This Week:

- Gold & Silver in NZ Dollars: 2018 in Review & Our Punts for 2019

- Gold/Silver Power Higher Over the Holidays

- What Do You Mean There is No Safe Haven?

- Best Time to Buy Gold since 2001?

Prices and Charts

Gold Powers Higher Over the Holidays

Just to keep us on our toes, gold and silver did the complete opposite to what they have often done over the low volume Christmas and New Year holiday break.

Instead of sharp falls we instead saw a very sharp run higher in prices.

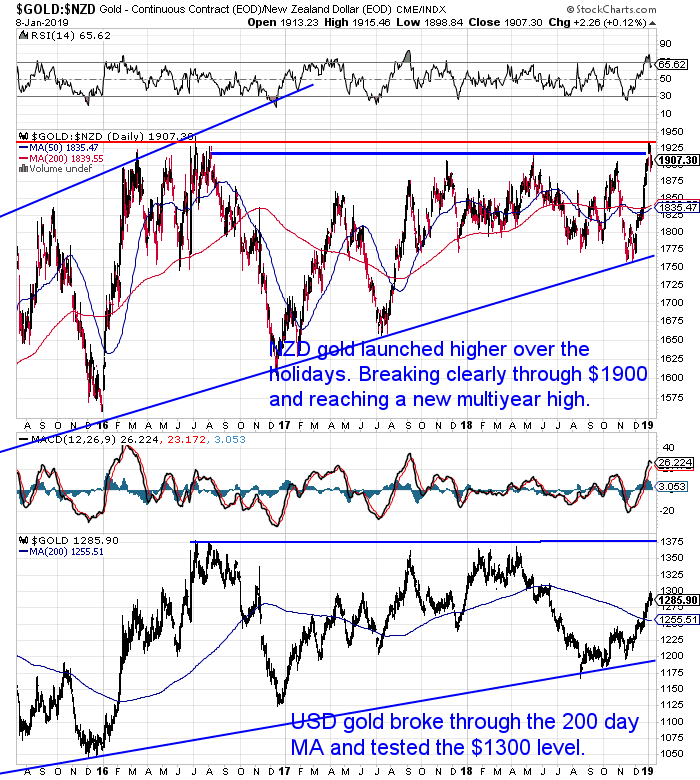

Since our last weekly update 3 weeks ago, gold in NZ dollars is up almost 5%. Gold not only broke decisively through the 50 and 200 day moving averages (MA). It also made a new 2.5 year high after busting above $1900.

In the last few days gold has turned down from these highs. Not surprising as it had gotten very overbought.

Where to Now for NZD Gold?

After such a strong run higher we’d expect gold to have a further pull back yet. We could see a return back down to the 50 and 200 day moving averages just below $1850. Anything near that mark could likely be a good buy zone.

But after that retracement is complete the odds favour a move back above $1925 before too long now. From there there is a lot of blue sky ahead before the next major resistance at $2200.

