Here’s some thoughts on the debate between holding cash or gold in an economic crisis. We look to be in the early stages of the crisis written about in 2015 right now…

In our article last week titled, What Will the Impacts of the COVID19 Lockdown be on the Global and New Zealand Economy?, we received the following comment G.B.:

I am a previous customer and have held over the past year, I have read one commentator advising that the coming storm will drive a huge flood of money back into the US dollar, raising its level and driving down the cost of gold in the shorter term, any thoughts?

We’re guessing that G.B. was referring to this recent article by Vern Gowdie:

The Case AGAINST Gold.

My position on gold is agnostic.

Neither ‘for or against’ the precious metal.

In August 2015, I made a recommendation in Gowdie Family Wealth to buy into a gold ETF at AU$141.

Currently, that gold ETF is trading at $250…a gain (on paper) of nearly 80% in less than five years.

In the 18 November 2019 issue of The Gowdie Letter, I updated my position on this investment…

‘With regards to the gold ETF, the initial recommendation in Gowdie Family Wealth [in August 2015] was the ETFS Physical Gold [ASX:GOLD].

‘In the near term, I intend placing a sell on this investment.

‘I appreciate that this view puts me at odds with almost everybody. Popular thinking says to buy gold in times of crisis.

‘However, I think gold is going to go through a significant correction.

‘Why?

‘There are a number of governments and corporates in developing and emerging markets holding US dollar (USD) denominated debt.

‘When the proverbial hits the fan, investors seeking safety of capital will pour money into US Treasuries.

‘This will force the USD to strengthen.

‘When that happens, the cost of the USD debt in local currency terms will go through the roof.

‘What do I mean by that?

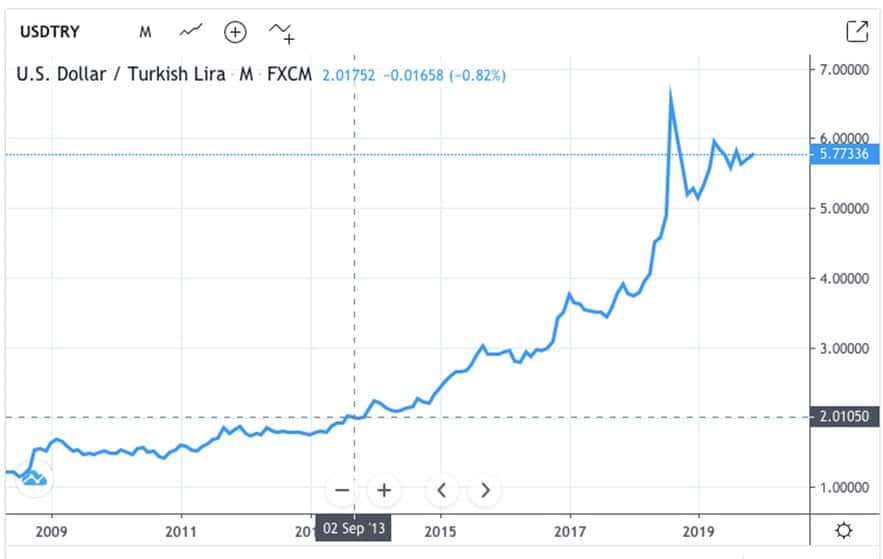

‘The following chart is the Turkish lira to USD.

‘In September 2013, the exchange rate was two Lira = $US$1.

‘Back in 2013, a Turkish business with a US$1 million loan had a two million lira liability.

‘Today, with the exchange rate at 5.77 lira to US$1, that USD loan liability in local currency terms is now 5.77 million lira.

‘An extra 3.77 million lira is not easy to find…unless you are holding a USD-based commodity.

‘What’s the world’s most readily tradeable USD commodity? Gold.

‘In my opinion, the looming deflationary environment plus the emerging and developing market selling pressure will conspire to force the gold price lower.

‘Should that scenario play out, then we can look at buying back into gold at a much lower price… possibly under US$1,000/oz.’

Since the financial crisis began, the downward pressure on the gold price (in US dollars) has mystified people.

Surely it should be soaring?

This extract from Reuters on 14 March 2020 adds weight to my belief that there’s a concerted effort to access US dollars to repay debts…

‘The dollar’s central role in this system is mainly due to the fact that its dominance in global commerce remains unrivalled.

‘It is by far the most widely used currency for loans and international trade, and many of the biggest commodities, such as oil and gold, are dollar denominated.

‘ …Governments, financial institutions and companies all borrow in dollars — and they need the greenback to pay those debts.’

Also, as I stated…

‘When the proverbial hits the fan, investors seeking safety of capital will pour money into US Treasuries.

