Prices and Charts

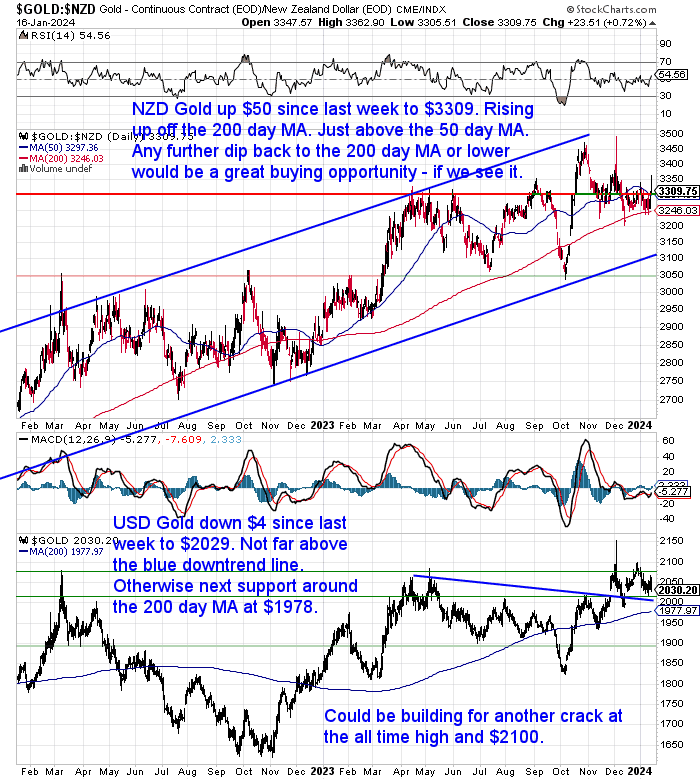

NZD Gold Rising Up Off 200 Day Moving Average Again

Gold in New Zealand dollars is up $50 or 1.5% from a week ago to $3309. It has risen up off the 200 day moving average (MA)Sitting at $3234 it has dropped below the 50 day moving average (MA) once again. We have only seen it dip below the 200 day MA once in the last 12 months. So that looks like being strong support and a good buying zone. Any dip below that and towards the blue uptrend line would be an even better buy. But don’t count on it happening.

While USD gold is down $4 from 7 days ago to $2029. 2023 is the first year that USD gold has closed above $2000. That is a significant milestone that passed with very little fanfare. As we say in this week’s feature article perhaps we won’t see USD gold back below $2000 again this year – or ever?

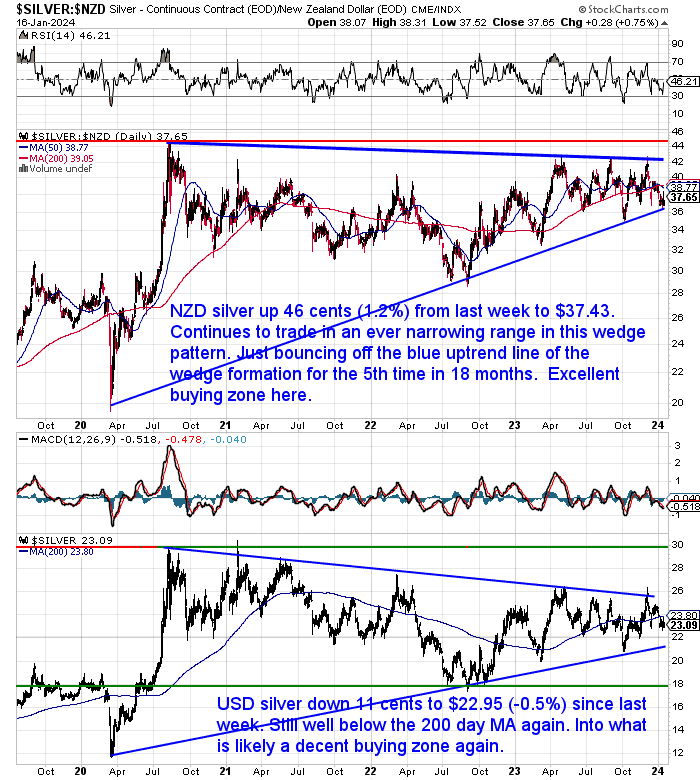

Silver Bounces Up From Uptrend Line Again – As Expected

NZD Silver was up 46 cents (1.2%) from last week to $37.43.

