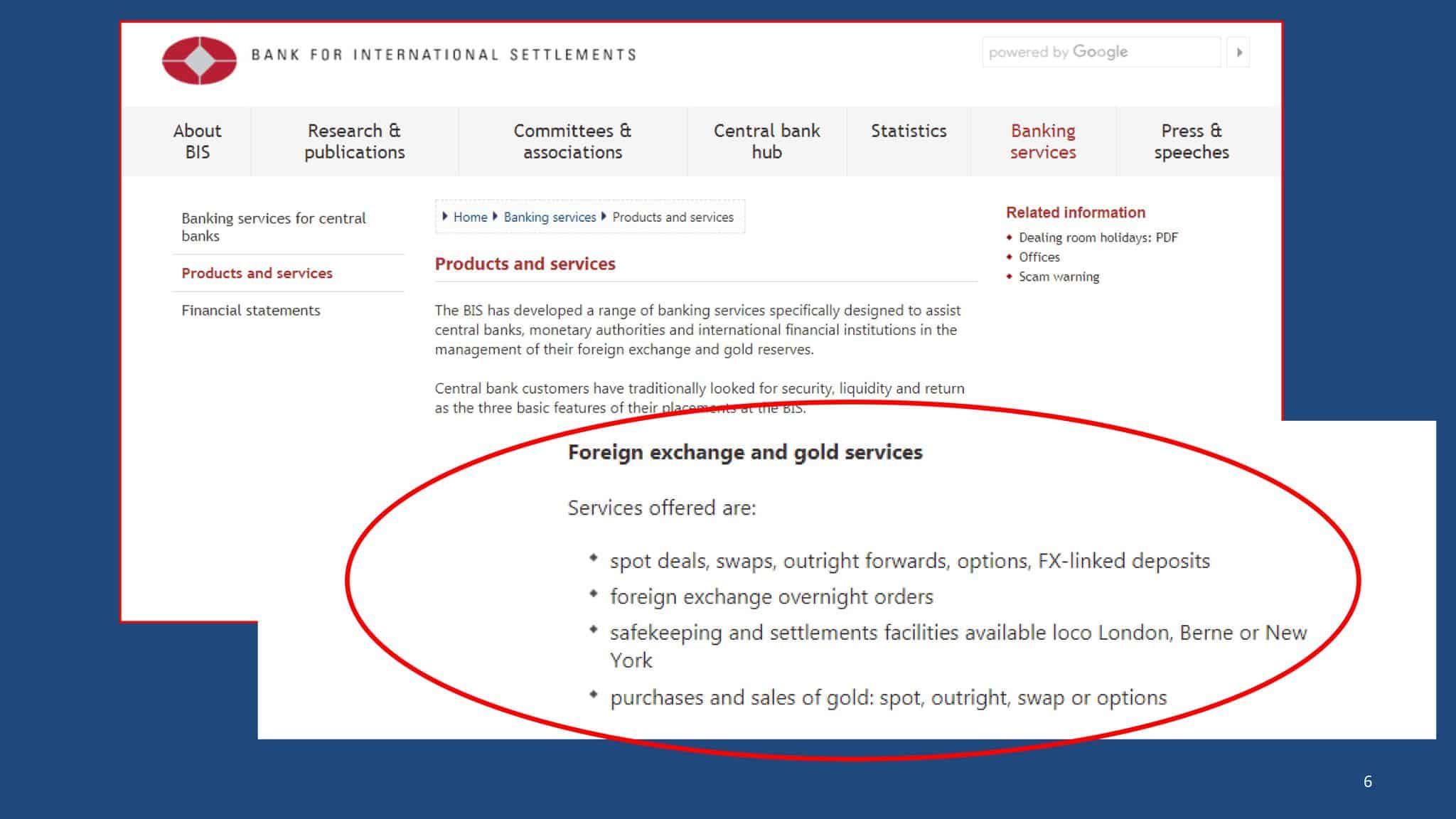

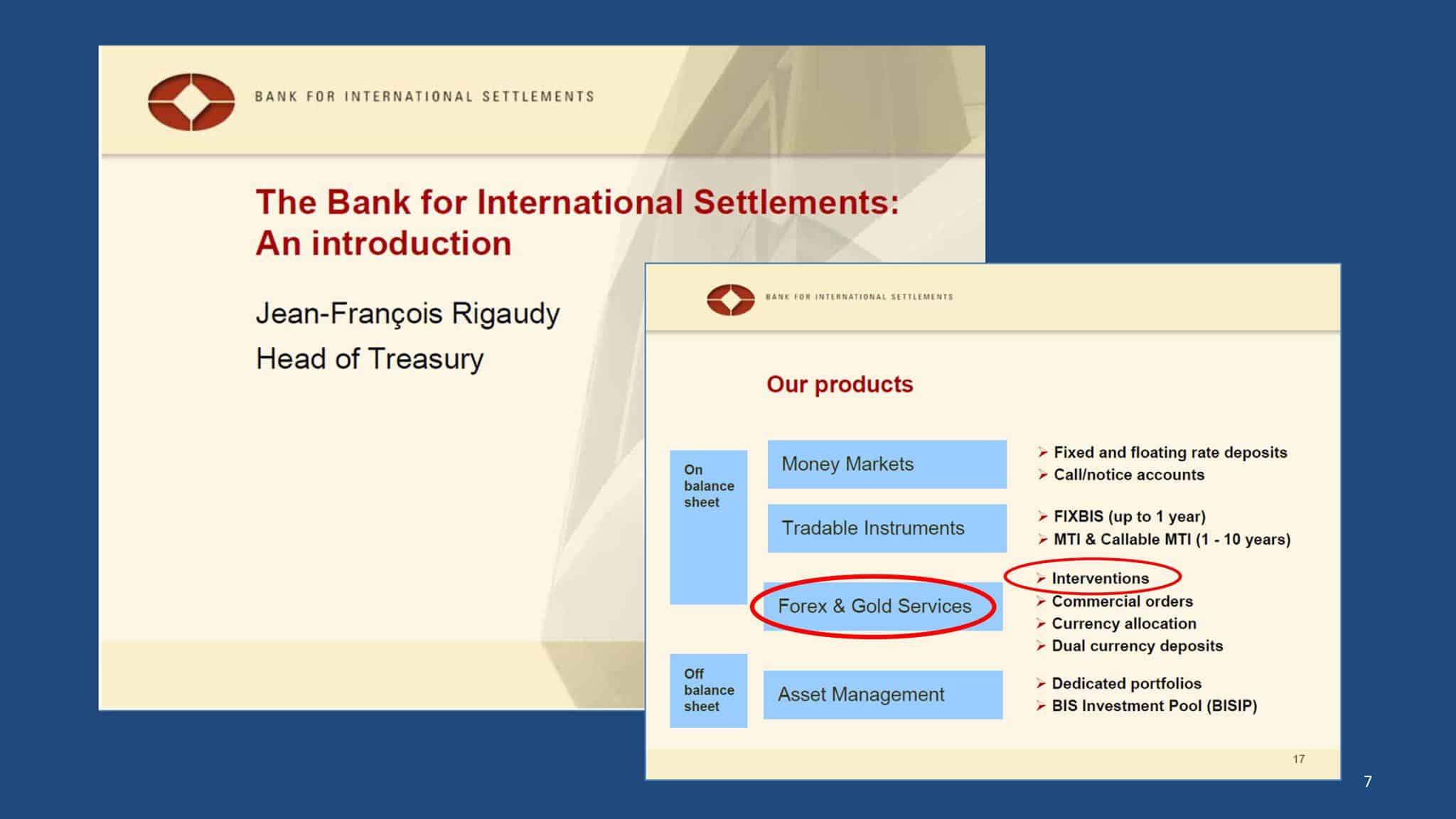

The BIS is the primary gold broker for its central bank members and does all sorts of gold business for them. This business is acknowledged in the bowels of the BIS’ internet site:

http://www.bis.org/banking/finserv.htm

SLIDE 6

Contrary to what some people would have you believe, central bank gold reserves don’t just sit quietly in their vaults all day. They are mobilized every day, often with the help of the BIS, not just through sales and leases but also through issuance of the various kinds of derivatives listed on the screen.

Indeed, when the BIS thinks that only its central bank members and potential members are listening, it even advertises that its services include secret interventions in the gold market.

This advertisement was part of the BIS presentation that was made to potential central bank members during a conference at BIS headquarters in Basel, Switzerland, in June 2008.

http://www.gata.org/node/11012

SLIDE 7

What exactly is the BIS doing in the gold market, for whom is it making its transactions, and what are their objectives?

Two weeks ago I put that question to the bank’s press office. I sent the bank’s press office Lambourne’s analysis of the bank’s gold transactions and asked if he was right or wrong and, if he was wrong, how so. I added: “Could you also please tell me the BIS’ purpose and objectives with these gold swaps and with the bank’s involvement in the gold and gold derivatives markets generally?”

The following day I received a curt and unsigned reply from the bank. The press office wrote: “We do not comment on specific accounts / holdings of central banks or of the BIS. Please see our latest annual report for details on gold. Further information can be gleaned from central banks directly.”

Ironically, on the same day the BIS’ press office told me to drop dead, the bank’s research director, Hyun Song Shin, attended a conference at the European Central Bank in Frankfurt, Germany, giving a speech titled “Can Central Banks Talk Too Much?”:

http://www.gata.org/node/17802

SLIDE 8

Shin told the ECB conference: “If central banks talk more to influence market prices, they should listen less to the signals emanating from those same markets. Otherwise, they could find themselves in an echo chamber of their own making, acting on market signals that are echoes of their own pronouncements.

“On the other hand,” Shin continued, “talking less is hardly a viable option. Central bank actions matter too much for the lives of ordinary people to turn the clock back to an era when silence was golden. Accountability demands that central banks make clear the basis for their actions.”

Accountability in central banking? That’s a laugh, especially in regard to gold.

