Prices and Charts

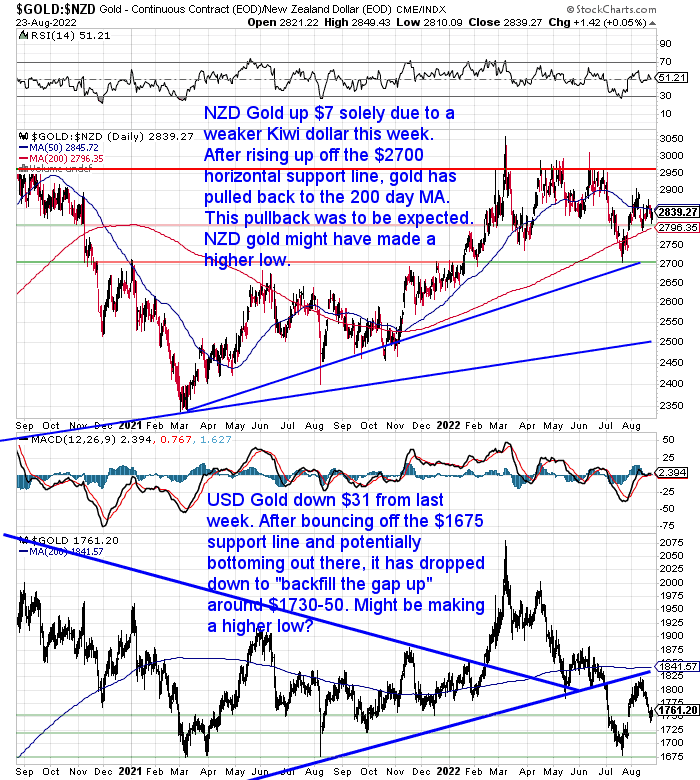

NZD Gold Held Up Solely By A Sharply Weaker NZ Dollar

Gold in New Zealand dollars was up just $7 from 7 days ago and this was solely due to the New Zealand dollar dropping by 2%. Since rising up off the $2700 horizontal support line last month, gold then fell back to the 200 day moving average (MA), before then rising up to the 50 day MA. This week it has pulled back and looks to be trying to make another higher low.

While USD gold has pulled back this week to backfill the “gap up” from late July. It might have now done this and is trying to eek out a higher low around that $1730-$1750 area.

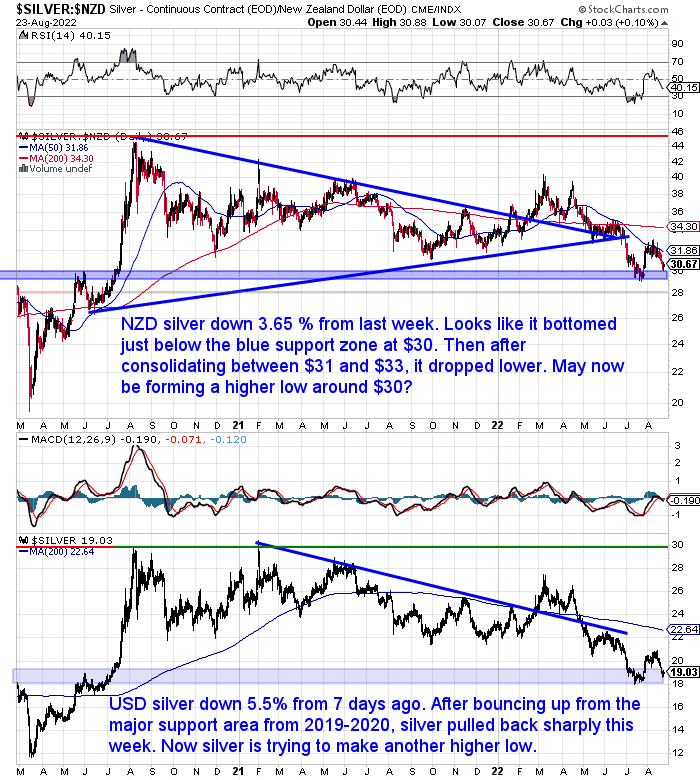

Silver Continues to be Much Weaker Than Gold

Meanwhile silver in New Zealand dollars was down a hefty 3.65%. And in USD terms an even larger 5.57%.

Although silver does still look like it bottomed at the blue support zone at NZ$30 (or US$18 lower half of the chart). Then after bouncing up and consolidating, silver has dropped lower this week. It now looks to be forming a higher low at around NZ$30 (or US$19).

But we now need to see silver form a higher high and start to rebuild to know for sure that the trend has changed.

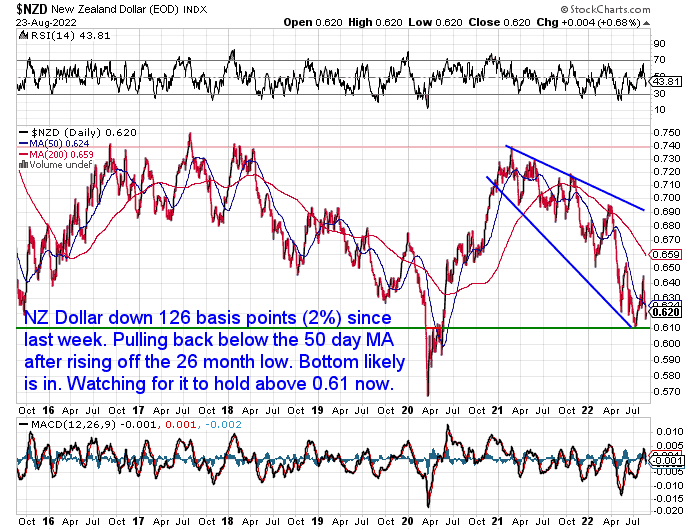

New Zealand Dollar Down 2%

As noted above the Kiwi was down a hefty 2% this week, negating some of the weakness in the US dollar gold and silver prices. The NZ dollar has now dipped back below the 50 day MA. We are watching to see if it can hold above 0.61 now.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out Any Gold/Silver Gains?

