Prices and Charts

Weaker Kiwi Dollar Holds Gold in NZD Steady

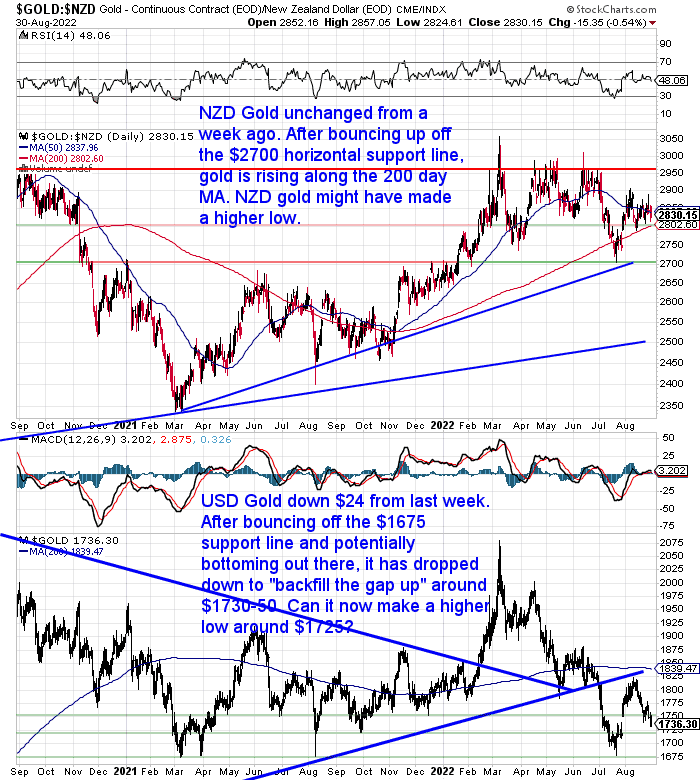

Once again a weaker NZ dollar has supported local precious metals prices. Gold in New Zealand dollars is unchanged from a week ago. Solely due to the NZ dollar falling by as much as USD gold price have fallen.

NZD gold continues to bump along above the 200 day moving average line. It still looks like a low was made at the $2700 horizontal support line. Maybe a higher low has now also been made.

Now that USD gold has backfilled the gap up it made in July, we are also watching to see if a higher low can be made. Maybe around $1725.

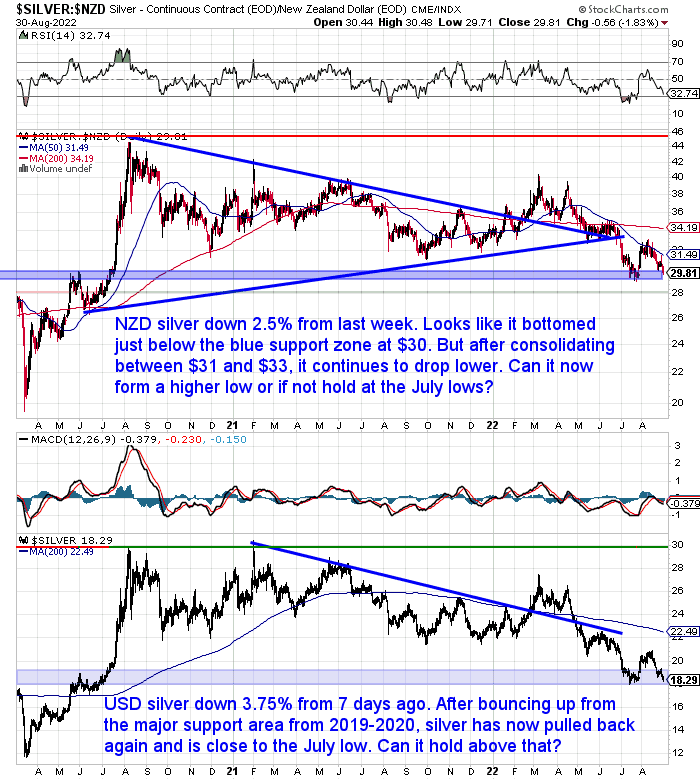

Silver Continues to be Weak

Meanwhile silver continues to struggle. In NZ dollars, silver was down close to 2.5% from 7 days ago. In USD it was down 3.75%. In either currency we are now watching to see if silver can hold above the lows from July. As it is getting very close to those levels now. Siler is also approaching oversold levels. So the next week will be interesting.