The subject line of last week’s update looks like being correct. As NZD silver bounced up off the blue uptrend line in the wedge formation. This is the 5th time since July 2022. Making it the 5th best time to buy in the last 18 months.

But you haven’t missed out yet as NZD silver isn’t sitting too far above the uptrend line still today.

Silver continues to trade in an ever narrowing range within the blue lines of the wedge or pennant pattern. It is only a matter of time before it breaks out of this.

USD silver was down 11 cents to $22.95. While USD silver has not made it back to the uptrend line yet, it is still down below the 200 day MA. So still in a very decent buying range here too.

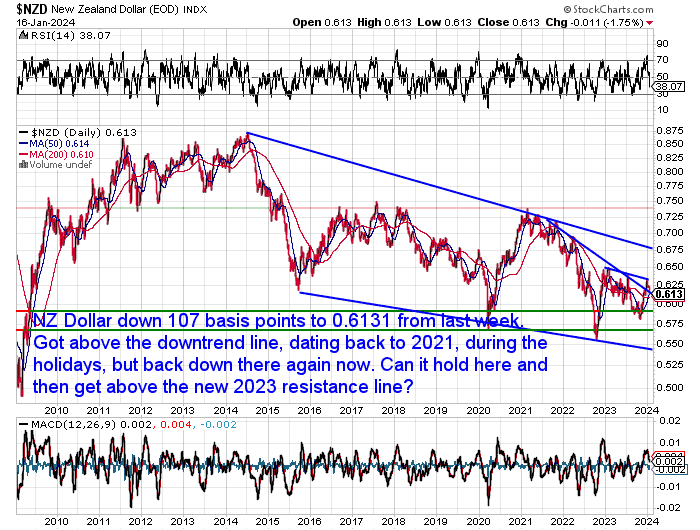

NZ Dollar Hardly Changed

The Kiwi dollar was down 107 basis points from last week to 0.6131. It got above the downtrend line which dates back to 2021 during the holidays. But it is back down to that again today. The question is can it hold here now and then challenge the new 2023 overhead resistance line?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Gold & Silver Performance: 2023 in Review & Our Punts for 2024

As per our tradition in the new year, it’s time for our yearly gold and silver in review article. You’ll see how gold and silver performed during 2023 compared to other investment classes. You’ll also see how much gold and silver have risen since the year 2000.

Then we look back at our predictions from the start of 2023 to see how we did. And finally we make a bunch of guesses as to what 2024 could have in stock for us.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

ASB Things to Watch For in 2024

ASB economists reckon there are 5 keys risks to watch for in 2024:

1. Inflation persistence. Will global and NZ inflation continue to ease back to historically low levels, or will inflation rates hold up for longer?

2. NZ fiscal policy. Will NZ fiscal policy objectives be met without igniting inflation, further delaying the return to surplus, or keeping the account deficit elevated?

3. NZ population growth. Will record net immigration rates continue and what will be the economic, labour market, and housing market impacts?

4. NZ housing market. Will strong population tailwinds or stretched affordability and debt servicing/rising unemployment headwinds dominate?

5. Geopolitics. 2024 will be a huge year as half of the globe goes to the polls at a time of heightened geopolitical tensions and where social cohesion shows signs of fraying.

They conclude that:

“The key risk pertains to whether NZ and global inflation will continue to subside and settle at historically low levels

This remains a major unknown, but markets seem to be more confident that it is ‘Mission Accomplished’ for central banks, with policy interest rate cuts expected to start from the middle of this year.”

Source.

To us that seems to be what the consensus view is too.

And interest rates are already falling:

Kiwibank is cutting a number of its home loan interest rates. Its two-year special rate drops from 7.05% to 6.89%, the three-year from 6.89% to 6.75%, the four-year from 6.79% to 6.69% and the five-year from 6.79% to 6.59%.

Read more

Analysis – David Chastan: More banks reduce mortgage rates – and TD rates along with them

Read more

But as you’ll see in one of our 2024 predictions, while interest rates may be falling for now, we think there will be a surprise yet to come with them, maybe as soon as later this year.

