Discover what the RBNZ Bank Financial Strength Dashboard is. Can it help you pick a “safe bank” in New Zealand?

Hopefully by now you are aware that there is no deposit insurance in New Zealand banks. So if a bank fails in New Zealand you as a depositor run the risk of losing part or all of your savings in the bank. See: Bank Failures | Could they happen in NZ | The Reserve Bank thinks so

So it does make sense to know what the financial strength of your bank is.

To assist with this, in 2018 the Reserve Bank of New Zealand (RBNZ) released a new tool – The RBNZ Bank Financial Strength Dashboard.

Here’s a short promo video ad on the dashboard…

Until this dashboard was released all you could do was check the 6 monthly updated “General Disclosure Statement” released by each bank. Then go through the balance sheet and financial statements contained in these for each bank. Then try to make a comparison.

Maybe an option if you were an accountant. But for the average Kiwi, not an easy task!

What is the Bank Financial Strength Dashboard?

The RBNZ has instead launched a website that summarises key data of each bank in New Zealand. The dashboard allows you to make a comparison of various measures between all the banks in New Zealand.

The dashboard also includes a profile page for each bank. Now that over a year has passed since the dashboard was released, you can see the change in various measures from quarter to quarter for a bank.

For an example go here to see ANZ’s profile page. You can click any bank on the left to see the details for that bank.

What Does the Bank Financial Strength Dashboard Measure?

The Bank Financial Strength Dashboard measures:

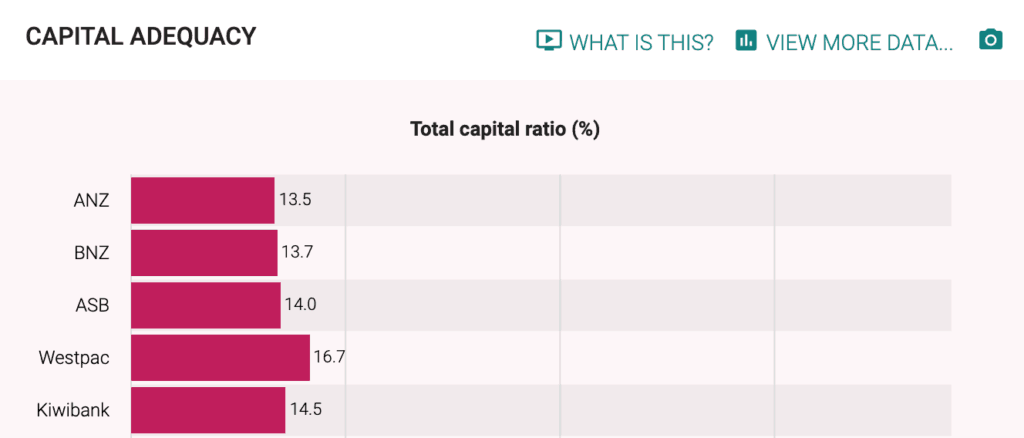

- Capital adequacy

- Asset quality

- Profitability

- Balance sheet

- Liquidity

- Credit concentration

You can view videos explaining each of these measures. An example is the video below explaining capital adequacy.

Interest.co.nz has also released their own simplified version of the RBNZ tool. Instead focusing on simple comparisons between three banks at once. See: https://www.interest.co.nz/saving/bank-financial-comparator

A Video Summary of the Dashboard

Martin North of Digital Financial Analytics in Australia has just released a useful video summarising the RBNZ bank dashboard. Interestingly he notes that Australia has nothing like this available over there.

The Reality of Bank Deposit Bail-In

Here’s Why the RBNZ Bank Financial Strength Dashboard May Still Not Help You

Looking at the 6 metrics listed above one thing is noticeable. There is very little difference in most of the measures between the top 5 banks in New Zealand. So even using the dashboard it may be difficult to pick a “safer” bank.

One view would be that New Zealand banks are amongst the safest in the world. So there is not much risk.

However, New Zealand does have a highly concentrated banking system. Where just a few banks, control most of the market.

As we’ve commented previously, the greatest risk to New Zealand banks would come from an offshore event. An event affecting the flow of credit into New Zealand (which we require given that we borrow much more than we save).

So if one New Zealand bank was in trouble it would be highly likely that a number of them may be experiencing similar problems. In short, a problem big enough to affect one bank might well affect them all.

A recent report from ratings agency S&P also points this the risks facing the NZ banking sector:

NZ banks exposed: S&P

Risks in the New Zealand banking system are comparable with Iceland, Ireland and Mexico, according to a new report from ratings agency Standard & Poors.

…The credit rating agency believes “persistent” current account deficits, expected to be in line with historical levels of 3%-4% of GDP, pose a potential problem for the banking sector.

S&P also says high levels of external debt, roughly 170% of current account receipts, could be a problem for the sector.

The agency says: “In our view, the New Zealand banking sector’s funding profile remains a weakness for the banking system. This is despite a modest strengthening of banks’ customer deposits and a slight reduction in banks’ dependence on external borrowing over the last few years.”

Source.

If You Can’t Pick a “Safe Bank” What Should You Do?

As we have said previously while discussing Kiwisaver and bank bail ins, when making any investments it’s wise to have some financial insurance. We don’t mean life insurance but rather physical gold and silver. See: Why Gold Bullion is Your Financial Insurance

Because gold and silver are the only financial assets that have no counter-party risk. That is, unlike deposits in a bank, gold and silver are not at the same time someone else’s liability.

Also think about a point Martin North makes in the video above. That your…

“deposits are unsecured loans to the bank”.

And so…

“receiving almost no interest on deposits, or worse still, going into negative interest rates, and having to pay to keep money in the bank if rates do go negative, is put into a whole new light”.

Indeed. One of the reasons people argue against holding gold or silver is the “cost of carry”. You need to store them somewhere. But if you’re getting next to nothing (or worse) in the bank, then gold and silver look even more attractive.

Become your own central bank and buy and hold some physical gold or silver to offset any investments you have.

Buy gold or buy silver here today.

Read more: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver

Editors Note: This article was first published 12 June 2018. Updated 2 October 2019 to include video from Martin North and updated bank profile.

Pingback: RBNZ Bank Dashboard: Why it May Not Help You Pick a Safe Bank - Gold Survival Guide

Pingback: New: The Beer to Gold Ratio! - Gold Survival Guide

Pingback: Are the Federal Reserve’s “Temporary” Money Injections Becoming Permanent? - Gold Survival Guide