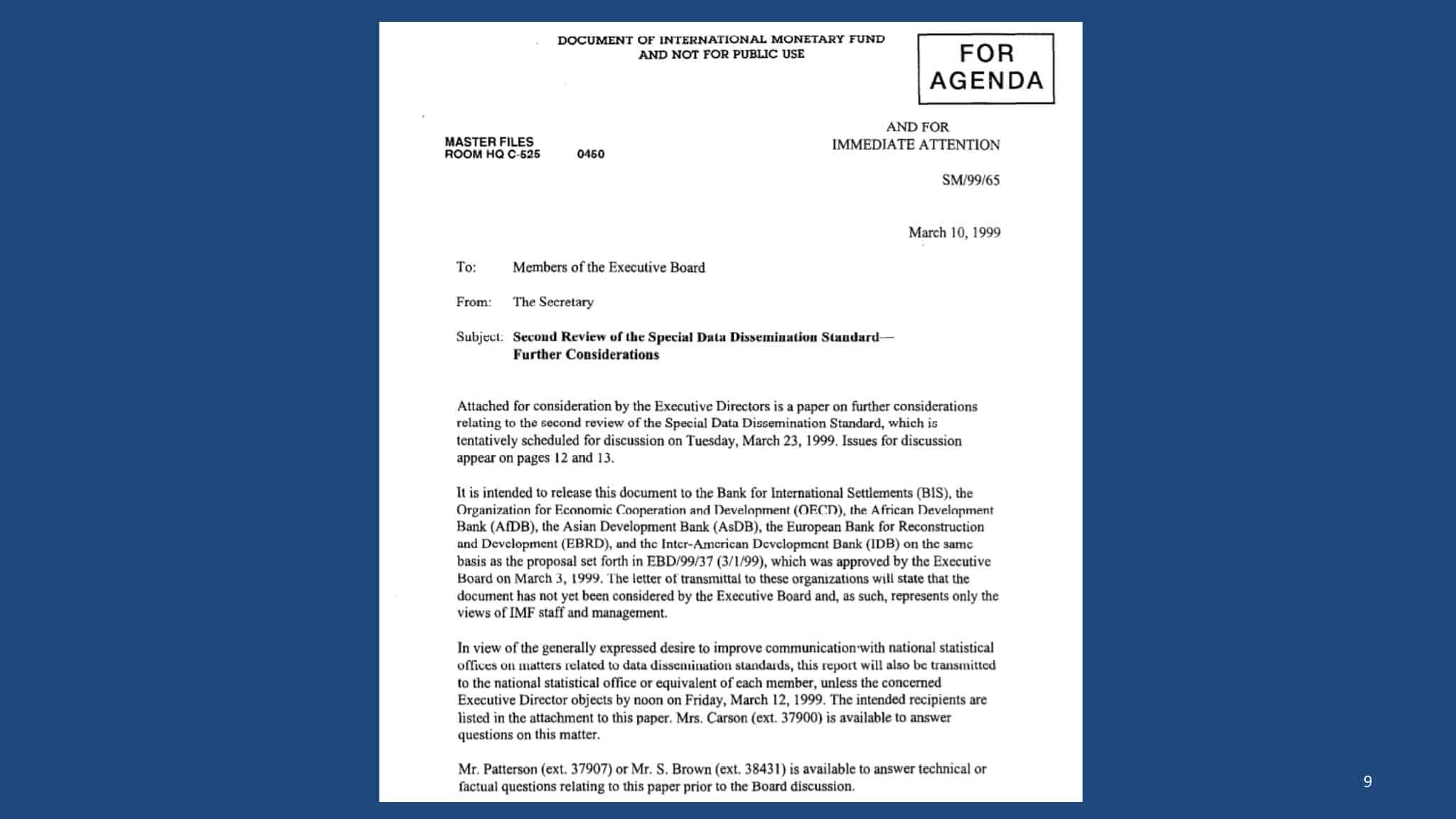

All you need to know about the supposed accountability of central banking is conveyed by the secret March 1999 report of the staff of the International Monetary Fund to the fund’s executive board.

http://www.gata.org/node/12016

SLIDE 9

The report told the board that central banks conceal their gold swaps and leases to facilitate their surreptitious interventions in the gold and currency markets. That is, central banks conceal their gold swaps and leases to defeat accountability.

The BIS is a powerful organization but most of its power comes from the refusal of mainstream financial news organizations and gold market analysts to ask the bank to explain what it does in the gold market and then to report the bank’s refusal to explain.

