Gold Survival Gold Article Updates:

12 March 2015

This Week:

- NZ Dollar Down But Bounces on RBNZ Statement

- Will “the Chinese” takeover NZ?

- Do You Know the Rule of 3? – Are You Prepared Accordingly?

- Reader Question: What would I do to purchase goods and or services with gold?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

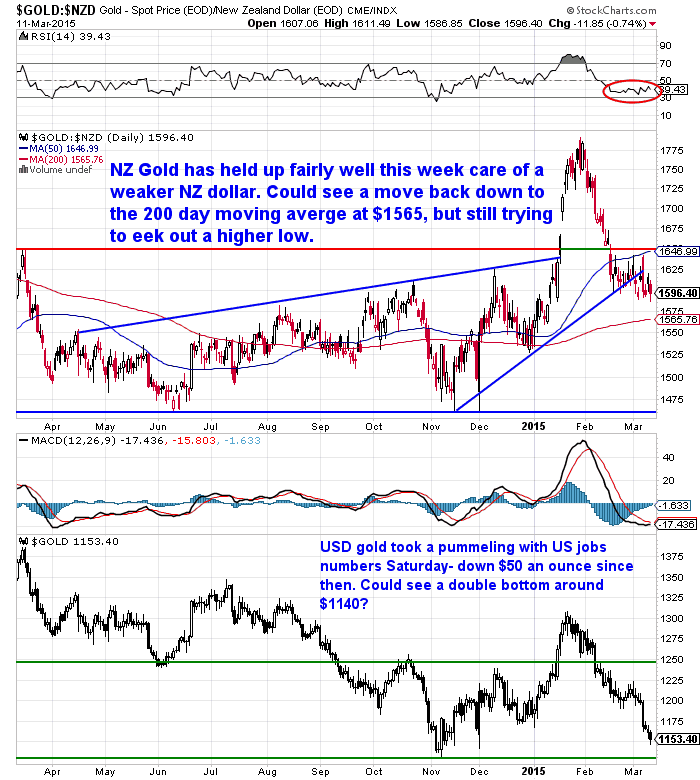

| NZD Gold | $1589.02 | + $3.41 | + 0.21% |

| USD Gold | $1154.90 | – $46.36 | – 3.85% |

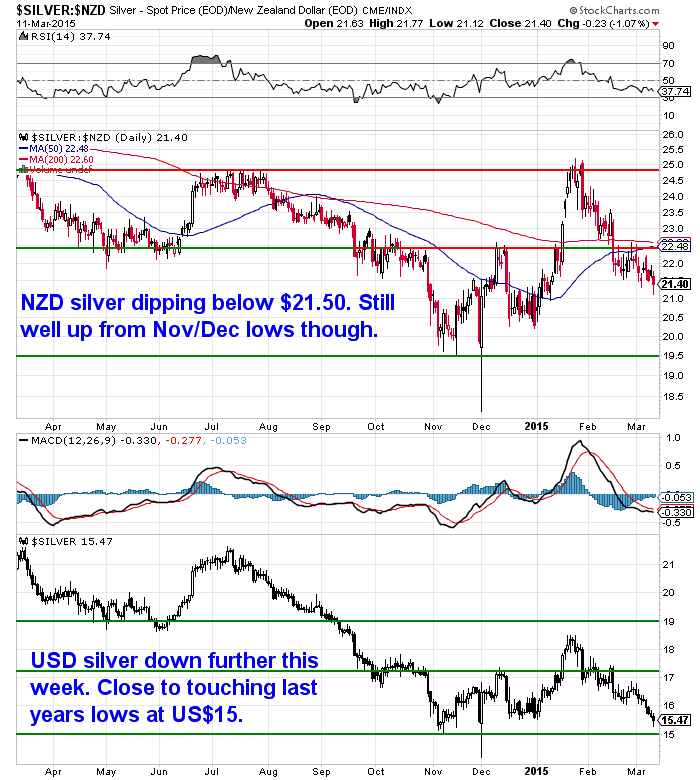

| NZD Silver | $21.38 | – $0.03 | – 0.14% |

| USD Silver | $15.54 | – $0.68 | – 4.19% |

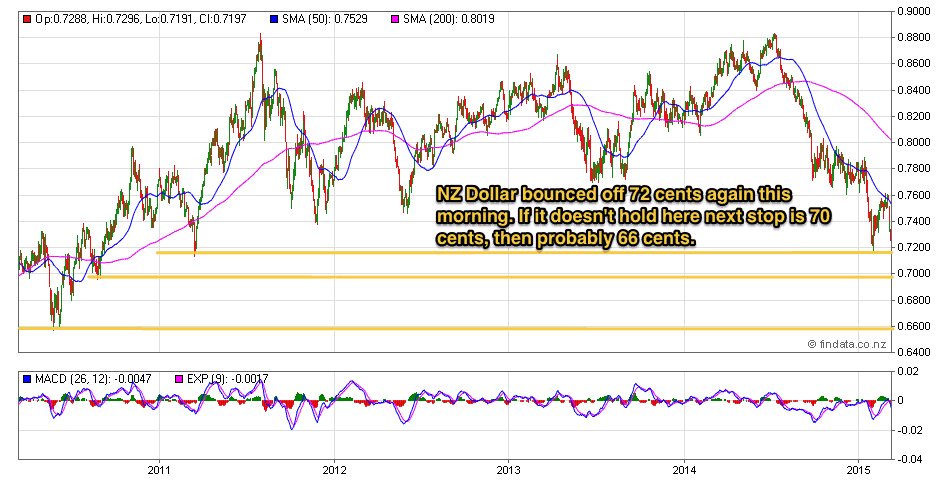

| NZD/USD | 0.7268 | – 0.0308 | – 4.06% |

The numbers this week emphasise just how much of a factor the strength of the US dollar has been lately.

Both metals in NZ dollars are actually up slightly for the week. Whereas in US dollars gold is down a hefty -3.85% and silver slightly more at -4.19%.

This drop came after supposedly rosey US jobs numbers last Saturday. We say supposedly because we read during the week that a very large percentage of them were in the service and hospitality sectors making up for the drop in the oil sector. But more low paying jobs aren’t going to make up for the losses in the high paying oil services sector.

The charts below also clearly show the ongoing divergence in US dollar gold versus NZ dollar gold (and gold in pretty much every other currency too).

Gold in NZ dollars remains in the steady uptrend it has been in for the past almost 12 months. While the lower half of the chart shows how conversely the USD buys more gold now that it did 12 months ago.

We see the same situation with Silver. With silver in NZ dollars still well up from the lows of late 2014. Whereas in USD silver it is now very close to them.

NZ Dollar Down But Bounces on RBNZ Statement

As already stated the falling NZ dollar has been the key driver lately in the local gold price. It has been falling all week. The result of a press release from the RBNZ last Thursday which points to the Central Bank looking to put restrictions in place on lending to property investors. The theory being we guess that this will allow them to keep interest rates lower for longer.

Almost certainly there will be some “unforeseen” consequence to this likely intervention.

However after falling all week, this morning the Kiwi dollar bounced off the low from earlier this year at 72 cents.

This article reckons it rose as expectations had built for wording to reflect an “easing bias” which it didn’t. To us it read pretty similarly to the last RBNZ OCR announcement which was the one that surprised everyone saying they will adopt a wait and see approach to any future raising or lowering of rates.

