|

|

|

| Call David on 0800 888 465 to discuss your silver and gold

requirements. |

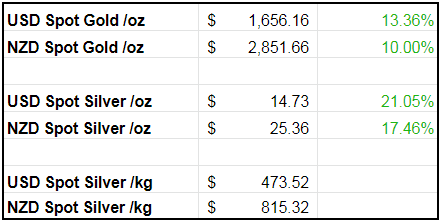

| TODAY’S SPOT PRICES AND PERCENTAGE CHANGES |

|

|

|

|

|

|

| LOOKING TO SELL YOUR GOLD AND SILVER? |

|

|

| Buying Back 1oz NZ Gold 9999 Purity |

$n/a |

| Buying Back 1kg NZ Silver 999 Purity |

$n/a |

|

|

|

|

| TODAY’S CHARTS & COMMENTARY |

|

|

| Offshore Gold and Silver Commentary: |

|

|

| Since our last email on Friday, in the offshore markets, gold in US dollars rallied around $195 to $1656.16 per ounce.

Silver gained around $2.56 cents to $14.73 per ounce.

|

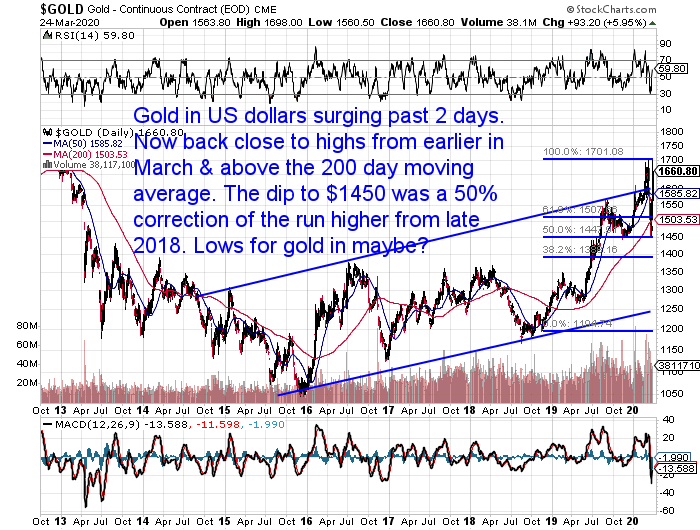

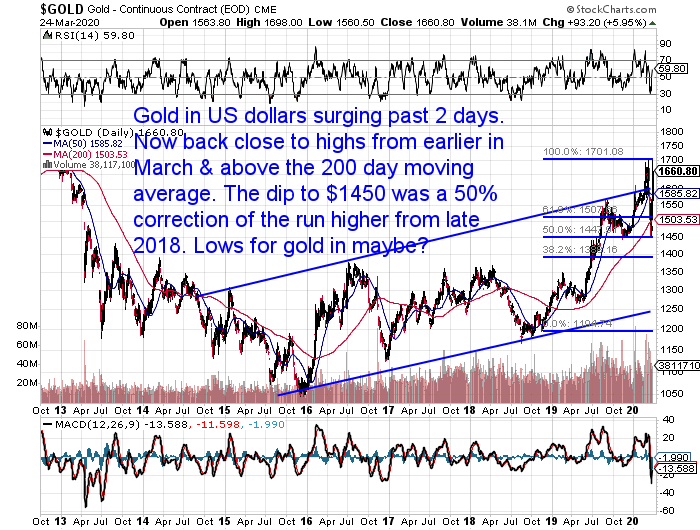

| Short Term Gold Chart in US Dollars |

|

|

USD gold has surged higher the past 2 days. Now back close to the highs from earlier this month.

Once again well above the 50 day and 200 day moving average. $1450 was a 50% retracement of the rise from late 2018.

