Prices and Charts

NZD Gold Hovering Around May Lows

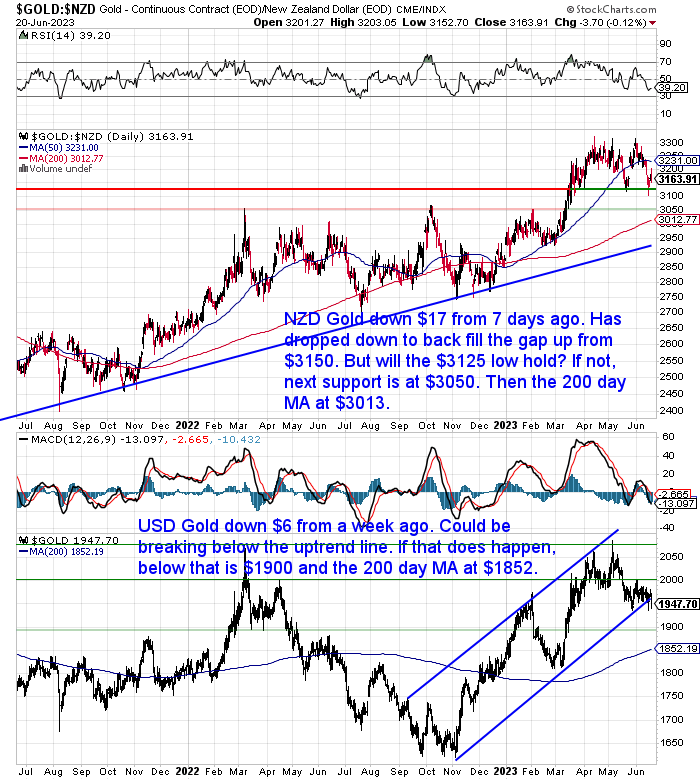

Gold in New Zealand dollars was down $17 this week. It dropped back to fill the gap up that occurred in May. So far it is holding above the May lows. But we continue watching to see if that will hold. If it doesn’t, then the next support level is at $3050 which was the 2020 highs. Then just below that is the 200 day moving average at $3013.

Gold in US dollars is down just $6 from last week. However it has dipped just under the lower line of the uptrend channel from late 2022. So it could be breaking down from that. If that occurs then the next support line is US$1900 and below that the 200 day moving average which is currently at $1852.

NZD Silver Down Nearly 2.5%

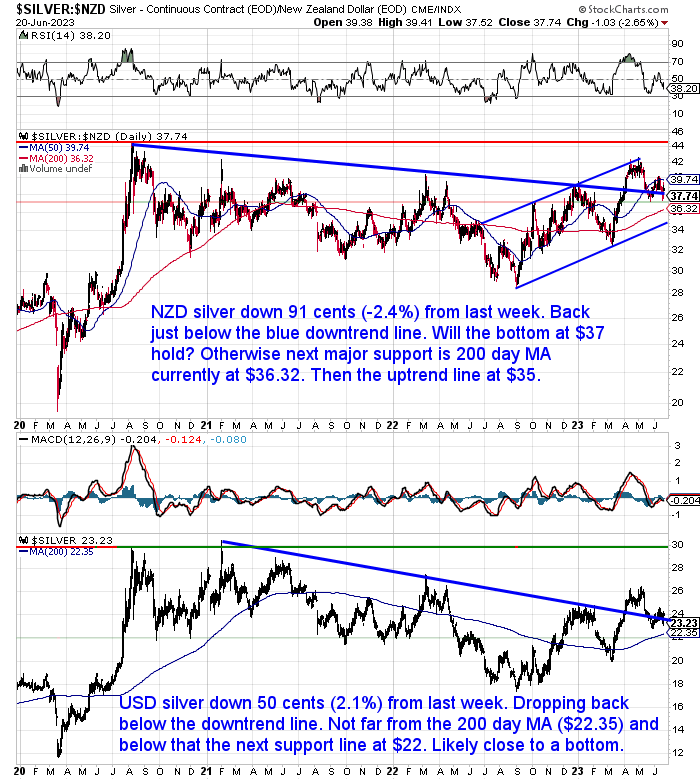

Silver in NZ dollars dropped 91 cents from 7 days ago. This fall of almost 2.5% took the price back down to just under the downtrend line. Now we watch to see if the May bottom at $37 will hold? If not, then the next major support level is the 200 day MA at $36.32. Below that is the uptrend line at about $35. If we hit either of those 2 it will likely be a great buying zone with a great entry price for the next leg up.

USD silver was down 50 cents (2.1%). It also dropped back below the downtrend line. It is also not far from the 200 day MA at $22.35 and then $22 not much below that. Silver is likely getting very close to a bottom.

