Gold has surged over the past year. If you’re wondering, “Isn’t it too late to buy?” — you’re not alone. But here’s the truth: even at higher prices, gold is still one of the most powerful ways to protect your wealth.

Whether you’re concerned about inflation, global tensions, or just want to diversify outside of the banking system, gold remains a timeless asset — and 2025 may be the most important time in years to own it.

Table of Contents

- 1. Markets Remain Volatile Despite Highs

- 2. Geopolitical Risk Is Surging

- 3. Inflation May Not Be Over

- 4. Central Banks Are Trapped

- 5. Record Central Bank Gold Buying

- 6. Mine Supply Is Flatlining

- 7. NZD Gold Price Shows How Gold Protects Against Currency Risk

- 8. China’s Gold Hoard Is Likely Much Larger

- 9. Share & Property Markets May Underperform

- 10. Gold Is Wealth Insurance

- 11. Gold Lets You Exit the Banking System

- 12. Protect Against Currency Devaluation

- 13. Be Your Own Central Bank

- 14. Gold Has Been Money for 5,000 Years

- 15. Gold Helps Preserve Family Wealth

- 16. Gold Is Highly Liquid and Portable

- 17. Gold Requires Low Ongoing Maintenance

- Why Buy Gold in New Zealand?

- FAQs: Understanding Gold’s Role in a Portfolio

- FAQs: Buying and Storing Gold in NZ

- Final Thoughts: Gold Is Not Just an Investment — It’s a Form of Freedom

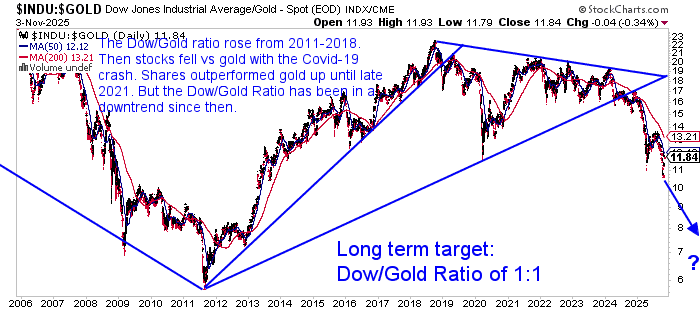

1. Markets Remain Volatile Despite Highs

Global stock markets have hit record levels in 2025, but under the surface, things aren’t as solid. Valuations are stretched, and many analysts expect flat or falling returns over the next decade. Gold often outperforms in these environments.

See: Dow Gold Ratio – How Does Gold Compare to Shares?

2. Geopolitical Risk Is Surging

Wars in Ukraine and the Middle East, rising tensions in Taiwan, and cyber threats from state actors all add uncertainty. Gold has historically performed well in times of conflict because it’s a global store of value with no counterparty risk.

See: How Does War Affect the Gold and Silver Price?

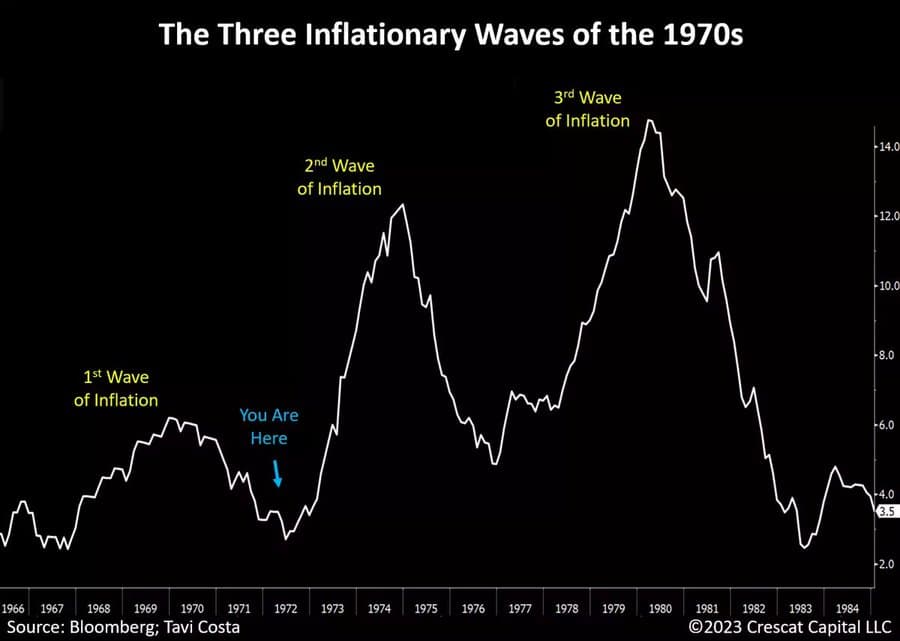

3. Inflation May Not Be Over

While inflation has eased since 2022–2023 highs, history shows it often comes in waves. Gold helps preserve purchasing power in high-inflation environments — unlike cash or term deposits, which lose value after tax and inflation.

