Prices and Charts

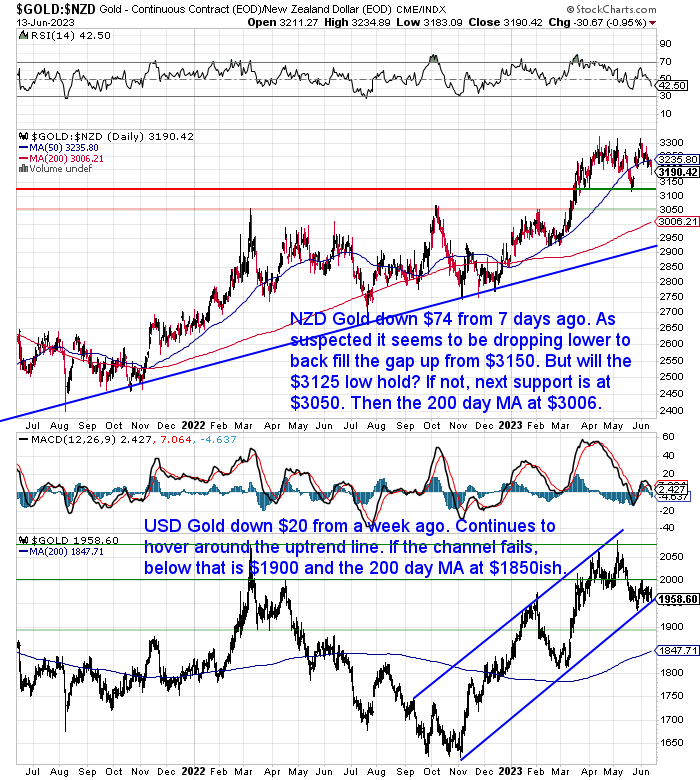

NZD Gold Dropping to Back Fill the May “Gap Up”

Gold in New Zealand dollars was down $74 (-2.3%) over the last 7 days. As we suspected last week, NZD gold looks to be dropping down to back fill the gap up that took place in late May. This was where NZD gold jumped higher from $3150 to $3200 before moving up to retest the all time high at $3300.

So we could now see gold dip back to $3150. Then the question is, will the May low at $3125 hold? If not, then the next support levels to watch for are $3050 and the 200 day moving average (MA), currently at $3006 but still rising.

USD gold was down $20 or around 1%. It continues to hover along the lower line in the uptrend channel. If it breaks below that channel, then the support levels to watch are the May low at $1930, $1900 and then the 200 day MA at around $1850.

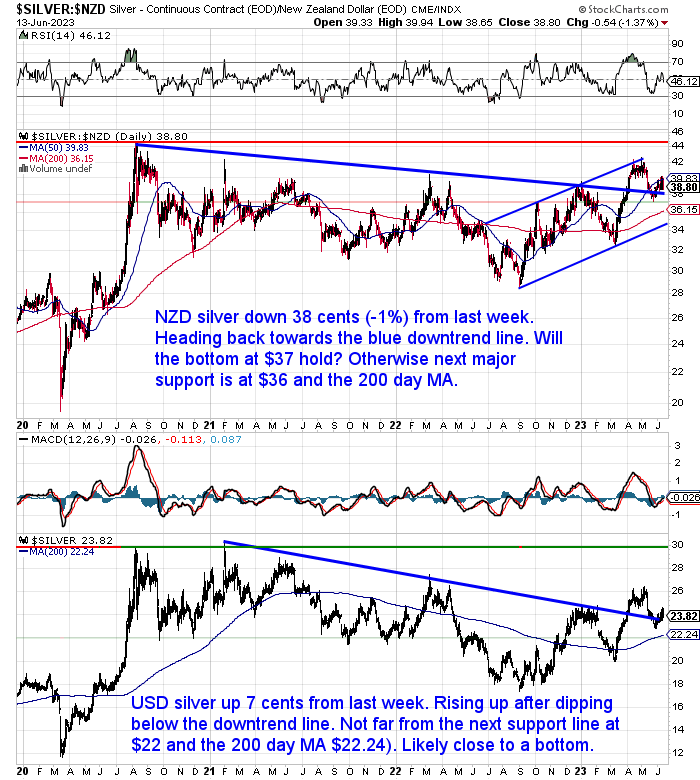

NZD Silver Dropping Back Towards the Downtrend Line

Silver in New Zealand dollars was down 38 cents (1%) this week. After touching the 50 day MA it is now dropping back towards the downtrend line again. Then will it bounce up off that or retest the May low at $37? If that doesn’t hold then the 200 day MA is not much lower at $36.15 and then the uptrend line is just below that. The odds favour a bottom not being too much further off.