NZ Dollar Edges Higher

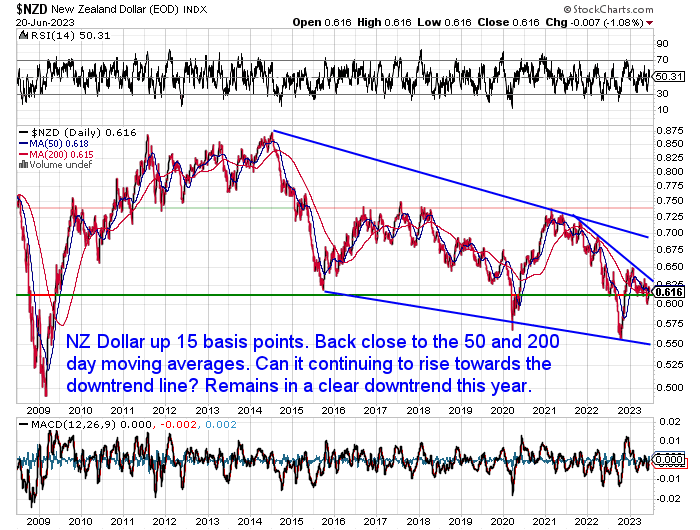

The Kiwi dollar was up just 15 basis points this week (0.25%). It sits back close to the 50 and 200 day MAs. Can it now continue to rise towards the downtrend line? But it clearly remains in a downtrend this year.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Why Sleeping Beauty Should Own Some Gold or Silver in 2023

Things may have calmed down in some respects compared to the madness of lockdowns etc. But the world remains a very unpredictable place right now.

So this week we use the metaphor of a fairy tale to look at how to add some solidity to your future.

This week’s feature article covers:

- The World’s Monetary System is Changing

- Sanctions Speeding up De-Dollarisation

- Higher Interest Rates Combined with Huge Debt Levels

- Technology and Money

- US Dollar’s Reserve Currency Status in Danger

- When Sleeping Beauty Wakes Up, What Will Money Look Like?

- Look to the Past to Prepare for the Future

- How to Transfer Your Wealth into an Unknown Future

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Rickards: A Gold Backed BRICS Currency?

Sticking to the topic of changes to the global monetary system, the BRICS (Brazil, Russia, India, China and South Africa) may soon launch their own currency. Or rather a BRICS+ currency, as there are 8 countries who have applied to join, along with another 17 who have expressed interest. We have seen discussion of it such as here, but we haven’t seen a date mentioned.

Perhaps Jim Rickards has some inside information or it could be just good marketing for a financial newsletter, but he theorises that a BRICS+ currency could be launched as soon as August this year. When the next meeting is held in South Africa.

Rickards goes on to say:

“The currency will be pegged to a basket of commodities for use in trade among members. Initially, the BRICS+ commodity basket would include oil, wheat, copper and other essential goods traded globally in specified quantities.

In all likelihood, the new BRICS+ currency would not be available in the form of paper notes for use in everyday transactions. It would be a digital currency on a permissioned ledger maintained by a new BRICS+ financial institution with encrypted message traffic to record payments due or owing by participating parties.”

He then thorises that…

“Based on the impracticality of commodity baskets as uniform stores of value, it appears likely that the new BRICS+ currency will be linked to a weight of gold.”

…the BRICS+ currency offers the opportunity to leapfrog the Treasury market and create a deep, liquid bond market that could challenge Treasuries on the world stage almost from thin air.

The key is to create a BRICS+ currency bond market in 20 or more countries at once, relying on retail investors in each country to buy the bonds.

The BRICS+ bonds would be offered through banks and postal offices and other retail outlets. They would be denominated in BRICS+ currency but investors could purchase them in local currency at market-based exchange rates.

Since the currency is gold backed it would offer an attractive store of value compared with inflation- or default-prone local instruments in countries like Brazil or Argentina. The Chinese in particular would find such investments attractive since they are largely banned from foreign markets and are overinvested in real estate and domestic stocks.

It will take time for such a market to appeal to institutional investors, but the sheer volume of retail investing in BRICS+-denominated instruments in India, China, Brazil and Russia and other countries at the same time could absorb surpluses generated through world trade in the BRICS+ currency.

In short, the way to create an instant reserve currency is to create an instant bond market using your own citizens as willing buyers.

…If the BRICS+ use a kind of Liberty Bond patriotic model, they may well be able to create international reserve assets denominated in the BRICS+ currency even in the absence of developed market support.

