See how another financial crisis could cause the NZ Super Fund to lose over 50% in value. And why we believe the fund guardians should have an exposure to physical gold as insurance against crisis events.

Table of contents

Estimated reading time: 8 minutes

The New Zealand Super Fund was set up to help the Government save now. In order to help pay for the future cost of providing universal superannuation. With the aim to help smooth the cost of superannuation between today’s taxpayers and future generations.

Repeat of Financial Crisis Could Equate to 50% Fall in NZ Super Fund Assets

A previous NZ Super Fund report contained some interesting reading. The guardians of the fund outlined how a repeat of the global financial crisis would see the almost $40 billion fund (at that time) lose more than $22 billion. A loss of more than 50% of its assets.

However the same modelling showed this loss would be recovered within 2 years.

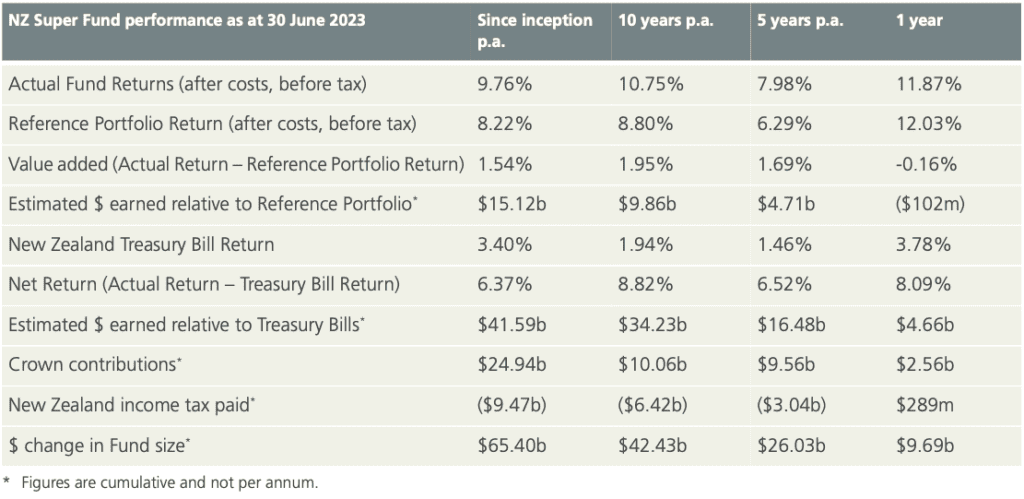

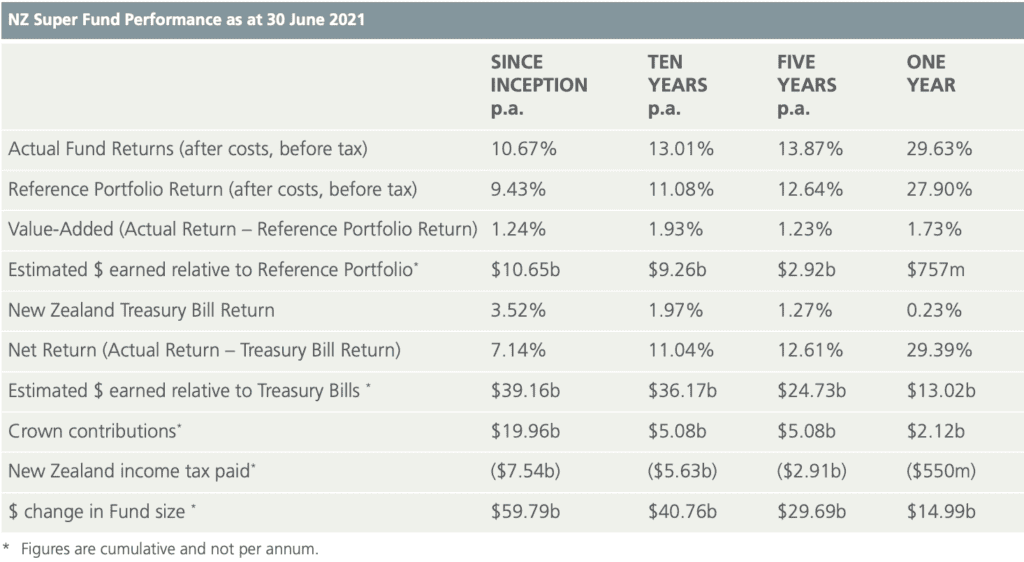

The fund has performed very well since its inception in 2003. Returning 9.76% annually. While over the past 10 years the return was 10.75%. It weathered the 2008 financial crisis and the stock market crisis during the initial COVID19 outbreak.

However, the NZ Super fund is considered a relatively high risk investor focusing on growth. With 80% of its assets invested in shares and just 20% in bonds.

It is interesting to see how the return from bonds (T-Bills) vs shares has shifted over that time. Reflecting the fall in interest rates since the financial crisis. And the outperformance of Sharemarkets.

