We’re at the end of the second week of the national Level 4 lockdown.

So it’s worth reflecting on what will the impacts of the COVID19 lockdown be?

This article covers:

Estimated reading time: 11 minutes

There are many theories as to where the virus started. Debate about how bad it will be and how much worse it could have been, were it not for the drastic measures taken.

If you’re anything like us and read a bit of alternative media, you might have come to the same conclusion.

That is, the only thing we can be sure of is that we don’t know the full picture.

We do know it’s now illegal to swim, surf or do any exercise that isn’t close to home. But we have many questions…

We wonder why many small suppliers of food are closed and supermarkets only are open? Also is it safer to shop in a confined space than it is in an outdoor farmers market? If everyone is gathering in one indoor place could that in fact help to spread the virus?

Why are small town butchers and vege shops not “essential”?

We can’t buy seeds, or plants from nurseries. How are these not “essential” at a time like this?

But we can buy coffee machines and winter clothes online even though it’s still 22 degrees outside today. Do big retailers have more lobbying power than nursery owners and butchers?

Will we see plants thrown out like in the UK? Will there be food shortages down the line?

So there are a lot of questions to ponder right now.

We’re afraid not enough people are wondering whether we will get back all the freedoms that have been taken away in recent weeks?

It seems the majority are happy enough to go along as there “didn’t seem to be any other option”.

Will the Cure be Worse Than the Disease?

But we can’t help wondering whether the cure will be worse than the disease?

Mike Maloney highlights an article with just that title in this video.

There has been massive intervention into the economy globally by central banks and governments…

Timeline of US Federal Reserve Interventions In Response to COVID19

Here’s a timeline of what the US Federal Reserve has done care of Laissez Faire Today.

Remember there were already issues being papered over back in 2019 before the Virus hit.

“The timeline (which doesn’t even cover everything):

- Sept. 17, 2019: Fed injects $53 billion into repo markets

- Sept. 18, 2019: Fed injects $75 billion into repo markets

- Sept. 19, 2019: Fed injects another $75 billion into repo markets

- Sept. 24, 2019: Fed commits to “at least” $120 billion to repo markets

- Jan 20, 2020: Fed has injected $500 billion to repo to date

- Feb. 20-28: Largest weeklong stock market crash in history

- March 3: Fed issues emergency 50bps interest rate cut

- March 4: Market crashes again

- March 12: Fed injects $1.5 trillion

- March 13: Market crashes again

- March 16: Fed announces $700 billion QE

- March 16: Fed cuts interest rates 100 bps to ZERO

- March 17: Market crashes again

- March 20: Fed to conduct $1 Trillion in daily repo

- March 22: Fed announces QE Infinity!

Says Patrick Lewis:

“Its three most aggressive moves to date all transpired within a 10-day window. And in its latest unprecedented act, the Fed will begin buying corporate bonds on the secondary market as well as participate in primary issuances of corporate credit.”

Moreover, if that ain’t enough…

The Fed has expanded its purchase of mortgage-backed securities to include commercial securities.

And established a facility to issue asset backed securities to purchase student loans, auto loans, credit card loans… and on.”

What the RBNZ Has Done in Response to COVID19?

The Reserve Bank of New Zealand has not exactly been a slouch when it comes to interventions either. Here’s a summary of what they’ve been up to…

March 16

- Slashed the Official Cash Rate (OCR) from 1.0 percent to 0.25 percent. Will remain at this level for at least the next 12 months.

- Loosened banks capital requirements and delayed some regulatory changes to help banks roll out the Government mortgage payment deferrals and business finance guarantee scheme. Source.

March 20

- RBNZ Launches A Term Auction Facility. The RBNZ will lend to banks for up to 12 months, taking Government bonds, residential mortgage-backed securities, and other bonds as collateral. The aim is to prevent an increase in the cost of bank funding, and keep short-term interest rates for businesses and households low.

- FX swap market funding. Banks sometimes borrow money from offshore and swap the debt back to New Zealand dollars. The cost of this swap exploded. Aim is to keep the cost of overseas funding contained. And stop interest rates rising.