Silver Shot Even Higher

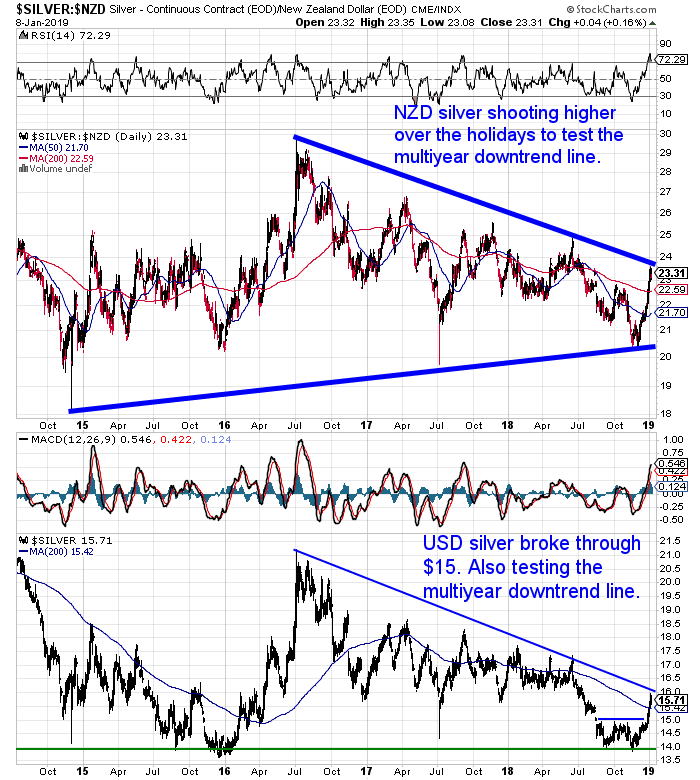

3 weeks ago NZD silver was sitting on the 50 day MA at about $21.50. Over the break silver launched nearly 9% higher. Busting through the 200 day MA and then touching the downtrend line dating back to mid-2016.

Silver remains very overbought. So as we said for gold, silver is due a decent retracement now too. Look for a test of the 200 day MA at $22.50 and then maybe even a return to around $22. Which would be a 50% retracement of the recent run higher.

NZD silver continues to get compressed between the rising and falling thick blue trendlines. A break out will come and our guess is it will be to the upside.

So if you’re looking at buying keep a close eye on the prices of both metals over the next couple of weeks.

NZ Dollar Pulled Back Over December

The New Zealand Dollar went lower over the holidays. Dipping 1.80%. But it is now moving out of overbought territory and looks like it has bottomed out.

So a rising NZ dollar could also help to nudge local precious metals prices lower over the next week or so.

More thoughts on the NZ dollar in our Year in Review article below.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Free Shipping NZ Wide.

What Do You Mean There is No Safe Haven?

Spotted yesterday was this headline on interest.co.nz:

Even in the GFC, global investors saw US Treasuries as the safest asset available. But under Trump portfolio managers find themselves in rough seas with no port of call that can offer shelter from the storm

“With equities slumping, exchange-rate volatility increasing, and political risks intensifying, financial markets around the world have hit a rough patch. During times like these, international investors generally grow cautious and prioritize safety over returns, so money flees to “safe havens” that can provide secure, liquid investment-grade assets on a sufficiently large scale. But there are no obvious safe havens today. For the first time in living memory, investors lack a quiet port where they can find shelter from the storm.”

Source.

The author Benjamin Cohen points out treasuries bonds have not been a safe haven recently. He also comments that the Eurozone, Swiss Franc, Japan and China all have issues that preclude them from being a safe haven.

He is right about the lack of refuge. As we point out in our year in review article, a Deutsch Bank study reported that 94% of all assets lost ground in 2018. The worst year since 1920!

However not surprisingly Cohen fails to consider gold as the ultimate safe haven. In 2008 gold finished the year up – unlike just about everything else. 10 years later in 2018 gold also was positive in a year where most assets lost value. More on golds performance below…

2018 in Review & Our Punts for 2019

With the arrival of the New Year it’s time for our usual year in review article.

You’ll see how gold and silver in NZ dollars performed during 2018. Also taking a longer term view right back to 2000.

We also look at our predictions for 2018 and see how we did (not so great!).

And finally we make a few punts as to what 2019 might hold.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Best Time to Buy Gold Since 2001?

Gold has had a strong rally over the holiday break.

But Steve Sjuggerud thinks this is now the best time since 2002 to buy gold…

“The last time gold was this hated – in late 2001 – the major gold-stock index (the HUI Gold BUGS Index) soared by nearly 300% in a little more than two years.

While I can’t promise you 300% gains in two years today, I can tell you that the setup today in gold is the same as what we saw back in late 2001.

The outcome could be similar, too. Gold and gold stocks could make investors a few times their money.

This week, for the first time in years – and for only the second time in my long career – I’m personally buying gold stocks again. And I’m also doubling the amount of physical gold I own.

In short, I am putting my money where my mouth is. Why?

