Prices and Charts

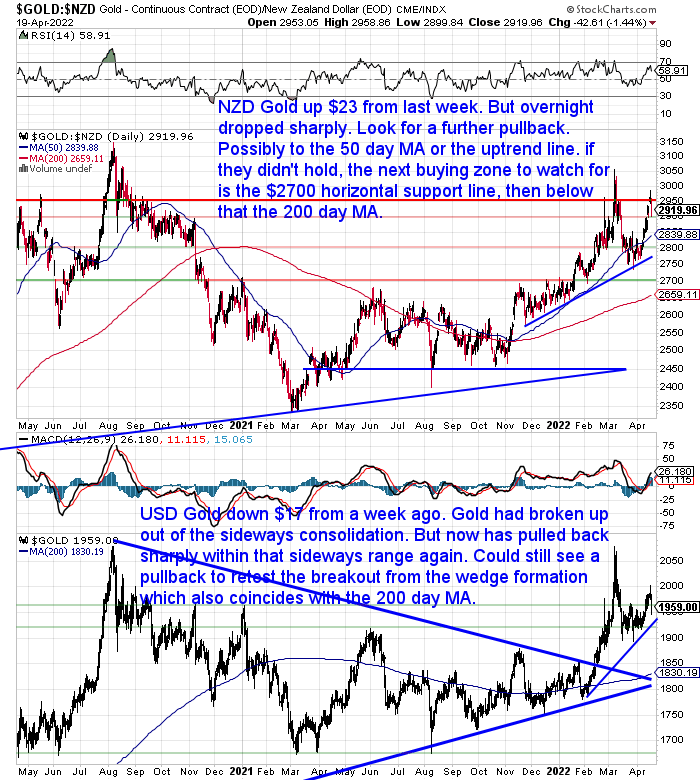

Gold in NZ Dollars – Expected Pull Back is Underway

Gold in New Zealand dollars is up $23 from 7 days ago. However, there was a sharp pullback overnight from even higher levels. This wasn’t a big surprise after such a hefty bounce back. We could now see NZD gold retreat back down to the 50 day moving average (MA) around $2840. Or even back to the blue uptrend line.

If neither of those levels held, then the next support zones to watch for would be the horizontal support line at $2700. Or the 200 day moving average – currently at $2660.

Regardless of where gold pulls back to, the uptrend that started in March 2021 will still clearly be in play.

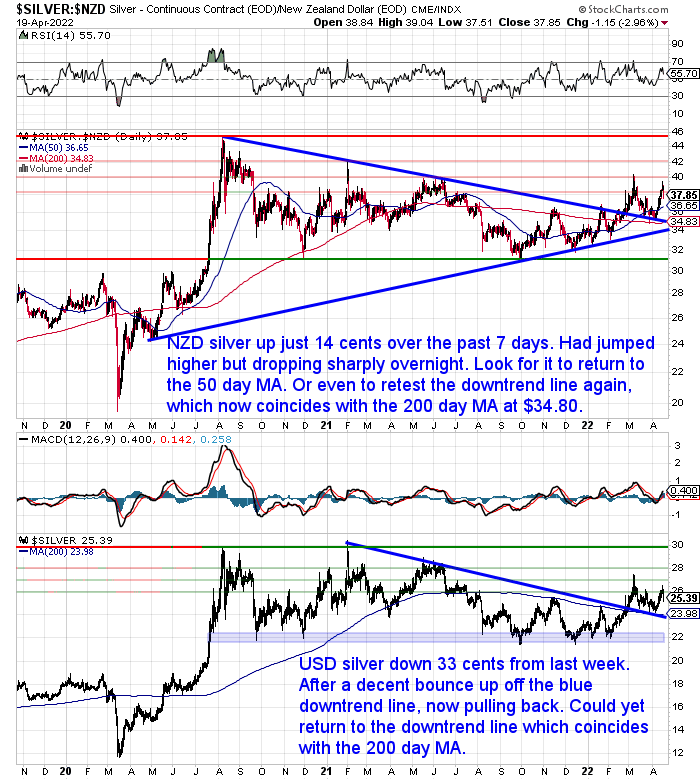

Silver Also Pulling Back – But Uptrend Clearly in Place

Silver in New Zealand dollars is up just 14 cents from 7 days ago. Silver had risen substantially over the past week but overnight it fell sharply. Look for silver to now return back towards the 50 day moving average at $36.65. Or even to retest the downtrend line again, which also coincides with the 200 day MA at $34.80.

Like gold, regardless of whether silver pulled back to any of these marks, or even a bit lower to $34, the uptrend from September last year will remain in place.