4. Central Banks Are Trapped

Raise rates too much and the economy crashes. Cut too early and inflation takes off. Gold shines when trust in central banks wavers. In fact, central banks are now buying more gold than ever…

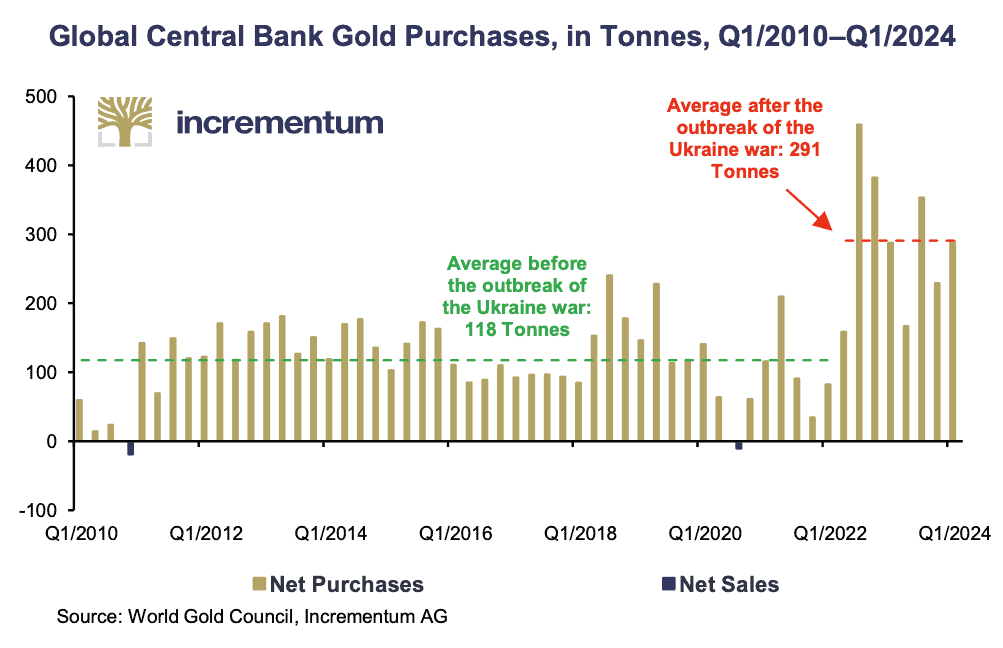

5. Record Central Bank Gold Buying

2022 to 2024 saw the largest central bank gold purchases in history. Countries like China, Russia, and Turkey are shifting reserves away from US dollars. Shouldn’t you do the same?

Since the Ukraine war, average quarterly central bank gold purchases have jumped from 118 to 291 tonnes — likely a response to the growing risk of US dollar reserves being frozen or confiscated. | Source: In Gold We Trust Report

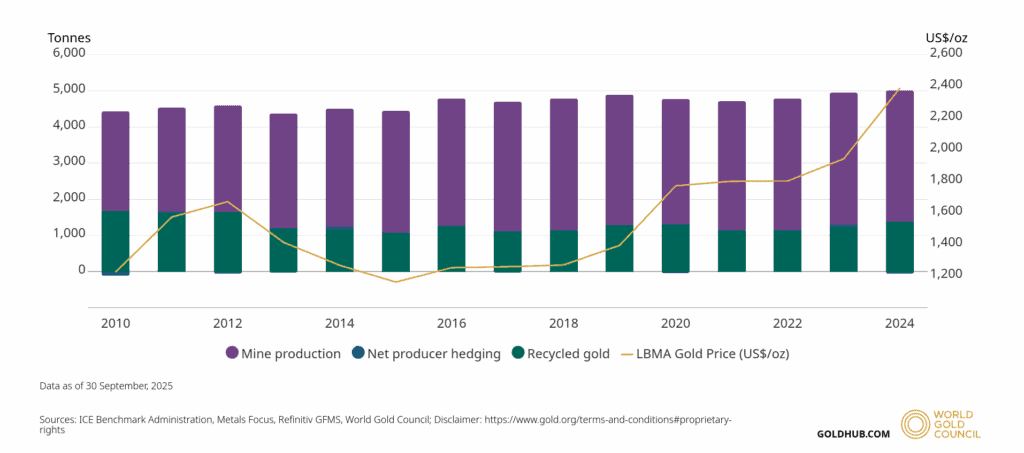

6. Mine Supply Is Flatlining

Global gold mine production has been stagnant for years. With fewer major discoveries and rising extraction costs, supply constraints may drive prices even higher in the future.