‘This will force the USD to strengthen.’

Again, right on cue is this headline from the 9 March 2020 edition of The Wall Street Journal…

Source: The Wall Street Journal

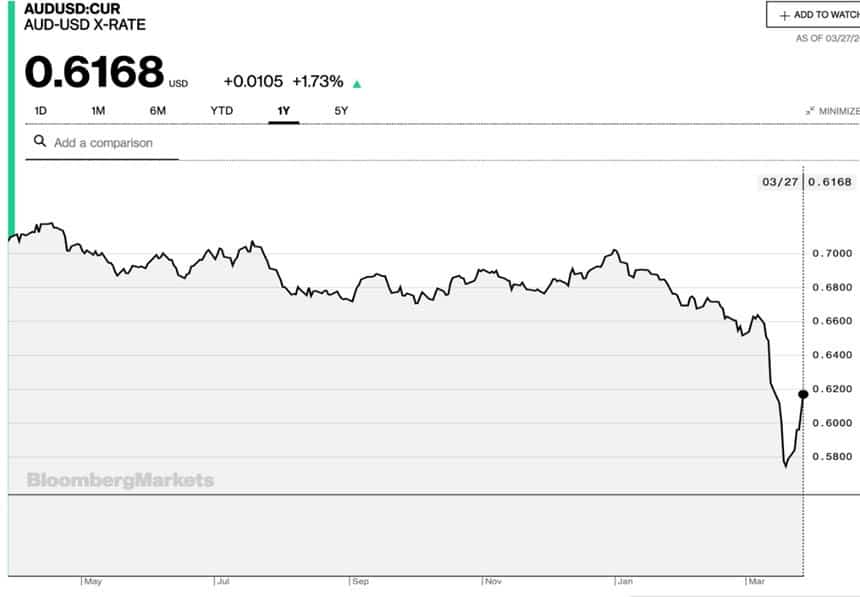

And that rush to buy US Treasuries resulted in this…the Aussie dollar plunged to 55 US cents.

The weakening of the Aussie dollar (AUD) against the USD is a positive for the AUD price of gold.

However, if the USD price of gold does fall below US$1,000, then that near 40% fall will not be offset by our dollar going to, say, 50 US cents.

This is why I’m looking to exit our GOLD position with a reasonable profit and reconsider buying back in at a later date.

Vern Gowdie Video

Here’s a recent video where Vern expands upon his comments above:

Deflation Before Inflation?

There is a very good argument to be made that we may see a deflationary fall first. In response, central banks would then come up with even more inventive ways to combat this. (This appears to have already begun with the US Federal Reserve implementing multiple new programs in recent weeks. As has the Reserve Bank of New Zealand)

In fact, here are a number of headlines we’ve seen in just the past few days, discussing deflation and depression scenarios. Some were in the mainstream press too:

One Bank Explains Why No V-Shaped Recovery Is Coming, And Why The Fed Will Nationalize Everything

U.S. consumer prices post largest drop in five years amid coronavirus disruptions

Another U.S.-Wide Housing Slump Is Coming

Ray Dalio predicts a coronavirus depression: ‘This is bigger than what happened in 2008’

Robert Shiller: Pandemic of fear could tip economy into a depression

Goldman says downturn will be 4 times worse than housing crisis, then an ‘unprecedented’ recovery

US Import, Export Prices Plummet In March As COVID Deflationary Drag Strikes

Top economist: The 1930s Depression was ‘Great.’ This one might be greater

Even If the Fed Keeps Pumping Money, We May Still See Deflation

How Deflation Could Doom the Economy to a New Great Depression

Here comes the great deflation threat

Massive Stimulus May Boost Inflation The Wrong Way: Stagflation

So perhaps a deflation is coming?

Coincidentally, back in 2015 we read a similar opinion from Vern and wrote the below response to it. What we said back then still applies now. So check that out. It includes important considerations for New Zealanders compared to Australians. At the end we also give an update for 2020 with a couple of other points to consider…

NZers: Do You Hold Cash or Gold in the Coming Crisis?

Over the weekend we received an interesting email from Vern Gowdie in the Daily Reckoning Australia, headed “Do You Hold Cash or Gold in the Coming Crisis?”

It gave a good run down of how gold performed in the 1970’s, during and after the 1987 crash and also during the 2008 financial crisis.

He explained how all the money printing since 2009 led many to believe that hyperinflation was just around the corner and that is what took gold up to its 2011 high. But how since then it has fallen 40% (in USD terms). He then went on to say how deflation has been the main issue in recent years.

