Prices and Charts

Late Update:

NZD Gold is up $21 and silver is up 31 cents as we go to hit send compared to the numbers listed above and in the charts below.

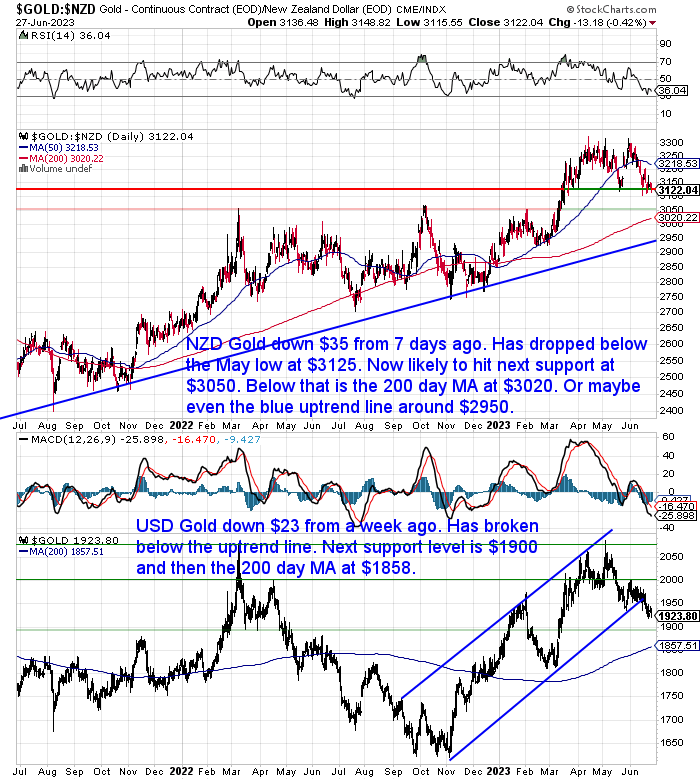

Lower Prices Still to Come for Gold?

Gold in New Zealand dollars is down $35 from last week. It has dipped below the May low at $3125. Now it looks likely to hit the next support levels at $3050 which was the high in 2022. Not much further below that is the 200 day moving average (MA). Then finally is the blue uptrend line. So it seems likely there is a little more downside to come. That will most likely push the RSI overbought oversold indicator into very oversold levels below 30. Thereby kicking off the next up leg.

USD gold is down $23 from 7 days ago. It has clearly broken below the lower line in the uptrend channel. So there’s a good chance it will hit the next support level at $1900. Or maybe even down to the 200 day MA which is currently at $1858 but still rising.

But we are likely nearing the end of this corrective phase which will then set gold up for the next move higher.

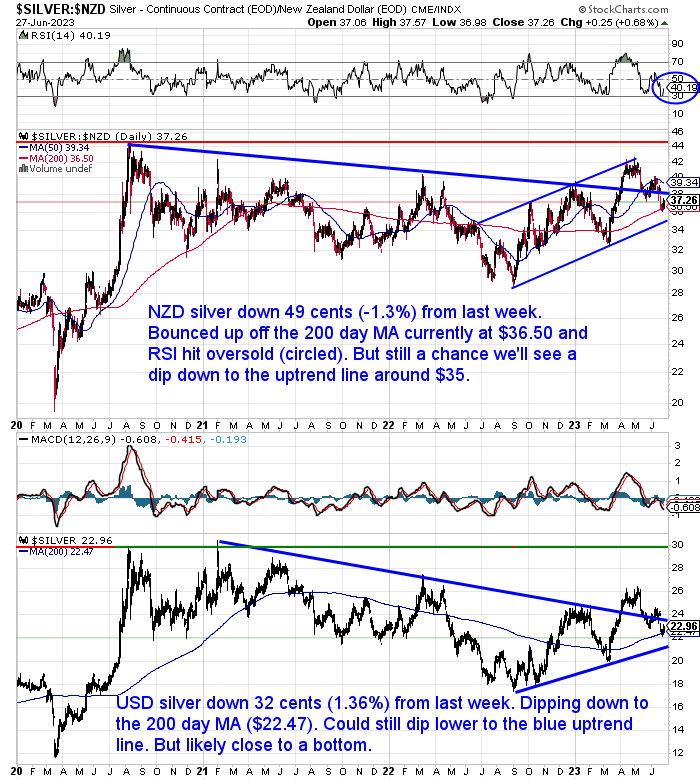

NZD Silver Drops to the 200 Day Moving Average

Silver in NZ Dollars dropped 49 cents (-1.3%) this past week. It dipped down to the 200 day MA and is up slightly off that today. We could still see silver dip down to the blue uptrend line which currently is at $35.

