Once again it’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2023. Because it’s no point making predictions if you don’t check back and see how you did. Then finally we’ll finish off by making a few guesses as to what could happen in 2024…

Table of contents

Estimated reading time: 7 minutes

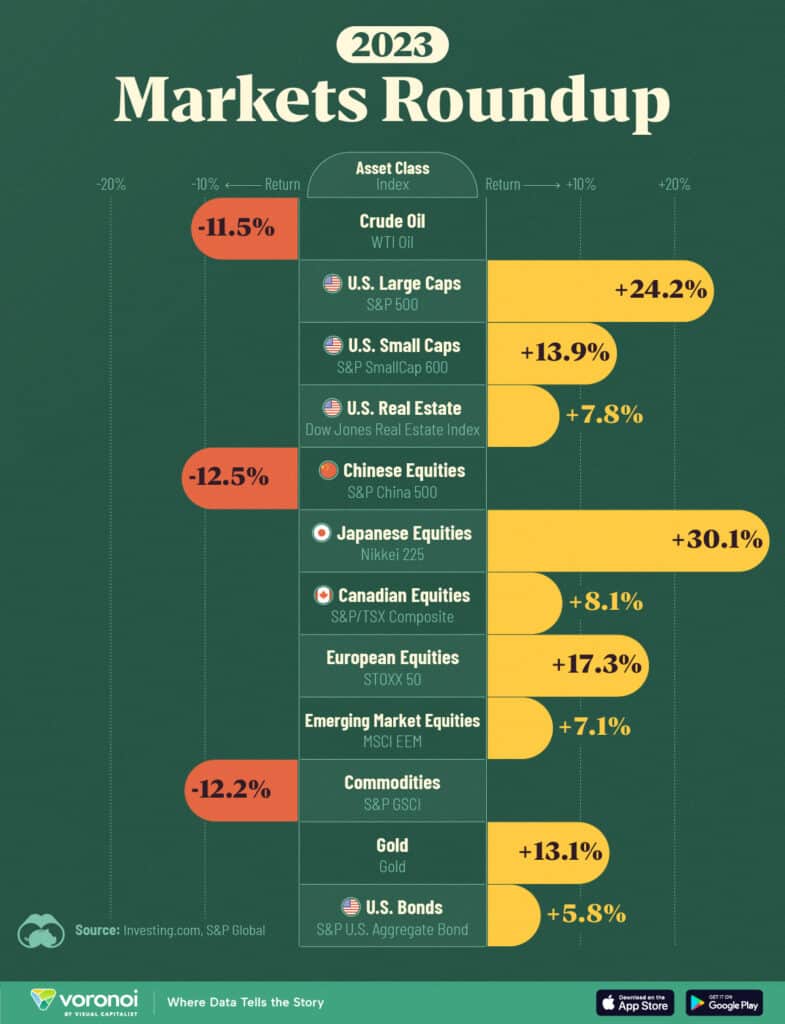

2023 was a bit of a mixed bag for returns as far as different asset classes go. Following a terrible year in 2022 sharemarkets, including the US and Japan, staged a comeback. You’ll see that in US dollar terms gold was the 5th best performer in the below table from Visual Capitalist. Interestingly we looked at a number of other 2023 asset class perfromance tables from the likes of Blackrock and others. But they all only listed commodities in general and lump gold in with that. So gold is still often overlooked as an asset class by the mainstream investment community.

But as as usually the case, the table above only looks at gold in US dollars, being up 13.1%. (Our own calculation says USD gold was up 13.45% probably just down to exactly what starting and closing price is used). As we are in New Zealand we should track the NZ dollar gold and silver price, not the US dollar price. So how did precious metals perform in 2023 in New Zealand dollar terms?

