Prices and Charts

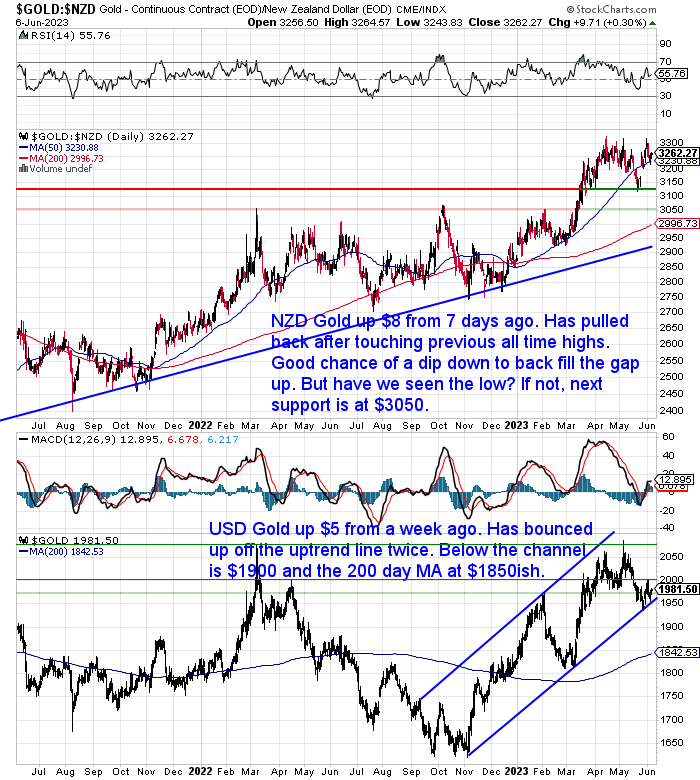

NZD Gold Holding Around the 50 Day Moving Average

Gold in New Zealand dollars was down $8 from a week ago. During the week it did get up to touch the all time highs around $3300 again. But has pulled back to the 50 day MA since then. There’s still a decent chance we’ll see NZD gold dip down to back fill the gap up from $3150. Then the question would be have we seen the low at $3125? If not, then the next major support level would be the 2022 highs at $3050. Then below that the 200 day MA which is closing in on $3000.

In US dollar terms gold was up $5 from 7 days prior. It has bounced up twice off the uptrend line. We’re watching to see if that channel can hold. If not, the next support level is at $1900. Then below that is the 200 day MA which is close to $1850.

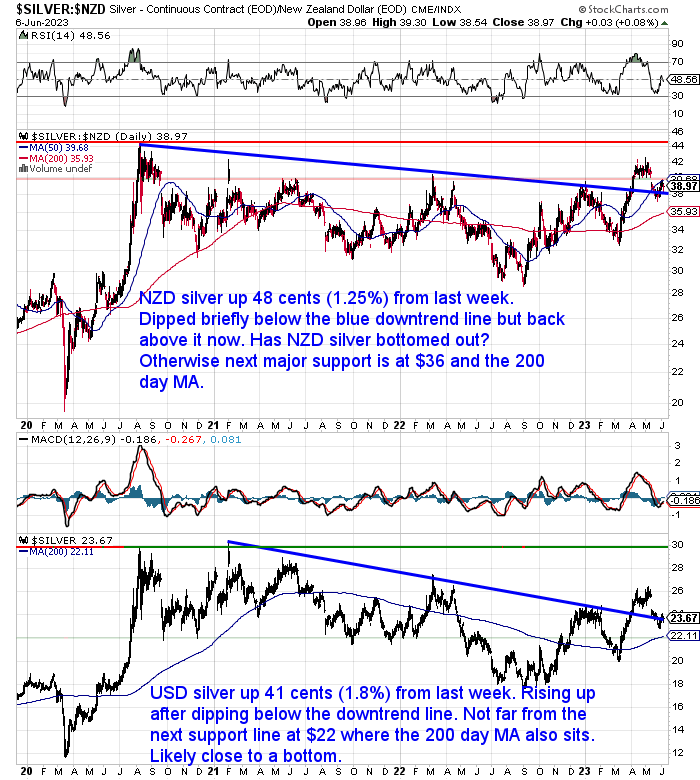

NZD Silver Rising Up Above Downtrend Line

Silver in New Zealand dollars was up 48 cents from a week ago. Rising up off the downtrend line. Has NZD silver bottomed out just below that line? If we see a further dip lower, the next major support is at $36, which also coincides with the 200 day MA.

