Feeling negative about gold and silver?

Join the club. According to Stewart Thomson below (ST as he’s known), he can’t remember a time when the Western gold community morale was much lower than it is now. There certainly isn’t much buying going on from what we’re personally seeing and reports from major Western mints also reflect this.

But – somewhat counterintuitively – this isn’t generally where prices go lower from, but rather move higher. And ST outlines how there are a number of both technical (price and chart related) and fundamental news items currently that could move gold higher from here.

We thought this was well worth reposting for 2 reasons:

1) Stewart Thomson doesn’t have his newsletter available to the public for free very often.

2) We haven’t heard him this bullish sounding for a long while. If anything he is usually sitting on the fence or even preparing his readers for lower prices. So this issue might well be worth paying attention to in the long run…

Graceland Updates

By Stewart Thomson

- I’m hard pressed to remember a time where the morale of the Western gold community was much lower than it is now.

- Regardless, some very good technical and fundamental news for gold enthusiasts has suddenly appeared.

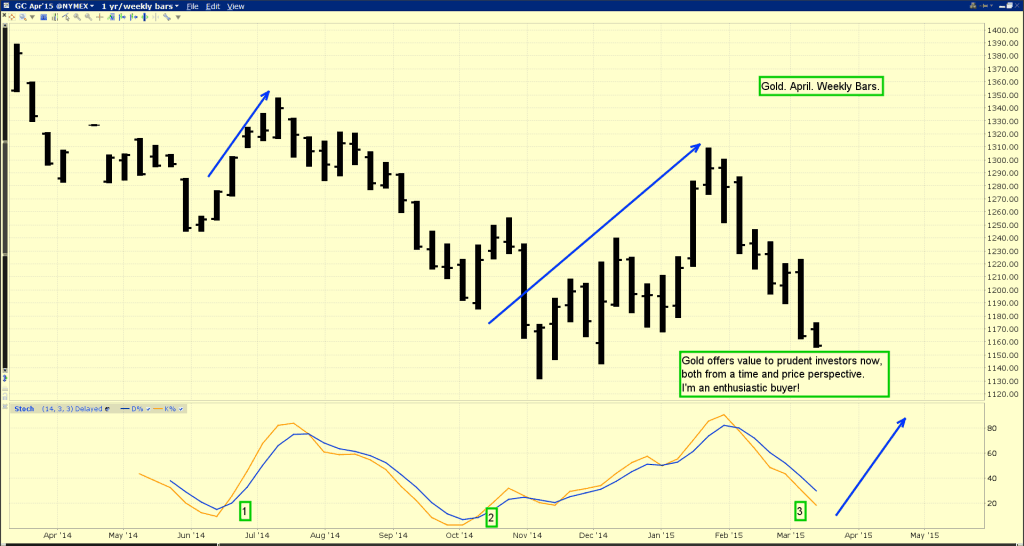

- To view some of the good news, please see below. That’s the weekly chart for gold. When the Stochastics oscillator (14,3,3 series) moves below the 20 line, substantial rallies in the gold price tend to follow.