As usual who knows exactly why?

We’ve mentioned a few times this year that the US dollar seems ripe for a correction after rising for what we read this week is a record number of months in a row.

(See King Dollar- Longest monthly winning streak in history! What’s next?)

“The US dollar continues to rise, and even though sentiment is extremely bullish and lopsidely for the dollar it could well go higher yet.”

But of course things can rise for longer than anyone predicts. Currently the expectation is still that the US Federal Reserve will raise interest rates as early as the middle of this year. We remain unconvinced, but while the majority believe this perhaps the US dollar can keep rising for a fair while longer yet.

The chart below shows we are not too far from the next level of support for the NZD/USD cross rate at 70 cents and then a bit lower to 66 cents. From there it is a long way down with not much support until 50-55 cents (not shown on this chart).

Maybe not under the current circumstances, given how extended the US dollar is already. However under a Financial Crisis Mark II, who’s to say it couldn’t. That’s what took the kiwi down that low back in 2008/09 afterall.

Will “the Chinese” Takeover NZ?

Here’s a thought we had while discussing property with someone this week…

There seems to be a meme building that “the Chinese” will take over New Zealand. We saw a statistic this week that said 40% of Aucklanders were not born here.

No real surprises there.

So projecting that out it’s also not surprising than many would think the influx of migrants to NZ will continue indefinitely. After all China is a big place with a LOT of people. And so we’ll simply never have enough houses.

However this did get us thinking of a similar sentiment that was pervading Australia, particularly the eastern seaboard, during visits in our youth back in the late 80’s/early 90’s.

That was the fear that “the Japanese” were going to takeover Australia. There certainly was a lot of property being bought by them at the time back then.

But did that come to pass?

No.

The Japanese Asset Bubble collapsed in 1991 and Japan went on to experience Ushinawareta Jūnen – The Lost Decade, which in turn became the Lost 20 Years and is likely continuing on now.

So the money dried up and so did the amount of property being bought by Japanese in Australia.

This Daily Bell article summarises that there are problems brewing under the surface in China.