Either way, there is likely not too much downside left in silver. While there is a lot of upside potential ahead once $45 is broken. As the all time high still sits above $60.

USD silver is also just above the downtrend line. Having risen 41 cents from a week ago. Silver is not far from the next support line at $22 which also coincides with the 200 day MA. So we are likely close to a bottom in USD silver.

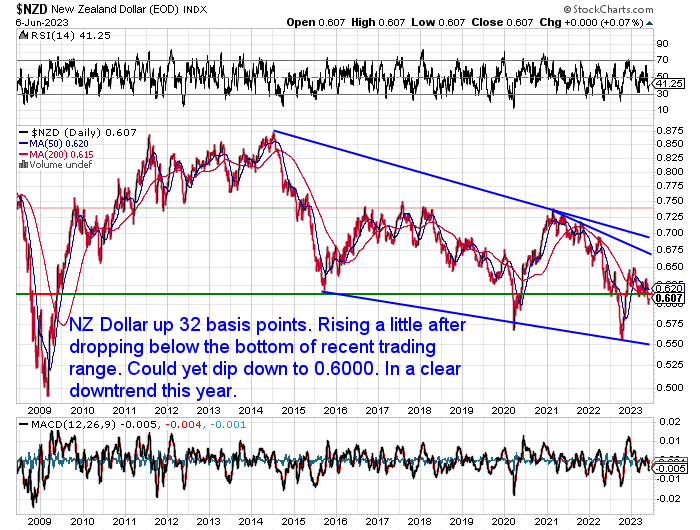

NZ Dollar Up Half a Percent

The New Zealand dollar bounced back a bit this week. Up 32 basis points after getting down close to 0.6000. It could still dip down to that level. The Kiwi remains in a clear downtrend year to date. So far our expectation of a stronger NZD vs the USD for 2023 has not taken place.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Why New Zealand Won’t Have Any Say in a Global Currency Reset in 2023 or Beyond

Last week we wrote how the various sanctions that the USA has taken out against the likes of Russia and Iran have likely only resulted in less use of the US dollar. These maligned nations are finding other ways to continue to trade with other countries. As a result, these measures from the US are also making other countries, who have not had sanctions taken out against them, also consider what the impacts on them might be if this were to happen.

Then just this week the BRIC’s nations met to look at how a possible new shared currency might shield them from US sanctions:

BRICS Nations Say New Currency May Offer Shield From Sanctions

The latest In Gold We Trust report (which we also referenced last week) notes that these moves out of the US dollar seem to have increased in velocity in recent years:

“De-dollarization is a reality: Adjusting for FX movements, USD has lost about 11% of its market share since 2016 and 2x that amount since 2008. USD’s share of global currency reserves dropped to only 58% in 2022 from a share of 73% in 2001.”

Source.

So some kind of currency reset is certainly looking more likely in the coming years.

The question then for those of us living here down under is how would such a reset affect us?

This week we answer this question:

- How Would a Global Currency Reset Affect Us Down Under?

- How Does New Zealand Compare to Australia in Terms of Gold Mining?

- How About New Zealand’s Official or Central Bank Gold Reserves?

- Countries with similar GDP to New Zealand and their gold reserves

- Why New Zealand Won’t Have Any Say in a Global Currency Reset

- What Should You Do About New Zealand’s Lack of Gold Reserves?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

A US Debt Deal Has Been Achieved. Now What?

This week, much as expected, a bill was passed to increase the US debt ceiling. This will allow the US to continue issuing US treasury bonds and continue racking up more debt as is required for the current monetary system to function.

So back to business as usual for America Inc?

MAybe but maybe not. Willem Middelkoop pointed out that we should recall what happened after the last debt ceiling fiasco in August 2019…

“The huge amount of money needed by the US-Treasury led to the Repo-Crisis within weeks. To tackle this crisis the Fed had to start emergency QE in September 2019

“After the debt ceiling was suspended in early August 2019, the US Treasury quickly set out to rebuild its dwindling cash balances, draining more than $120 billion of reserves in the 30 days between 14 August and 17 September alone, and half of this amount in the last week of that period.”

Source.

So watch this space. Solving one problem could well cause another.

Institutional Investors May Have Biggest Impact on Silver

The global push out of petroleum and into electric engines is resulting in a significant increase in the industrial use of silver.