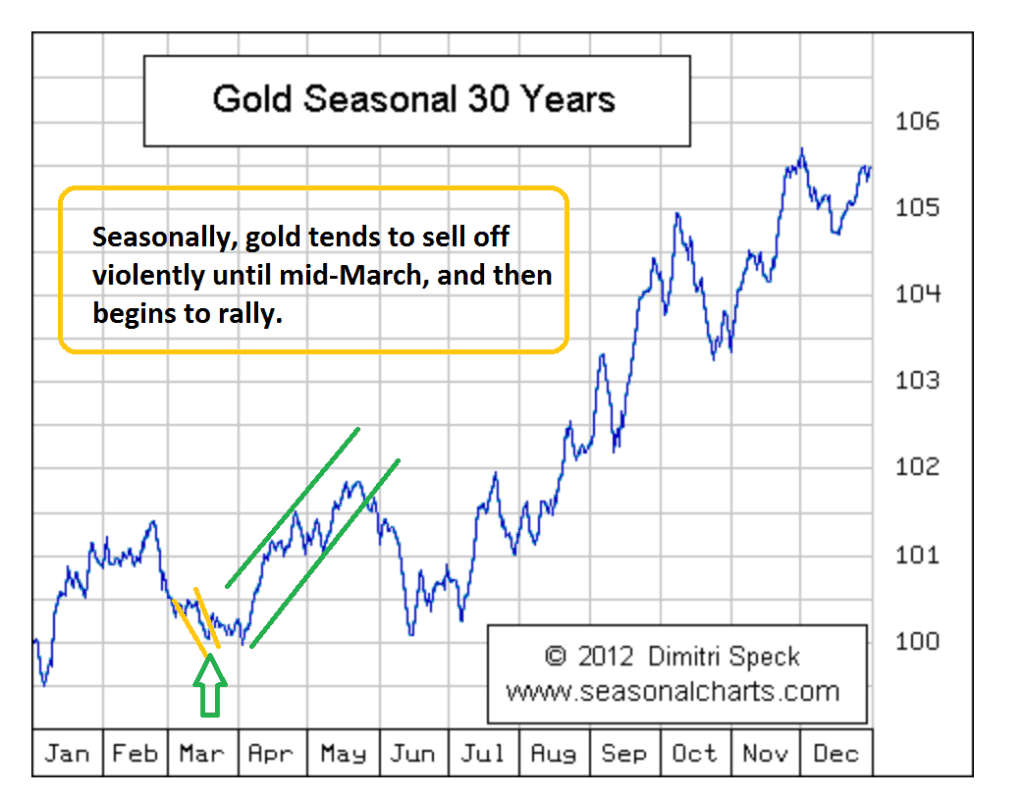

- Rallies of $100 – $200 are quite normal in these types of technical situations, and there’s more good news. Please see below. That’s the seasonal chart for gold, courtesy of Dimitri Speck.

- From a cyclical perspective, gold tends to sell-off quite violently until mid-March. Then it typically bases, and rallies strongly.

- The main reason it does that, is because of the Indian wedding season. That begins in mid-March, and continues until June.

- As the season comes to a close, buying dries up in late May, and the gold price becomes soft again, before staging a much bigger rally. That larger rally occurs as preparations for the huge nation-wide Diwali festival begin.

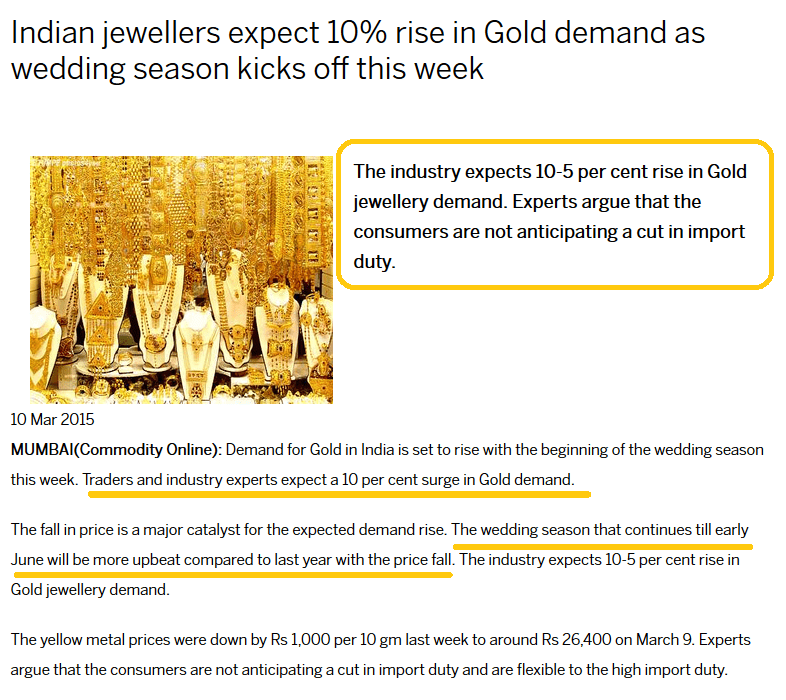

- Please see below. Wedding season begins this week. There are more than 10 million weddings a year in India, and gold is the main gift given to the bride!

- There is absolutely nothing unusual about gold’s price action in advance of the current wedding season, and I doubt there will be anything unusual about the rally that occurs, as the season gets underway!

- There’s another bullish, but much more ominous gold price driver that could soon come in to play. To view it, please see below.

- Geopolitics helped drive gold higher in 1979, and it may be about to happen again. Here’s why: The Kashmir border between India and Pakistan is the most dangerous border in the world. Pakistan and India have substantial arsenals of nuclear weapons, and both sides agree that they could be used if either country becomes overly aggressive at the Kashmir border.

- ISIS has the capability to substantially increase tensions in the Kashmir area. If that happens, the gold price could respond violently to the upside.

- There are very few major market rallies that occur when analysts predict them. For example, the 2009 US stock market lows were not accompanied by grand predictions of a new bull market or a big rally.

- Instead, those lows were accompanied by rampant shorting of Dow stocks, and projections of vastly lower prices.

- That’s the state of gold market sentiment, here and now.

- UBS bank analysts are influential. They can move substantial amounts of liquidity out of gold, or into it, with their statements. That’s because those statements are followed by large money managers.

- In the past, UBS gold market economists have shied away from mentioning China and India. That may be changing now, in a very big way. ‘“The next four months will be a battle between [US interest rate rises] in the West and physical demand in the East. “In the short term, you’d pick the interest rates on that.” However, in the longer term Mr Battershill predicted Asian demand would put a solid floor under the gold price.’ – UBS analyst Jo Battershill, quoted by The Sydney Morning Herald newspaper, March 9, 2015.

- It’s very good news to see sharp bank economists at UBS using terms like “solid floor”! UBS has a one month average price target for gold of $1200, and a three month target of $1170.

- This superb analysis, ironically, comes at a time when many amateur analysts in the gold community are severely demoralized, and are drawing giant arrows to much lower prices on the gold chart. The action of these amateur analysts is very bullish.

