A question in this week from Pat asking can silver rise when JP Morgan controls so much physical and paper silver and manipulates the silver price?

“I’ve been doing a bit of research, trying to decide whether or not I’d like to buy silver bullion and I’ve come across a fair amount of information (from Ted Butler and others) which details the market manipulation tactics of JP Morgan. My amateurish understanding is that although they own a LOT of physical silver they are heavily invested in a ‘paper short’ position on the COMEX futures market, and as such they cannot allow a proper price rally to occur, which is why it hasn’t. Given the Gold/Silver ratio is sitting quite high, and consistently so, there is a lot of upside implied for Silver. However, my question for you is: can it happen under these circumstances? My thinking is that JP Morgan being deeply invested in a short position and having the ability to flood the market with physical silver will insure that the price remains depressed.

Love the site and all the great information!”

Ted Butler on JP Morgan’s Silver Position

Firstly in case you’re unaware of JP Morgan’s silver market position, here it is laid out from Ted Butler:

In the annals of silver in the modern age, there have been two well-known instances of very large investor accumulations of the metal. First came the purchase by the Hunt Brothers and their associates in early 1980, followed by the purchase by Warren Buffett’s Berkshire Hathaway, 17 years later. The Hunts were said to control around 100 million ounces of actual metal (plus another 100 million ounces in long paper futures contracts), while Berkshire held as many as 129 million ounces.

Now there is compelling evidence of a third great investment accumulation of physical silver by none other than JPMorgan, one of the most powerful and connected banks in the world. This accumulation can be dated from the price peak of April 2011, after silver began what is now a near seven-year price decline. From zero in April 2011, the amount of silver in the JPMorgan COMEX warehouse has increased to 120 million ounces.

Read more: The Last Great Silver Buy

As it happens we recently wrote about both the Hunt Brothers and Warren Buffett’s past silver positions. So for more on those topics see:

Why Buffett is (Still) Wrong About Gold – But How He Loves Silver

and:

What Today’s Silver Buyer Can Learn From the Real Hunt Brothers Silver Story

A Bit More History on Silver (and Gold) Manipulation

The silver (and gold) manipulation is quite a rabbit hole if you choose to go down it. We’ve posted plenty on this over the years.

But if you need a bit more background then the following summary will save you some time:

Further Details on Silver Manipulation Exposed

And for a full run down from Gold Anti Trust Action committee see: Update on Gold Market Manipulation

Now Back to Pat’s Question: Can Silver Rise if it is Manipulated?

The manipulation of silver (and gold) was discussed much further back than 2011 (when the JP Morgan accumulation is asserted to have begun).

The Gold Anti-Trust Action Committee (GATA) was formed in 1998 to “expose, oppose, and litigate against collusion to control the price and supply of gold and related financial instruments.”

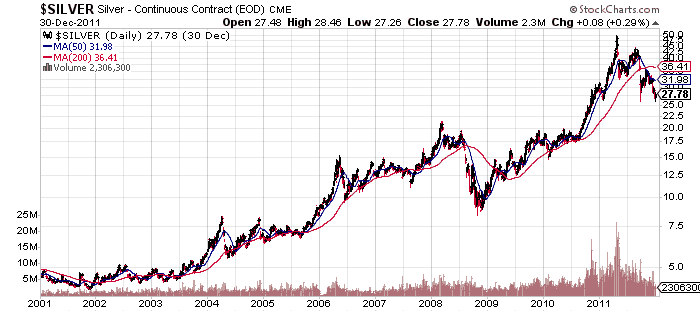

Despite this manipulation, silver still managed to rise quite considerably from 2002 to 2011.

As we said late last year:

“Yes indeed silver holders have been frustrated of late. But as was shown by the London Gold Pool in the 1960’s manipulation cannot last forever. When it finally ends silver and gold are likely to be priced much higher than they are currently.”

Source: Further Details on Silver Manipulation Exposed

When Silver Might Rise

But we’re not the only ones. Gary Christenson commented a year ago:

“Silver prices bottomed in December 2015 at $13.61, again in December 2016 at $15.65, and last December at $15.60.

A typical rally, if similar to the above nine rallies (green lines) since 1972, would push silver prices to about $60 in two to three years, say 2020, with wide time and price variation possible.

Objections to this Scenario

1. All-time highs seem distant. However, the silver price in 2009 was under $13, and yet prices touched $48 in 2011. In a few years $50 to $100 is likely.

2. All the speculative froth has gone into Bitcoin and other cryptocurrencies. The silver market is dead. Not a chance! Modern life, medicine, and technology depend upon silver. Can you say the same for Bitcoin?

3. Central bankers, the government, the COMEX, and JPMorgan will never allow silver to rise to all-time highs again. Nonsense! Central bankers will weaken the dollar to minimize the coming recession, governments will obsess over larger issues, COMEX will become less relevant as physical silver markets overwhelm paper markets, and JPMorgan would love to see their half billion ounces of silver bullion (per Ted Butler) rise in price. Yes, much higher prices are not only possible, but likely.

4. Silver at $50 is too big a move. Not true! Consider Apple stock in 2009 at $10.01. Today $170. Amazon stock in 2008 at $35.00. Today $1,450. Bitcoin in January 2017 $800.00. It peaked near $20,000 in December of 2017. The world changes, but silver is necessary, more expensive to mine, and critical for high-tech, medical uses, and future power generation. Dollars will disappear long before silver is forgotten.”