Asset Managers, Industry Aggressively Snapping Up Silver

“In a recent interview, First Majestic CEO Keith Neumeyer outlined the tremendous strain that could soon be placed on available silver supplies.

Keith Neumeyer: “On the demand side, it’s pretty phenomenal. Two industries, solar panels, about 160 million ounces. Automobiles about 80 million ounces. So it’s like 250 million ounces between those two industries, which didn’t exist a decade ago for really any large degree. Consuming almost 30% of the entire mine supply of silver. Governments want to eliminate all fuel cars by what? 2030? 2035, 2040 some say. The automotive sector can’t produce the amount of electric cars required to replace all the fuel combustion cars over that period of time. And if we’re producing as a global industry, the automotive industry… producing, call it 9 million electric cars last year, consuming 60 million ounces of silver, you do the math. In an 850 million ounce market, and the automotive sector needs to be producing 50 million cars a year over 20 years just replace the current fleet. So, you multiply those numbers out and you basically have no silver left.”

Of course, in addition to being an indispensable metal in high-tech applications, silver is also historically a form of money. It’s generally not held in monetary reserves by central banks like gold is. But is held by individual investors who seek to hold sound money in their reserves.

Silver bullion demand by individuals has been quite strong over the past couple years. And there are signs that silver may be catching on at the institutional level as money managers eye alternative assets with big upside potential.

BlackRock, the world’s largest asset manager, disclosed in a regulatory filing in March that it had purchased a 10.9% stake in an exchange-traded silver instrument.

Despite this, institutional investment in precious metals currently averages under 0.5%. Meanwhile, the combined paper asset holdings of the top five investment firms are over $30 trillion. A tiny percentage increase in their allocation to hard assets would have an enormous impact on already tight physical gold and silver markets.’

Source.

The increase in industrial demand for silver is commonly cited as a reason for the silver price to rise. However this is one of the first mentions we’ve seen of a move by institutional investors into silver. It’s one we’ll keep a closer eye on now.

Could This Be What Finally Unleashes the Silver Price?

Silver analyst Ted Butler makes a good case for what else could finally launch the silver price higher. The possible end of price manipulation…

“A set of readily-verifiable facts have combined to point to a stunning conclusion, namely, that thanks largely to enough people doing the right thing, that the federal commodities regulator, the Commodity Futures Trading Commission, may have also finally done the right thing when it comes to the decades-old COMEX silver price manipulation. If my assessment is correct, the most logical conclusion is that we may be at the end of the long-running manipulation and set to rocket higher in silver prices.”

Butler then outlines how a letter he wrote (and also encouraged others to do the same) to the CFTC in 2021 may have had an impact and led to…

“…the unprecedented decline in the concentrated short position in COMEX silver futures to this time, particularly concerning the commercial-only component of what I always considered at the core of the manipulation.

“…From the high-point of 65,262 contracts (326 million oz) on Feb 2, 2021 for the 4 largest COMEX shorts (which prompted me to write and encourage others to do the same in the first place), the short position of the 4 largest shorts has fallen to 36,478 contracts (183 million oz) as of the most recent COT report (May 30), and when adjusted to reflect the commercial-only component of this position, the concentrated position is down around close to 27,500 contracts (138 million oz), down close to a stunning 60% from Feb 2, 2021.”

So this massive fall in the short position of these major bullion banks leads Butler to believe that:

“…the Commission, most likely, gave the big commercial shorts some time (say two years) to work down their concentrated short positions.”

“…As I’ve been reporting recently (to subscribers), for the first time ever, on the recent $6 silver price rally from early March to the beginning of May, the 4 big commercial shorts on the COMEX failed to increase their concentrated short position, as they always had in the past. I took this to strongly suggest that they would not do so on the next silver rally, whenever that rally commenced.”

“…If they don’t add aggressively to such short positions, then that rally should prove epic and we won’t have to sit around and wonder any longer about the silver manipulation.”

Source.

We’ll also be paying close attention to the commercial short position in the futures market when the next silver rally emerges.

As noted at the start of today’s letter, there is likely a fairly limited downside in silver right now. Sure, there could be a further pullback yet, but the bottom is likely not too far away. But the upside is much, much greater. Plus these couple of news items above point to possible price drivers for silver.

There were some lengthy wait times with the surge in orders following the US bank failures. But these have now come down considerably too.

So right now could be a very good time to be buying silver for the long run.

Get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|