What the Telegraph article adds to the mix is the information that some of China’s economic difficulties are the result of specific central bank tampering: And that this is not generally understood yet in the West. (Many may believe that China has already turned on the liquidity taps once more – but not so.)

Put together, China is pursuing the most contractionary mix of economic policies in the G20, relative to the status quo ante. Collateral damage is already visible in the sliding global prices of iron ore, copper, nickel, lead and zinc over recent months, as well as thermal coal, oil, corn and even sugar.

Zhiwei Zhang, from Deutsche Bank, says China faces a “fiscal cliff” this year as Beijing attempts to rein in spending. “This year, China will likely face the worst fiscal challenge since 1981. This is not well recognised in the market,” he said.

The International Monetary Fund says China’s budget deficit topped 10pc of GDP in 2014 if measured properly, including borrowing by the regions through “financing vehicles” as well as land sales – a patently unsustainable form of funding that makes up 35pc of local government revenue. This is the highest deficit of any major country in the world, and far above safe levels.

China must cut spending because otherwise price inflation is going to become increasingly more difficult to control – even as the economy itself shows no sign of a rebound. In the West, this has been known as “stagflation.”

Unfortunately, government spending makes up a goodly portion of the gross Chinese outlay. China is being squeezed by a lack of foreign demand and an inability to generate domestic demand. The third leg of the stool has been government spending – but that’s the part that is under attack now…

…recent interest rate cuts by The People’s Bank of China (PBOC) that have reduced the seven-day interest rate to 5.5 percent from 7 percent is probably not going to do any good, either. The Chinese central banks can slash rates but when money is growing more expensive in the real world, then such liquidity really doesn’t have an impact.

And here’s another point made by the article: China has stopped buying US Treasuries and global bonds. It is actually selling, not buying. Of course, China is also buying gold, too, and the government’s position (including the banking system, which is covertly and overtly run by the government) may not be as desperate as this article indicates.

But all the problems that the alternative media (and The Daily Bell in particular) have been warning about are seemingly beginning to form massive thunderclouds that could give the Chinese economy a thorough drenching.

China’s initial mistake was adopting a Keynesian system and applying it aggressively starting some 30 years ago or so. But as in the West, this system merely piles up liquidity without ever letting bad companies collapse. Over time, people don’t know what companies are solvent and which ones are not.

Additionally, over time, economies tend to deflate when confronted by monetary debasement. This happens as asset bubbles collapse. As economies move south, the debt overhang becomes more prominent. China’s consumer and government debt is sizeable now and getting bigger.

If the government prints to counteract these implosive forces, then there’s the risk of a major outbreak of price inflation. The most obvious solution would be to devalue. But the article points out that a formal devaluation would be a considerable shock to the world’s economy. Nonetheless, we would bet over time that an informal devaluation might take hold in China – perhaps a piecemeal one.

China is no longer manufacturing trinkets for the Western world. And the idea that the Chinese themselves would buy its own industrial production has proven to be the chimera. The consumerist, Keynesian model that Chinese leaders adopted has predictably proven to be a failure – as it is always a failure.

Conclusion:

The only question remaining seems to be how bad the bust is going to be and how long it is going to last. Japan’s “bust” in similar circumstances began in 1987 and the country’s economy is still unwinding today.”

The expectation seems to be that China will just slow modestly. But this article shows there is perhaps risk of much more than that.

So is it too long a bow to draw to say there is a possibility that the current flow of money out of China and here into New Zealand (as well as the likes of Australia and Canada) could well be cut off if things deteriorate there? Just like occurred with Japan in the 90’s?

Just a thought…

Do You Know the Rule of 3? – Are You Prepared Accordingly?

A couple of weeks ago we let you know about the launch of Emergency Food NZ.

http://freezedriedemergencyfood.co.nz

In case you missed it, we also mentioned that freeze dried long life food was only the first part of what we intended to offer.

We’ve also got something today that is even more important in preparing for the unexpected than food.

What is that?

Have you heard of the “Rule of 3”?

The rule of 3 says you can survive 3 minutes without air, 3 hours without shelter, 3 weeks without food, but only 3 days without water.

We’ve got the food covered, but the rule of 3 shows water is actually more important in a survival situation.

So we’ve now got a supply of what we believe are the most effective yet versatile water filters and purifiers available.

And so we thought you might be interested in hearing about what makes them so useful…

Gravity Water Filters

>>> These are gravity water filters.

They filter water without using electricity, making them reliable for use during all sorts of emergencies such as storms, power failures, solar flares, and EMP attacks.

And of course any natural disasters that may damage your town water supply such as earthquakes. Plus they offer a level of protection from any water borne viral outbreaks as has happened on occasion here in various towns around the country.