- The US Federal Reserve and the Reserve Bank of New Zealand established a $30bn US dollar swap line. This enables the Reserve Bank of New Zealand to borrow US dollars if it needs. This was also done in 2008.

- The RBNZ is now paying the OCR on all cash balances banks hold at the RBNZ (previously, banks were paid a lower rate if they held large balances). This will give the RBNZ greater control over short-term interest rates, keeping them closer to the OCR.

- Providing liquidity in NZ Government bond markets. Interest rates on New Zealand Government bonds shot higher as bond market liquidity dried up. Reaching 2.6% for 17 years, whereas a week prior to that the interest rate was 1.3%. The RBNZ is buying NZ Government Bonds on the open market, in an effort to provide liquidity. But, the amount of liquidity provided was tiny, and so had little effect on longer-term Government bond rates.

- Source.

March 23

- RBNZ Launches Large Scale Asset Purchase Program (NZ’s first Quantitative easing).

- RBNZ commits to buying up to $30 billion of New Zealand Government bonds over the next 12 months. They did this as other measures were not keeping long term interest rates from rising. Source.

March 30

- A new weekly Open Market Operation (OMO) will provide liquidity in exchange for eligible Corporate and Asset-Backed securities.

April 2

- Introduces a Term Lending Facility (TLF), a new longer-term funding scheme for the banking system, in support of the Government’s Business Finance Guarantee Scheme to help promote lending to businesses.

April 7

- RBNZ expands quantitative easing. Commits to buying up to $3 billion of local government bonds, in addition to $30 billion of central government bonds, to support liquidity. Source.

But we are also seeing major “stimulus” interventions by governments too.

US Government Stimulus “CARE” Package

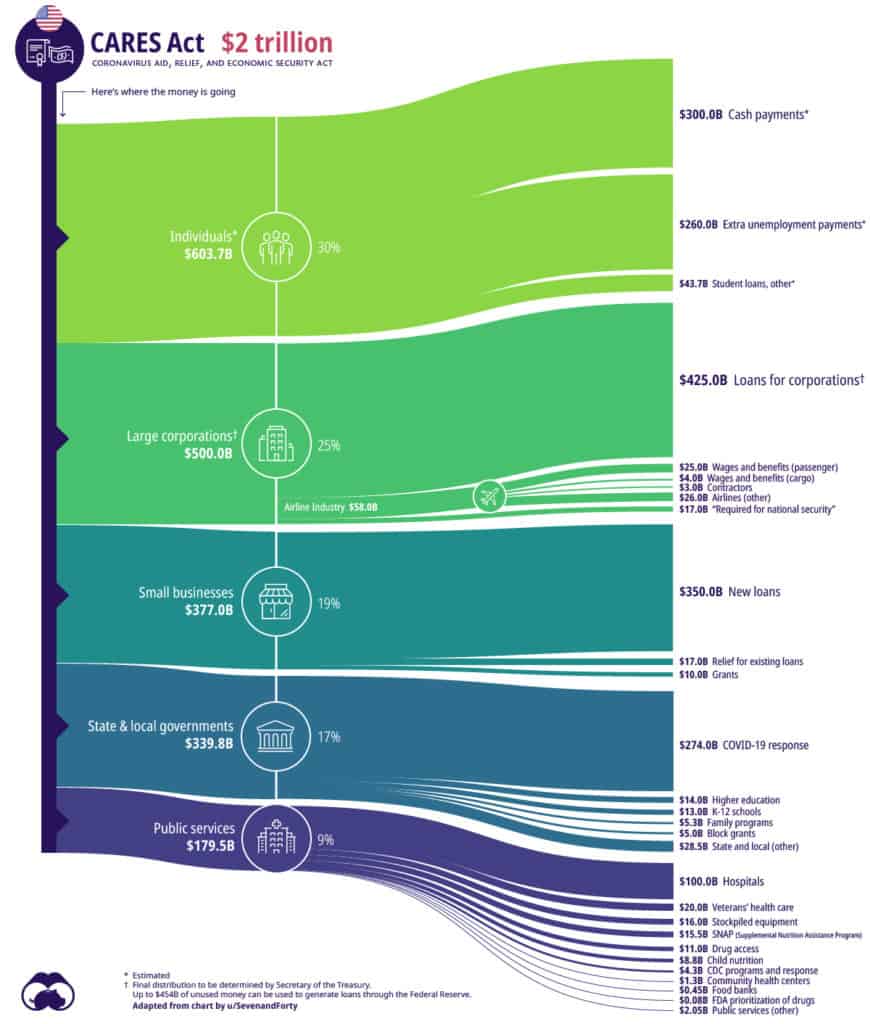

The US has enacted a $2 trillion package. $603.7 billion – 30% of the total – will go to individuals and families. This includes “helicopter money” — direct cash payments to individuals and families.

