Table of Contents

Estimated reading time: 6 minutes

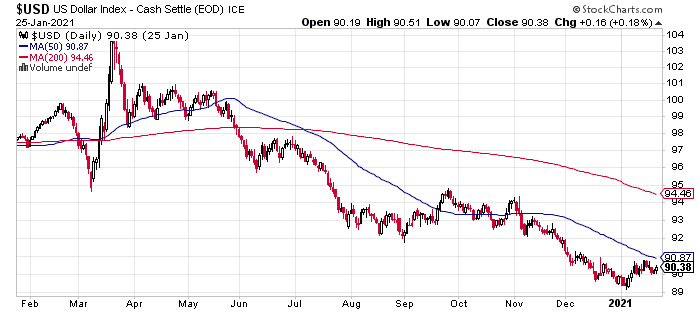

The US dollar has fallen significantly since initially spiking higher in March last year during the initial stages of the corona-panic.

As a result we are seeing more talk in the media of a US Dollar collapse. We even shared some thoughts on this topic in last week’s newsletter. (See: “A US Dollar Crash This Year?“).

A reader Francois question is likely once again on the minds of many New Zealanders too:

“Have you seen any (intelligent) analysis to indicate what would happen to the NZ Dollar when the US Dollar collapses?”

Well we’ve made a few comments on this before. Although we’ll leave it up to you to decide whether this passes for “intelligent analysis” or not! So we’ll have a crack at expanding upon this further today.

Firstly Why Has the NZ Dollar Been Rising?

1. Interest rate differential. i.e. Until recently New Zealand interest rates have been higher than most others and were expected to rise, so money was coming here in a search of higher yield. This is why the kiwi dollar is one of the most traded currencies globally.

2. Commodity currency. Rising commodities demand and prices (such as dairy, beef, lamb, logs) mean there is more demand for NZ dollars to pay for these. So more demand means a higher currency.

3. The more recent reason is simply that New Zealand has been doing better than most other countries over the past 6-9 months. While the US and much of rest of the world has continued to struggle with ongoing lock downs and restrictions, demand for our exports which are mostly primary have continued to be strong.

So Would This Rising NZ Dollar Change in a US Dollar Collapse?

The most obvious thought might be that if the US dollar were to collapse or massively lose value then the NZ dollar might rise massively against it. However there is another side to consider.

In an article from last August, “If/When the US Dollar Collapses, What Will Gold be Priced in?”, we discussed a few possibilities as to how a US dollar collapse could occur. One of these was that it could be a more gradual event…

“Take the trade wars between China and the USA currently. Ructions like these could encourage China to avoid using the US dollar to settle their international balance of payments. This could prompt other nations to confront the US and see less and less use of the dollar.

Of course, all currencies today are priced with the USD as the reference point. And anyone with a cursory understanding of monetary history will know that this is a floating or elastic reference point.

But the US dollar needs to function in order for all currencies to continue to function.

Many talk about the US dollar being the first to collapse. However as the dollar is at the centre it could in fact be the last. We first heard Sandeep Jaitly say this many years ago and it took a bit to get our head around. Ronald Stoeferle (of the “In gold We Trust” report) also was of this theory when he was in New Zealand some years ago.

We have seen this scenario in action in recent years. With many emerging market currencies falling massively against the US dollar. A collapse is more likely to begin in the periphery and move towards the centre. So somewhat paradoxically, in a “dollar collapse”, it may well be that the US dollar is the last domino to fall.”

Source.

As we noted “all currencies today are priced with the USD as the reference point. And anyone with a cursory understanding of monetary history will know that this is a floating or elastic reference point.

But the US dollar needs to function in order for all currencies to continue to function.”

So if the Reference Point (the USD) Tumbles, Then Will It Take the Rest With It?

This is what we have seen in slow motion over the past 14 years or so. The US dollar has lost value versus gold but so has every other fiat currency on the planet. Just some (like the kiwi dollar) have lost value against gold at a slower rate than the US dollar.

But in the final stages of a US dollar collapse we could see a repeat of 2008 and the early stages of the Corona-panic. Where money flooded back to the US causing every other currency (including the NZ dollar) to plunge in value against the US dollar. And so against gold they would likely plunge even more.

Could Currency Flood Back to the US? How would This Affect the NZ Dollar?

Well initially at least, currency would likely move back into US government treasury bonds which continue to be seen as a safe haven. But we could then see a countervailing movement into gold after this, much like in 2008. But perhaps on a much larger scale?

As we noted in the article above we have seen these large falls in value of emerging markets currencies versus the US dollar in previous years. When the Federal Reserve was discussing and then beginning, supposedly at least (see this article for why this might only be supposedly: A Fake Taper), to wind back its money printing programme. But in a US dollar collapse it could occur in a much more widespread manner.

Ronald Stoeferle who we mentioned in the above referenced article discussed this in a Q&A session when in Auckland in 2013 in answer to the question: “Will the US lose its reserve currency role?” His reply was that:

“He didn’t think so. Mainly because the US is so dominant militarily. In fact he thought the US dollar will likely be the last fiat to fail.

Source.

A view we have noted in the past more than once which is shared by Sandeep Jaitly. And a view that NZ dollar based buyers of gold should take heed of. As if the US dollar is the last to fall, at some point in the future the kiwi dollar may be very weak against the US dollar. Something virtually no one expects now, and gold would be the hedge against this.

So it seems likely in a serious US dollar collapse we could see a much weaker kiwi dollar. But also potentially gold having much greater purchasing power.

Read more: In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out Any Gold/Silver Gains?

Editors note: This post was originally posted 4 July 2014. Last updated 27 January 2021 with USD index chart and updated content.

Pingback: Gold Prices | Gold Investing Guide Doug Casey: “America Has Ceased to Exist”

Pingback: Will “the Chinese” takeover NZ? - Gold Prices | Gold Investing Guide

Pingback: What Will Happen to You When the Dollar Collapses? - Gold Prices | Gold Investing Guide

Pingback: Questions From Readers: Precious Metals & Kiwisaver, BoomBust Cycle, Gold & Silver Exit Strategies - Gold Survival Guide

Pingback: In a US Dollar Collapse Won't The Rising NZ Dollar Cancel Out Any Gold/Silver Gains? - Gold Survival Guide

Pingback: USD Gold Up But NZD Gold Down - Gold Survival Guide

Pingback: Silver Plunges 8% Overnight But Still Up 5% on a Week Ago - Gold Survival Guide

Pingback: How Will the Global Monetary System Change Take Place? Will China Take over the Reserve Currency Role? - Gold Survival Guide

Pingback: Thoughts on the “Dollar MilkShake” Theory - Gold Survival Guide