Likewise in USD terms, silver also hit the 200 day MA and is not far from the uptrend line.

Silver seems to be a bit further progressed in the corrective move compared to gold. Demonstrated by the fact it hit very oversold (30) on the RSI overbought/oversold indicator. So we might see it move back a bit higher before one last downdraft perhaps?

But our guess is that buying anywhere from current levels down to the uptrend line is likely to be a very good long term entry point.

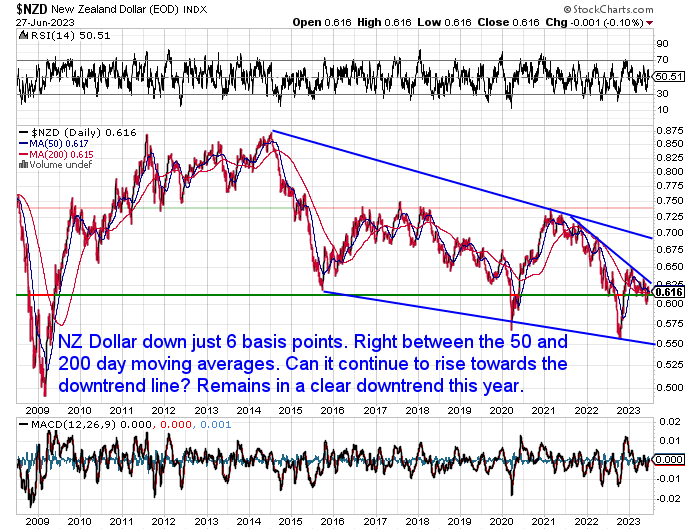

NZ Dollar Unchanged

The NZ dollar was basically unchanged from last week, down just 6 basis points. It sits right between the 50 and 200 day MAs. Watching for it to continue to rise up to the downtrend line. That would coincide with lower prices for local NZD gold and silver and usher in the final bottom in them.

Overall the Kiwi remains in a clear downtrend for 2023.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Is Now a Good Time to Buy Gold in New Zealand in 2023?

The NZD gold price hit a new all time high back in May. So many people are likely worried about buying near to what they might perceive as a top.

So let’s look at 6 indicators and what they can tell us about whether now is a good time to buy gold:

- NZ Dollar Gold Price Has Corrected – Good Time to Buy?

- What is the Longer Term Trend?

- Property and Stock Markets Are in a Downtrend

- Seasonality: Closing in on the Time of Year When Gold Often Rises

- Gold Sentiment – Most Negative Since February

- Next Wave Up May Have Begun

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

More on the Possibility of a BRICS Gold Backed Currency

Following on from last week’s email discussing Jim Rickards theory of a gold backed BRICS+ currency, Rickards has written more on this topic this week:

The Biggest Monetary Shock in 52 Years

The Only Way to Measure the Dollar

“The only objective metric for dollar strength is the dollar price of gold by weight since gold is not a central bank currency. This resolves any valuation conundrum as follows:

1. Dollar strength can only properly be measured in gold.

2. Gold is money but it is also a commodity.

3. BRICS are dollar poor but commodity rich.

4. A new BRICS+ currency will be linked to gold.

So the collapse of the dollar really means higher inflation and a much higher dollar price for gold. That means other commodity prices will rise in lockstep. A commodity boom favors BRICS generally speaking.

This dynamic could lead the BRICS+ currency to displace the dollar as a dominant payment currency more quickly than most expect because of the link to gold.

…The dollar stands to lose in value measured in gold or BRICS currency. The dollar will also lose value due to inflation resulting from the lower value. It will take more dollars to buy imported goods or take vacations abroad.

Moving money to stocks, bonds or savings accounts won’t protect you because they’re all denominated in dollars.

There’s a simple solution to this coming currency crisis. Just buy gold. That will preserve wealth and protect you from inflation. You can always sell the gold if you need cash; it’s just that you’ll get more cash than what you used to buy it. That’s what the BRICS are doing and you can too.