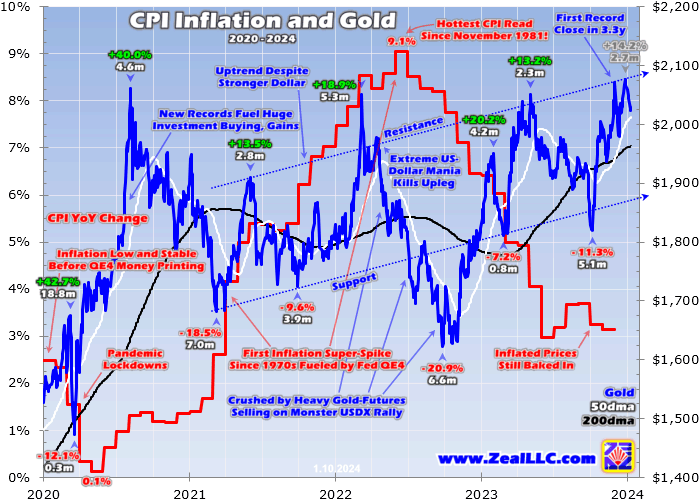

Gold-Inflation Disconnect – Adam Hamilton

Another of our predictions was around inflation rates. That they may continue to fall but then also surprise most people too.

Something that may have surprised you in the past year or 2 is that gold didn’t react as strongly as many people might have thought it would in the face of historically high inflation levels globally. That might account for why investment demand was very low during 2023.

Adam Hamilton had some interesting thoughts on the gold-inflation disconnect this week:

“Any way you slice it, gold investment demand has been dismal in recent years. From gold’s pandemic-stock-panic low in mid-March 2020 to its latest record close in late December 2023, it has powered 41.1% higher. Yet during that same span, the combined holdings of the mighty world-dominant GLD and IAU gold ETFs have slumped 1.9%. They are the best daily high-resolution proxy for global gold investment demand.

From gold’s monster-dollar-rally low in late September 2022 to late December 2023, it surged up 28.0%. Yet investors didn’t care, as GLD+IAU holdings actually fell 10.5% in that span! Investors have been missing in action in gold for years, allowing hyper-leveraged gold-futures speculators to run amok in bullying around gold prices. Investors haven’t yet returned because gold’s price action hasn’t been good enough.

Investors love chasing winners, and flood into gold during major uplegs to ride its upside momentum. Their big buying accelerates gold uplegs, easily overpowering whatever the gold-futures specs are doing. But investors need plenty of convincing before buying back in, gold has to first rally high enough for long enough to generate sufficient excitement. That hasn’t yet happened, so gold’s inflation disconnect has lingered.

Investors are still apathetic on gold because its gold-futures-driven price action in recent years hasn’t been bullish enough. Gold’s futures price is unfortunately its world reference one, which investors see. So gold psychology has been artificially suppressed in recent years by hyper-leveraged gold-futures trading fading the US dollar’s fortunes on Fed officials’ flamboyant meddling! Is gold doomed to this lot forever?

No way, markets are perpetually cyclical. Extremes of price and sentiment never last for long before mean reverting and overshooting the other way. And that’s coming this year, accelerating gold’s record breakout upleg in 2024. This gold-inflation disconnect’s days are numbered, and way-higher gold prices are coming on the other side. The catalyst will be the Fed shifting from a higher-rates-for-longer bias to cutting.”

Source.

We’d have to agree. It seems like gold (and possibly silver even more so) is building for a break out to higher levels. As noted already USD gold closed the year above $2000 for the first time. Often in these low volume holiday times we see the price forced way down, but gold is holding up well. This all time high yearly close passed by with little fanfare. Expectations for gold and silver are low. At some stage they will surprise to the upside. Our guess is that it’s only a matter of time before new all time highs for USD gold are seen this year.

Get in touch for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

New Australian Product: The Superoo 16 Litre Gravity Water Filter by Filteroo. Leak free design with double the capacity of similar filters.

This filter will provide you and your family with safe drinking water for years to come. It’s simple, lightweight, easy to use, and very cost effective. Comes complete with Stainless Steel Tap, Stand and Water Jug.

Shop the Range…

—–

|