Prices and Charts

Gold Continues in Sideways Range of Last 2 Months

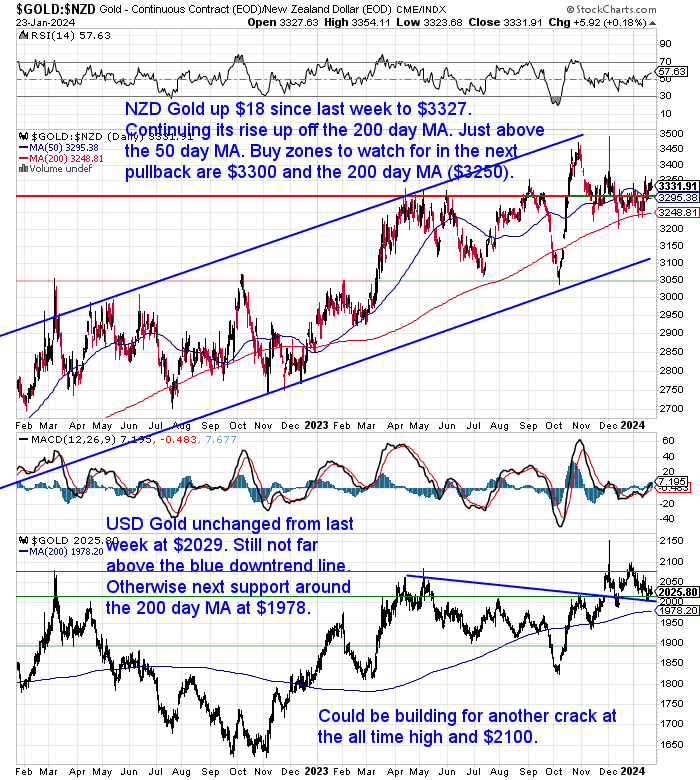

Gold in New Zealand dollars is up $18 or 0.5% from a week ago to $3327. It has continued to rise up from the 200 day moving average (MA), getting above the 50 day MA. It is not too far from $3350 now. When we see the next pullback, the buy zones to keep an eye out for are $3300, and the 200 day MA around $3250. Then below that (if we see it) the blue uptrend line in the current rising trend channel, currently around $3150. As you can see this hasn’t been hit very often, so the 200 day MA is likely a decent zone to aim for.

USD gold was unchanged from a week prior. Still at US$2029 and still not far from the blue downtrend line. $2100 remains the key overhead resistance level to watch for. Once we get a clear break out above that line the next run higher likely begins. But until then the next support area is around the 200 day MA at $1978. Before that $2000 could be strong support too.

Silver Continues Pullback to the Uptrend Line – Strong Buy Zone

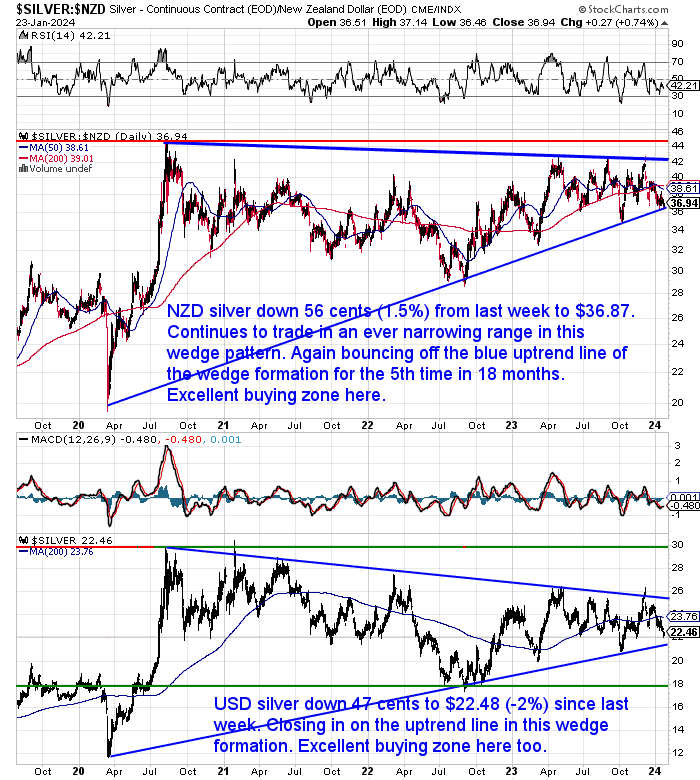

NZD silver was down 56 cents or 1.5% this week. Sitting today at $36.87, bouncing up after hitting the blue uptrend line again yesterday. This is the 5th time in 18 months that this line has been hit. So that makes it an excellent buy zone if you’re after some silver. The trend of an ever narrowing wedge pattern continues. Silver will have to break out of this in the coming months.

In USD terms a similar pattern is playing out. USD silver was down 2% or 47 cents to $22.48. Also getting very close to the blue uptrend line. So USD silver is also in a very strong buying zone around here too.

