It’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2022. Then finish off by making a few guesses as to what 2023 might hold in store for us…

Table of Contents

Estimated reading time: 8 minutes

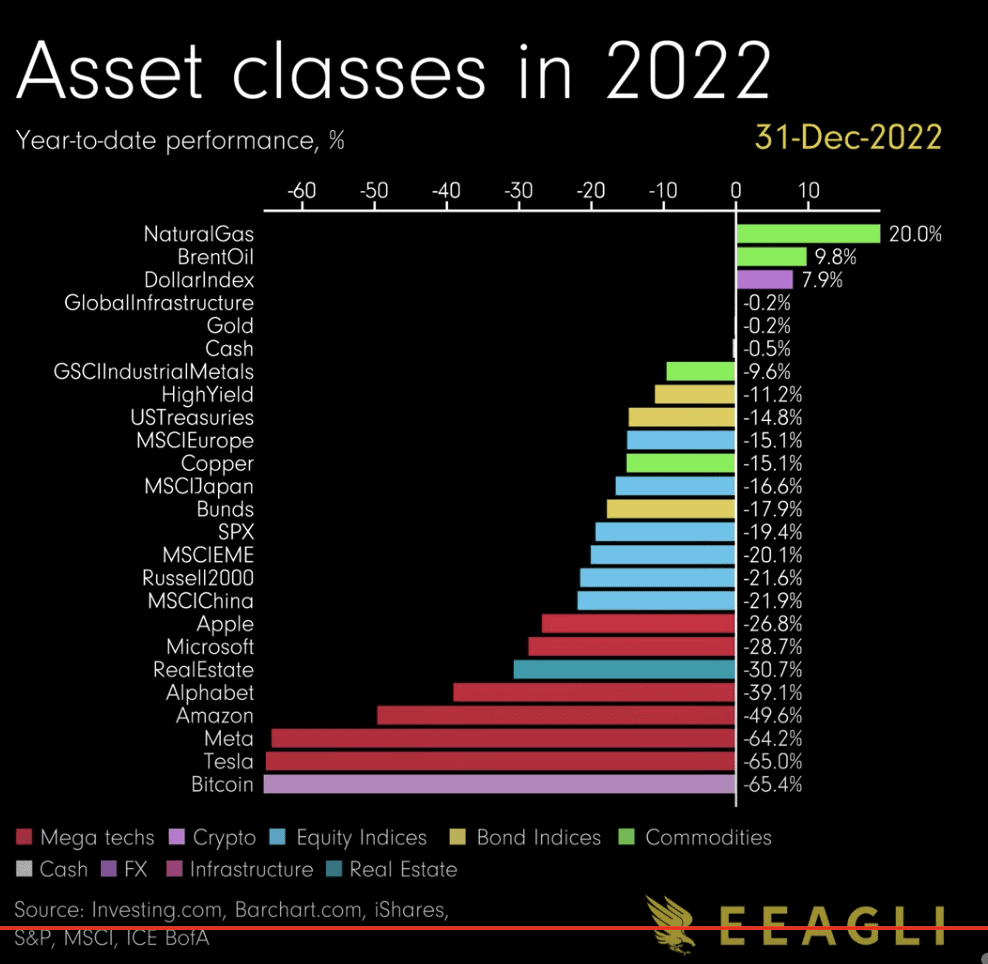

2022 was a terrible year for most investment classes. For many asset classes such as US shares it was the worst year since 2008. Only saved by an end of year rally to dampen the losses in the Dow Jones and S&P indices.

Here’s a great table care of James Eagle that shows the performance of many asset classes for 2022. You can watch an excellent animated version of it here to see how this changed as the year progressed.

You’ll see our asset of interest gold was near the top of the chart for 2022. Bitcoin was at the bottom, a complete reversal of the year before. Even the supposed safety of US treasury bonds was down 15%.

Learn more about our preferred method of investing in bitcoin and cryptocurrencies here.

But the above table looks at gold and silver in US dollars. As we are in New Zealand we should track the NZ dollar gold and silver price, not the US dollar price. So how how did precious metals fare in 2022 in New Zealand Dollar terms?