The reason is simple…

This Is the Best Moment to Buy Gold Since 2001

If you’re a longtime reader, then you know what I look for in a great trade…

I want to buy what’s cheap, hated, and in the start of an uptrend.

This strategy works in just about every type of asset… The most important question to answer is, “How do you define these terms for different assets?”

For example, how do you know that gold is hated?

Some folks like to use surveys of investors…

And that works. For example, in the latest Bank of America Merrill Lynch Fund Manager Survey, gold sentiment hit a 17-year low among investors surveyed.

But I prefer to look at “real money” on the line…

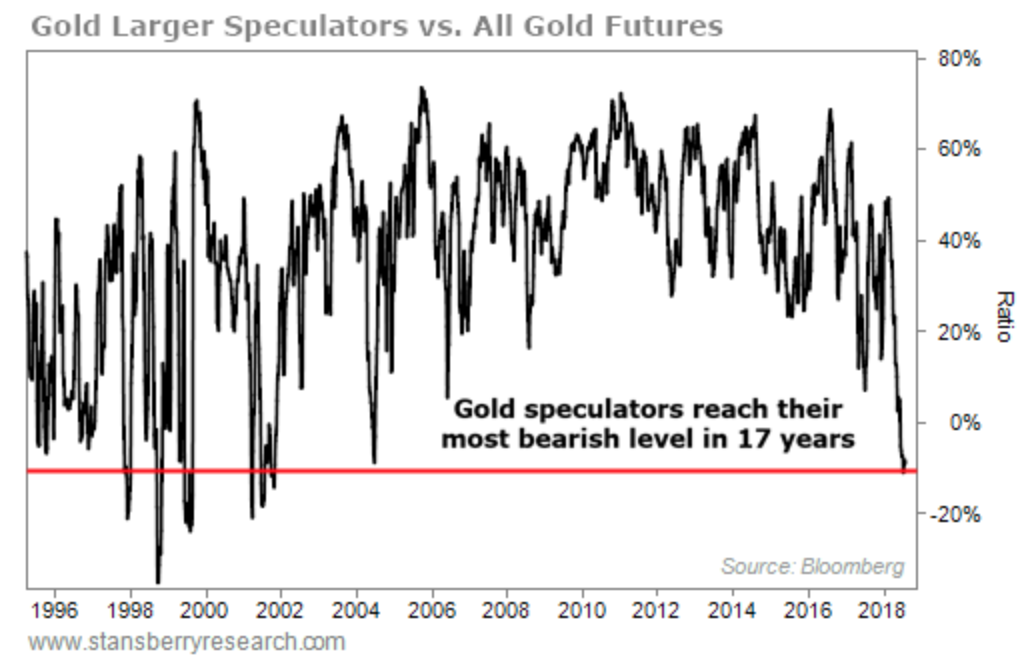

The best way to see that in gold is to look at what large speculators in the futures markets are doing with their money. For that, we look at the Commitment of Traders (“COT”) report.

It shows the real-money bets of futures traders.

Importantly, when these speculators are crowded at one side of a trade, the opposite tends to happen.

Currently, large speculators in gold futures have bigger bets against the gold price (relative to all futures bets on gold) than at any time since 2001.

Take a look…

This is EXACTLY what I want to see.

As the chart shows, gold speculators are betting against gold to a greater degree than at any time since 2001.

As you know, gold’s great bull market started in 2001, from a similar degree of “hated.” And as you know, gold stocks soared starting around that time.

I realize nobody is talking about gold or gold stocks today. But that’s what you want…

In order to buy an asset at the best price, you want to buy it when it’s hated and ignored. And you want to sell it when it’s all over the news.

I expect today’s extreme means that we are close to the start of the next great bull market in gold.”

Source.

There are no shortage of geopolitical risks, that could help nudge gold higher: (see top geopolitical risks for 2019).

But keep a close eye on the price currently for a pull back and buying opportunity.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Learn More and Pre-order NOW….

—–

|