Below is an excerpt from the article where he then makes the argument for being wholly in cash in the lead up to the crisis he sees coming. After that we’ll give our take for New Zealanders. This is important, as there are some definite differences to consider compared to his Australian audience.

(By the way if you get the chance, check out Vern’s book “The End of Australia”, as much of what he thinks will have happen in Australia has implications for us here in NZ too.)

“There is asset price inflation, but economic deflation — the world can make far more widgets than there is demand for those widgets.

Since 2008 countries, corporations and households (to a lesser degree) have all taken on more debt. And hell, why not? When central banks are giving it away in plentiful supply for next-to-no cost.

Therein lies the problem with the next crisis. A lot of this newly acquired debt is in US dollars. Emerging markets have US dollar based debts to the tune of US$9 trillion.

It’s reasonable to assume some of this US$9 trillion has been lent to a few ‘good time Charlies’ who really aren’t good for the money. When the next (and even more severe) credit crisis hits, the scramble is going to be on to pay back those US dollar debts.

Everything goes on the auction table in a crisis…everything except cash.

In my opinion gold will — rightly or wrongly — be sold off as borrowers rush to raise US dollars to satisfy the creditor demands.

1. What about gold in Australian dollar terms?

2. How safe is cash?

The Australian dollar got hammered in 2008/09 as investors rushed to buy US dollar base Treasury Bills. I expect the same to happen next time, but only a much harder fall. We could well see the Aussie dollar touch below 50 cents (which it has done once before in the early 2000s).

From our dollar’s current level that would be a fall of 30%.

If the US dollar price of gold also falls 30% (back to the US$700 to $800 range), then it is a zero sum game as far as the Aussie dollar price of gold.

You can play with those percentages but the falling Aussie dollar will soften the impact of a falling US dollar gold price.

If you think this is a probability, then in my view it is simply better to own US dollars and pick up the entire 30% currency depreciation gain.

How safe is cash? Will there be a bail-in? Will cash be made illegal? Will we be limited as to how much the ATM can dispense on a daily basis?

The simple answer is, I’m not sure. Until the system is tested we do not know the level of pressure it can withstand and what the policymakers’ responses will be.

As it stands today, we have a Government guarantee to protect deposits up to $250,000 per taxable entity per approved deposit taking institution. Personally I think the government will honour that guarantee — for no other reason than if the government wants to restore calm and maintain any shred of confidence in the banking system, it must stand behind the guarantee.

Will there be cash controls? Probably. So make sure you have a few dollars tucked away somewhere safe.

However the bigger issue for me is not whether I can get my hands on actual dollars but whether I’ll be able to electronically transfer money to say the Perth Mint to buy gold, CommSec to buy shares or a Solicitor’s Trust account to buy property.

I think electronic transfers will still exists — otherwise no one will be able to buy or sell anything and the whole system comes to a grinding halt.”

Source.

Our Take For NZ’ers on Whether to Hold Cash or Gold in the Coming Crisis

These are some excellent points he makes. If we get a similar crisis to 2008, there will be a rush back into the US Dollar. [2020 Update: This has been the case, with the US Dollar strengthening compared to the likes of the NZ and Aussie Dollars]

Also just as Vern says if this happened the Aussie Dollar will tumble, and so will the NZ Dollar. And so gold in NZ dollars will also hold up much better than gold in US Dollars, much like gold in Aussie dollars.

So then how about the point that “it is simply better to own US dollars and pick up the entire 30% currency depreciation gain”.

There are two factors to consider here we reckon:

1. Could You Actually Buy Gold if it Falls?

Verns case that we may yet see another fall for gold and silver in the “deflation before inflation” phase, is a similar position as author Mike Maloney takes. However Maloney also notes that while that paper price of gold may drop below US$1000 and silver could plunge to single digits on the futures market, you won’t be able to actually buy any physical metal at this price as it’s likely demand will sky rocket and premiums will rise as they did in 2009.

So while you might have made a gain on holding US dollars versus NZ dollars, you may not then be able to buy gold (or silver) here in New Zealand at prices anywhere close to the paper spot price of gold or silver. (We recall silver selling for well over 30% above the spot price back in 2009 here in NZ).

[2020 Update: This is just what we have seen recently. With premiums on physical gold and silver rising with the huge increase in demand during the share market crash in March 2020. If we were to see gold fall further, this demand is also likely to increase. But the premiums will likely increase even more than they have to date. So you may not be able to buy gold at the lower price Vern expects.]

2. The Differences Between Australia and New Zealand

The second factor to consider are the differences between Australia and NZ in considering the points he raises such as “How safe is cash? Will there be a bail-in? Will cash be made illegal? Will we be limited as to how much the ATM can dispense on a daily basis?”