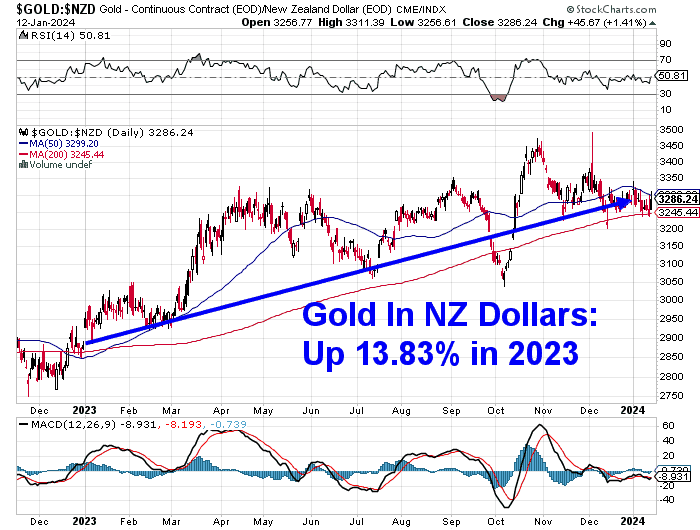

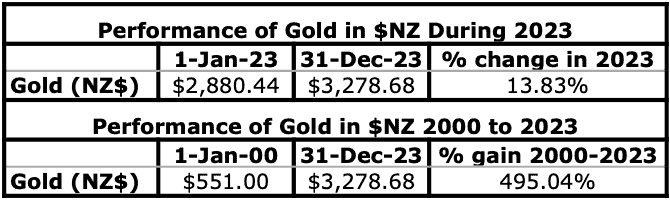

Gold in $NZ – Performance During 2023

The below chart of gold in New Zealand dollars shows a very similar performance to that of USD gold. NZD gold being up 13.83% from the end of 2022 through to the end of 2023.

NZD gold rose in a pretty steady trajectory all year. Although there was a sharp rise in March which sent NZD gold to a new all time above $3050. This was followed by a period of consolidation around $3300. Then a sharp fall in September followed by an even sharper bounce back in October. Before NZD gold then consolidated for the last couple of months of 2023. It currently sits right on the 200 day moving average which, apart from a brief dip on October, gold has stayed above all of last year.

Casting our eye back even further to the start of the millennium, and the start of the current bull market in precious metals, gold is now up almost 500%. Averaging 20% per year over those 24 years.

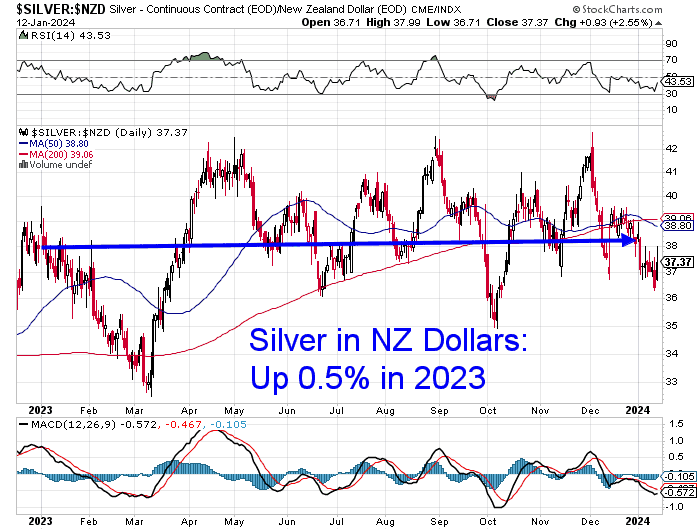

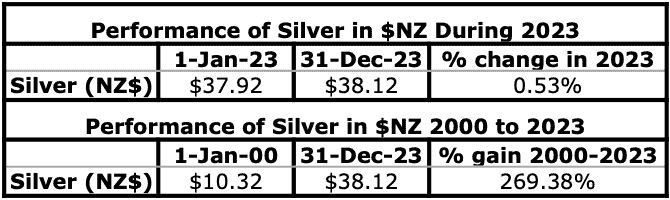

Silver in $NZ – Performance During 2022

Unlike in 2022, silver underperformed gold. Silver in New Zealand dollars was pretty much unchanged for the year up just 0.5% during 2023. Closing at $38.12, NZD silver got as low as $33 in March. But as high as $42 on multiple occasions. Once $42 is clearly broken then the 2020 high at $45 will likely be tested fairly quickly.

Over the much longer term silver has also underperformed gold. With silver rising 269% since the year 2000. We shouldn’t really be particularly surprised by this. As past bull markets have shown that silver can make very large gains in a short period of time. So we can expect that the major gains for silver might be more likely to come near the tail end of this current precious metals bull market.

How Did We Go With Our 2022 Predictions?

Now, time to check back on our 2023 prognostications and see how accurate or inaccurate we were. As noted already, there’s no point making any if we don’t take a look back!

Here were our predictions for 2023:

- We’ll again say that NZD priced gold and silver will finish 2023 higher than they started them. However we’ll also say that their rise will be smaller than that of gold and silver in US dollars.

Half a mark for this one but only just. NZD gold and silver both ended the year higher than they began (silver only just). But their rises were slightly higher than in US dollar terms.

2. The New Zealand dollar will be up against the US Dollar for 2023. The trend that started in October 2022 is likely to continue this year. Although maybe not with such strength. So we’ll say more of a gentle rise for 2023.

The NZ dollar was just about unchanged for the year. By our calculations, down just 0.33% during 2023. So we didn’t get that right. Although we did think there wasn’t going to be a strong uptrend. In the end it wasn’t a strong uptrend but also it wasn’t a strong downtrend either. We could be generous and give ourselves half a mark for that one.