Risk Versus Volatility

In the below video New Zealand Super Fund CEO Matt Whineray provides an overview of the funds investment ethos. Explaining how they view risk versus volatility.

“Whineray says by taking on the market risk associated with growth assets, the Guardians accept the risk that markets may experience sharp drops in value, be they driven by financial or political shocks, large commodity price movements, natural disasters or war.” Source.

In a previous interview he elaborates upon this:

“Risk is different. Risk is often conflated with volatility because you’ll hear financial reports and they’ll say ‘VIX today,’ which is a measure of really short-term one month volatility, ‘is up, so markets are riskier.’ But for us risk is different. Because for us the risk is not that we see volatility, we know we’re going to, that’s an outcome that we’ve made in terms of choice of our portfolio. The risk is that we don’t have the discipline, or the capabilities or the support from our stakeholders and in a broader sense stakeholders are government, media, public, that we don’t have the support to hold the course on our investment strategy,” Whineray says. Source.

We would agree that risk is very different to volatility. However our view of risk is a little different to the funds guardians.

What if Markets Don’t Bounce Back Within 2 Years?

In 2021 the fund had its best year ever, with a return of 29.63%. However there were tougher times following this which resulted in the return since inception dropping from 10.67% in 2021 to 9.76% in 2023. As markets experienced a much tougher year in 2022. But then in 2023 performed better and so regained much of the 2022 fall. We still think some tougher times might be ahead for broad share markets in the years to come. With possibly a stagflationary environment like the 1970’s. As we reported here this might include:

- A nasty stock market correction.

- Oil prices rising.

- All commodities rising in price. So basic everyday necessities will also rise in price. CPI will go higher.

- As the stock market continues to fall and commodities continue to rise, more people will rotate from shares to commodities, further reinforcing this cyclical change.

So then what if there wasn’t just a sharp fall over a year or 2 like we saw in 2008 and in early 2020? What if there was a major cyclical change in markets instead that lasted for many years? How would the fund perform then with its 80% weighting to global stockmarkets?

Even the NZ Super Fund CEO says:

“The recovery from the GFC was noticeably swift, and such a recovery might not be replicated after the next crisis.” Source.

The financial system was only hours away from completely collapsing back in 2008 as shown by this report quoting a US politician.

Had this occurred would sharemarkets have bounced back as fast? Would some companies have even survived?

These might seem like extreme outlier risks to many people. But we’d say the Super Fund guardians have a fiduciary responsibility to consider such risks.

What Risk is the NZ Super Fund Ignoring?

Whineray says risk is all about potentially not having the “intestinal fortitude”, or support of stakeholders, to stick to your guns and hold on during these extreme times when asset prices plunge.

Perhaps even more importantly, we also think they are over-looking another risk. That being counter-party risk. Ignoring the possibility that assets in the fund could not just fall for a year or two, but actually go to zero. If a custodian of an asset (a custodian is likely to be another investment fund or a bank) were to fail, then the assets they hold may also be at risk.

Learn more about counter-party risk here.

How Could the NZ Super Fund Mitigate These Outlier Risks?

These extreme outlier risks might be written off as highly unlikely and not worth considering. But unlikely does mean impossible.

Is there a way to minimise such risks without adversely affecting overall performance of an investment fund?

We’d say a holding of physical gold bullion is the way to go.

NZ Super Fund Should Invest in Gold

Lack of Counter-Party Risk is the Main Reason to “Invest” in Gold

The most important reason to have a holding of physical gold is the risk that a significant event could permanently wipe out a decent portion of the NZ Super Funds investments.

Gold is a real tangible asset that has no counter-party risk. Should a portion of the funds assets be wiped out, an “investment” allocation to gold would go some way towards making up for these losses.

(We put “invest” in quotation marks as we don’t really refer to gold as an investment. But rather we consider consider gold as financial insurance).

But the NZ Super Fund Does Invest in “Real Assets”

The Fund guardians might answer to say they do invest in “Real Assets”. As outlined in the annual report on page 42:

REAL ASSETS

Source.

- Timber

- Rural Land

- Real Estate (Opportunistic) • Real Estate (Value Add)

- Real Estate (Core)

- Infrastructure (Core)

- Infrastructure (Value Add) • Infrastructure

(Development) • Energy Growth

(Alternative)*- Energy(Shale)*

The Real Assets Group comprises investments or holdings in physical assets.

But these are still paper assets generally with a custodian holding them on behalf of NZ Super Fund. So there is still a counter-party holding and managing the assets on the funds behalf.

The fund does own a number of dairy and beef farms in New Zealand as well as a 42% stake in Kaingaroa Timberlands. Along with other real estate investments. In recent years the fund has also sought to “diversify our rural holdings away from an initial focus on New Zealand dairy and into international and permanent horticulture investments.”

In 2021 the super fund “purchased six properties in New Zealand including vineyards, a hop garden, a beef farm and dairy farms.” (Page 49 of the 2021 annual report).

So even these “real assets” are businesses with other inherent risks.

Whereas a holding of physical gold relies upon no counter-party. Gold will not be wiped out in a financial crisis. In fact it is likely to go up in value compared to other assets.