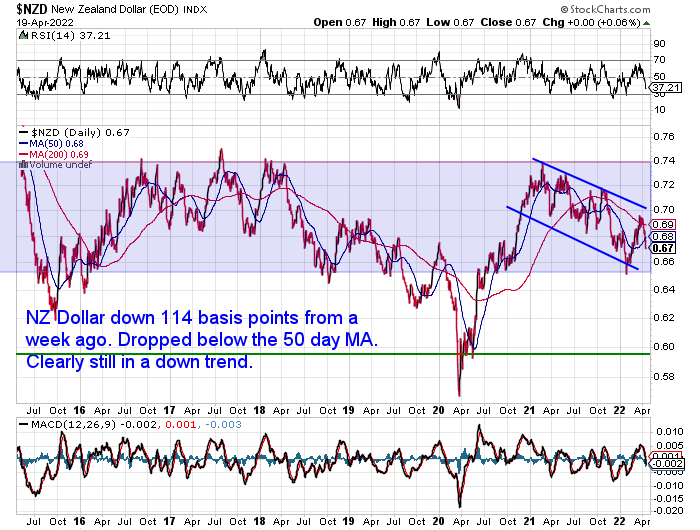

Conversely the Downtrend in the NZ Dollar Remains

The New Zealand dollar continued its recent fall. Down 114 basis points or over 1.5%. Unlike gold and silver the Kiwi remains clearly in the downtrend it has been in since early 2021.

US interest rates are now much higher than those of many other currencies, and money has therefore been flowing into the USD from across the globe. Even with the RBNZ raising rates last week by half a percent, that doesn’t seem to have made much difference to the funds preferring to flow into USD rather than NZD right now. As it seems the differential between the NZ rate and the US rate is not great enough for forex investors.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – New Stock Finally Here

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

The Current Danger of the 60/40 Investing Approach

We have been pointing out that sharemarkets may well be in for an extended period of underperformance. The previously much exalted NASDAQ tech stock market index is down almost 14% year to date. It seems that the majority still think this is a short term blip. With buy the dip still being the mantra for many.

The standard recommendation remains to be 60/40 split in terms of shares to bonds. Most investment funds continue to follow this approach to investing.

The “40” in this split also has the added risk that interest rates might also be undergoing a long term change from falling to rising rates. So this will hurt the performance of bonds. Because bond prices fall as interest rates rise. Why? Because each new bond that gets issued will have a higher coupon or interest rate yield. Therefore older bonds lose value as their yield is lower. So a buyer will pay a lesser amount for an older bond, compared to a newer bond with a higher rate.

This approach 60:40 to investing means that most people’s investments are potentially at risk on both fronts. While the average person in New Zealand doesn’t invest in bonds, most Kiwisaver funds and managed funds do. Bonds are part of the fixed interest asset allocation. What is usually referred to as the “low risk” part of a Kiwisaver or managed fund. Shares make up the rest. Which could include real estate funds.

Why the NZ Super Fund Should “Invest” in Gold in 2022

This reminds us that future retirees are also at risk from this investment approach.

As the NZ Super Fund operates on a different and what might be seen as even more high risk split than this. The NZ Super Fund invests with a 80/20 stocks to bonds split.

So this week’s feature article looks at the risks faced by the NZ Super Fund. How they could reduce them and what you can learn from this.

Here’s what’s covered:

- A Repeat of the Financial Crisis Could Equate to 50% Fall in NZ Super Fund Assets

- Risk Versus Volatility

- What if Markets Don’t Bounce Back Within 2 Years?

- What Risk is the NZ Super Fund Ignoring?

- How Could the NZ Super Fund Mitigate These Outlier Risks?

- NZ Super Fund Should Invest in Gold

- Lack of Counter-Party Risk is the Main Reason to “Invest” in Gold

- But the NZ Super Fund Does Invest in “Real Assets”

- Gold is a Non-Correlated Asset

- Holding Gold Can Reduce Losses in Financial Crises

- Will the NZ Super Fund Invest in Gold?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Central Banks in a Quandry – No Easy Exit

People continue to be surprised by rising inflation and interest rates. The recency bias means we are conditioned to think that the past will be the future. Tomorrow the latest New Zealand CPI number will be released. Inflation is already at a 3 decade high. But it’s predicted to have skyrocketed above 7% now.

So the RBNZ, just like every other central bank, finds themselves in a quandary. As our secret investment advisor recently pointed out, while central banks know that inflation hits the poorer people the most, they also know if they clamp down too hard stocks would plunge far more steeply than the so-far “manageable” declines.

Here in New Zealand where most people invest in real estate, the same rules apply to how interest rate increases affect real estate prices.

After years of vast increases in money creation, when it seemed like no ill effects would appear, central banks are now caught. There is no easy exit for them.

Make sure you are protected as they attempt their no win exit.

If you’d like a quote please get in touch…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Inflation/Stagflation, or Deflation and Gold to Plunge? - Gold Survival Guide