- There’s nothing to be afraid of in the gold market. In this general price area, the wise investor is a modest buyer.

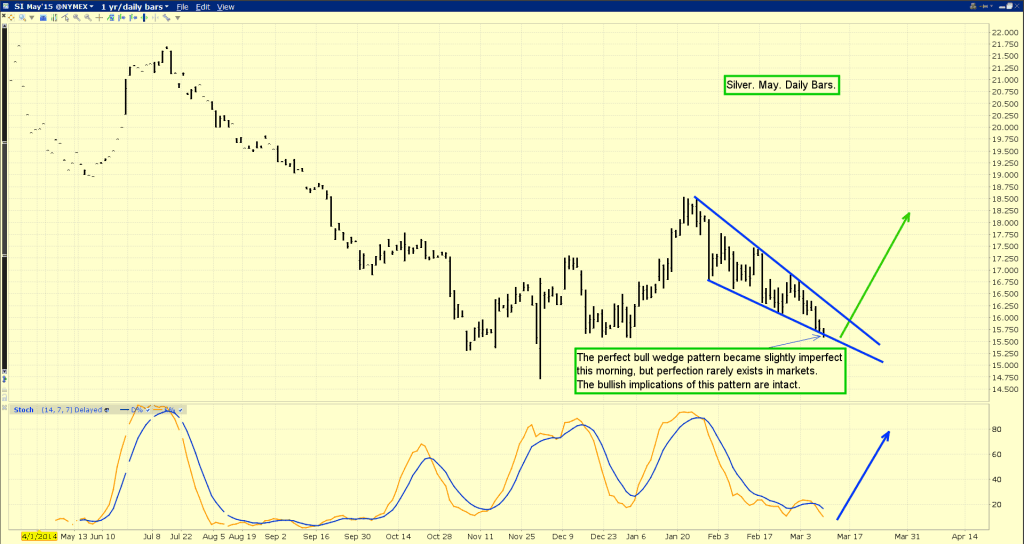

- Please see below now. That’s the daily silver chart. It looks superb. Trading volume on the SGE (Shanghai Gold Exchange) has already surpassed COMEX volume, and the new London Gold Fix is set to launch on March 20, with major Chinese banks playing a key role in price discovery there.

- Like gold investors, silver investors have little to fear, if they place buy orders today. Good things are coming to the silver market, and this mighty metal has held up very well during the current sell-off in gold.

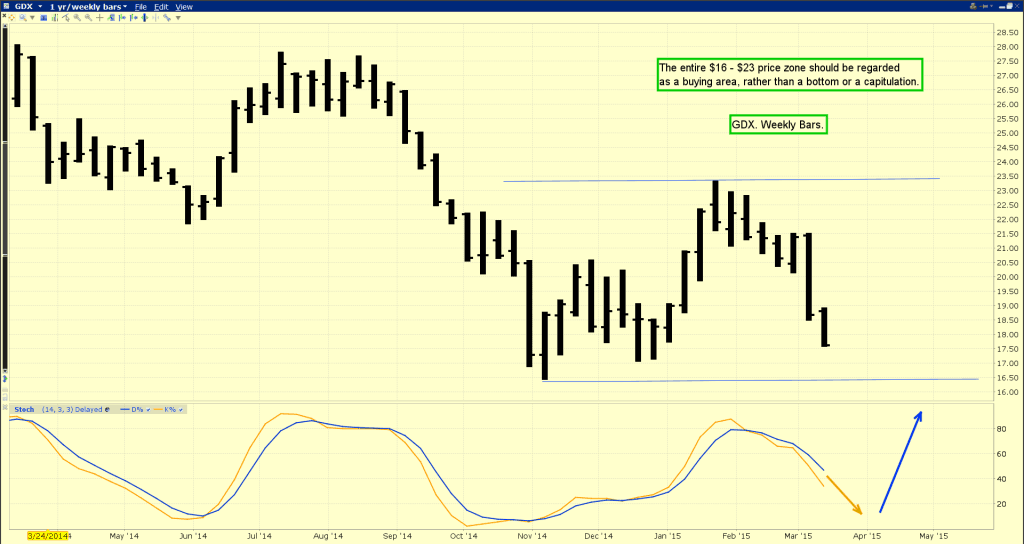

- Please see below now. That’s the weekly GDX [gold miners index] chart. While the key 14,3,3 Stochastics series oscillator is not as oversold as it is for gold or silver bullion, this is still an important buying area. It’s very important to discern between the game of calling tops and bottoms, and professionally buying or selling a key asset.

- This is a buying area, not a top or bottom calling contest, and I invite the strongest hands in the Western gold community to join me this morning, as I modestly buy GDX and other key precious metal assets!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Manage GDXJ Professionally!” report. I show investors the tactics required to act calmly, and profitably on the GDXJ price grid! I’ll include buy and sell points for two large reserve companies that are poised to outperform the entire sector!

Thanks!

Cheers

st

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: stewart@gracelandupdates.com

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Pingback: Will “the Chinese” takeover NZ? - Gold Prices | Gold Investing Guide