So the lows may now be in for gold.

|

|

| |

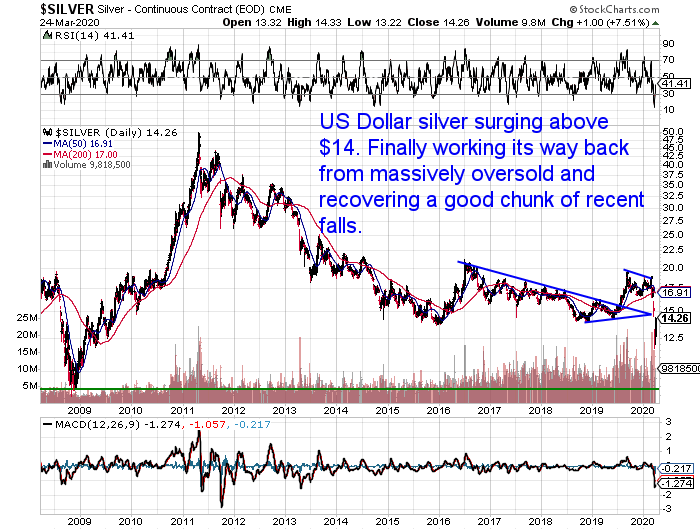

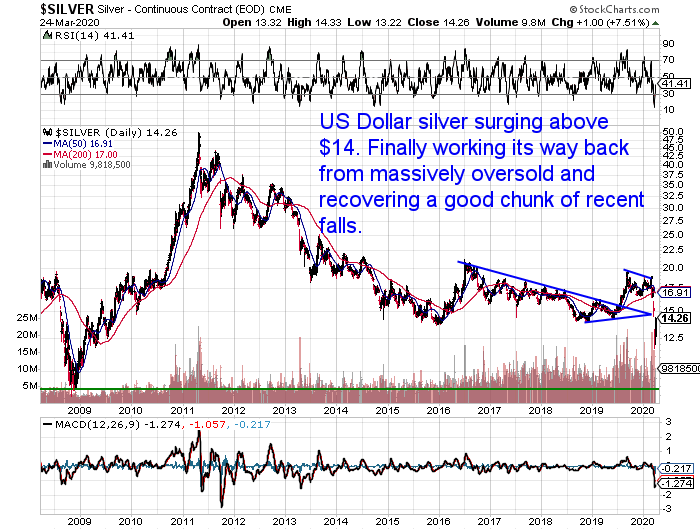

| Short Term Silver Chart in US Dollars |

|

|

Silver in US dollars has actually out-performed gold over the past couple of days. Moving up above $15 as we type. Silver has regained a good chunk of the massive fall from last week.

We’ve been saying, silver looks to be following a very similar pattern to the 2008 crash. Where it followed sharemarkets lower and also fell more than gold. However, back then like gold, silver bounced back hugely. Also faster than the share markets did. That looks like it might be happening already. if that is the case it would be much faster than in 2008.

As stated above the difficulty is that the lock down means physical silver is not currently available for pick up or delivery. But we can still lock prices in for later delivery.

|

|

| |

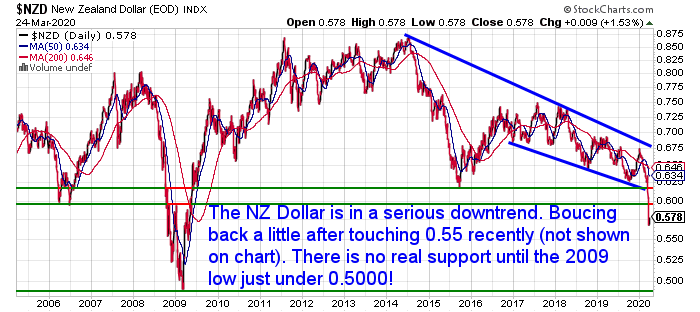

| Gold and Silver Commentary in NZ Dollars: |

|

|

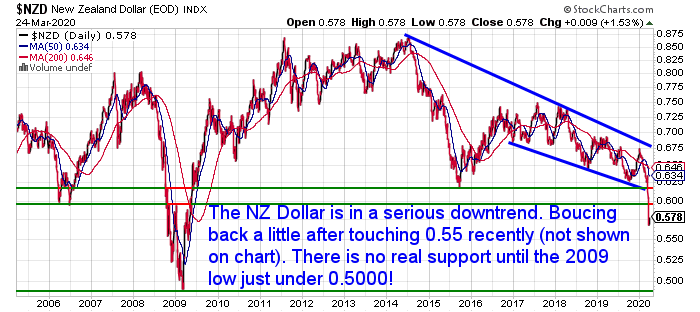

Here in NZ the kiwi dollar is higher at 0.5808. Got as low as 0.55 in recent days (although not shown on the chart below). Now well below the support line at 0.6000. There is not much support now until the 2008 lows just below 0.50! Could we be headed there in the not too distant future?