Source: The Anatomy of the $2 Trillion COVID-19 Stimulus Bill

New Zealand Government Support During COVID19 Lockdown

The New Zealand government was quick to roll out support programs. Which given they are the ones causing the hardship is probably fair enough.

This includes a wage subsidy scheme that has so far paid out $6.6 billion. The equivalent of 2% of gross domestic product (GDP) pre-COVID-19.

“More than 40% of New Zealand’s workforce is now being supported by the Government’s wage subsidy scheme.

1.073 million people, or 41% of those in employment as at December 2019 (the most recent labour market figures available), are being supported by the subsidy.

…Treasury estimates the 12-week scheme will pay out between $8 billion and $12 billion. For each full-time worker, businesses receive a lump-sum payment of $7,029.60, and for each part time worker $4,200.”

Source.

There are also six month principal and interest payment holidays for mortgage holders and SME customers whose incomes have been affected by the economic disruption from COVID-19.

Source.

What Will the Impacts of the COVID19 Lockdown Be?

So that is the easy part. Looking at what actions have been taken to date.

The hard part is determining what the impact of all these measures will be? Plus there are almost certainly to be even more interventions by governments and central banks in the future.

For example the IMF has just announced they may launch a new program to help address the “global shortage of dollars”, providing a backup to the Federal Reserve’s campaign to keep greenbacks flowing around the world economy.

3 Predictions

If you think things are going back to normal after the lockdown ends, then you should watch this video. It’s by Roger Hamilton, who heads up Entrepreneurs Institute.

We all need to be rethinking how our businesses will operate in the future. If you’re an employee you need to be thinking about how secure your job is. In both cases you need to be planning for what is coming…

Here’s a quick summary of his 3 predictions…

- This is only the first wave – be ready for the rest. Not necessarily that we will see a second virus wave, but more likely it will be the economic wave. Where governments keep borders closed from international travel for a long time. So hospitality and tourism aren’t likely to bounce back in a hurry.

- Governments will break down. Massive unemployment will mean even big companies will start shutting down. Irreparable damage to our economies will flow through to lower asset prices. Currencies will lose value in countries where there is massive money printing.

- We are moving into an era of micro economies. Communities will get together to trade amongst themselves such as which occurred in the great depression. With micro currencies and barter. Some will be digital and some will be physical currencies.

High Inflation Coming?

There can be a good argument made that the seeds of very high inflation are being sown currently.

The currency printing in 2008 didn’t result in very high inflation as only those “close” to this money got the use of it. It wasn’t released from the commercial banks balance sheets. So the 2008 Q.E. pushed up the prices of stocks and property. But not everyday goods and services (well according to government statistics anyway!).

But now we have these new measures such as helicopter drops direct to citizens, along with even greater quantitative easing (and probably more inventions to come). So the central banks may actually get their wish and create inflation in the long run.

Dead Cat Bounce?

In recent days we have seen share market prices bouncing back sharply on news that deaths are dropping in the likes of New York and Italy.

We’d say there is a good chance that this is the infamous “dead cat bounce”. This is where we see a bear market rally suck people back into the market before further falls come.

Much like occurred in 1930. Where people rushed back into stocks following the 1929 crash. Only to be wiped out in the next wave in 1930.

We could even see a deflationary plunge in the shorter term. Where prices of many things fall. It’s likely we’d also see even more interventions by the central planners to counteract this deflation.

Here’s something we wrote back in 2016 on this very topic: Inflation Versus Deflation and What Comes Next?