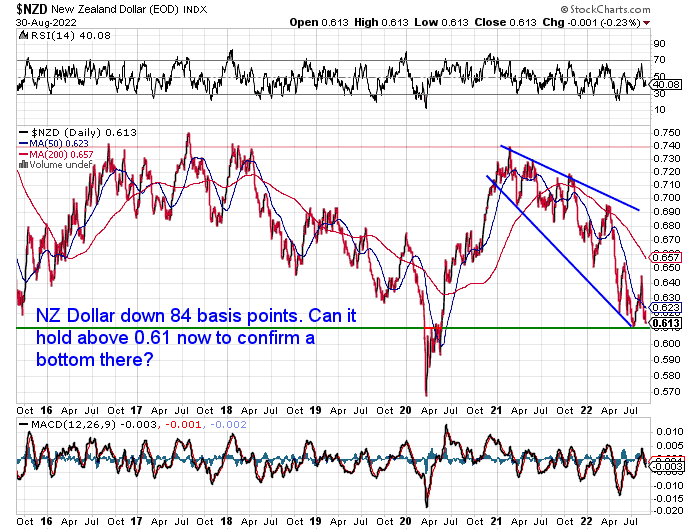

NZ Dollar Back Close to July Lows

As mentioned, the New Zealand dollar took another fall this week. Now back close to the July lows. So we’re watching to see if the Kiwi can hold above 0.6100.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

If Interest Rates Continue to Rise in 2022, What Happens to Gold?

At the end of last week US central bank head Jerome Powell made a speech at the annual Jackson Hole talkfest of global central bankers, which drew a lot of interest.

In his speech Powell poured cold water on the idea that interest rate increases will be short lived.

“Federal Reserve Chairman Jerome Powell delivered a stern commitment Friday to halting inflation, warning that he expects the central bank to continue raising interest rates in a way that will cause “some pain” to the U.S. economy.

In his much-anticipated annual policy speech at Jackson Hole, Wyoming, Powell affirmed that the Fed will “use our tools forcefully” to attack inflation that is still running near its highest level in more than 40 years.”

Source.

Since the speech we have seen numerous comparisons to the 1980 Fed head Paul Volker. As he raised interest rates and just kept doing it until faith in the US dollar was restored.

However it’s a little premature to be comparing Powell to Volker yet we’d say. As always with central bankers it’s more important to watch what they do, not what they say.

Nevertheless Powell’s speech did cause global stock markets to take a dive. We’ve been wondering about the recent tick up in them merely being a short term rise in what is likely to be a longer term downtrend. That might well be the case now.

Precious metals were not spared either. As noted already silver has taken a decent tumble this week. Many will be wondering why gold and silver aren’t doing better in a time of uncertainty such as this? Our guess is the threat of higher interest rates could be playing a major role.

So this week we delve into the conventional wisdom that higher interest rates are bad for gold.

Here’s what is covered:

- A Common Misconception About Gold and Rising Interest Rates

- What Really Happens to Gold When the Fed Raises Rates?

- Rising Interest Rates in the 1970’s and the Effect on Gold

- Real Interest Rates and Gold

- What Happened to the Gold Price the Last Time the Federal Reserve Hiked Interest Rates?

- How has Gold Performed Since the RBNZ Began Rising Interest Rates in October 2021?