This entire turn of events — introduction of a new gold-backed currency, rapid adoption as a payment currency and gradual use as a reserve asset currency — will begin on Aug. 22, 2023, after years of development.

Except for direct participants, the world has mostly ignored this prospect. The result will be an upheaval of the international monetary system coming in a matter of weeks.”

Source.

As already noted, this could just be a good bit of marketing for Rickards newsletter, but he is certainly well connected so he could have some advance information. We’ll be keeping an eye out in August anyway.

Commercial Real Estate Could Kick Off the Next Crisis

The EpochTimes has a comprehensive rundown of the troubles brewing in the US commercial real estate market. Commercial mortgages are getting hit on two fronts: first, by the lack of demand for office space due to the increase in work from home, leading to credit concerns regarding landlords; and second, by interest rate hikes that make it significantly more expensive for borrowers to refinance.

Regional Banks Scramble to Unload Commercial Real Estate Loans, Fearing New Crisis

Analysts fear that CRE exposure could spark another round of bank failures

“There is an estimated $1.5 trillion of commercial property debt that will be due for repayment in about 18 months,” Peter Earle, an economist at the American Institute for Economic Research, told The Epoch Times. “It’s not improbable that even if interest rates have fallen by that time, some of that real estate debt will nevertheless be impaired and have an adverse impact on regional banks.”

…“Between the Fed’s 500+ basis point hikes over the past 16 months and the failure of Silicon Valley Bank, and others, earlier this year, a credit tightening is already underway,” Earle said. “That has put a lot of pressure on regional lenders.”

A March academic study titled “Monetary Tightening and U.S. Bank Fragility in 2023” stated that the market value of assets held by U.S. banks is $2.2 trillion lower than what is reported in terms of their book value. This represents an average 10 percent decline in the market value of assets across the U.S. banking industry, and much of this decline came from commercial real estate loans.

Consequently, the authors wrote, “even if only half of uninsured depositors decide to withdraw, almost 190 banks with assets of $300 billion are at a potential risk of impairment, meaning that the mark-to-market value of their remaining assets after these withdrawals will be insufficient to repay all insured deposits.”

Source.

News items about US banks at risk have certainly died down in recent weeks. However it seems likely that behind closed doors there is ongoing concern.

How do we think that?

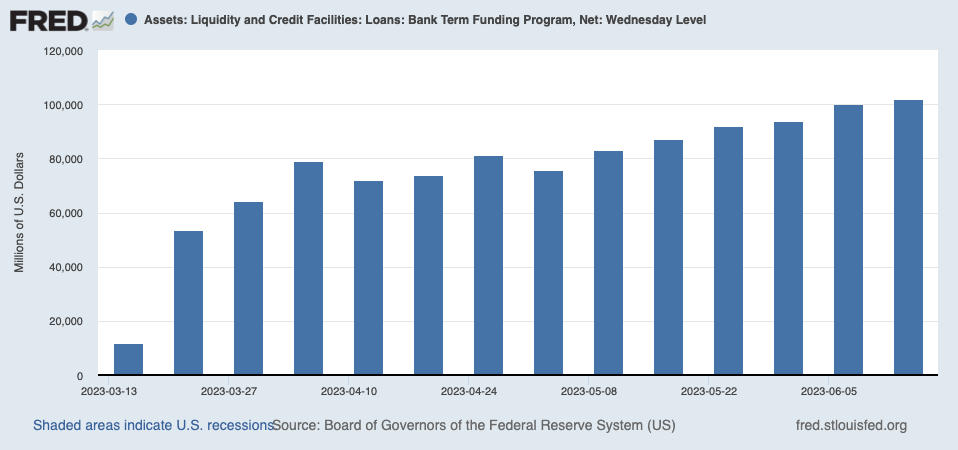

By looking at the data from the Federal Reserves hastily created Bank Term Funding Program (BTFP).

After being fairly steady throughout April, it has surged higher in May and now the most recently weekly data shows it hitting $100 billion for the first time. Recall that this is a lending program for banks that need to borrow cheaply for up to a year. Effectively it stopped the failure of many other banks.

Source.

As ZeroHedge points out:

“If everything is so awesome – with regional banks at 3-month highs – why are they needing to borrow $100 billion from The Fed?”

Back in 2008/09 there were many months between the various bank failures. So just because all is quiet for a period of time we should believe everything is solved.

If you don’t think everything is as awesome as they’d like to have us believe, then you might want to add to your “financial insurance reserves”.

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: US Inflation May be Bottoming Now - How About NZ? - Gold Survival Guide

Pingback: Ray Dalio: Great Disorder is Coming - Gold Survival Guide

Pingback: The Gold Standard & A Free Market For Money: What Do We Think About It?