Conversely, USD silver was up 7 cents for the week. It too has risen up after dipping under the downtrend line. That May bottom was not that far from the 200 day MA ($22.24). So even if the bottom didn’t hold we are likely not that far from one being reached.

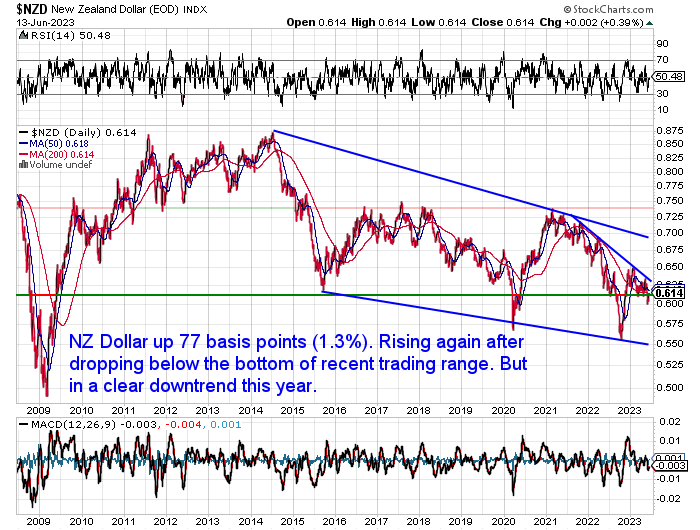

NZ Dollar Jumps 1.3%

This week the New Zealand dollar bounced back from the weakness we have seen recently. It was up 77 basis points of 1.3%. So that helped put a dent in local gold and silver prices. The Kiwi is now back to the 200 day moving average. But it clearly remains in a downtrend year to date.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Does Gold Seasonality Affect the NZ Dollar Gold Price? What About in 2023?

Gold and silver in New Zealand dollars have been pulling back lately. But as you’ll see in this week’s feature article this is not an uncommon occurrence at this time of the year. You’ll also see why history favours higher prices in gold and silver through the second half of the year…

- What is Gold Seasonality?

- But Does Gold Seasonality Affect the New Zealand Dollar Gold Price?

- What About Silver Seasonality for Silver in NZ Dollars?

- Buying Opportunity for Gold and Silver Approaching?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

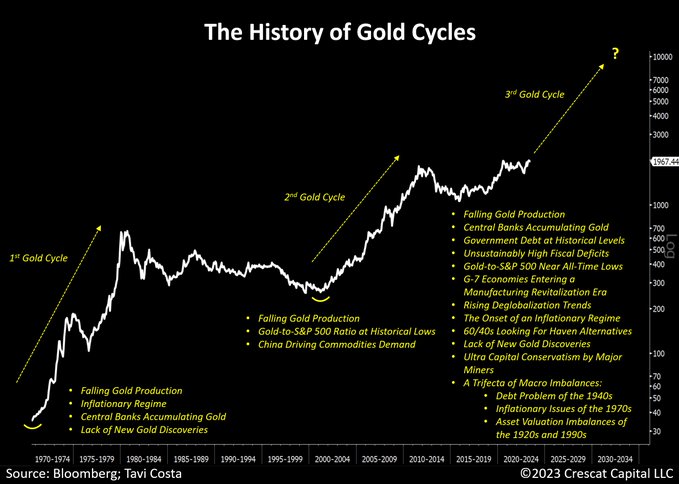

The Start of the 3rd Gold Cycle Since 1970?

Otavio Costa, portfolio manager at Crescat Capital, points out the many big picture factors that support the start of another upwards movement in gold…

“The multitude of macro drivers supporting the onset of another gold cycle is truly remarkable.

Amplified by the prevailing skepticism surrounding the metal, we are arguably experiencing the most important time in gold’s history.

