Prices and Charts

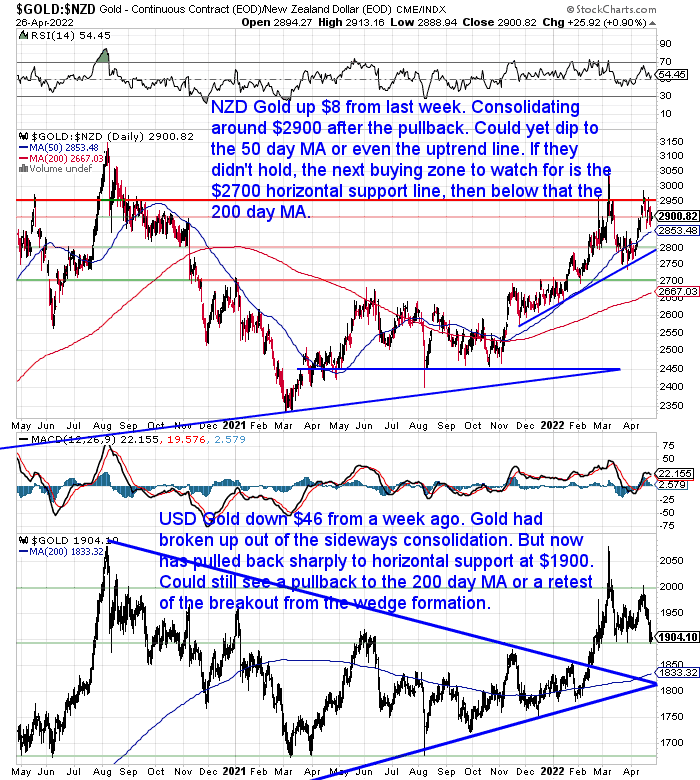

NZD Gold Flat From Last Week

Gold in New Zealand Dollars was up just $8 from a week ago. Consolidating around $2900 after the sharp pullback. It could yet dip to the 50 day moving average (MA) or back to the blue uptrend line. If those 2 levels didn’t hold, then the next buying zone to watch for would be the horizontal support line at $2700, Then below that the 200 day MA at $2667.

The pullback has been more significant in US dollars. With USD gold down $46 or 2.35%. It is sitting just above horizontal support at $1900.

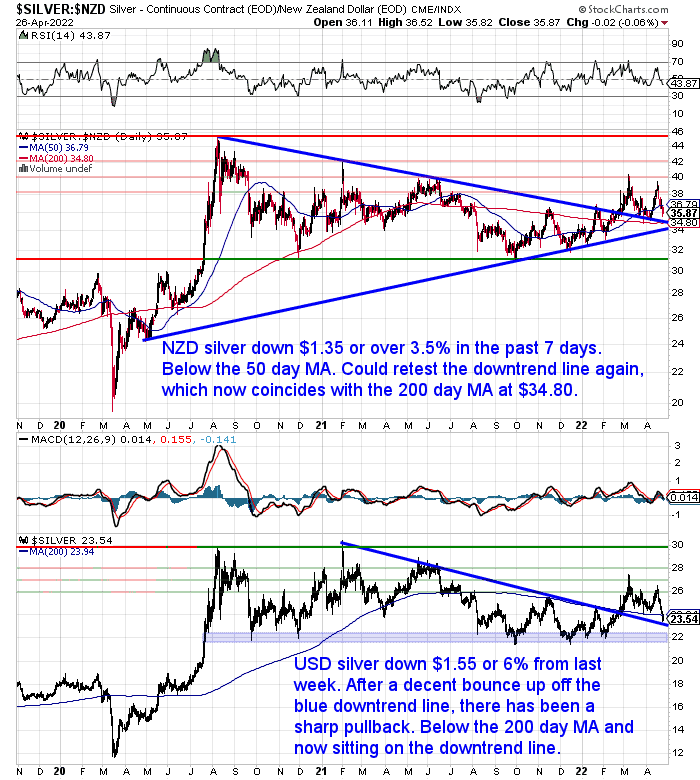

Whereas NZD Silver Down 3.6%

Meanwhile poor man’s gold was actually down a hefty $1.35 or 3.6% over the past 7 days when measured in New Zealand Dollars.

The stronger USD meant the drop was even greater for USD silver. Down a whopping 6% from a week ago.

But in either currency, silver is now close to or at the downtrend line. So we could be near to a bounce back for silver already.

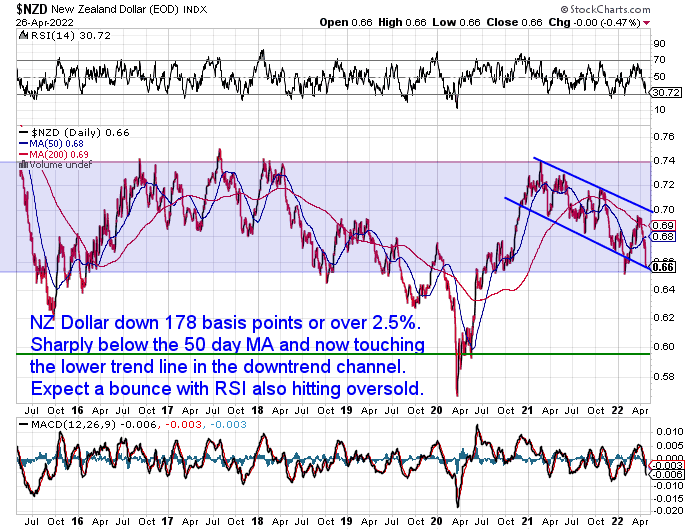

New Zealand Dollar Drops Over 2.5%

The New Zealand dollar was sharply weaker this week. Down 178 basis points, the Kiwi has fallen well below the 50 day MA. It is now touching on the lower margin of the downtrend channel it has been in since the start of 2021. With the RSI now touching on oversold we should expect a bounce soon. That could put pressure on local gold and silver prices.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – New Stock Finally Here

