The US Dollar may well have recently entered another cycle of decline against the other major currencies of the world. How will this affect gold and silver bought in New Zealand dollars?

Table of contents

Estimated reading time: 6 minutes

This week we have a question from a reader as to how a falling US dollat might impact any gains in the NZ Dollar gold price:

When we buy precious metals, all prices are according to USD, then with varied exchange rates to NZD. Of course, people are expecting the prices to be going up to take profit.

If the USD is expecting to be going down in the future, whereas supposing the metals prices & NZD are going up, the profit will be eroded by the NZD appreciation. For example, if I buy gold at USD1500 and sell USD2000, the net gain is USD500, but if NZD appreciates 20% against USD, I make much less than it seems.

I have started to think what is the point buying metals, even though the prices are going up.

I am wondering how New Zealanders make money out of metals?

So in a nutshell the question was…

In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out any Gold/Silver Gains?

We have had some similar questions over the years too. Here was one from back in April 2018. This too was a time when the New Zealand Dollar had been rising against the US dollar. Interestingly though, this trend reversed soon after we received the following question:

Q. Assuming that in the near future that gold/silver is still priced in USD, and given the trend and the outlook for the USD is downwards and that currency pairs are a zero sum game, with the advent of a currency crisis for the USD, it means our NZD would gain in strength by the same amount as the USD decline. And assuming the price of gold/silver would rise in the advent of a crisis, would not any potential gains in the spot price of it be lost to our strengthening NZD? Or is the assumption to be that hopefully the increase in the spot would be greater than the rise in the NZD?

The short answer is yes. We would expect that gold and silver would “gain” more than the comparative rise in the NZD/USD exchange rate.

Or put another way the NZ Dollar may “go up” against the US Dollar over a number of years – as it has done in the past. However we believe gold will “go up” more.

History also strongly supports this theory.

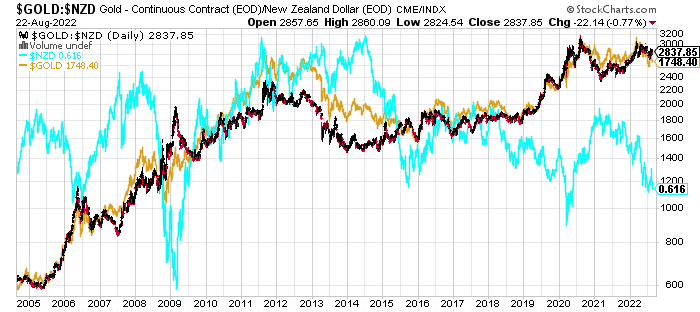

This is shown visually in the gold chart below. The black/red line is gold in NZD. The gold line is gold in USD. While the blue line is the NZD/USD exchange rate.

You’ll notice the NZ Dollar has impacted the NZD gold price. And at times has caused the NZD gold price to rise more or less than the USD gold price.

Related: If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

How Has Gold in NZ Dollars Performed Compared to Gold in US Dollars Since 2003?

Since June 2003 (when the data for NZD gold begins in stockcharts) gold is up 333% in NZD ($655 to $2838). While gold priced in USD is up 386% ($360 to $1748).

So gold has risen more in US dollar terms than in NZ Dollar terms. Although the difference is not that great.

However the price of gold in either currency has been up over the past 19 years. i.e. the overall trend is the same.

Or perhaps put more correctly, both currencies have lost value against gold over the past 19 years.

So our reader may think she is not “gaining” as much when buying gold in New Zealand. However clearly the New Zealand dollar has lost a lot of value against gold in the past 19 years.

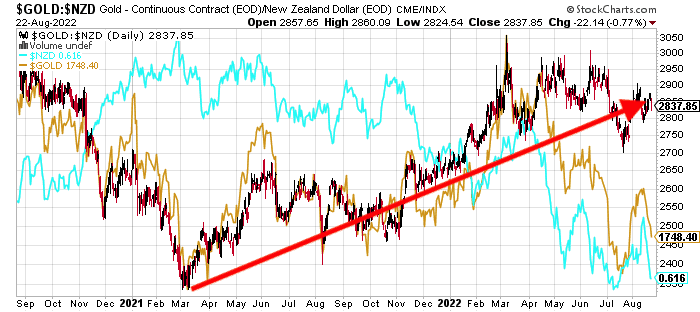

We have had a period over the past 2 years where gold in NZ Dollars has outperformed gold in USD. As shown in the chart below. It’s possible we may now see a period where gold in USD rises more than gold in NZD.

An old saying springs to mind here…

Each fiat currency is merely taking it in turns to be the “prettiest horse in the glue factory”. In other words, in the long run they are all dying. It’s just that sometimes one currency looks better than the rest.

There’s also something else we should point out here. It’s true that the USD gold price is the price most commonly quoted. But here in New Zealand, we buy gold in New Zealand Dollars. So that is the best price to keep a track of. So keep track of gold and silver in whatever your local currency is.

For more on this topic check out: Why You Should Ignore the USD Gold Price When Buying in New Zealand

Is it Guaranteed that the US Dollar Will Collapse Faster Than Other Fiat Currencies?

The above is all predicated upon the US Dollar losing value faster than the NZ Dollar. However, there is also an argument to be made that perhaps the USD will actually be the last to fall? That is, in a crisis, we could see the USD gain sharply in value compared to other currencies (as it did in 2008).

So a US Dollar collapse is not necessarily a given. Or at least not in the way most people might at first glance think. See:

What Would Happen to the NZ Dollar When the US Dollar Collapses?

So if the reference point (the USD) tumbles then it will take the rest with it.

This is what we have seen in slow motion over the past 14 years or so. The US dollar has lost value versus gold but so has every other fiat currency on the planet. Just some (like the kiwi dollar) at a slower rate than the US dollar.

But in the final stages of a US dollar collapse we could see a repeat of 2008. Where money flooded back to the US causing every other currency (including the NZ dollar) to plunge in value against the US dollar. And so against gold they would likely plunge even more.

Read more on Why would money flood back to the US in a crisis

For more on how a Dollar collapse may play out check out: If/When the US Dollar Collapses, What Will Gold be Priced in?

Editors note: This article was first published 10 April 2018. Updated 9 January 2019 to include an extra question, a 6 month short term chart and updated wording. All charts and figures last updated 23 August 2022.

Pingback: What Would Happen to the NZ Dollar if the US Dollar Collapsed?

Pingback: New Zealand Dollar Third Best Performing Currency Since 2001 - So Why Does it Still “Suck”? - Gold Survival Guide

Pingback: Gold & Silver Performance: 2019 in Review & Our 2020 Guesses - Gold Survival Guide

Pingback: What Might Support the Gold Price in 2020? - Gold Survival Guide

Pingback: The 2019 Top 5: Our Most Read Articles of 2019 - Gold Survival Guide