NZ Dollar Down 0.5%

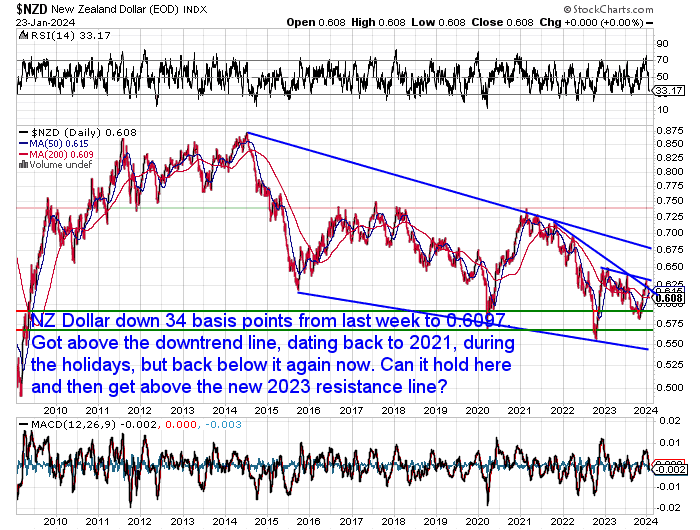

The New Zealand dollar was down 34 basis points from last week. It is back below the downtrend line dating back to 2021, having broken above it over the holidays. We’ll need to see the Kiwi get above at least 0.6500 before we can say the trend is up. And above 0.6750 before we can say the same thing about the downtrend that has been in play since 2014 being over.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Why the NZ Super Fund Should “Invest” in Gold in 2024

The New Zealand Super Fund is a government savings scheme that aims to help pay for the future cost of universal superannuation. The fund has performed well since its inception in 2003. In 2023 it again performed well. A Radio NZ article stated:

“The Superannuation Fund has turned 20 and is claiming the country is $40 billion better off as a result.

It was set up in 2003 by then finance minister Michael Cullen as a way of funding future costs of providing pensions to a growing number of ageing New Zealanders.

In that time it has become one of the best performing sovereign wealth funds in the world, with a long term perspective on investment, riding out the highs and lows of markets, and broadening its scope to beyond stocks and bonds to include large infrastructure projects.”

Source.

However in this week’s feature article we make the argument that the Super Fund is also exposed to high risks due to its heavy allocation to shares and low diversification.

Read on to see why gold could protect the fund, and the surprising performance comparison of gold priced in NZ dollars compared to the NZ Super Fund performance. Plus you can compare whether you might personally face any similar risks to the fund in terms of your own investments.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

NZ Inflation Rate Falls in December Quarter

The latest inflation numbers for NZ were released today:

“The Consumers Price Index increased just 0.5% in the December quarter, bringing the annual inflation rate to its lowest level in over two years.

Statistics New Zealand says annual inflation fell to 4.7% from 5.6% during the three-month period, dropping to its lowest level since September 2021.

…The RBNZ forecast the headline inflation rate would be 5% in the year ended December, while most bank economists expected it to be 4.7%.

Annual tradable inflation, which includes imported goods such as petrol, dropped to 3% from 4.7% while non-tradable inflation fell to 5.9% from 6.3%, meaning it came in higher than the RBNZ’s 5.7% prediction.”

Source.

Before the release wholesale interest rate markets were:

“…pricing in an 80% chance of a cut to the OCR as soon as May of this year. And the markets are expecting there will be nearly 100 basis points worth of cuts by November.

The RBNZ’s most recent forecast is that there will be NO cuts at all in 2024 and the first cuts won’t start till next year.

The markets’ belief that the RBNZ will be forced to cut much earlier than it has said was strengthened enormously by the September quarter GDP figures, released in mid-December 2023. These showed a 0.3% fall for the quarter – going very much against the RBNZ’s expectation of a 0.3% rise.

It’s fair to say that the markets and the RBNZ don’t appear to be on the same page at the moment when it comes to the future movements of the OCR.”

Source.

Red Sea Instability, Supply Disruptions, Shipping Price Increases Now; Inflation Increases Later?

However, while inflation rates fell in the December quarter, even local economists are worried about the potential for the current geopolitical instability to cause supply disruptions and increase prices. Note they talk about inflation, but in our view the inflation has already happened when the currency supplied has been increased. The increase in consumer prices is just the final step in this process.

“Economists are cautioning that the unstable geopolitical situation may yet cause inflationary disruption – even as new figures due out this week are likely to show our inflation rate coming down significantly. In their latest First View publication, Kiwibank’s chief economist Jarrod Kerr, senior economist Mary Jo Vergara and economist Sabrina Delgado say that in the war against inflation, “we face further setbacks as actual wars disrupt shipping”.”

Read more

As we stated in last week’s predictions for 2024, we think inflation may continue to fall for a bit, however we expect this just to be a dip lower in a longer term upwards cycle.

There are some indicators that are pointing to this. Earlier this month we saw a huge surge in the global freight rate for containers:

“Oh boy. Global freight rate for containers just surged 61% this week. Not the time to celebrate the end of inflation. A second wave is likely underway. H/t @dailychartbook”

Source.