Time to hop on the BRICS bandwagon — with gold.”

Since we posted the Rickards article last week, we have come across a few other mentions of this BRICS+ currency.

For an Indian perspective:

BRICS Expansion Plan And Launching Of BRICS Currency To Decrease Influence Of US Dollar: Gaurav Gupta

Then this one also discussed a gold backed BRICS Bonds:

A BRICS Currency Could Shake the Dollar’s Dominance

Then the most mainstream mention came in an article republished at Fortune 2 days ago:

How long will the dollar last as the world’s default currency? The BRICS nations are gathering in South Africa this August with it on the agenda

So there is a bit of information floating about on the topic now.

Finally this one from Kitco which includes a projected gold price increase due to central bank buying:

“Emerging central banks are gearing up for a new monetary regime in which gold will play a vital role as a settlement mechanism, according to Goehring & Rozencwajg.

…Central banks have not only been a massive source of demand in the last two years, but they are also the driving force for this whole decade.

And this could be connected to a monetary regime change Goehring & Rozencwajg is forecasting. “The monetary regime changes in 1930, 1968, and 1998 were hugely stimulative for commodity prices, and we believe the monetary regime change that will take place this decade will be no different,” Goehring said.

The idea that the U.S. dollar is losing its reserve currency status has existed for years. But it has been nothing but noise. So what makes this time different?

There is a growing amount of evidence of countries moving away from the greenback, including Saudi Arabia talking about settling their oil in renminbi, all sanctioned Russian oil sales being paid in renminbi, Brazil wanting to settle its agriculture trade with China in renminbi, and France’s TotalEnergies willing to sell their LNG to China and accept renminbi.

But these efforts cannot be classified as a monetary regime change because China’s got a closed capital account, and the countries trading in renminbi cannot exchange it, Goehring pointed out.

This is where gold comes in. “How in the world would you ever be able to exchange renminbi? They’re talking about eventually settling it all up with gold,” Goehring said. “Any move by China to displace the U.S. dollar as a reserve currency must include some degree of gold convertibility. Foreign holders could then convert some portion of their trade surplus from renminbi into gold via the Shanghai gold exchange.”

…”Are we trying to set up this system by being able to trade in commodities outside the dollar? And if we get a capital imbalance — we got too much renminbi, or we need more renminbi — we can now settle it on gold,” Goehring said. “Are we exploring this idea of trying to undermine the dollar reserve status and settle things in local currencies and be able to eventually take out capital imbalances through gold? It’s an interesting idea.”

Goehring & Rozencwajg is bullish on gold for the rest of this year, projecting a break through $2,100.

Source.

US Inflation May be Bottoming Now – How About NZ?

Jim Bianco of Bianco Research has been putting out some interesting information of late.

Bianco had a lengthy interview with Adam Taggart of Wealthion discussing why he thinks inflation in the USA may be bottoming right now.

He also covered the same topic in just 3 minutes on Fox news here. Basically the base effect refers to the fact that a year ago US monthly inflation was at its highest. So now next month that highest number will drop out and next month will be compared to a lower number. But current rates are not hugely lower so the year on year number will start to go up.

This got us wondering how might the same thing work here in NZ?

Here we only get quarterly numbers. But last June was also the high at 7.3%. CPI only dropped a little and was 7.2% in both Sept and Dec quarters. But in March it was down to 6.7%. Odds favour the June number also being lower. So the base effect may not play such a role here for a few more quarters yet.

However the Fuel excise duty tax cut will end at the end of this month. As will diesel road user charges and public transport rates. So from 1 July we’ll see a 25 cent increase in fuel prices.

Thankfully fuel prices are quite a bit lower than they were when the cut was introduced in March 2022. They are about $1 less than a year ago. But this increase will still increase the prices of many goods due to the increased transportation costs. So it does have an amplified effect.

Inflation remains historically high. The increase in fuel taxes certainly won’t help. We’ll stick to our call that inflation and interest rates are set to stay higher for much longer than most people expect or that commentators and economists predict.

Plan accordingly and ensure you have protection from loss of purchasing power. Plus the chance to perhaps even increase it, if the US dollar gold price rises this year as Goehring predicts it will.

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|