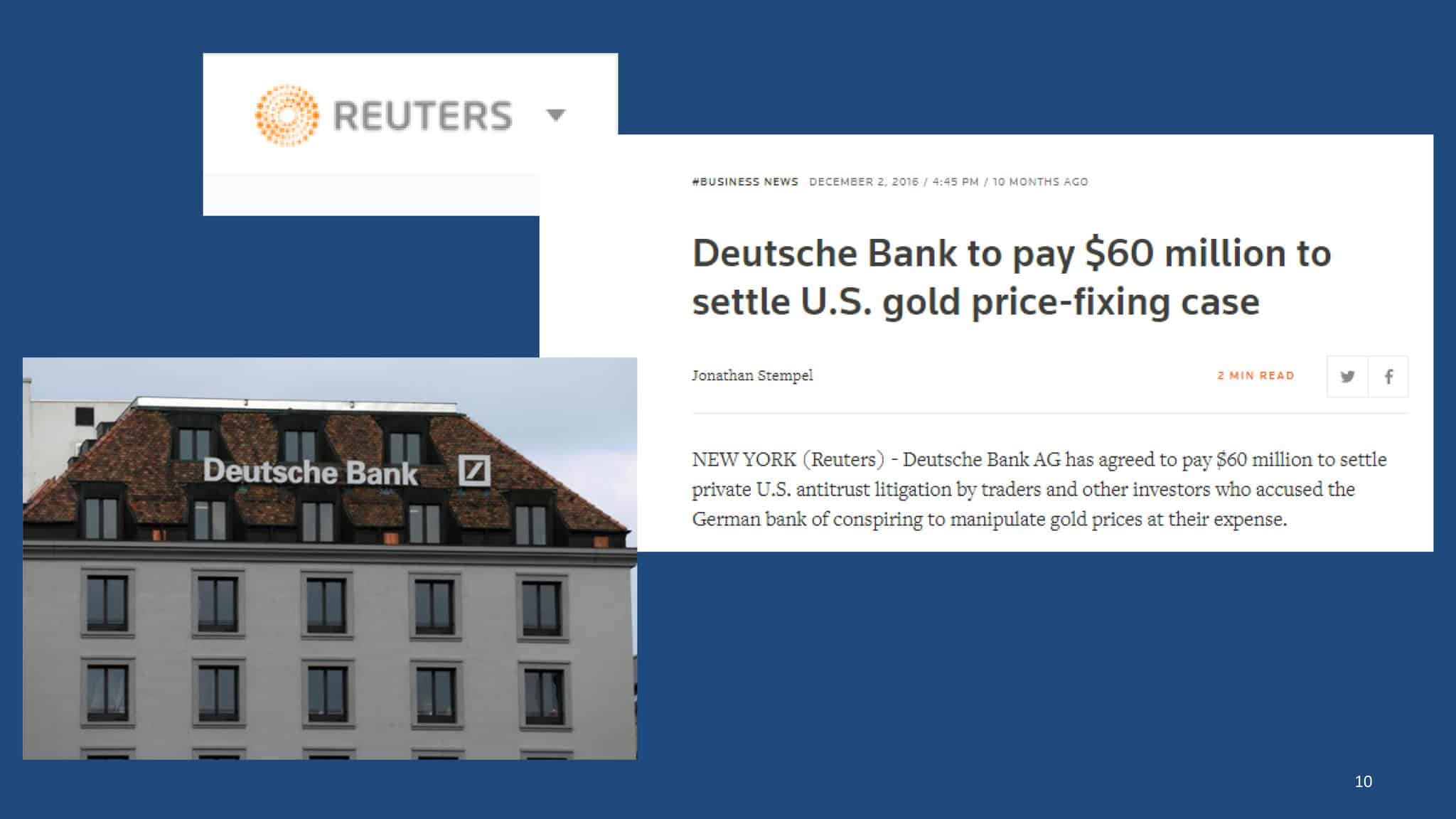

Confirmations of gold and silver market rigging below the central bank level have poured in during the last year.

In December last year Deutsche Bank agreed to pay $60 million to settle a class-action anti-trust lawsuit’s complaints that it had manipulated the gold market. In October last year Deutsche Bank agreed to pay another $38 million to settle a similar complaint that it had manipulated the silver market. Perhaps more importantly, Deutsche Bank agreed to provide the plaintiffs with evidence against the banks it admitted conspiring with:

http://www.gata.org/node/16964

SLIDE 10

Unfortunately the discovery and deposition procedures in the class-action anti-trust lawsuits against Deutsche Bank have been put on hold at the request of the U.S. Justice Department, which purports to be undertaking its own investigation of the bank. More likely the Justice Department is just trying to delay exposure of the U.S. government’s own involvement with the market rigging.

http://www.gata.org/node/17157

In June a former metals trader for Deutsche Bank pleaded guilty in federal court in Chicago to using “spoofing” techniques to manipulate the futures markets for gold, silver, platinum, and palladium. The former trader for Deutsche Bank also admitted front-running customer orders.