Gravity filtration has been used by relief organizations such as UNICEF, the Peace Corps, Red Cross Societies Internationally, missionaries and relief workers throughout the world.

Untreated water from stagnant ponds, rivers, lakes, streams, bores and wells all become drinkable water sources with one of these on hand.

Great for everyday use too

But what we personally really like about these filters is that they are great for everyday use to filter and purify the likes of chlorine and other chemicals from the local town supply. Giving our families clean, pure great tasting water everyday.

We love that they can even remove fluoride from town supply water with an added Arsenic/Fluoride filter element too.

>>>Get the full details of these water filters.

Great value for money

They also have the benefit of being great value for money. The filter elements are cleanable meaning they don’t have to be replaced as often as many other brands.

We can replace the water delivery we used to get at $12.30 a 17L container, for the equivalent of only 12 cents ongoing cost.

Best of Both Worlds

So you get quality healthy drinking water on a daily basis but also have on hand a water purifier for emergency situations, and even camping use too.

Benefit from Bulk Pricing

We’re about to place an order from the US supplier, so we thought we’d give you the chance to get some better pricing by locking in a bulk group order.

So you’ve got until Wednesday 25th March to place your order at a 10% discount with FREE shipping. You can compare the pricing to what you’d get on Amazon (don’t forget to check the shipping cost from Amazon to NZ which will be NZ$50 or more), and see this is a great deal.

We’ll complete the order on the 25th March so get in fast as there is also only limited stock from the supplier. (Seems a lot of water filters are being bought in the US currently!) Your order should then arrive within a couple of weeks.

Order yours today and be prepared.

Feel free to email us back or call 0800 888 465 if you have any questions.

Reader Question: What would I do to purchase goods and or services with gold?

This week we received a question from a reader that was similar to one we’ve had before.

But probably one that might be on your mind too, so we thought it worth sharing:

“One question that has come to mind re my recent purchase into gold and silver is this.

As I am buying these assets in precious metals to start protecting myself from the loss of value in our paper money, what would I do to purchase goods and or services with gold when and if it occurred, as presumably the trading banks would be closed? And presumably their [sic} would no longer any super weekly as their is now?

I look forward to your modules for info, but also get info from the Outsider Club, which I am guessing would benefit those with the US dollars and which I am not.

Regards, C”

Here’s our answer:

Hi C,

I think your question may well be answered by this article:

What Good is a Bar of Gold When the Shelves are Empty?

This covers a couple of scenarios as of course no one knows exactly how things will play out. There is not necessarily going to be a complete collapse. We could just see paper money continue to be devalued more and more. Eventually to the point where it is replaced by something else – perhaps the return of gold and silver as money or a variation on this?

Or maybe just where the value of gold to other assets increases enough so that you’d rather exchange it for something else – e.g. property or businesses/shares. This might be done by “selling” gold for paper money and then buying something else. Or perhaps by exchanging it directly. No one knows for sure.

But the article above outlines a few scenarios.

Here’s another few that are somewhat related as well that might interest you:

https://goldsurvivalguide.co.nz/what-would-happen-to-the-nz-dollar-when-the-us-dollar-collapses/

https://goldsurvivalguide.co.nz/ifwhen-the-us-dollar-collapses-what-will-gold-be-priced-in/

https://goldsurvivalguide.co.nz/exit-strategies-for-when-the-time-comes-to-sell-gold-and-silver/

As to whether Superannuation will continue? Who knows? I’m certainly not counting on it – but then it is a long way off for me. For those receiving it currently I imagine the odds are much higher that it will continue for them. But this depends on whether the government can afford it. This in turn depends upon how things play out globally.

Either way at least you’ll have a nest egg put away and have given it some thought – unlike the vast majority.

Hopefully that might clear things up for you. Thanks again for the thoughtful question.”

Have you got your nest egg together yet?

Prices are down slightly today so a good time to get in. Plus in one of this weeks articles on the website is the thought that there could be Good News ahead for gold.

Also check out the Top 10 Financial Surprises for 2015. Some interesting contrarian ideas in there.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,020 and delivery is now about 7-10 business days.

This Weeks Articles: |

|

|

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices

Spot Gold |

|

| NZ $ 1643.05 / oz | US $ 1154.90 / oz |

| Spot Silver | |

| NZ $ 21.38 / oz

NZ $ 687.31 / kg |

US $ 15.54 / oz

US $ 499.54 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

|

| The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2013 Gold Survival Guide.

All Rights Reserved. |

Pingback: What to make of all this interest rate stuff? - Gold Prices | Gold Investing Guide

Pingback: The Disruptive Disaster Facing China - Gold Survival Guide - Gold Survival Guide

Pingback: Do You Have to Document Your Precious Metals Purchase?