Prices and Charts

Gold Dipping Lower Out of Recent Consolidation Range

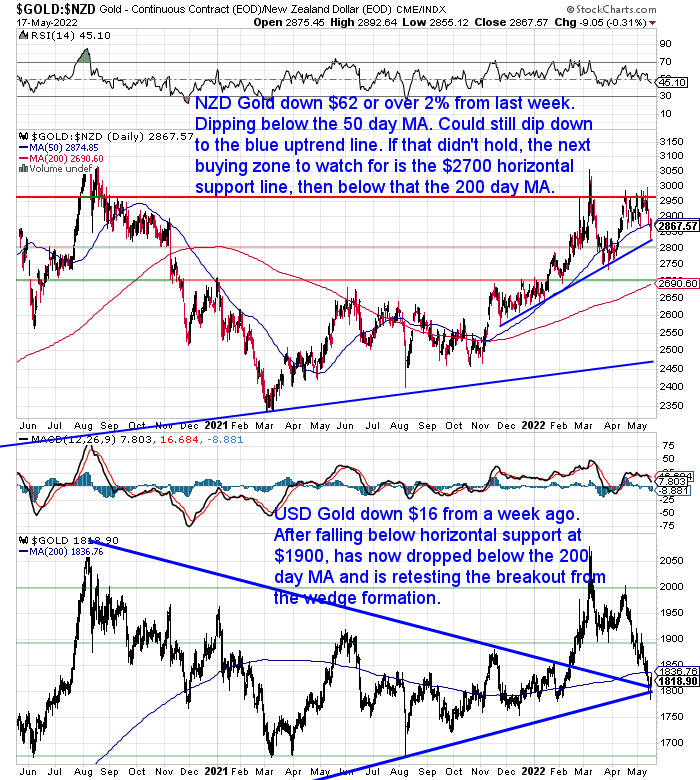

Gold in NZ Dollars is down over 2% from 7 day ago. It has dipped just below the recent sideways consolidation it had been in. Now just below the 50 day moving average (MA). From here it could still dip to the blue uptrend line. If that wasn’t able to hold then the next buying zone to watch for is the horizontal support line at $2700, which is now also coinciding with the 200 day MA. We would expect strong support there.

While in USD terms, gold is now sitting right on the trendline of the wedge formation. Currently retesting the breakout from February. We’re watching for a bounce from around here.

Silver Outperforming Gold This Week

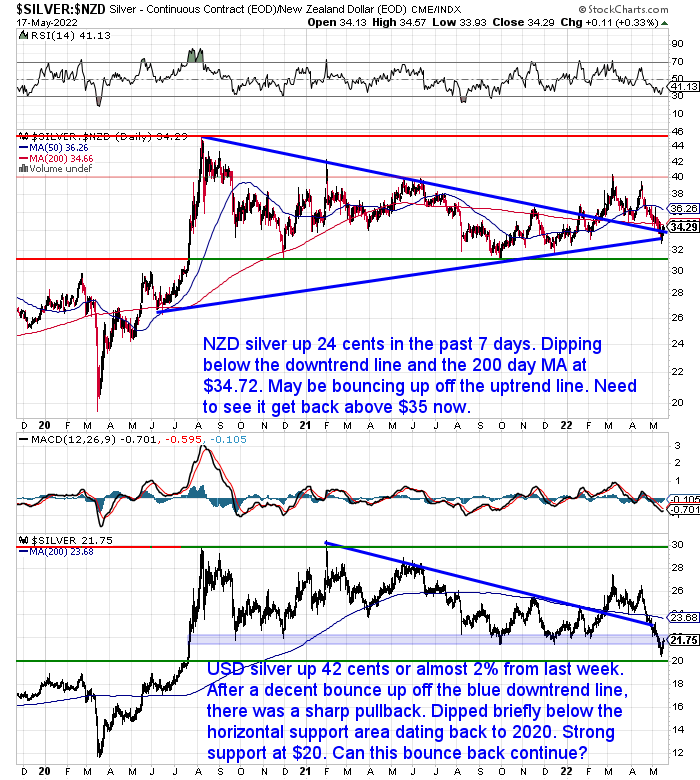

NZD silver has staged a small bounce back this week. After dipping below the downtrend line and the 200 day MA at $34.66, silver is now back up to those levels. We may be witnessing silver bouncing up from the blue uptrend line. But we now need to see it get back above $35 and break out of the downtrend it has been in since mid April.