http://www.gata.org/node/17407

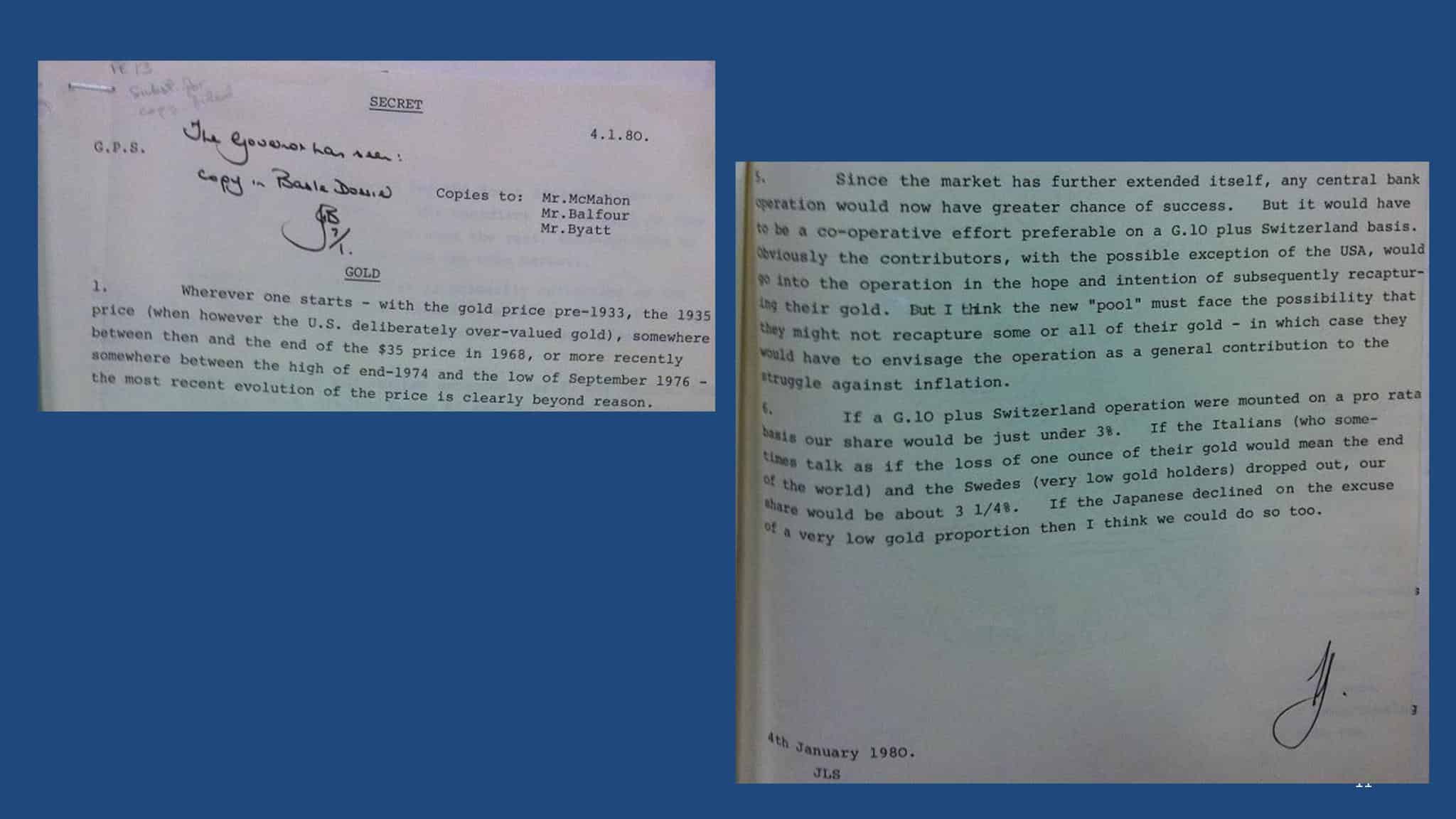

In May gold researcher Ronan Manly, reviewing records at the Bank of England, discovered minutes showing that Western central bankers conspired in the early 1980s to suppress the gold price in exchange for continued cheap oil exports from the Middle East. These Bank of England minutes are confirmation of the long-held belief in gold circles that gold price suppression originates in part from the desire of Middle Eastern oil exporters to be able to exchange their oil for better money than U.S. dollars, money that can’t be devalued so easily:

http://www.gata.org/node/17386

SLIDE 11

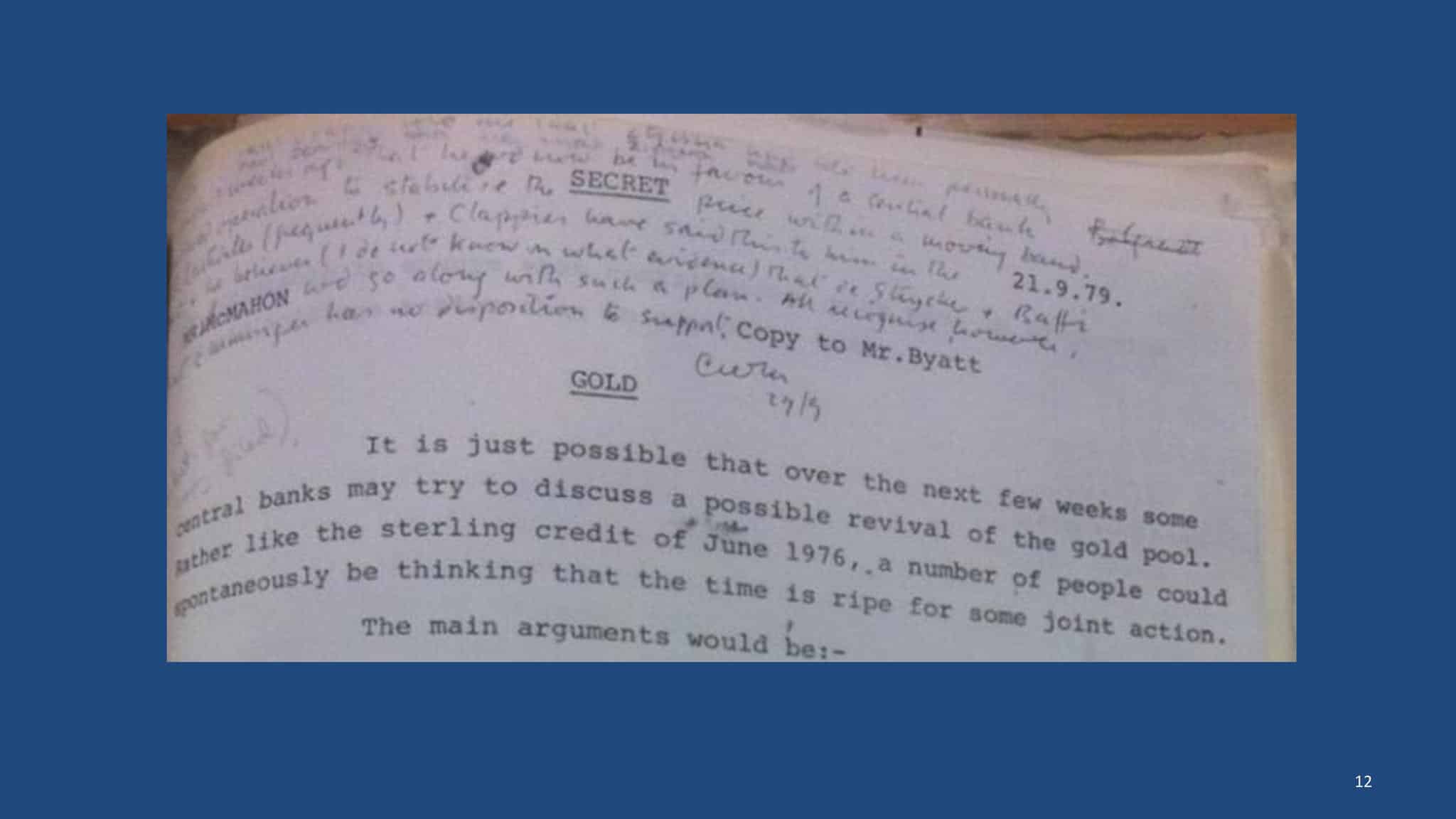

Reviewing those Bank of England records, Manly also discovered that Western central banks conspired in 1979 to create a second London gold pool to control the metal’s price:

