|

Gold Survival Gold Article Updates:

June 19,2014

This Week:

- A Central Banking Extravaganza!

- A Correction on Negative Interest Rates

- Gold and Silver Surprisingly Rise on Fed Ongoing “Taper”

- A Fake Taper?

- Central Banks Buying Stocks

- Precious Metals Pricing Moving to the East?

As the title to this email said, this week we do have a Central Banking Extravaganza. With the majority of our news items all relating to happenings in the strange and murky world that is Central Banker land.

First though as always we cast our eye over price movements from a week ago.

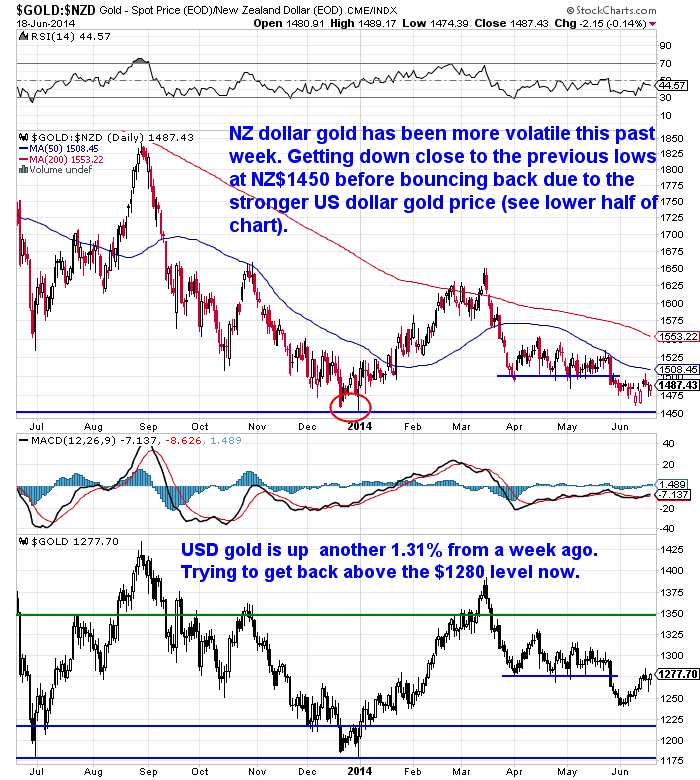

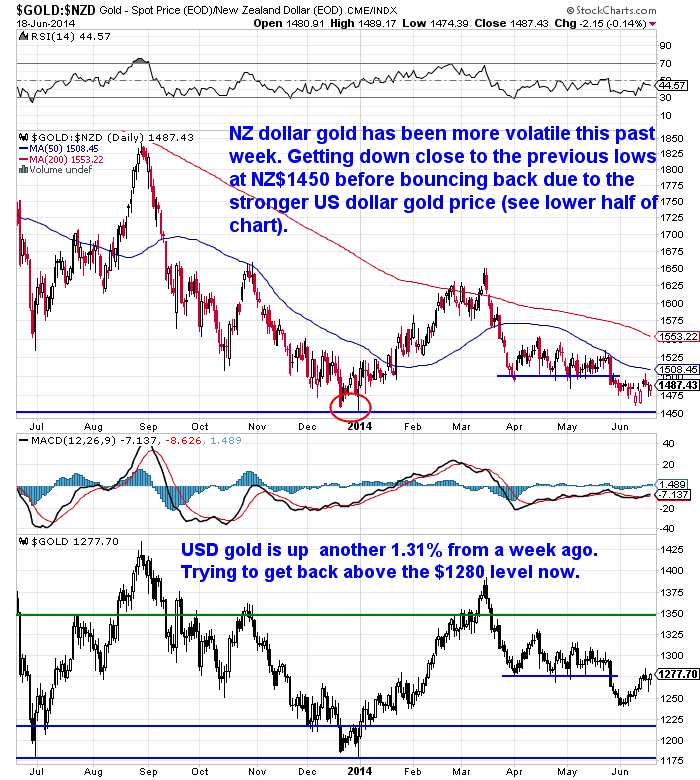

Since last week gold in NZ dollars is down $9.99 per ounce or 0.68% to $1466.51. Solely due to the stronger kiwi dollar. As in US dollars gold is actually up up $16.48 or 1.31% to US$1278.36.