Since Friday, NZD gold has rallied around $259 to $2851.66 per ounce, while silver gained around $121 to $815.32 per kilo, or in ounces up $3.77 to $25.36.

Late update – silver is now at $26.53.

|

|

|

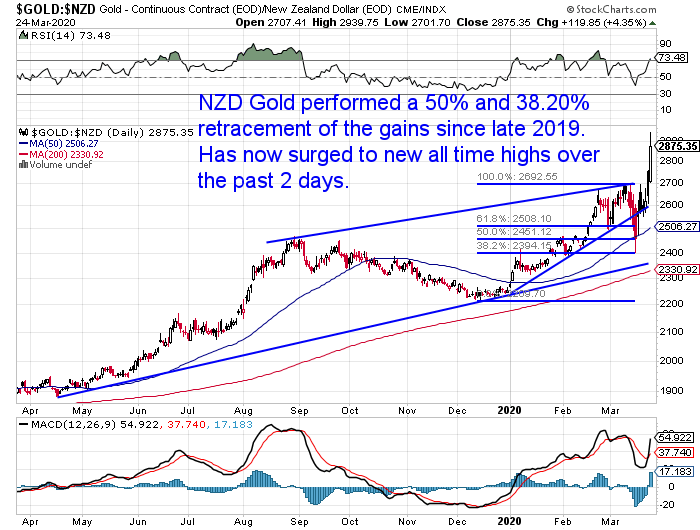

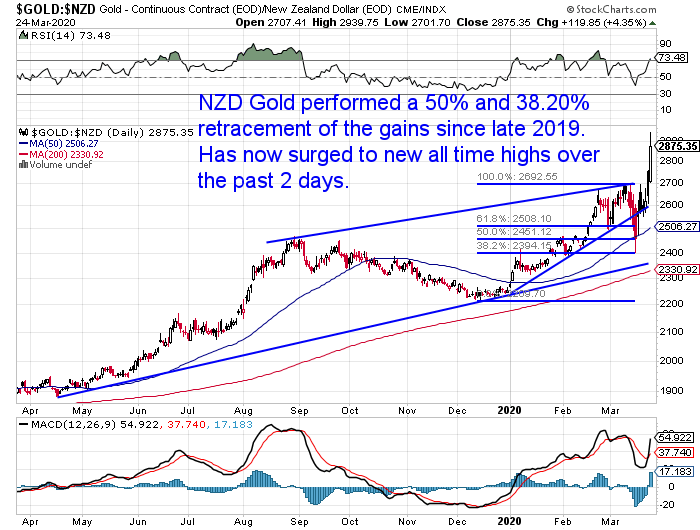

| Short Term Gold Chart in NZ Dollars |

|

|

Gold in NZ dollars has jumped massively in recent days.

The recent fall took gold down to the 50% and 38.2% fibonacci levels. As suspected that is all the fall we have seen before this bounce back.

Gold is holding up much better than just about every other market. Any pull back looks like being a definite “buy the dip” opportunity.