http://www.gata.org/node/17372

SLIDE 12

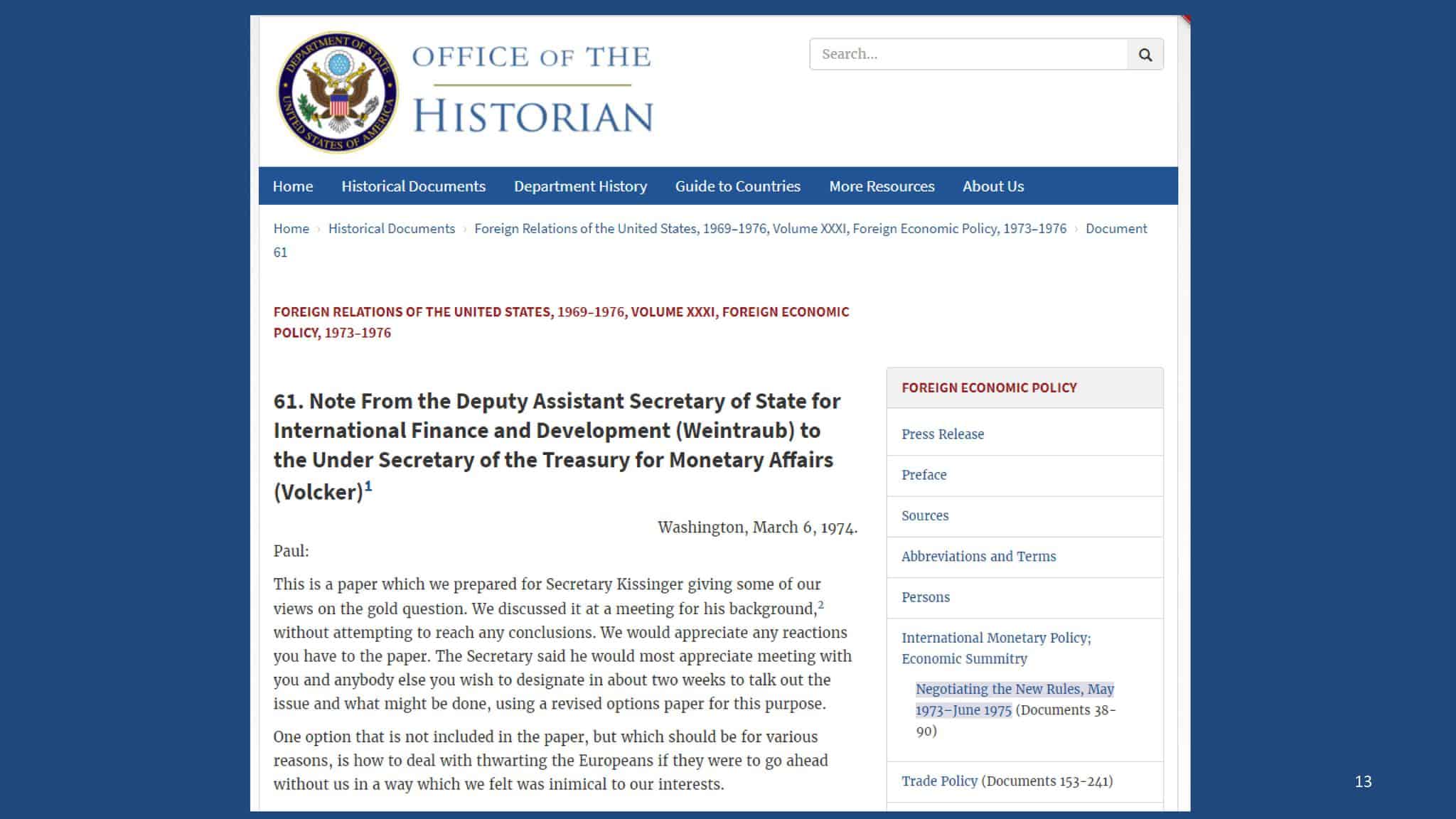

In May GoldMoney Vice President John Butler discovered still another U.S. State Department memorandum detailing U.S. government policy to drive gold out of the world financial system in favor of the U.S. dollar and the Special Drawing Rights issued by the International Monetary Fund, which then was under U.S. government control.

http://www.gata.org/node/17361

SLIDE 13

The memo was written in 1974 by Deputy Assistant Secretary of State Sidney Weintraub for Secretary of State Henry Kissinger and the Treasury Department’s undersecretary for monetary affairs, Paul Volcker, who of course went on to become chairman of the Federal Reserve.

Weintraub wrote: “To encourage and facilitate the eventual demonetization of gold, our position is to keep the present gold price, maintain the present Bretton Woods agreement ban against official gold purchases at above the official price, and encourage the gradual disposition of monetary gold through sales in the private market.”