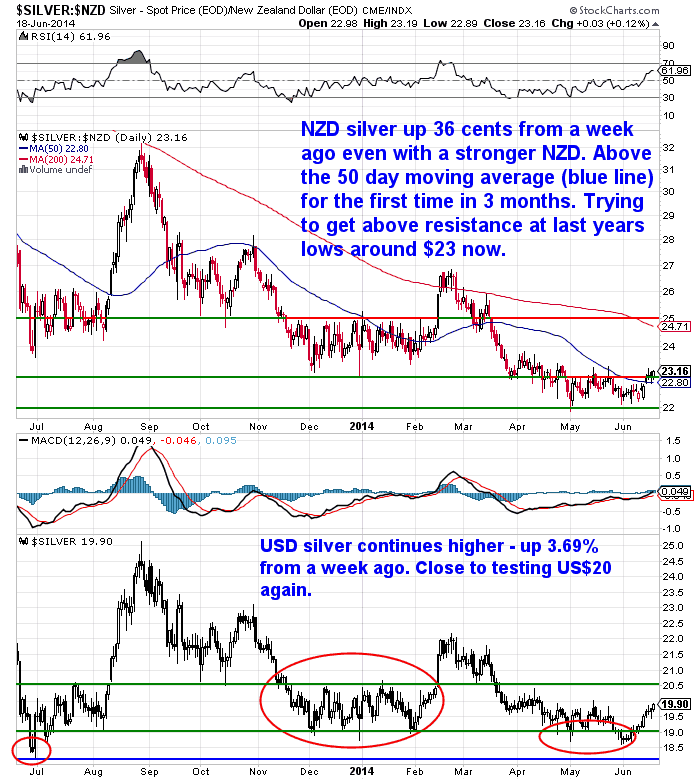

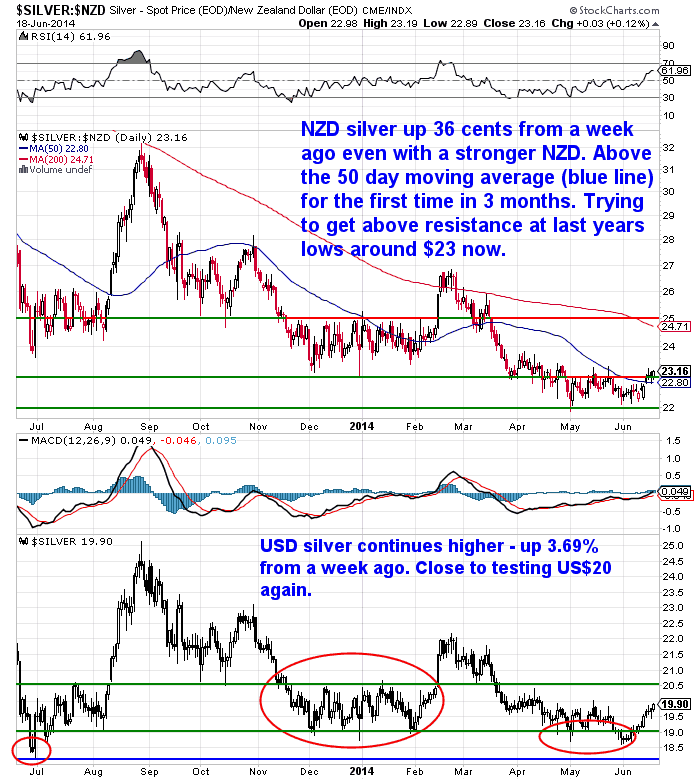

Silver has been the strong performer this past week. Even in the face of the much stronger NZ dollar the local price is still up 36 cents per ounce or 1.6% to NZ$22.86.

While US dollar silver is up a hefty 71 cents or 3.69% to US$19.93 and getting very close to that $20 level again.