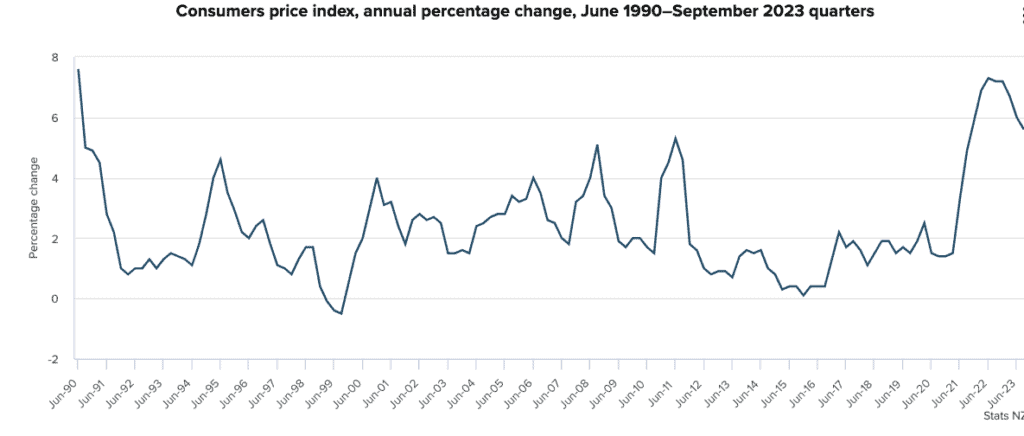

3. We are starting to see talk of inflation having peaked with reports out this week. However we think high inflation rates are here for a number of years to come yet. We expect inflation to continue to hover around similar levels to 2022.

For the 12 months to December 2022, the NZ consumer price index (CPI) inflation rate was 7.2%. During 2022 the inflation rate hovered between 6.9% and 7.2%. The latest data for 2023 we have is that: “New Zealand’s consumers price index increased 5.6 percent in the 12 months to the September 2023 quarter”. That is down a little from the 2022 levels but still historically very high as shown in the chart below.

So we could go either way on whether that is similar to 2022 levels. But to be fair 5.6% is actually lower. The CPI remains high but is down from 2022, so it’s hard to give ourselves a full tick for that even if the CPI still looks much higher than the previous 30 years. Half a mark maybe?

4. 2023 will also see stock markets continue to fall. Both the US S&P500 and the NZX50 will finish the year lower than they started. The tech heavy NASDAQ could continue to drop sharply. Maybe we’ll see that fall another 20%?

But in US stock markets were up, the NASDAQ up strongly by 43% and by more than the general market (DOW was up 13.70%). So another cross there. However, the NASDAQ is still down from its 2021 high while the broader US stock market indices are hovering at all time highs.

Maybe we are guilty of suffering from recency bias with some of last years calls?! That is expecting more of the same to happen.

Reading the Tea Leaves: Our Guesses for 2024

Now what about our predictions for the coming year? Here’s what we think might happen in 2024:

- We think it is only a matter of time before USD gold will set a new all time closing high above $2100 during 2024. We’ll go out on a limb and say we’ll see double digit percentage gains for USD gold. And close to that for NZ gold. 2023 was the first time USD gold closed the year above $2000. We’ll also say that 2024 may be the first year that USD gold doesn’t again go below US$2000.

- US silver will finish the year higher than it starts. Silver is due to play catch up with gold but should we say 2024 will be that year? We don’t feel it strongly enough to put it down on paper.

- We think the US dollar will weaken this year and so the NZ dollar is likely to rise compared to the US. Maybe we’ll finally get this call right this year!

- We’ll also double down on the stock market call from last year. With US stocks back around all time highs we’d expect them to fall back towards the previous lows in 2024.

- Long term interest rates and inflation rates will fall during the year. But we’d say this is a short term counter-cyclical move in a longer term uptrend for them both. So maybe by the end of the year they will both have turned back up again?

So there you have our predictions for 2024. We didn’t have much luck in 2023 so maybe we’ll return to form in 2024? But it is incredibly difficult to predict market moves over a specific time frame. That’s why a better bet is often to use dollar cost averaging and just make purchases of gold and silver at preset times during the year.

Or use some technical indicators to time your purchases after a pull back in the precious metal prices.

Gold and silver are down since the start of 2024. At the end of last we we wrote to our daily price alert subscribers to say it was likely a very good buying zone that wouldn’t last for long especially in silver.

So sign up to our daily price alerts if you want to hear when other pull backs like this occur throughout the year.

Pingback: Why the NZ Super Fund Should “Invest” in Gold in 2024 - Gold Survival Guide

Pingback: Red Sea Instability, Supply Disruptions, & Shipping Price Increases Now; Inflation Increases Later? - Gold Survival Guide