If 2008 is anything to go buy, even if gold did go lower, it will likely only be for a short period of time, before bouncing back strongly. We may have seen all the correction we are going to.

|

|

|

|

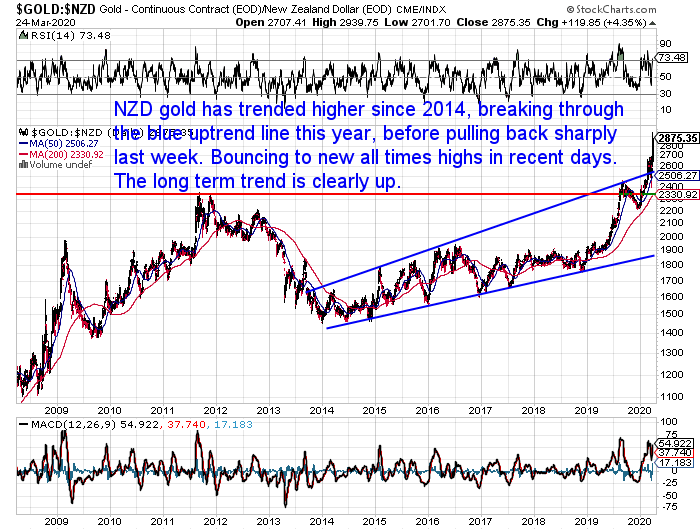

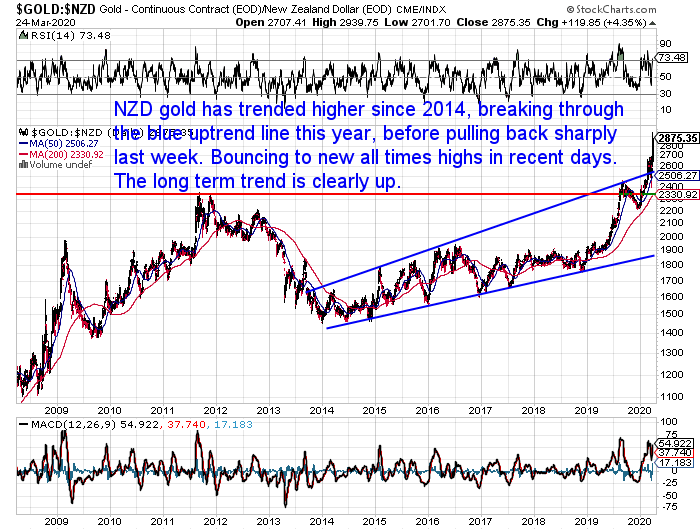

| Long Term Gold Chart in NZ Dollars |

|

|

| NZ Dollar gold pulled back – but not for long. Now breaking clearly higher than the long term uptrend line.

What we had been saying has proven to be the case… consider layering in from here, in case we don’t see much more of a correction.