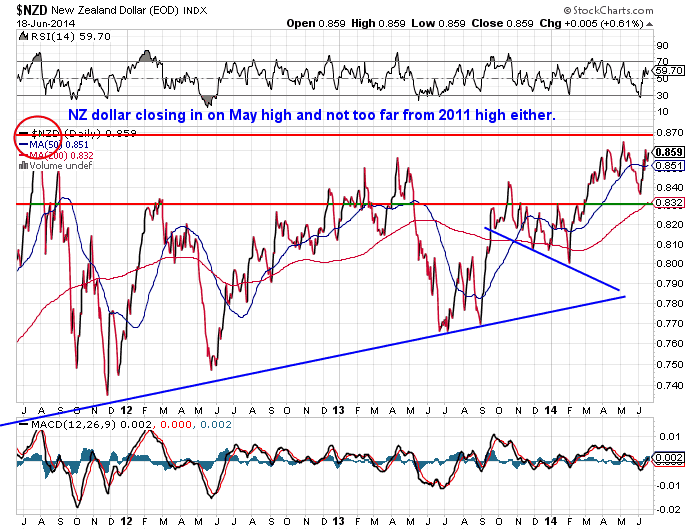

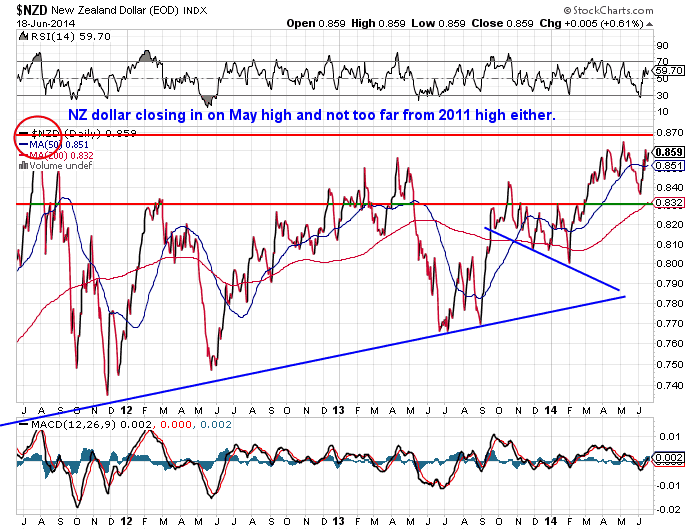

The NZ dollar has been moving steadily higher since the RBNZ announcement last week. As you can see below getting close to previous highs again.

It is possible the NZ dollar could be heading even higher from here. However with gold and silver prices in US dollars terms close to their lows and the kiwi dollar exchange rate as close to its highs for long term buyers of precious metals this could be a good entry point.

A Correction on Negative Interest Rates

Last week we noted the negative interest rate announcement by the ECB and repeated the comment from the article that it was the first time a central bank had done this. However a reader (thanks C.D.) pointed out that Denmark had actually had negative rates since 2012. Which is of course correct. Although earlier this year Denmark raised their benchmark out of the negatives.

Still the ECB’s negative rate is obviously likely to be more impactful simply due to their size.

On top of this we also read during the week that in the late 1970’s the Swiss National Bank had even steeper negative rates for Swiss franc deposits, aiming to stop the franc from soaring even further. (As it happened late 1978 saw the peak of the franc for many years to come.)

So the ECB is not the first but it could still quietly usher in a new phase of the currency wars and we doubt they will be the last to “go negative”.

Gold and SIlver Surprisingly Rise on Fed Ongoing “Taper”

Back across the Atlantic now and at this mornings Federal Reserve Press Conference more of the same we come to expect of late:

—–

“The Federal Reserve said growth is bouncing back and the job market is improving as it continued to reduce the monthly pace of asset purchases.

“Economic activity is rebounding in the current quarter and will continue to expand at a moderate pace thereafter,” Federal Reserve Chair Janet Yellen said at a press conference in Washington today following a meeting of the Federal Open Market Committee. Even with declines in unemployment, “a broader assessment of indicators suggests that underutilization in the labor market remains significant.”

The FOMC trimmed bond-buying by $10 billion for a fifth straight meeting, to $35 billion, keeping it on pace to end the program late this year.

Yellen and her fellow policy makers are debating how long to keep interest rates near zero as the U.S. labor market improves and inflation moves closer to the Fed’s 2 percent goal.

The policy-making FOMC repeated today that it’s likely to “reduce the pace of asset purchases in further measured steps” and that it expects rates to stay low for a “considerable time” after the bond-buying ends.”

Source.

—–

Nothing too surprising in there. Although you could argue that it was surprising that gold and silver have actually risen following her speech. As further tapering (although expected) and the generally positive tone could have been expected to put a dent in gold and silvers recent rises.

Fed Bond Selling a Long Way Off

But also not surprising this week was another announcement by the Fed.

They are now saying they won’t reduce their balance sheet back to “pre-Crisis” levels at the completion of the QE tapering. This could be another reason why interest rates will stay low for longer than most think possible.