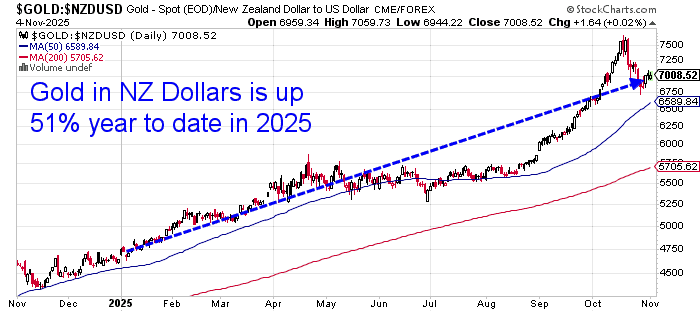

7. NZD Gold Price Shows How Gold Protects Against Currency Risk

Even when the USD gold price pauses, local investors in New Zealand can still see strong gains. That’s because the NZD tends to weaken during global uncertainty — and gold responds accordingly.

In 2025 alone, gold in NZ dollars is up 51% year-to-date, far outpacing inflation and outperforming most asset classes. That’s wealth preservation in action.

But gold could have much further to go yet. See: How Do You Value Gold | What Price Could Gold Reach?

8. China’s Gold Hoard Is Likely Much Larger

The People’s Bank of China reports official reserves, but many believe they hold far more via proxies. Their message is clear: gold is strategic. As their share of global power grows, gold demand is likely to follow.

9. Share & Property Markets May Underperform

Real estate has cooled in New Zealand since 2022, and share markets face demographic and debt-driven headwinds. Gold offers an alternative that doesn’t rely on economic growth to perform.

Gold will likely outperform both property and sharemarkets. See: NZ Housing to Gold Ratio 1962 – Dec 2023: Measuring House Prices in Gold

10. Gold Is Wealth Insurance

Gold is not a get-rich-quick scheme. It’s financial insurance. If the monetary system stumbles, you’ll be glad you hold a portion of your wealth in a real, tangible asset with no counterparty risk.

Learn more: Why Gold Bullion is Your Financial Insurance

11. Gold Lets You Exit the Banking System

Concerned about bail-ins, banking crises, or financial censorship? Physical gold is one of the only assets that lets you hold your wealth outside of the traditional financial system — quietly and securely.

12. Protect Against Currency Devaluation

All fiat currencies lose value over time. Gold does not. In fact, every government-issued currency in history has eventually collapsed — gold has always retained its value through these cycles.

13. Be Your Own Central Bank

Central banks hold gold for a reason. Why shouldn’t you? Holding physical bullion means you don’t rely on others to back your money — you’re sovereign.

But the Reserve Bank of New Zealand has no gold reserves, so don’t expect any help from them in maintaining NZ Dollar purchasing power. See: Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves.

14. Gold Has Been Money for 5,000 Years

Gold has outlasted every empire, every currency, and every economic crisis. It’s universally recognised, easy to store, and can be sold anywhere in the world.

See: No Fiat Currency Lasts Forever – What About the NZ Dollar?.

15. Gold Helps Preserve Family Wealth

Many families have passed on wealth across generations by holding gold. It’s discreet, portable, and immune to policy shifts. In a world of rising taxes and regulation, gold helps you maintain privacy and control.

16. Gold Is Highly Liquid and Portable

Gold is globally recognised and easy to convert into cash or other assets. Whether you’re in Auckland or Zurich, physical gold is instantly tradable and doesn’t rely on a broker or financial platform to unlock its value.

17. Gold Requires Low Ongoing Maintenance

Unlike rental properties or even dividend stocks, physical gold doesn’t require active management, maintenance, or paperwork. It just sits quietly — holding its value — until you need it.

Why Buy Gold in New Zealand?

Here in NZ, buying gold makes even more sense due to:

- A vulnerable housing market

- A small, open economy exposed to global shocks

- A banking system dominated by offshore ownership

Gold acts as a buffer between you and global volatility.

FAQs: Understanding Gold’s Role in a Portfolio

Yes. Gold has historically acted as a safe haven during times of crisis, from wars to financial meltdowns. It’s a tangible asset that isn’t tied to any single country or institution, making it reliable when trust in systems breaks down.

Yes. Gold is highly liquid. It can be sold almost anywhere in the world, through bullion dealers, exchanges, or private transactions. The global demand and recognition of gold means it can quickly be converted into cash or other assets.