NZ Dollar Finally Regaining Some Ground

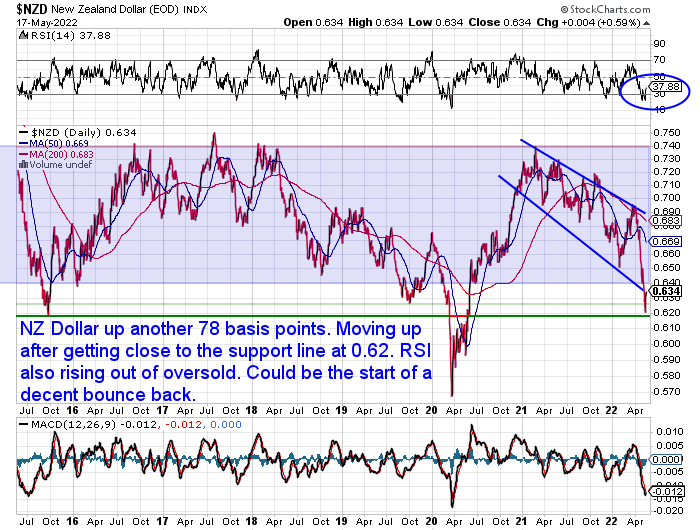

The Kiwi dollar was up 78 basis points or 1.24% over the past 7 days. After getting close to the support line at 0.62 it has staged a bit of a bounce back. The RSI was the most oversold it has been since the March 2020 plummet. That has now moved up above 30 and out of oversold.

This could be the start of a decent bounce back in the New Zealand Dollar. So that could put some pressure on local gold and silver prices in the coming days and weeks.

But of course we will have to see how USD gold and silver prices perform. They too look like they are bottoming out. So perhaps we will just see muted rises in NZD gold and silver?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – New Stock Finally Here

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Why Buy Silver? Here’s 21 Reasons to Buy Silver in 2022

Last week our featured post on 15 reasons to buy gold in 2022 proved quite popular.

So we thought we should share the love for gold’s sister metal this week. With silver not far from the lowest price for the year, most people will likely not be interested in it. But of course from a contrarian point of view, this is likely to be exactly the time to give silver some close consideration.

So this week we have even more reasons to consider buying silver. 21 of them in fact.

You’ll see how the demand and supply dynamics look quite bullish for silver.

You’ll also discover 3 reasons why silver likely has more upside than gold…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

NZ Super Fund Down $2 Billion in Past Year

Last month we shared our post: Why the NZ Super Fund Should “Invest” in Gold in 2022

A report just out said the fund has lost $2 billion in the past year and the “downturn is expected to continue over the next 12 months.”

The fund’s guardians say that rising interest rates are “weighing heavily on equity markets as central banks seek to tame inflation.” Also making their life difficult are high commodity prices which increase inflationary pressure and crimp global growth.

“The Super Fund now stands at $57b – about the same level as at the end of April 2021.

As with previous market downturns, the guardians say they are focusing on long-term horizons, “investing in a contrarian style and buying assets when we consider them to be cheap”.

Source.

We explained last month how the fund is a relatively high risk investor focusing on growth. With 80% of its assets invested in shares and just 20% in bonds. So a crisis could see the fund’s assets fall by 50%. Something even the fund managers agree could happen in such a situation. However they reason that their modelling shows this would recover within 2 years.

We’d say that if covid19 has taught us anything it is… don’t trust modellers!

So then, what if markets didn’t recover in 2 years? More thoughts on that below…

Current Issues with Kiwisaver – But What About Longer Term Risks?

Other news items this week highlighted how little the average NZer has in Kiwisaver retirement savings. Particularly younger Kiwis in their 30s…

Kiwis in their 30s are set to run out of KiwiSaver cash less than four years after retiring, new analysis shows. The analysis, commissioned by digital KiwiSaver advice platform BetterSaver, looked at the retirement prospects of Kiwis in balanced funds earning the average wage, with average household expenditure for where they live, as well as the national average current KiwiSaver balance of around $26,000.

Read more

But also everyone in Kiwisaver will be feeling the hit their funds have taken in recent months:

Why is my KiwiSaver losing money, and what should I do? Investors checking the returns of their KiwiSaver fund in the last month may have done so with a wince of pain.

Read more

The experts consulted in the above article, also seem to offer advice that sounds like the NZ Super Fund’s guardians.

Advice offered included:

- Ignore the losses,

- Invest for the long haul,

- Dollar cost average, and

- Don’t sell as you crystallise losses

In our article on the NZ Super Fund, we take into consideration what if markets don’t bounce back within 2 years? What if we have entered a longer term cycle of higher interest rates and higher inflation?

Then both the NZ Super Fund strategy and the advice from Kiwisaver “experts” might not prove to be that fantastic.

We doubt the NZ Super Fund guardians are too worried at this stage. We also doubt they’ll be buying any gold soon. But if you don’t agree with them then consider adding some gold to at least offset other investments you have. Unlike other investments gold can’t go to zero.

If you agree and want to get some or add to your stash, then please get in touch…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|