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

What Type of Gold Bar Should I Buy? The 2022 Ultimate Guide

The charts above show that gold has been clearly back in an uptrend since about March of 2021. With record high inflation rates meaning record high destruction in purchasing power, it’s no wonder more people are turning to gold as a hedge.

Gold bars are the most popular way to purchase gold. So if you’re trying to decide what type to buy today’s feature article will see you right. Here’s what’s covered:

- Why Buy Gold Bars?

- What Size Gold Bar Should I Buy?

- Pros and Cons of Different Bar Sizes

- 1kg Gold Bar Advantage: 1kg Bars Can be Borrowed Against

- What is the Most Common Gold Bar Size That is Bought?

- Other Factors to Consider When Buying Gold Ingots and Bars

- Different Brands of Gold Bars

- Pros and Cons of Cast and Minted Bars

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Australia About to Board the High-Inflation Bandwagon?

So far Australia has been one of the few countries to avoid the record high inflation rates. This morning ASB commented that could be about to end:

“Aussie Q1 CPI figures, due at 1:30pm NZT. Market expectations are for an acceleration in annual inflation to 4.6% y/y from 3.5% last quarter. Our friends at CBA are below-market at 4.3%. Markets (and CBA) are currently primed for a June start to the RBA interest rate hiking cycle, but this could be brought forward to May if CPI prints above expectations (particularly core inflation). This sort of scenario would spell trouble in particular for NZD/AUD, which may fall back towards the key 0.9100 support level. “

Sure enough inflation did surprise to the upside. With the actual quarterly increase coming in at 2.1%, against a forecast 1.7%. Which over the twelve months to the March 2022 quarter, resulted in a rise in the CPI of 5.1%.

Inflation It’s Everybody Else’s Fault!

The bank economists have been wrong about inflation for the past couple of years. They continue to be so.

Before last week’s New Zealand CPI numbers ASB stated:

“Today’s first quarter inflation outturn will be a whopper – we expect a 2.2% quarterly increase in the CPI to lift annual CPI inflation to 7.3% (market: 7.1%). This will most likely mark the peak this cycle. The spike in headline inflation is now well understood and priced, but what will be more interesting is what core inflation measures say about the likely persistence of high inflation. These are already all sitting uncomfortably above the RBNZ’s 1-3% inflation target and are set to rise further in Q1.”

The actual rate came in a bit lower but as this article points out the peak is likely not here yet:

Inflation is yet to peak despite hitting a 30-year high on Thursday, one leading economist says, as the Prime Minister continues to point at overseas factors as the main contributors to rising cost of living. StatsNZ revealed on Thursday annual inflation in the year to March 2021 had risen 6.9 percent, the largest year-on-year increase since 1990 and up from the 5.9 percent recorded last quarter.

Read more

The prime Minister blames oversea factors for high inflation. Funnily enough every country seems to be blaming “overseas factors”! But if inflation is high everywhere then who is to blame?

Nothing to do with massive currency printing amid lockdowns! No, of course not.

Inflation/Stagflation, or Deflation and Gold to Plunge?

Last week we ended with the no win exit that central banks face from their years of expansion of the currency supply.

“After years of vast increases in money creation, when it seemed like no ill effects would appear, central banks are now caught. There is no easy exit for them.”

Inflation is looking out of control and so central banks (ours included) are trying to reign this in with interest rate increases. But they are well behind the eight ball currently. But they also realise if they clamp down too hard shares would plunge far more steeply than the so-far “manageable” declines. Likewise for real estate prices.

So central banks are trying to find the goldilocks “just right” interest rate level. Something they are likely to fail at. The market should set the price of money, not some grey haired old men and women.

So the question is what happens from here?

Do central banks continue to err on the low side and cause inflation to rise even further?

Or do they pump rates much higher and cause a crash in shares and potentially property too?

Some analysts like Henrik Zeberg believe there is a massive stock market fall to come, along with a deflationary bust:

Zeberg has also argued that gold will plunge in a deflationary collapse. We’re not convinced a deflationary collapse will occur. However we have looked at this scenario multiple times before.

For example, Harry Dent has also long argued that gold will first plunge:

See this article from 2015 for why we’d disagree with Dent and Zeberg’s assertion about gold falling: Dear Harry Dent: Wanna Bet About Gold?

More on Harry Dent, along with arguments for and against the various “flations”, are also covered here: Inflation Versus Deflation and What Comes Next?

But that said, we have no crystal ball. Gold surely won’t rise in a straight line. A deflation could cause a fall in gold too. However we would think this could be temporary as argued in the two articles above.

So in the long run we believe holding metals should be positive, no matter which route central banks take us down. We’d rather hold gold and silver now and hang on through any pullbacks, than take the gamble that there will be a big fall in the price of gold. But instead miss out on buying when a big fall never never eventuates.

If you agree then get in touch for a quote…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|