Source: Silver: 2018 and Beyond

What Could Force Silver Higher?

Chris Marcus at Miles Franklin wrote on this topic in early 2018 also:

“Of course if the manipulation assumption is indeed correct, there’s also a chance that the price gaps substantially higher. Some analysts have suggested that we could have some sort of Sunday night announcement with a price reset. Similar to how Richard Nixon popped up in the middle of an episode of Bonanza in 1971 to inform the world that he was taking the U.S. off the gold standard and implementing price controls.

Another school of thought is that we could see what’s known as a “force majeure” on the Comex. Where you get settled in cash at the current price, only to see the actual metal price then trade substantially higher. Which again would mean there would be no “last chance” to get in at the lower price.

This is why you hear so many analysts talk about purchasing and stacking metals on a regular basis. While avoiding trying to outsmart the market. Is it fun waking up so often and seeing the price smashed down just when you were getting your hopes up again? Of course not.

But for those who have seen the movie The Big Short (highly recommended by the way), It serves as a great reminder of the value of patience in investing.

…Either way, it’s a great metaphor for the situation in precious metals. Where there is an abundance of evidence to suggest that prices almost necessarily have to move higher at some point. Fortunately, as long as you invest within your means and allow the element of time to be on your side, you can remove a lot of the emotion by keeping an eye on the fundamentals and remembering that all manipulations eventually do end.

Just as this one will some day too. And when that does finally happen, I believe you will be well rewarded for all of your patience and perseverance.”

Source: If Gold and Silver Are Manipulated, Why Bother Investing?

Silver Has to Rise Eventually

And even Ted Butler thinks an upside price rise is inevitable:

“That JPMorgan has accumulated at least 675 million ounces of silver appears clear to me. More to the point is what JPMorgan intends to do with its epic physical silver holdings. The bank has maintained its death-grip on lower silver prices for so long it feels like it will do so forever.

However, I remain convinced that JPMorgan has the same intent as did the two previous great physical accumulators of investment silver, the Hunt Bros. and Warren Buffet. That intent is to sell at as large a profit as possible. No one buys any investment asset with the intention of losing money, least of all JPMorgan. They didn’t spend the last seven years accumulating physical silver to sell that silver at anything but the highest price possible. I can’t tell you when JPM will let the price of silver fly, but I am certain that that day is coming. And considering the means and deception with which it has accumulated the physical silver it holds, watching JPMorgan distribute its holdings at the highest prices it can attain will be one for the history books. That’s what these guys do for a living.”

Source: The Last Great Silver Buy

So is There Manipulation or Price Management in Silver (and Gold) Markets?

The evidence confirms manipulation exists (see the posts listed above). The only question is to what extent this occurs.

There is no way of knowing just how much impact this manipulation has had upon the silver price.

Perhaps JP Morgan is currently holding down the silver price through their massive short position in the futures market?

At fist glance this might appear to be the case…

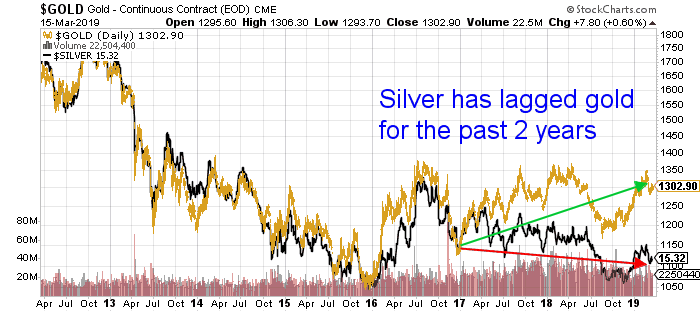

The gold price has been quietly rising the past couple of years. While silver has actually headed slightly lower.

However this underperformance of silver is not necessarily simply due to a JP Morgan manipulation.

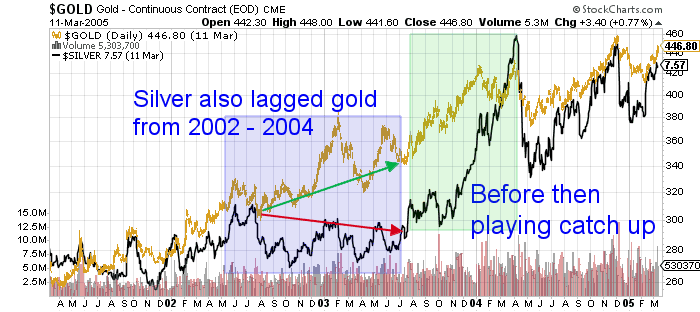

Silver more often than not lags gold. Particularly early in a bull market. We saw this very same occurence from 2002 to 2004.

Silver actually fell during this period while gold rose. But then silver played some serious catch up straight after this. A similar thing also occurred after 2009.

When Will the Upside in Silver Arrive?

Our guess is that silver is just lagging like it has done previously. Silver is not dead.

Any current manipulation impacting silver will not last forever.

Previously silver has lagged gold for a couple of years and then played some serious catch up. If these past episodes are any guide, we could be nearing the end of this period of under performance for silver.

The difficulty is that when silver rises it can happen very fast.

Being “clever” and trying to time your entry when silver has broken out could be very difficult to do.

Instead our strategy is simply to get on board at what are historically depressed levels for silver, then forget about it for a while.

Head over to our shop to see what silver is currently available to buy.

Read more on silver: Why Buy Silver? Here’s 21 Reasons to Buy Silver Now