—–

“Federal Reserve officials, concerned that selling bonds from their $4.3 trillion portfolio could crush the U.S. recovery, are preparing to keep their balance sheet close to record levels for years.

Central bankers are stepping back from a three-year-old strategy for an exit from the unprecedented easing they deployed to battle the worst recession since the Great Depression. Minutes of their last meeting in April made no mention of asset sales.

Officials worry that such sales would spark an abrupt increase in long-term interest rates, making it more expensive for consumers to buy goods on credit and companies to invest, according to James Bullard, president of the Federal Reserve Bank of St. Louis.”

Source.

—–

A Fake Taper?

Of course it is also likely that the QE Taper itself is not real and is masked by such antics as using Belgium as a front for the Fed to continue to be the largest buyer of US treasuries. First reported by ZeroHedge back in March, although we think this Paul Craig Roberts piece explains the likely process well, whereby the Fed is effectively using Belgium as a custodian for its own treasury holdings. So instead of tapering them, the Fed likely increased their holdings to make up for Russia dumping $26 billion or 20% of the US treasuries they hold!

But while people continue to believe in the omnipotence of the Central Banker the system can keep trucking along for a while yet.

Another sign that we remain in the “central bankers are omnipotent and can do no wrong stage” is something closer to home. RBNZ Guv Wheeler was recently named top public sector boss in political newsletter Trans Tasman’s fifth Annual Briefing Report.

—–

‘‘He’s made some gutsy calls and stood up to the political pressure not to interfere in the iconic quarter acre dream,’’ the report said of Wheeler.

‘‘A courageous governor – and we will find out over the next year or so whether he made the right calls.’’

Source.

—–

Sheesh. Hero worshipping there indeed. But while most still believe in Central Bankers the House of Cards can remain standing a while yet.

Central Banks Buying Stocks

Also on the topic of Central Banks comes some surprising news reported by FT and picked up by Zerohedge. Actually we should rephrase that to say it is not the news itself that is surprising, just the fact that it has been allowed to be reported.

What was the news?

That Central Banks globally have been buying trillions in stocks and other assets – $29 Trillion in holdings to be precise. The very same Central Banks that have been printing the money have been funnelling it into global stock markets as well.

Why?

Most likely to keep the differential between bond yields and dividend yields from not blowing out. That is, if they keep stock prices going up it will reduce their dividend yields and therefore keep bonds looking comparatively attractive, and interest rates down, and therefore help keep government interest bills down. Got that?

So it seems likely that while this continues stock markets will continue to go up for a while yet. We’ve read increasing opinions that a crash is coming and not far off. A crash seems likely in the end, but perhaps not for a while yet. Why?

Because there are likely still many that exited markets in 2008 and are still yet to return. They likely will return closer to the end only to get done over yet again unfortunately.

Sort of on the subject of a crash, Ben Davies pointed out an interesting recent Financial Times headline that said: “Volatiliy ‘extinguished’ by moves from central banks” He believes this will be looked back as a good contrarian indicator and that volatility will be returning soon enough.

Precious Metals Pricing Moving Slowly to the East?

With the end of the London Silver Fix in August and plenty of discussion about the London Gold Fix there has been more news on possible replacements this week.

A couple of weeks ago was the news that the Shanghai Gold Exchange (SGE) is intending to allow international trading there, with a view to giving Chinese trade a much larger impact on price setting. Koos Jansen had a translation of an interesting article on a speech by the head of the SGE where he said:

—–

“that the right to price gold now lies in the West, namely New York and London. New York prices gold through bidding whereas gold price is fixed by five banks in London. However the London gold fixing price is now being questioned since these five banks are price-fixers while at the same time they are also the market’s most important participants.

Xu pointed out that the current gold market, especially the physical gold market is actually in the East, mainly in China. Last year China’s own gold-enterprises produced 428 tons; at the same time China imported 1,540 tons of gold, adding up to nearly 2,000 tons. China’s import volume is significant but China’s influence in the gold price is very small. Although influence was visible last year, real influence still lies in the West. Data such as Non-farm payroll, even a speech could impact the gold market in a big way. In this sense, the mass and scale of China’s gold market and its voice and influence in the international gold market do not match, so it should speed up the development of China’s gold market.”

Source.

