Prices and Charts

NZD Gold Challenging March All Time Highs

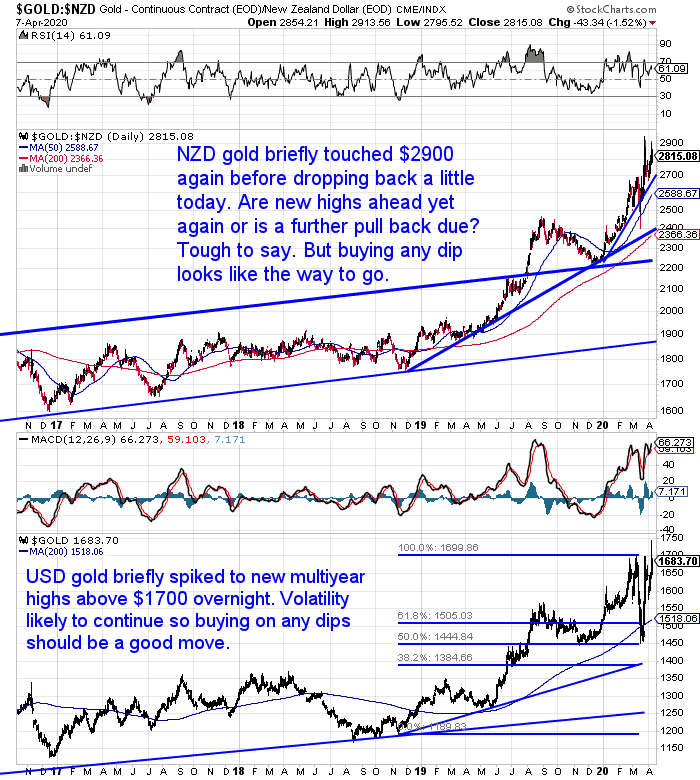

Gold in New Zealand Dollars was up just under 4% this week despite the NZ dollar also bouncing back a bit. NZD gold spiked up close to the March high just above $2900 per ounce before pulling back today. Currently just under $2800 again.

Looking at the chart below it is clear that in 2020 the right call has been to buy any dip in NZD gold. As the trend has been sharply higher despite the volatility.

That’s likely to be a good mantra to observe in the future too.

Silver Bouncing Back Even More Strongly

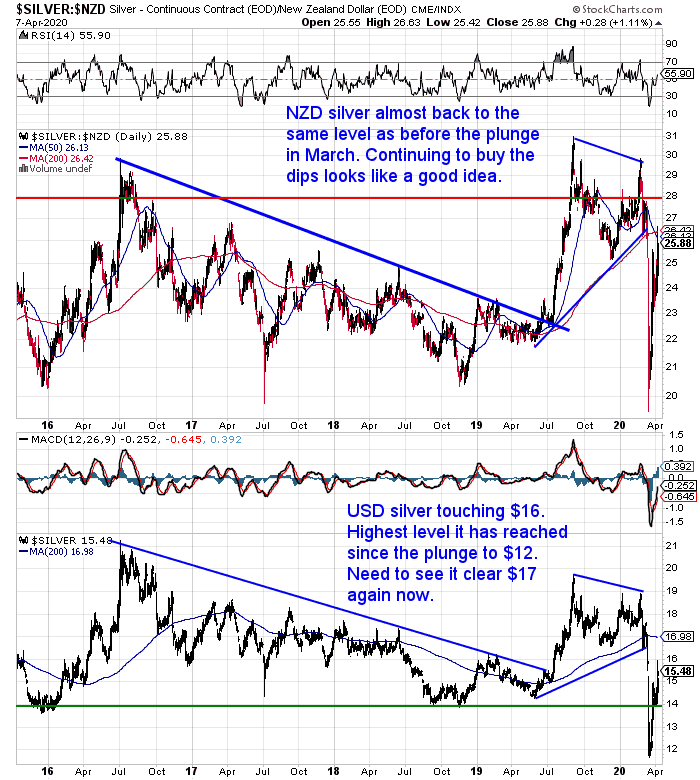

NZD silver is up 6% from a week ago. Outperforming gold and back close to where silver was before the plunge in March.

Where to next for silver is a harder call to make than for gold though. As for now silver is still under the 50 and 200 day moving averages. More thoughts on that in this week’s feature article below.