The stars are aligning, and it appears to be only a matter of time until we see a major breakout from the recent triple-top formation.”

Source.

3 Contrarian Indicators That a Bottom in Precious Metals is Close

As noted earlier, if the bottoms for this correction in gold and silver aren’t already in, we believe the odds are they are not too much further away. Costa’s chart above shows all the reasons to be positive about gold right now. However that doesn’t seem to be reflected in market sentiment. However here’s 3 contrarian reasons why we also think a significant move higher is coming:

1. It is very, very quiet in terms of people buying gold and silver currently. Which as we’ve commented before seems to happen closer to market bottoms than market tops.

2. Belief in gold seems to be really lacking at present. Again we’ve noticed this around key market bottoms previously. Here is just one anecdotal example of this. Precious metals Analyst Rob Kientz this week tweeted:

“Any pullbacks I would consider buying opportunities, without exception” #preciousmetals

Source.

In response were only 2 positive comments. Whereas here were some of the negative comments:

“I said it before…we will see $1870 this summer”

“Not sure if we’ll see a pullback in premiums though, so any pullback in paper market will be meaningless for physical buyer.”

“Pullback after pullback seems like never gonna end”

“There is always a new low in pm. Trots the story since 2011. And Nothing a see in the ner [sic] future is in change for that”

“By the time gold finally does something meaningful, I’ll be way too old to enjoy it.”

These comments probably sum up the negative sentiment towards gold and silver right now.

3. Premiums above spot price are falling. So interestingly the second comment above may already be proven incorrect…

“Not sure if we’ll see a pullback in premiums though, so any pullback in paper market will be meaningless for physical buyer.”

Falling silver coin premiums indicate a lack of demand. So in response wholesalers drop their premiums. For example, the premium above spot price on a monster box of Austrian silver Philharmonic coins has dropped over 20% since the start of June. That equates to 80 cents per coin. While the above spot premium of the popular silver maple coin is also down 20% but in just the last 7 days. This is $1.38 per coin lower.

So combine this with a dip in the silver price and we could be seeing an excellent buying opportunity for those wanting to add silver coins.

Contrarian Indicators: US Stock Market Peaking?

Conversely here are a few contrarian indicators pointing to why the current rebound in the US stock market may be close to peaking out.

Care of Jim Bianco:

1. Today’s Barron’s cover

Contrarians take note

2. Last week’s net bullishness (bulls-bears) reading from the weekly survey conducted by the American Association of Individual Investors (AAII) jumped 20%.

This marked the highest net bullishness since November 2021, which was a few weeks before a 25% price decline.

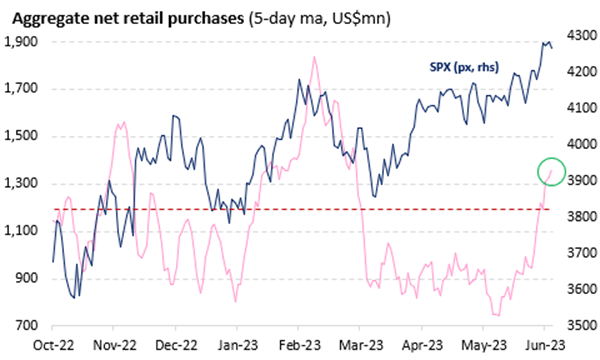

3. Finally, the following BofA chart shows retail (pink line) has been jumping back into stocks in a big way in the last few weeks.

——

Between the Barron’s cover story, the AAII survey, and the retail chart above, it is safe to conclude the consensus is bullish.

A big change in Google trends in just one week would seem to back this up:

“Historically, Florida is the only state searching for #BullMarket more than #BearMarket. Over the past week, bull market is now more searched in every state except Missouri.”

Source.

Our thinking is still that the likes of stocks, bonds and housing will continue to stagnate. There will be moves up to suck people in – much like the current one in the US stock market. But in real terms (as in after inflation) these assets will likely go nowhere in the years to come.

While gold and silver will likely go up in terms of their buying power. Do you are agree that the indicators shown today point to now being a pretty decent time to be buying for the long run?

If so please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: A Gold Backed BRICS Currency in August 2023? - Gold Survival Guide