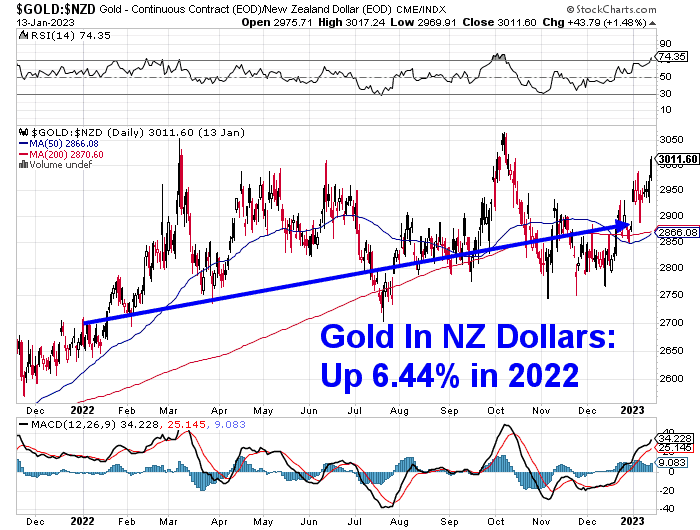

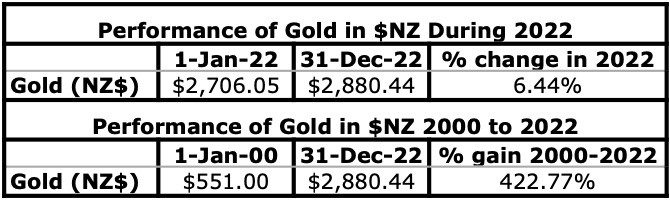

Gold in $NZ – Performance During 2022

The chart for gold in New Zealand dollars shows that unlike gold in US dollars, which was flat for 2022, NZD gold was actually up almost 6.5% for the year.

NZD gold rose strongly at the start of 2022. Rising from $2700 up to $3050 by March. But it then spent the rest of 2022 zig-zagging sideways to finish the year in about the middle of this sideways trading range. This trend has continued for the first couple of the weeks of the year with gold jumping over $100 further. It looks to be closing in on the 2022 high at $3050.

Looking back to the start of the millennium, gold is now up a decent 422.77%.

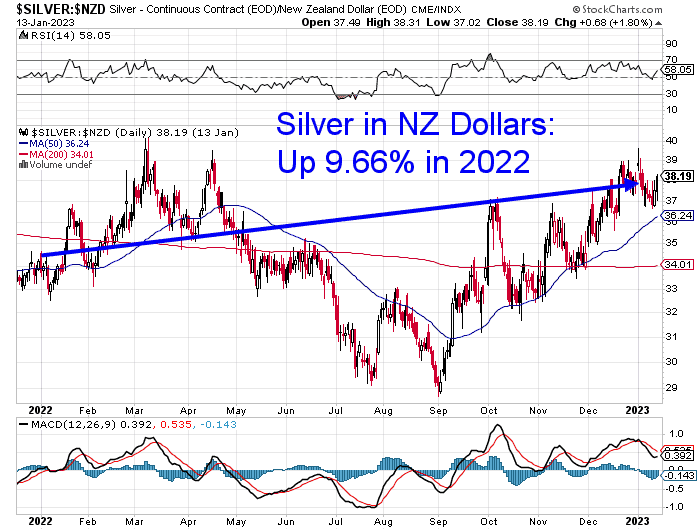

Silver in $NZ – Performance During 2022

2022 saw silver outperform gold. Silver in NZ dollars was up almost 10% over the course of 2022. This was in stark contrast to 2021 when NZD silver was down 8%.

Just as it did back in 2021, last year NZD silver bottomed out in late September at just below NZ$29 per ounce. To our eye it looks like silver is back in an uptrend since that bottom. Now we are watching to see if silver can get above the 2022 high of $40 this year.

Over the much longer term silver also has actually underperformed gold. With silver up 267% since the year 2000. This is not a surprise really. As past bull markets show that silver makes a lot of gains in a short period of time. So the major gains could come towards the tail end of this current precious metals bull market.

How Did We Go With Our 2022 Predictions?

Now, let’s see how accurate we are with our 2022 predictions or perhaps more accurately “guesses”? No point making any if we don’t take a look back!

Here were our 2022 predictions:

1. In 2019 and 2020 gold and silver had a couple of stellar years. So we guess with hindsight it wasn’t a big surprise that 2021 saw them take a breather. Therefore we’ll say that gold and silver will finish 2022 higher than they started them. Just so we’re not copying and pasting last years we’ll also predict that they will both have double digit rises. So the bull market was just on pause last year and should bounce back in 2022.

With gold up 6.44% that was single figures. However with silver up 9.44% in 2022, that is very close to double digits. So we got that both were up for a half mark. But still maybe we could score ourselves 0.6 out of 1 for this one?

2. Unlike 2021, silver will outperform gold in 2022.

Right on that one with silver up 9.44% compared to gold’s rise of 6.44%.

3. Inflation won’t just be “transient”. We’ll see high inflation persist throughout 2022.

Annual inflation in NZ measured by the CPI in September 2022 was 7.2%. So that certainly wasn’t transient. With hindsight that one now seems very obvious. But remember that throughout 2021 central banks and bank economists were still predicting that inflation was just a temporary blip caused by covid shut downs. So another point there too.