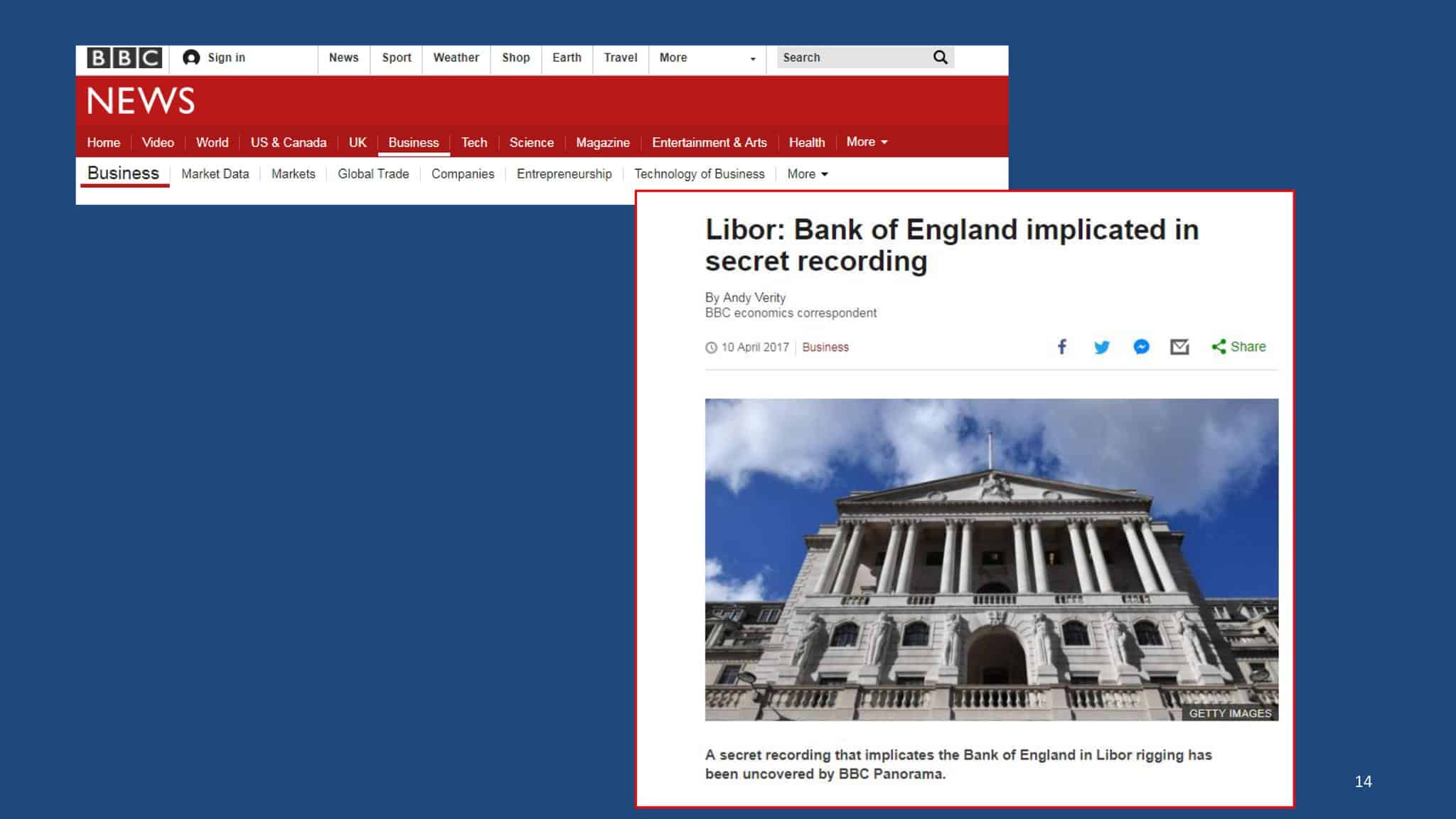

In April the British Broadcasting Co.’s “Panorama” program obtained and broadcast a recording of a conversation between two officials of Barclays bank that implicated the Bank of England in the infamous rigging of the London Interbank Offered Rate, the LIBOR interest rate.

http://www.gata.org/node/17303

SLIDE 14

In the recording a senior Barclays manager, Mark Dearlove, instructs the bank’s LIBOR rate submitter, Peter Johnson, to lower the rates Barclays is submitting.

Dearlove tells Johnson: “We’ve had some very serious pressure from the UK government and the Bank of England about pushing our LIBORs lower.”

Johnson objects, saying that this would mean breaking the rules for setting LIBOR, which required Barclays to submit rates based only on the cost of borrowing cash. Johnson asks: “So I’ll push them below a realistic level of where I think I can get money?”

His boss Dearlove replies: “We’ve got the Bank of England, all sorts of people involved in the whole thing. … I am as reluctant as you are. … These guys have just turned around and said just do it.”