Gold has a 5,000-year track record of preserving value. Unlike fiat currencies, which can be devalued by inflation or policy decisions, gold maintains purchasing power across decades and even centuries.

Gold is physical, portable, and does not depend on a digital system or financial counterparty. It’s real, not a promise — and you can hold it in your hand, store it privately, or pass it down to future generations.

FAQs: Buying and Storing Gold in NZ

No. Gold has long-term value. Price rises often happen in waves — and many indicators show we are still in the early stages of a long bull market.

Both have benefits. Gold is more stable and better for larger wealth. Silver can be more volatile but may offer higher upside.

Experts often recommend 10–20% as part of a diversified strategy.

For wealth protection, physical gold — bars or coins — is best. ETFs are easier to buy/sell, but you don’t own the underlying asset.

Use secure, insured storage — either at home, in a bank vault, or via a professional storage provider.

Final Thoughts: Gold Is Not Just an Investment — It’s a Form of Freedom

Gold is timeless wealth. It protects against the erosion of purchasing power, the fragility of financial systems, and the uncertainty of global politics.

As part of your portfolio, it doesn’t just preserve value — it gives you peace of mind and freedom.

Ready to Buy Gold in NZ?

- Order Gold or Silver Bullion Now

- Have questions? Contact our team

- Explore secure storage

Want to Learn More?

Get our free guide: “19 Nuggets of Knowledge: How to Buy Gold in NZ”

Or dive deeper into the structure of the monetary system with our Gold eCourse

Can you think of any other reasons to buy gold? Share them with us and other readers – Leave a comment below!

Editors Note: Initially published on 26 September 2012. Fully updated 4 November 2025.

Pingback: Gold to Silver Ratio: What Can We Expect Now After QE3? | Gold Prices | Gold Investing Guide

Hi there, Good reasons, may they be oft repeated. Another one is that, at this point at least, there is no tax to pay when selling, or GST… it is possible to “hide” ones wealth in precious metals. Its not officially money right? There is no need to declare it in any way. I’m just another conspiracy nutter with dreams of Gold but no “real” digits in any bank computer; no need to bother with me…thats how I like it!

Keep up the good work!

Gerry.

Hi Gerry,

Thanks for taking the time to add another very relevant reason – especially for those who prefer to stay “off grid”.

Cheers

Glenn

Pingback: Why Buy Silver? | Gold Prices | Gold Investing Guide

Pingback: Winston Peters - Let’s Join the Currency Wars | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Silver or Gold? Which Should You Buy? - Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide NZ Dollar Gold and Silver: Update After the Fall

Pingback: How Much Further Could Gold in NZD Fall? -

Pingback: Buying Precious Metals: Common Questions from First Time Buyers -

Pingback: Gold & Silver in NZ Dollars: 2015 in Review & Our Guess For 2016

Pingback: GoldSurvivalGuide's Mission Explained - Gold Survival Guide

Pingback: Gold and Silver Technical Analysis: The Ultimate Beginners Guide - Gold Survival Guide

Pingback: 12 Reasons Why Gold and Silver Will Rise in 2018 - Gold Survival Guide

Pingback: Reader Question: Why is Gold More Valuable Than Worthless Paper?

Pingback: Just How Well Capitalised are New Zealand Banks?

Pingback: Derivatives - a Beginner's Guide to “Financial Weapons of Mass Destruction”

Pingback: 7 Reasons to (Still) Buy Gold

Pingback: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver - Gold Survival Guide

Pingback: What Type of Gold Bar Should I Buy? - Gold Survival Guide

Pingback: 28 Reasons to Buy Physical Gold - Gold Survival Guide

Pingback: The 5 Biggest Market Risks That Billionaires are Hedging Against - Gold Survival Guide

Pingback: How Many People Own Gold? New Zealand vs Other Countries - Gold Survival Guide

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated) - Gold Survival Guide

Pingback: What Percentage of Gold and Silver Should Be in My Portfolio? - Gold Survival Guide

Pingback: Why Buy Gold? No Fiat Currency Lasts Forever - What About the NZ Dollar? - Gold Survival Guide

Pingback: Russian Gold Ban - Will the “Law of Unintended Consequences” Strike Again? - Gold Survival Guide

Pingback: Caution: Don't Be Caught on the Sidelines - Gold Survival Guide

Pingback: Bank Failures: Most Likely Just the Start - Gold Survival Guide

Pingback: Largest Food Price Rise since 1987! - Gold Survival Guide

Pingback: Exit Strategies For When the Time Comes to Sell Gold and Silver