|

|

|

|

|

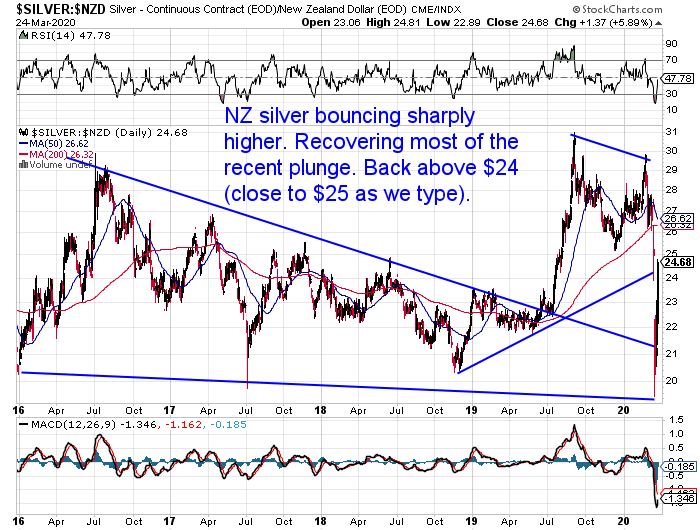

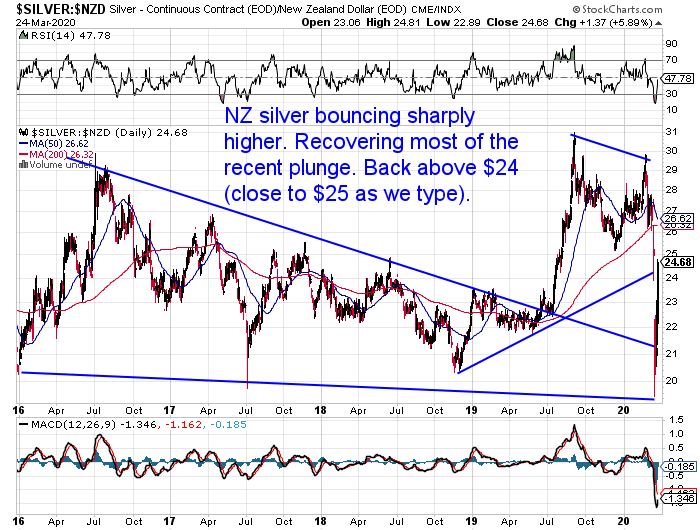

| Short Term Silver Chart in NZ Dollars |

|

|

| Silver in NZ dollars bouncing back massively today.

As we type it has now risen above $26. That means NZD silver has already regained all the losses of last week.

We’ve been saying, this reminds us very much of 2008 when silver plunged before rising sharply in the following years. But this has all happened in only a week!

|

|

|

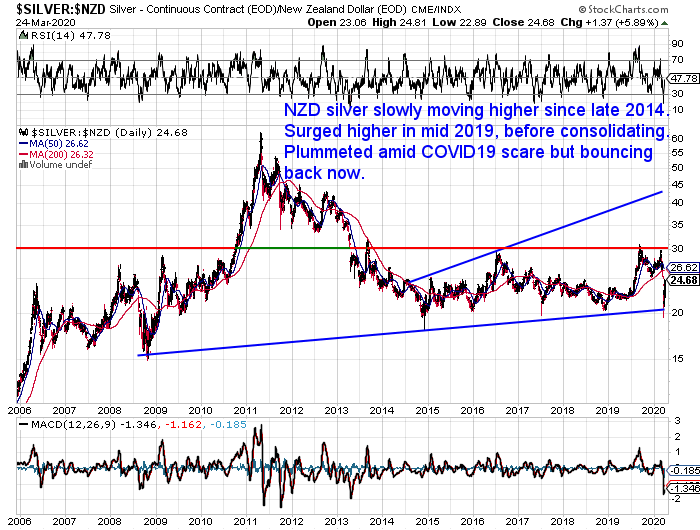

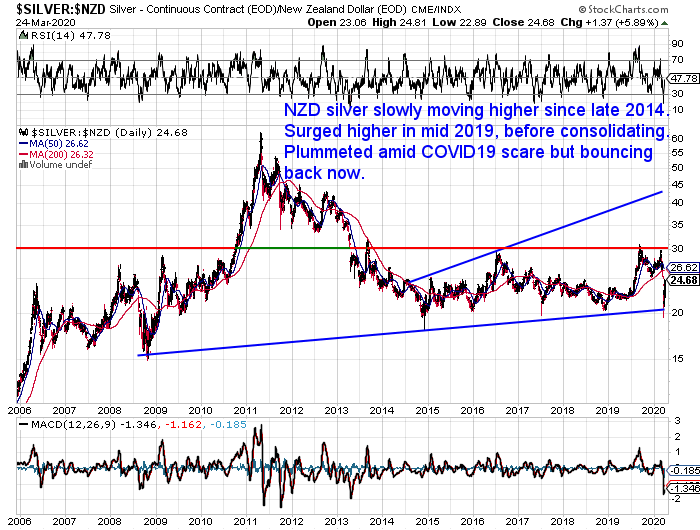

| Long Term Silver Chart in NZ Dollars |

|

After the strong moves higher in the third quarter of 2019, and the ensuing correction, NZ silver had been rising since December.

Recently plunged right back down to the long term uptrend line from way back in 2008.

But now shooting higher to get back to recent price levels.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The silver to gold ratio (how many ounces of silver to buy an ounce of gold) is down sharply to 106 as we type.

Silver is still incredibly cheap compared to gold today.

We’ve been saying, if we use use the 2008 crash as our guide, silver will likely rebound faster than gold at some point. Perhaps that is starting now?

|

Pingback: Update on Bullion in New Zealand Post Lock Down - Gold Survival Guide