Kiwi Dollar Continues to Bounce Back

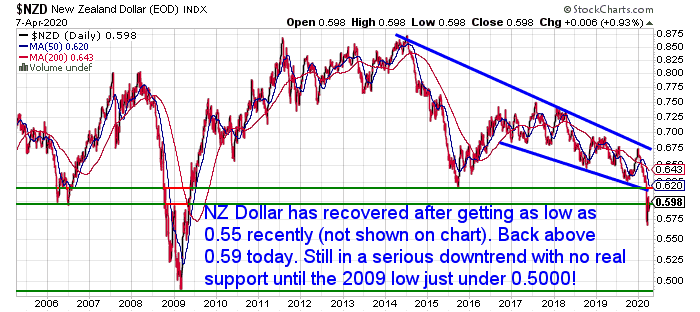

As noted already, the Kiwi dollar has also bounced back a bit this week. Although it has been unable to get back above 0.60. Until the outcome of the lockdown is clear, we might see the Kiwi range bound around here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

What Will the Impacts of the COVID19 Lockdown be on the Global and New Zealand Economy?

We’re at the end of the second week of the national Level 4 lockdown.

So it’s worth reflecting on what will the impacts of the COVID19 lockdown be?

We cover a lot of ground in this article including…

- Will the Cure be Worse Than the Disease?

- Timeline of US Federal Reserve Interventions In Response to COVID19

- What the RBNZ Has Done in Response to COVID19?

- US Government Stimulus “CARE” Package

- New Zealand Government Support During COVID19 Lockdown

- 3 Predictions on What is Yet to Come

- High Inflation Coming?

- Dead Cat Bounce?

- Impact on Gold and Silver

Major Gold Refiners Reopening – Will Gold and Silver Premiums May Now Fall?

Just like 2008 saw premiums rise while spot price fell. We have seen a similar occurrence recently caused by a massive surge in demand, coupled with the closure of a number of refineries and mints.

Bullionvault this week reported that…

“Three of the world’s biggest gold refineries, Valcambi, Argor-Heraeus and PAMP, said they will partially reopen after a two-week closure that disrupted global supply of the metal.

Together, says Reuters, those 3 process about 1,500 tonnes of gold a year – around 25% of total Good Delivery gold bullion bar production – also transforming large bars into ‘retail’ products such as small bullion bars and gold coins, as well as producing even higher purity metal for electronics and medical use.

Fears that it would be impossible to turn enough 400-ounce bars stored in London into 100-ounce bars used in New York drove US gold futures sharply above London prices after the refiners closed, and has also spurred the launch of a new Comex contract, deliverable with London standard bars through the so-called ACE system.”

So perhaps we can hope to see premiums above spot price for physical gold and silver bars and coins drop from here? Maybe not just yet…

“The Swiss reopening is also “likely to ease some of the tightness in the marketplace,” says Rhona O’Connell at brokerage INTL FCStone, “although logistics remain [difficult] in terms of delivery.

“Trucking is obviously an option within continental Europe, within strict limits, but airborne delivery is still going to be an issue. This is part of the reason why the cash to June spreads on Comex remains bloated as risk management is still to the forefront.”

So maybe these higher premiums will be around for a bit longer yet unfortunately.

Restrictions on NZ Bullion Refiners

Local bullion producers are unable to refine gold and silver. They also can’t dispatch any products out. So any orders received but not shipped out before the level 4 lockdown will remain with the local supplier. Rest assured they are securely stored and fully insured.

We continue to be able to trade online and by phone. Although there are limited products available. Due to the above restrictions and also to the high demand that preceded the lockdown, which cleared out the stocks of physical gold and silver worldwide. So there will be delays with any orders made as stated below.

Limited Stock Available

There are also many mints and refineries across the planet that have been closed due to COVID19. Further reducing stocks.

Our offshore suppliers have limited products available. However one continues to refine and has been officially declared a Critical Manufacturing Facility by the US Federal Government and essential to continue production based on their contracts and products. They are producing silver products that are directly being used for COVID-19 response in Italy.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Local Gold and Silver Bars

We can lock prices in for local gold and silver bars. However there is a 12+ week delay on delivery due to the lock down and demand that needs to be fulfilled from pre-lockdown.