- What Might the Future Hold for Interest Rates and Gold?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

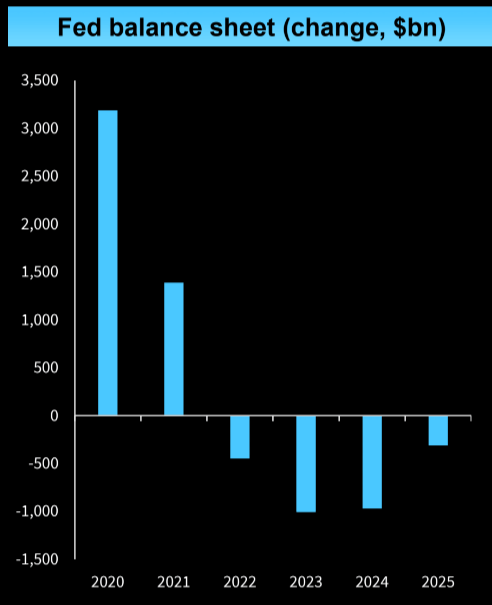

Why the Pace of Central Bank Balance Sheet Reductions is So Important

Last week we shared a chart showing how highly correlated major central bank balance sheets were with the S&P500 stock market index.

Here’s something else to consider on this topic. The pace of these balance sheet reductions is meant to be much faster than the last time the Fed shrunk its balance sheet. In fact it will be about twice as fast as back then…

THE trajectory

Never forget the “delta” of Fed’s BS. Barclay’s Abate reminds us about the pace: “The Fed’s current run-off plan is expected to shrink its balance sheet by about $450bn this year. This is much faster than in 2017-19,when it took nearly 20 months for the Fed’s balance sheet to shrink by $500bn”. This is not a point of focus at the moment, but the narrative could make a come back in September.

Source.

Source.

Take away from this? Don’t expect stock markets to like the punch bowl being removed so quickly. Further falls to come maybe?

Demand for physical gold and silver remains down again this week. We might be starting to sound like a stuck record, but from experience the times when not many others are buying are exactly the times to be buying.

So if you don’t have sufficient insurance against falling stock markets, house prices and high inflation, you know where to find us.

Get in touch for a quote today:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

|

This Weeks Articles:

|

Tue, 30 Aug 2022 4:46 PM NZST

Last week the Reserve Bank of New Zealand (RBNZ) raised the Official Cash Rate yet again by another 50 basis points. Today we look at interest rates and gold. Specifically answering the question: If interest rates rise, what happens to gold prices? This post covers: A Common Misconception About Gold and Rising Interest Rates Last […]

The post Interest Rates and Gold: If Interest Rates Rise in 2022 What Happens to Gold? appeared first on Gold Survival Guide.

|

|

Fri, 26 Aug 2022 3:58 PM NZST

Gold has been treasured as far back as 4000 BC, when Eastern Europeans used it to honour their idols and adorn places of worship. By 1500 BC, the metal was being used for money in Egypt and the shekel (a coin that weighed about 11.3 grams or 0.39 oz) was utilised as a standard unit […]

The post Real Gold vs Fake Gold: How To Tell if Gold is Real appeared first on Gold Survival Guide.

|

|

Wed, 24 Aug 2022 9:01 AM NZST

Prices and Charts Looking to sell your gold and silver? Visit this page for more information Buying Back 1oz NZ Gold 9999 Purity $2704 Buying Back 1kg NZ Silver 999 Purity $948 NZD Gold Held Up Solely By A Sharply Weaker NZ Dollar Gold in New Zealand dollars was up just $7 from 7 days […]

The post RBNZ Head Orr: “Inflation on its way down”. Yeah Right appeared first on Gold Survival Guide.

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

|

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Plus we accept BTC, BCH, Visa and Mastercard

|

| Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

| The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2022 Gold Survival Guide.

All Rights Reserved. |

|

Pingback: Electricity Prices: Another Lehman Moment in the Making? - Gold Survival Guide

Pingback: Will NZ's Housing Market Be the World's 'Crash Test Dummy'? - Gold Survival Guide