4. 2022 will finally see a stock market fall with a bear market correction (i.e greater than 20%). (Hat tip to our secret investment advisor for this one) This will come as complete surprise to many, as central planners have gotten everyone so used to seeing everything go up.

We’d have to give ourselves a tick for that one too. The S&P500 index was down 19.44% as of the end of 2022. But during the year it fell by as much as 24%. So that was a fall of over 20% during the year so that satisfies the definition of a bear market in US stocks. Score one there too.

5. Central banks will cause the stock market crash by withdrawal of stimulus. So we will see them promptly reverse course and pump more back into global economies. Hence real interest rates will continue to be negative.

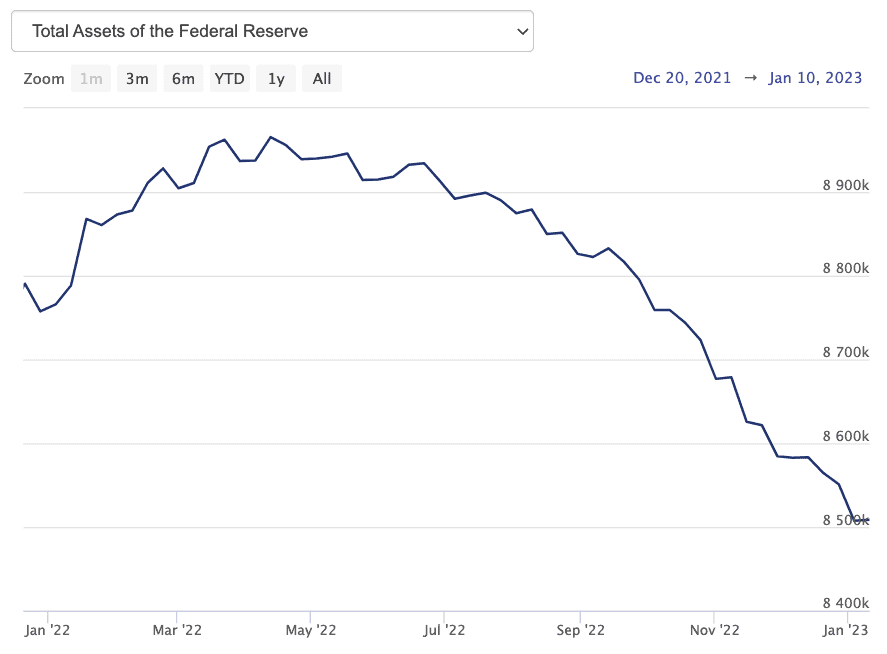

Central banks have continued to raise interest rates and the US central bank has also reduced its balance sheet during 2022.

The balance sheet reduction in particular likely played a role in share markets falling during the year. However we are yet to see Central Banks reverse course and pump more liquidity into the system. Although real (after inflation) interest rates have continued to be negative throughout 2022. Because despite central banks raising interest rates, inflation has remained higher than these rates. So we’ll mark ourselves hard there and say half a mark, even though maybe we were 2/3 on this one.

So overall we come in with a 4.1 out of 5. Much better than the year before. Perhaps we’ll give Nostradamus a run for his money yet! But as we say these are just punts we make for the fun of it more than anything.

Our Predictions (Guesses!) for 2023

Now what about our predictions for 2023? Here’s what we’ve seen in the crystal ball and tea leaves for this year…

- We’ll again say that NZD priced gold and silver will finish 2023 higher than they started them. However we’ll also say that their rise will be smaller than that of gold and silver in US dollars.

- The New Zealand dollar will be up against the US Dollar for 2023. The trend that started in October 2022 is likely to continue this year. Although maybe not with such strength. So we’ll say more of a gentle rise for 2023.

- We are starting to see talk of inflation having peaked with reports out this week. However we think high inflation rates are here for a number of years to come yet. We expect inflation to continue to hover around similar levels to 2022.

- 2023 will also see stock markets continue to fall. Both the US S&P500 and the NZX50 will finish the year lower than they started. The tech heavy NASDAQ could continue to drop sharply. Maybe we’ll see that fall another 20%?

That is 4 predictions for 2023. The more predictions you make, the more room you have to be wrong! So we’ll see whether we can have as much luck this year as we did last. It’s notoriously difficult to predict the markets over a defined timeframe. A better bet is to use dollar cost averaging and make regular purchases of gold and silver throughout the year.

Or use some technical indicators to time your purchases after a pull back in the precious metal prices.

Gold and silver are up since the start of 2023. So sign up to our daily price alerts if you want to hear when other pull backs occur throughout the year.

Pingback: NZ Inflation Remains at 7.2% - How Long Will it Stay High? - Gold Survival Guide

Pingback: Gold & Silver Performance: 2023 in Review & Our Punts for 2024 - Gold Survival Guide