Imported Bullion

We have monster boxes of 2018 Fiji Pacific Dollar 1 oz Silver Coins. These are the only 1oz silver coins we have been able to find that aren’t in multiple month back order. 4-5 weeks to be delivered to New Zealand

- 999 Fine Silver

- Legal Tender in Fiji

- Maximum Mintage: 250,000

- Sealed in Tubes

- Diameter: 39mm

There is only a 5-10 day delay for gold products to be dispatched from our offshore supplier. So orders should be in New Zealand in 3-4 weeks. The only unknown currently is whether the likes of Fedex and UPS can deliver to your door. Or whether imported bullion will instead be held at their secure depots until level 4 restrictions are lifted.

Extreme Monetary Policy Now the New Normal in New Zealand Too?

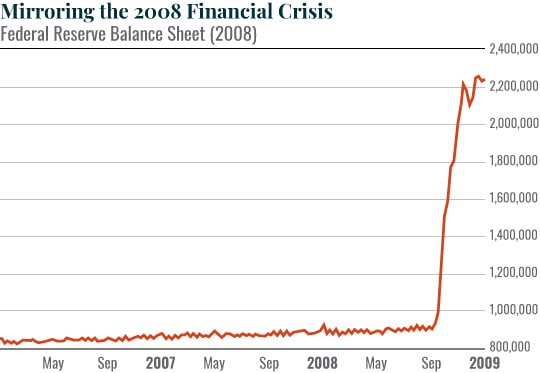

One of the impacts of the COVID19 crisis looks to be permanent interventions by central banks. Graham Summers this week made the point that “Extreme Monetary Policy Is the New Normal”.

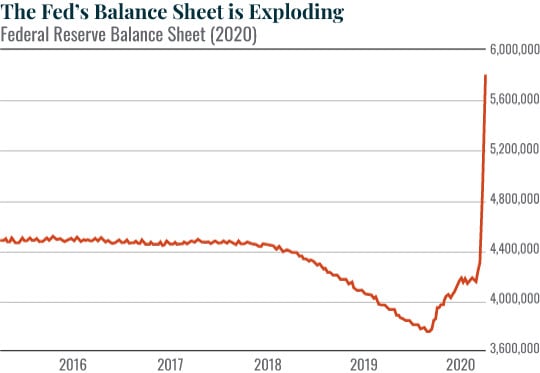

“In the last month, the Fed printed $1.3 TRILLION (with a “T”), or 1,300 billion dollars.

As a result of this, the Fed’s balance sheet has gone vertical, to a new all-time high of $5.8 trillion. To put that amount into perspective, it’s larger than the GDP of Japan, the third largest economy in the world.

By the way, that $1.3 trillion is the largest monthly increase in the Fed’s balance sheet since Lehman Brothers collapsed at the depth of the 2008 crisis.

By the way, that $1.3 trillion is the largest monthly increase in the Fed’s balance sheet since Lehman Brothers collapsed at the depth of the 2008 crisis.

So my question to the Fed is this…

If things are going fine and you’ve got this situation under control… why are you printing money at a pace not seen since the worst month of the worst financial crisis in 80+ years?

This just confirms what I’ve been arguing since 2008. The Fed can never stop intervening in the markets.

Once a central bank begins using extraordinary monetary policies to prop up the financial system, those policies quickly become normalized. Meaning the system NEEDS them to continue forever.

Put another way, I believe the Fed is going to be forced to intervene in the markets more and more going forward. Fed officials can say whatever they like, but as long as the Fed is printing money by the hundreds of billions of dollars per week, the real story is that the Fed is the only game in town.”

We can likely extrapolate this out to down here in New Zealand then. The RBNZ has begun the first Quantitative Easing or currency printing in New Zealand. So odds are, just like the Fed and every other central bank that has gone down the QE path, the RBNZ will also have to continue with extreme monetary policy – indefinitely.

Therefore, we can expect more distortions and bigger dislocations in markets into the future as a result. As the central planners try to avoid any crashes, they likely just set us up for an even bigger one down the line.

As we point out in this week’s feature article, no one really knows what happens from here. But the only financial assets that have no counterparty risk, and have stood the test of time for thousands of years, seem like a better bet than just about anything else for your savings currently.

Let us know what you are after and how much you are looking to spend and we can recommend what products are available.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: ASB Thinks the RBNZ Will Also Expand QE in May - Gold Survival Guide

Pingback: What Would Negative Interest Rates Mean for New Zealand? - Gold Survival Guide