—–

This week it was the news that the Dubai Gold and Commodities Exchange (DGCX) is “Diversifying away from its derivatives focus, the DGCX is all set to launch a spot gold contract this year that will make Dubai a major price discovery centre for the precious metal.”

Source.

On top of this was a World Gold Council press release overnight that it is holding a discussion forum to look at an overhaul of the London Gold fix. They came up with 5 principles which a reformed fix process or alternative should adhere to:

- “It should be based on executed trades, rather than quote submissions.

- It should be a tradeable price, not simply a reference one.

- The input data should be highly transparent, published and subject to audit.

- It should be calculated from a deep and liquid market, through which a significant volume of gold flows are transacted.

- It should represent a physically-deliverable price, as many users want to take physical delivery of gold.”

Who knows exactly what price setting system we will end up with – possibly later this year – for silver and gold. But it does seem we are slowly edging closer to not only a more transparent pricing structure but one that may more closely represent physical demand. And in particular one that is not chiefly set in London and New York

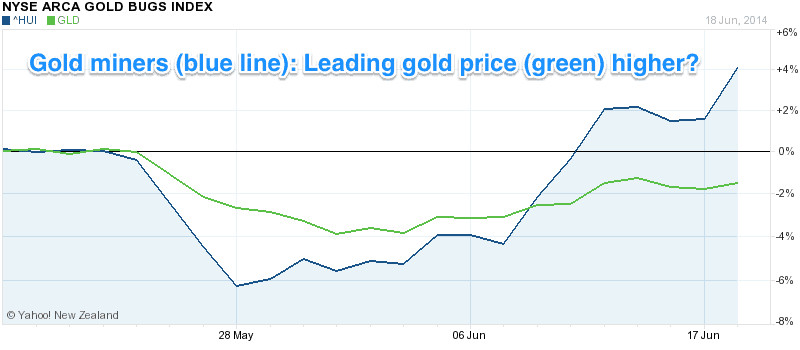

Miners Looking Positive

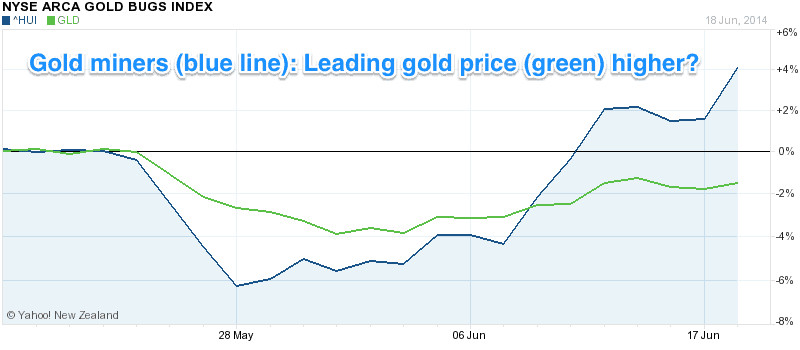

As noted already with the kiwi dollar close to record highs and gold and silver close to record lows this could make a very good entry point for long term buyers.

Another positive note is that the miners still seem to be leading the metals themselves higher. As can be clearly seen in the chart below, miners are actually up 4% on a month ago whereas gold is still down just under 2%.

And there are still close to record short positions in both gold and silver so the stage is possibly set for further gains. If you’d like to be on board at these levels then get in touch.

This Weeks ArticlesThis Weeks Articles:

Good News? Hedge Funds Betting Against Silver Reaches Record High |

2014-06-12 00:19:40-04 2014-06-12 00:19:40-04

Gold Survival Gold Article Updates: Jun 11, 2014 This Week: -Hedge Funds Betting Against Silver Reaches Record High: Good News? – 8 Should Ask Questions Before You Buy a Safe to Store Gold & Silver – Negative interest rate policy by the European Central Bank – Could Interest rates stay low longer than most imagine? |

I Owe My Soul—Why Negative Interest Rates Are Only the First Step |

2014-06-12 00:19:40-04

2014-06-12 00:19:40-04 2014-06-16 19:08:15-04

2014-06-16 19:08:15-04

Pingback: Gold Prices | Gold Investing Guide The Fed’s Stealth Tightening

Pingback: Gold Prices | Gold Investing Guide Big move in Gold and Silver Coincides With Indicators of a Likely Bottom - Gold Prices | Gold Investing Guide

Pingback: What Would Happen to the NZ Dollar if the US Dollar Collapsed? - Gold Prices | Gold Investing Guide