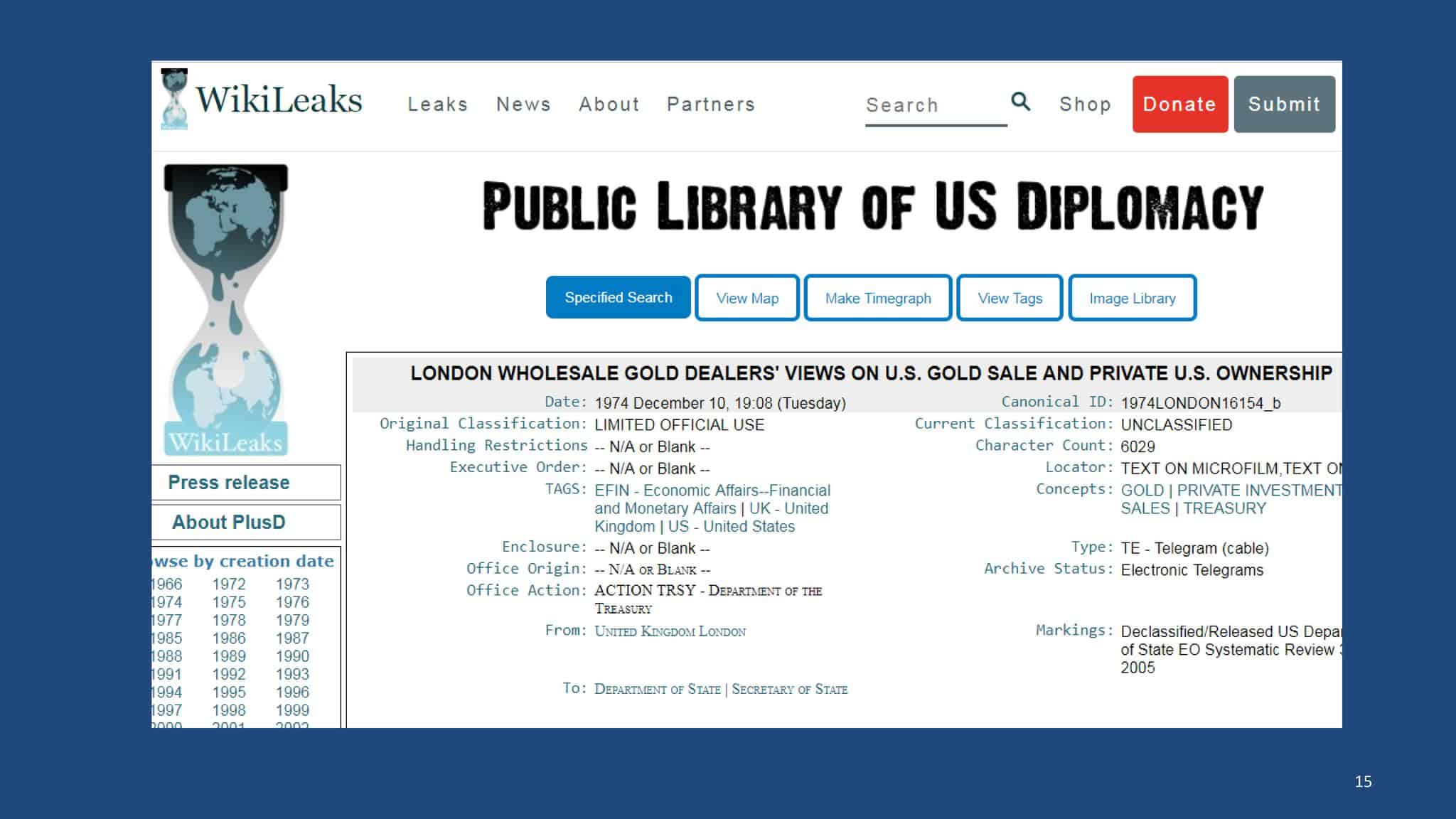

In January the TF Metals Report discovered in the Wikileaks archive of State Department diplomatic cables a cable sent in December 1974 from the U.S. embassy in London to the State Department in Washington. The cable shows that the U.S. government had just gotten assurances from London bullion banks that the imminent creation of a gold futures market in the United States would cause so much volatility in the gold price that ordinary investors would be driven out of gold:

http://www.gata.org/node/17081

SLIDE 15

In GATA’s view there are four crucial questions about the gold price. I urge you to put these questions to those who speak about gold at this conference. I also urge you to put them to the executives of companies that mine the monetary metals.

SLIDE 16

1) Are governments and central banks active in the monetary metals markets or not?

2) Are the documents compiled by GATA from government archives and other official sources asserting such activity genuine or forgeries?

3) If governments and central banks are active in the monetary metals markets, is it just for fun or is it for policy purposes?

SLIDE 17

4) If such activity by governments and central banks is for policy purposes, do those purposes involve the traditional objectives of defeating an independent world currency that competes with government currencies and interferes with government control of interest rates and, indeed, interferes with control of the entire economy and society itself?

In GATA’s view there are good arguments for investing in the monetary metals and the companies that mine them. But investors need to know what they’re getting into, what they’re up against, and what they can do to improve the prospects for their investments and for the restoration of free markets.

Remember, as author and fund manager Jim Rickards said on CNBC a few years ago: “When you own gold you’re fighting every central bank in the world.”

So if we want free and transparent markets and limited and accountable government, we just have to beat the bastards.

The documents and events I have reviewed today are mainly those that have been unearthed or developed during the past year. There is much more documentation of the central bank gold price suppression scheme at GATA’s internet site:

http://www.gata.org/taxonomy/term/21

A good summary of the scheme is posted in “The Basics” section of the GATA site:

http://www.gata.org/node/14839

You can find GATA on the internet at GATA.org, where you can sign up for our daily e-mail dispatches and, if you’re inclined to help us, make contributions that are federally tax-deductible in the United States. We really could use your help. Of course I’ll be glad to hear from you by e-mail at CPowell@GATA.org.

SLIDE 18

Thanks for your kind attention.

Pingback: Further Details on Silver Manipulation Exposed - Gold Survival Guide

Pingback: Can Silver Rise When JP Morgan Controls So Much Physical and Paper Silver? - Gold Survival Guide