Impact on Gold and Silver

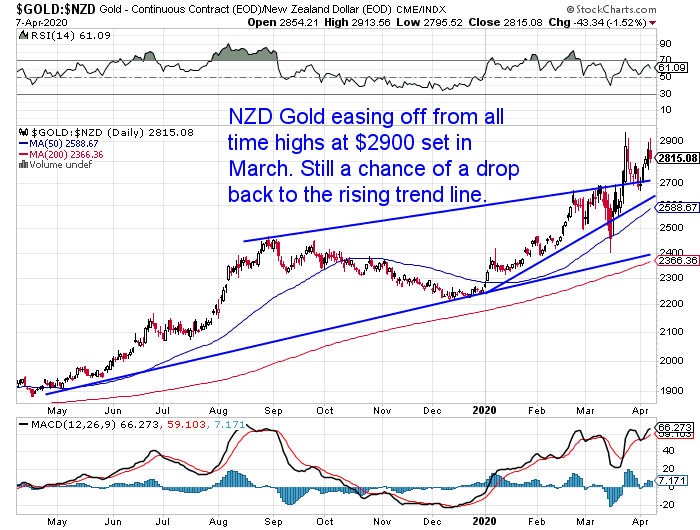

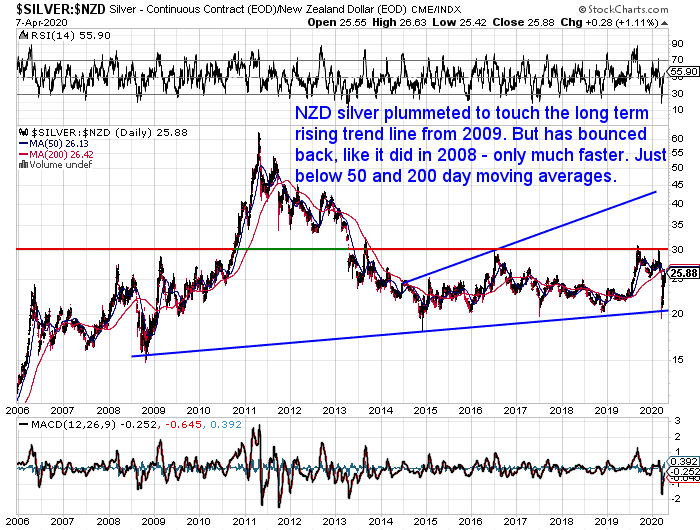

If we see a further fall in global stock markets, then we could see gold and silver dip again. Silver in particular would be at risk of another fall. Maybe back down to the recent lows?

But we still think if gold and silver were to fall, they will bounce back quicker than other markets. And gold in particular is likely to fall less. This is the scenario that played out in 2008.

That said both precious metals are holding up very well currently.

In the long run precious metals are likely to protect your existing wealth better than just about anything else. In a deflationary scenario they will hold their value better than other assets. In an inflationary one they will “rise” in price more than other assets.

So a safer bet than trying to pick when shares have bottomed.

We can all make predictions about what might come next. But no one knows for sure. The only assets without counter-party risk and a few thousand years history of holding their value seem like a pretty safe bet at the moment. For more on this theory see: Why Sleeping Beauty Should Own Some Gold or Silver

Pingback: Extreme Monetary Policy Now the New Normal in New Zealand Too? - Gold Survival Guide

Hi,

I am a previous customer and have held over the past year, I have read one commentator advising that the coming storm will drive a huge flood of money back into the US dollar, raising its level and driving down the cost of gold in the shorter term, any thoughts?

Pingback: NZers: Do You Hold Cash or Gold in the Coming Crisis?

Pingback: ASB Thinks the RBNZ Will Also Expand QE in May - Gold Survival Guide

Pingback: The Inverse Oil Shock - The Opposite of the 1970’s and The Gold to Oil Ratio - Gold Survival Guide

Pingback: Gold Cycles vs Property Cycles in 2020: When Will Gold Reach Peak Valuation? - Gold Survival Guide

Pingback: How Would Hyperinflation in the USA Affect New Zealand? - Gold Survival Guide

Pingback: RBNZ Ends Q.E./Currency Printing Early. How Will This Impact Precious Metals Prices? – Gold Survival Guide