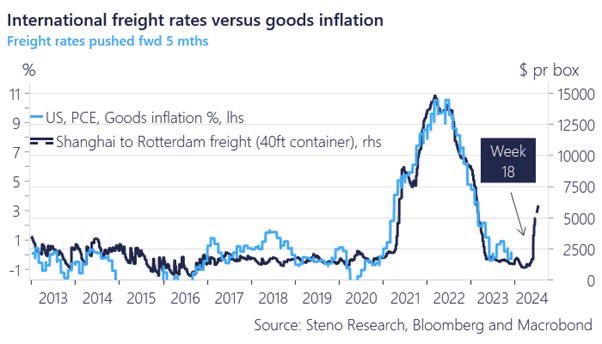

You may be thinking freight rates are only a small part of prices, how much do they correlate with overall inflation rates? This next chart seems to show quite a bit actually…

It pushes international freight rates forward by 5 months and shows a pretty decent correlation with US Personal Consumption Expenditure (PCE) inflation rate.

Inflation coming? Chart via @AndreasSteno

Source.

So if that holds true then later in the year we could see inflation rates ticking higher again.

Paulo Macro last week wrote about “How lopsided positioning is vulnerable to a change in Narrative around reflation”.

Via a number of charts from a Bank of America Fund Manager survey he showed how:

- The consensus is for a soft landing, or

- Maybe a tail risk of a hard landing

- That 62% of survey participants expected bond yields to fall.

- That fund managers are the most bullish on bonds in 15 years (i.e. they are betting on bond interest rate yields to fall)

- That they are also the most underweight commodities vs bonds since 2009

- Their energy allocation fell to a 3 year low

In the article titled “Inflation Hedge” Bros are coming” he concluded:

“…a mild recession is priced in, and/or hard landing is well on its way to being priced. This is the consensus. Big money is not made in the consensus. Pedestrian, subpar returns accrue to the consensus.

Do you know what’s not priced in and nobody cares about? A wage price spiral in 2024 that causes people to justify ex-post an equity & gold rally (and bond selloff) that coalesces around “Equities are a good inflation hedge,” or what I will call Inflation Hedge Bros. They’re coming.”

Source.

So Paulo thinks this could boost stock markets as traders use stocks to hedge against higher inflation.

Meanwhile, Alisdair Macleod also makes a similar statement about how almost everyone is getting the inflation and interest rate outlook wrong. Although he thinks stock markets will face a severe bear market.

Macleod outlines why the shift from commercial bank credit to “support” from excessive US Government spending is likely to be highly inflationary in the longer run.

He says that that funds continue to leave the US banking system but are ending up in government coffers by way of US government bonds and then being voraciously spent by the US government:

“The extent to which the Biden administration is sucking credit out of the US financial system is truly remarkable. While indicating that its own finances are in crisis, it shows that the level of risk aversion in private credit availability from the banking system is considerably greater than generally realised.

While the credit shortage for the private sector is acute, a combination of money fund flows and banks de-risking their balance sheets has allowed the US Government to borrow $2.6 trillion since this time last year, allowing for changes in its general account at the Fed. These funds are leaking back into the economy through government spending, none of which is productive in the sense that it is freely demanded. In other words, far from being deflationary as the monetarists suggest, by being taken out of the commercial banking system and redirected into government hands the apparent contraction of the sum of bank deposits and reverse repos is a more inflationary deployment of credit.

These are precisely the credit dynamics which fuelled stagflationary conditions in the 1970s. They lead to the opposite conditions currently discounted in financial markets. Therefore, far from an outlook for stable, lower interest rates and bond yields, the opposite is in prospect. And with the economic outlook deteriorating, even tighter credit conditions for businesses and consumers are certain. Furthermore, they are sure to lead to higher interest rates and bond yields reflecting higher inflation, and a severe bear market in equities as well.

This much will become increasingly obvious in the coming months.”

Source.

So they both have a similar outlook although differ on how this will affect stock markets.

Perhaps they could both be right on that front as we could see large stock market rallies and also large falls? With overall perhaps very little after inflation gains? Or maybe just different pockets doing well while other areas struggle? After all we are already seeing the latter…

Peter Boockvar points out how this is:

“Easily one of the strangest markets I’ve ever seen.”

When quoting Jason Goepfert of Sentiment Trader:

“The S&P 500 closed at an all-time high. [Large Cap Stocks]

The Russell 2000 [small cap stock] is still in a bear market*, down more than 20% from its high.

That’s never happened before.

Source

One thing that both Paulo Macro and Alisdair Macleod would seem to agree on is that a surprise inflationary scenario should trigger a decent rally in gold.

Even though gold went up over 13% in USD and NZD terms during 2023, most people probably think gold has done nothing while inflation has been soaring the past couple of years. So gold has been flying under the radar. Perhaps another surge in inflation is what it will take to attract more attention to precious metals. And with that a further boost in prices. Maybe a good idea to get in before that happens?

Get in touch for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

New Australian Product: The Superoo 16 Litre Gravity Water Filter by Filteroo. Leak free design with double the capacity of similar filters.

This filter will provide you and your family with safe drinking water for years to come. It’s simple, lightweight, easy to use, and very cost effective. Comes complete with Stainless Steel Tap, Stand and Water Jug.

Shop the Range…

—–

|