As we keep repeating in recent weeks, our thinking is that we will likely now see a period where the Kiwi dollar strengthens against the US dollar.

In fact it’s likely most currencies will strengthen against the US dollar.

It’s not uncommon to believe it is a bit pointless to buy gold and silver in New Zealand if the Kiwi dollar is going to rise strongly against the US dollar. A couple of reader questions allude to this.

So in this week’s feature article we delve into the impacts a strengthening NZ dollar could have for buyers of gold and silver in New Zealand.

We look at:

- How Has Gold in NZ Dollars Performed Compared to Gold in US Dollars Since 2003?

- Is it Guaranteed that the US Dollar Will Collapse Faster Than Other Fiat Currencies?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

RBNZ Head Orr: “Inflation on its way down”. Yeah Right.

In an interview this week just after the RBNZ hiked the OCR by another 0.50%, the head of the central bank said that he ‘honestly’ believes inflation ‘on its way down’.

“That was a view largely shared by Milford Asset Management investment analyst Katlyn Parker, although she noted New Zealand was still “miles off” the RBNZ’s 1-3 percent inflation target range.

Inflation came in at 7.3 percent in the second quarter of this year.

“If you look at those forecasts altogether, it does paint a relatively optimistic scenario that things are going to, very nicely and slowly, come to a slow end versus an abrupt halt,” Parker told AM.

But she said a future recession shouldn’t be ruled out.

“Adrian Orr, he said himself that he doesn’t foresee a recession but I wouldn’t be putting my money on this ‘Goldilocks scenario’ actually eventuating,” Parker said. “It’s a very, very tough thing to engineer.”

Source.

While a few weeks back an ASB report stated:

“Yes, inflation is high — but we expect it to have peaked this cycle.

We’re cautiously optimistic the direction of travel is downwards, but it is going to be at a snail’s pace.

The worry is now more about the persistence of inflation and not so much the peak.

How long inflation remains elevated is a concern given the fact that households are already feeling the burn. In last week’s NZ CPI print, quarterly inflation rose by 1.7% over Q2, taking the annual rate to a peak of 7.3%; the highest pace in 32 years.”

Maybe both Orr and ASB are correct and inflation has peaked. But then again neither the RBNZ head or the bank economists saw inflation coming last year. So we’re not so sure we’d trust them to see it going either!

But we would agree that persistence of inflation is the thing to be worried about. We could likely see periods where the inflation rate appears to be dipping. Because nothing goes up in a straight line. But once it’s out, history has shown it is very difficult to put the inflation genie back in the bottle.

We doubt the current ilk of central bankers have the stomach for what the likes of US Fed head Paul Volker did back in 1980. Namely, raising interest rates so they were significantly above the rate of inflation. Actually we’re not sure that is even possible today, with the level of debt that both governments and private individuals hold.

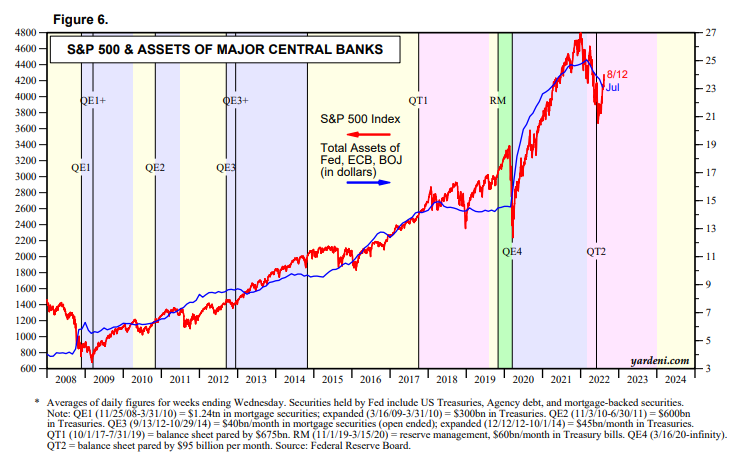

The below chart clearly shows how closely linked major central bank balance sheets are to the US S&P500 stock market index.

Source.

Therefore, if we see a global recession, then it’s likely central banks will reverse course on their interest rate increases and balance sheet reductions. As a result they could stoke inflation even higher down the track.

So unlike Mr Orr and most bank economists, we continue to believe that we have switched into a long term multi year trend of high inflation rates.

Currently gold and silver prices are not reflecting this. As we pointed out last week there has been a major drop off in demand for buyers of physical gold and silver in recent weeks. History shows us this is a very good contrarian indicator for a bottom arriving.

So if you don’t have sufficient insurance against a long term trend of higher inflation and low real after inflation interest rates, then now is likely a good time to do something about that.

Get in touch for a quote today:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Why the Pace of Central Bank Balance Sheet Reductions is So Important - Gold Survival Guide

Pingback: Gold and Inflation Analysis 2023 | Gold Survival Guide