Gold is a Non-Correlated Asset

If Super Fund assets are not wiped out, but merely take a heavy loss due to another financial crisis, there is still a benefit in holding gold.

Research shows that gold acts as “investment insurance” as it is an asset that is non correlated with many other assets. So when the likes of shares/stocks, bonds and property are performing poorly gold can often smooth out your overall returns. Many studies have proven gold’s counter cyclical qualities:

“Gold’s qualities as a hedging instrument and safe haven asset have been thoroughly examined in recent years. Sherman (1982) suggested a weighting of 5% in an equity portfolio resulted in lower risk and higher return.

…Studies by Bruno and Chincarini suggest allocating 10% of the portfolio to gold for non-US investors. Scherer recommends a 5-10% weighting of gold for sovereign wealth funds. For high net worth individuals and family offices, Klement and Longchamp (2010)suggest an allocation in the range of 5% to 10% by weight to gold in an equity portfolio.

Lucey, Poti et al. (2006) examine portfolio choice where the investor is concerned with downside protection and find an optimal weight of between 6% to 25%, depending on the time period and the other assets included. Baur and Lucey (2010) provided the first statistical test of when gold acts as a safe haven and when as a hedge.”

Source.

Read more:Why Gold Bullion is Your Financial Insurance

Holding Gold Can Reduce Losses in Financial Crises

So instead of suffering though these major draw downs, a holding of gold could reduce these falls considerably.

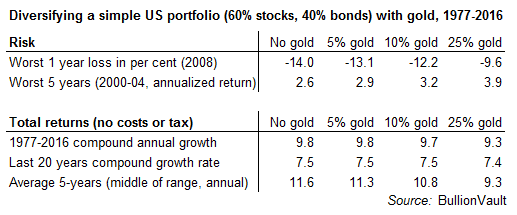

One study showed that holding 10% gold reduced losses in the worst year of the financial crisis, but only reduced annual returns over a 40 year period by 0.1%:

On a retirement portfolio of $1 million, adding 10% gold would have reduced losses during the worst year of the financial crisis by more than $17,000. During the Tech Stock Crash, holding 10% gold as “investment insurance” would have boosted a US portfolio’s total returns by almost 0.7 percentage points per annum, adding nearly $40,000 to initial savings of $1m.

…Over the four decades ending 2016, the total return on a portfolio with 10% gold would have shown compound annual growth of 9.7%. That was just 0.1 percentage points per year below the total annual returns of a portfolio holding 60:40 stocks-to-bonds with no gold.

Indeed, in the best single year for US equities and bonds (1995), keeping 10% of a portfolio in gold would have only reduced total returns from 32.2% to 29.1%.

Source.

These numbers would suggest that holding a percentage of its assets in physical gold would not significantly affect the overall returns of the Super Fund. But it would reduce the losses in times of crisis.

So there does not seem to be any significant downside to the NZ Super Fund at least maintaining a small exposure to physical gold.

The Super Fund website states:

“Given our long-term mandate, we expect to return at least 7.2% p.a. over any 20 year moving average period. This is our long-term performance expectation.”

Source.

Last week we completed our gold and silver performance review for 2023. In that we also tracked the percentage return of gold in NZ dollars since 2000. Just 3 years longer than the NZ super Fund has existed. NZD gold returned a total of 495% in the past 23 years. So we can see that over a similar period of time just holding gold on its own has performed very well. In fact by our calculation better than the Super Fund performance.

Interview on Reality Check Radio

Since this article was written Gold Survival Guide Co-Founder, Glenn Thomas, has been interviewed on Reality Check Radio on this topic. Listen to the 20 minute interview here.

Will the NZ Super Fund Invest in Gold?

Will the NZ Super Fund make an allocation to physical gold? We’d say this is very unlikely.

The mainstream investment community is generally very uninterested or even disparaging of gold.

There would be a possibility of them investing in gold miners – but investing in gold mining companies is not the same as holding physical gold. Read more: Paper Gold vs Physical Gold – What Should You Buy? >>

So we’d say there is little chance of the New Zealand Super Fund taking a position in physical gold. Which is why you should prepare for your own retirement. Don’t simply rely upon Superannuation and Kiwisaver.

Read more: Kiwisaver and Bank Bail Ins: If a Bank Fails, Are Kiwisaver Funds Affected by the OBR? >>

Instead construct your own retirement fund. And as the information above shows, make sure a portion of your own “Super Fund” contains a physical gold holding to protect your fund from crisis. Buy Gold Bullion.

Editors Note: First published 17 October 2018. Updated 20 April 2022 with the current risks in 2022 of a longer lasting market correction. Last updated 23 January 2024 with latest Super Fund report details.

Pingback: Oceania Gold Mine Expansion: Why the Greens Should be Embracing Gold

Pingback: Inflation/Stagflation, or Deflation and Gold to Plunge? - Gold Survival Guide

Pingback: But What About Longer Term Risks? - Gold Survival Guide