Unlike Australia New Zealand does not have a $250,000 bank deposit guarantee. In fact NZ has no bank guarantees at all. At any level. Whatsoever. Rather the Reserve Bank of New Zealand already has bail-in provisions in place. This means if a bank fails here depositors will receive a “hair cut” on their deposits and would only get back a percentage of their funds.

See this previous article and video of ours if you don’t know much about the RBNZ Bail in Scheme:

RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

Therefore to us sitting completely in US dollar cash would seem too big a risk to take here in NZ. You may make say a 30% gain if the NZ dollar fell against the US dollar. But that gain could well be wiped out if the financial crisis also caused bank failures, with no deposit guarantee to protect your savings.

Have Some Cash – But Own Some Gold and Silver Too

So by all means it makes sense to have some cash. But we also prefer to hold the only assets with no counterparty risk – gold and silver.

Is Vern anti gold? No not at all – he finishes his article with the comment:

“Because I do think gold will come into its own after the next crisis.

When faced with a crisis, far greater than 2008/09, central bankers will literally go for broke.

Then it’s a fair bet we’ll see the inflation genie released from the bottle.”

So we merely disagree with him on when the time is to purchase gold (and/or silver). We don’t like the idea of being all in cash – particularly in a country with no bank deposit guarantees. And if gold and silver bounce back like they did in 2008/09, then you’d only make a loss if you sold following any potential fall.

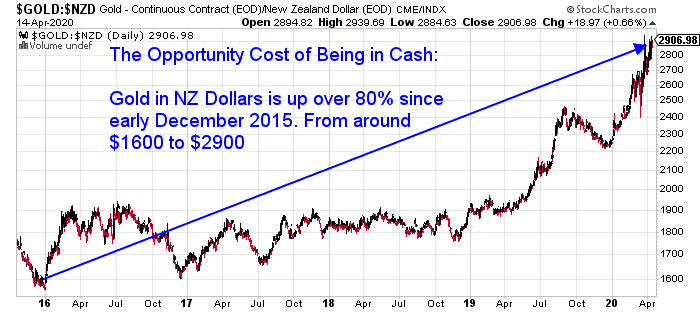

2020 Update: The Opportunity Cost of Being in Cash

There is also the opportunity cost of not holding anything other than cash. Since we wrote the above comments in 2015 the gold price in NZ Dollars has gone up by over 80%. From around NZ$1600 to close to $2900. Just for safely sitting there doing nothing. Meantime cash in the bank has earned at most a few percent in interest on fixed deposit.

What if There Isn’t a Major Dip in the Gold Price?

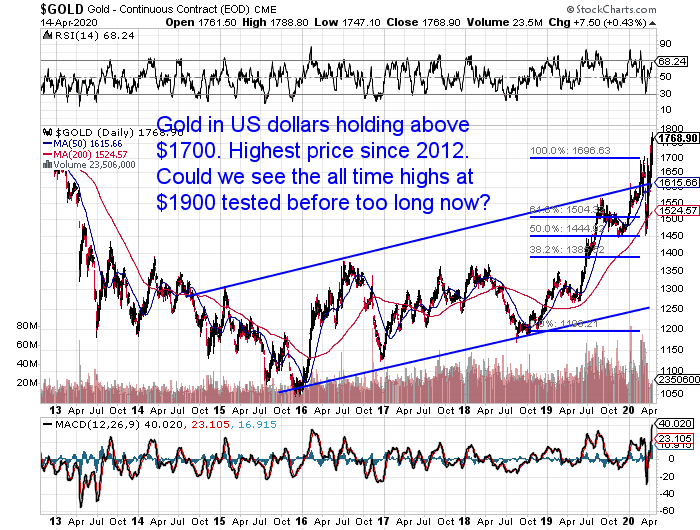

Gold in US Dollars also may be breaking out right now. Getting above $1700 for the first time since 2012.

So you should also consider that there is no guarantee we see a major fall in gold. We may have already seen the fall – down to US$1450 in March. So if you own no gold you risk buying it at much higher prices in the future. All after waiting for the fall that never comes.

Related:Paper Gold vs Physical Gold – What Should You Buy?

Editors Note: This article was originally published 3 December 2015. Updated 15 April 2020 with new reader question, new post from Vern Gowdie and new commentary on this.

Pingback: ASB Thinks the RBNZ Will Also Expand QE in May - Gold Survival Guide

Pingback: SILVER AND COVID-19, CAPITALISM’S BLACK SWAN - Gold Survival Guide

Pingback: Where Will the NZ Govt Get the Money for its Dramatic Increase in Spending? Tax, Borrow or Just Print it? - Gold Survival Guide